ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com

Global Economy Heading For "Mother Of All" Supply Chain Shocks As China Locks Down Ports

THURSDAY, JAN 13, 2022 - 01:06 PM

Over the past month, as Wall Street turned increasingly optimistic on US growth alongside the Fed, with consensus (shaped by the Fed's leaks and jawboning) now virtually certain of a March rate hike, we have been repeatedly warning that after a huge policy error in 2021 when the Fed erroneously said that inflation is "transitory" (it wasn't), the central bank is on pace to make another just as big policy mistake in 2022 by hiking as many as 4 times and also running off its massive balance sheet... right into a global growth slowdown.

The Fed is going from one huge error (inflation is transitory) to another huge error (4 rate hikes and runoff won't crash markets).

— zerohedge (@zerohedge)

January 11, 2022

And, as we have also discussed in recent weeks, one place where this growth slowdown is emerging - besides the upcoming deterioration in US consumption where spending is now being funded to record rates by credit cards before it encounters a troubling air pocket - is China and its "covid-zero" policy in general, and its covid-locked down ports in particular.

But what until recently was a minority view confined to our modest website, has since expanded and as

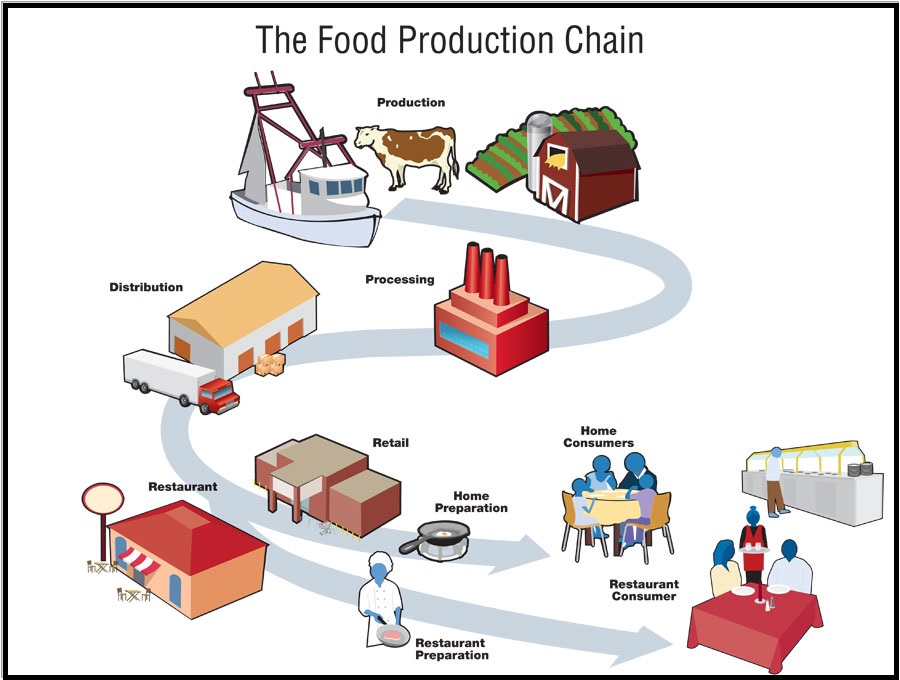

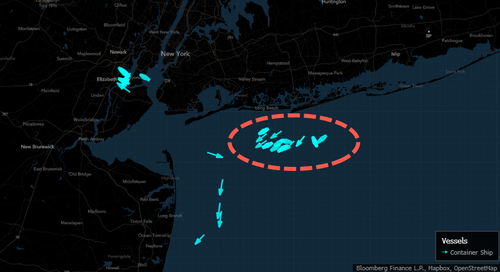

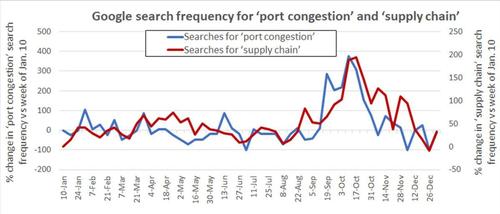

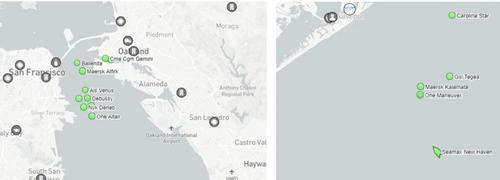

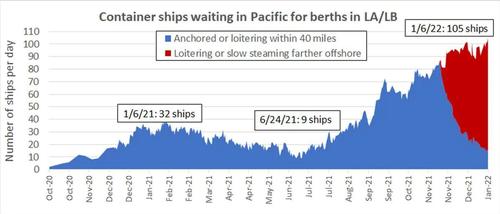

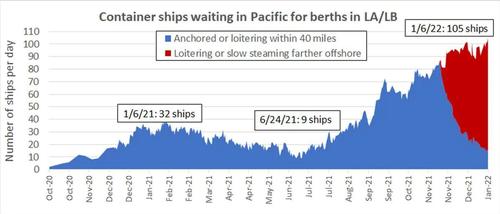

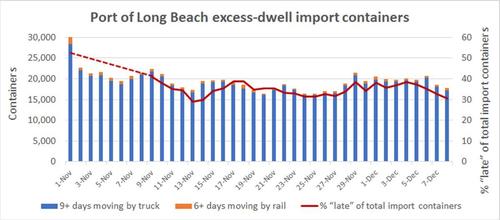

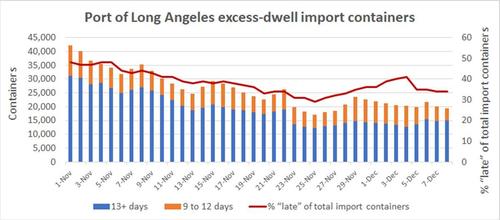

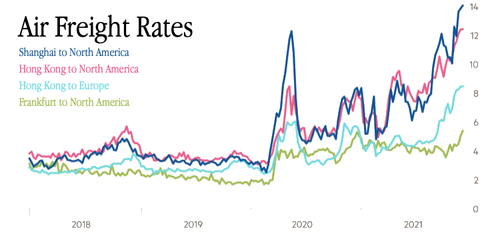

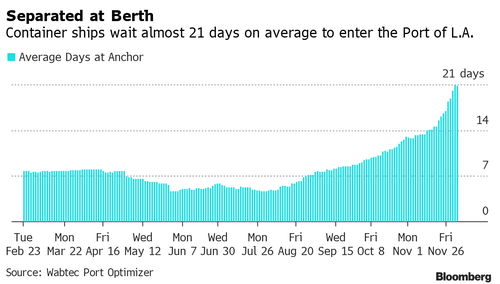

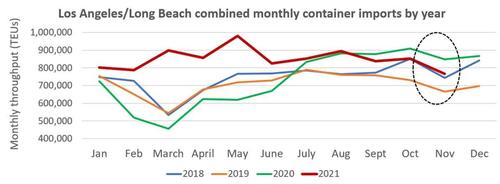

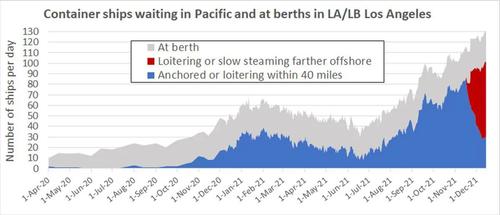

Bloomberg writes overnight, the effects of restrictions in China as the country maintains its Covid-zero policy "are starting to hit supply chains in the region." As a result of the slow movement of goods through some of the country’s busiest and most important ports means shippers are now diverting to Shanghai, causing the types of knock-on delays at the world’s biggest container port that led to massive congestion bottlnecks last summer that eventually translated into a record number of container ships waiting off the coast of California, a glut that hasn't been cleared to this day.

With sailing schedules already facing delays of about a week, freight forwarders warn of the impact on already back-logged gateways in Europe and the US and is also why

HSBC economists are warning that the world economy could be headed for the “mother of all” supply chain shocks if the highly infectious omicron variant which is already swamping much of the global economy spreads across Asia, especially China, at which point disruption to manufacturing will be inevitable.

"Temporary, one would hope, but hugely disruptive all the same" in the next few months, they wrote in a research note this week first noted by

Bloomberg.

For those who have forgotten last year's global shockwave when China locked down its ports for several days, a quick reminder: it led to an unprecedented hiccup in global logistics and shipping which hasn't been resolved to this day. That's because China is the world’s biggest trading nation and its ability to keep its factories humming through the pandemic has been crucial for global supply chains.

While the outbreak of omicron in China has been small compared to other nations (if one believes China's official data, which is a

big if) authorities are taking no chances, especially with China's continued "zero-covid" policy. In recent weeks scattered infections of both the delta and omicron variants have already triggered shutdowns to clothing factories and gas deliveries around one of China’s biggest seaports in Ningbo, disruptions at computer chip manufacturers in the locked-down city of Xi’an, and a second city-wide lockdown in Henan province Tuesday.

Below is a brief timeline of the most recent events courtesy of Deutsche Bank:

- China's first Omicron outbreak was detected in the city of Tianjin over the weekend. On the morning of Jan 8, two patients in Tianjin who actively sought medical treatment were confirmed as being infected with the Omicron variant. The local government immediately locked down certain districts, restricted travel, and conducted large-scale screening. A total of 41 positive cases have been reported as of the morning of Jan 11.

- The source of the local cases in Tianjin is still unknown, and community transmission is possible, according to local disease control officials. All previous local Omicron cases in Tianjin belonged to the same transmission chain. However, the above cases cannot be confirmed to be in the same transmission chain as the sequences of the imported cases of the Omicron variant that have been found in Tianjin. The early confirmed cases do not have any travel history outside Tianjin either. The specific source of the local cases found in Tianjin is still unknown at this time.

- More alarmingly, the same Omicron virus strain has already spread to outside Tianjin. Two positive cases were found in Anyang, Henan on Jan 8, and were later confirmed to be the same Omicron variant found in Tianjin. Through contact tracing and gene sequencing, the source was identified as a college student who returned to Anyang from Tianjin on December 28, 2021, and who did not show any symptoms. 81 cases have since been confirmed in Anyang over the past few days. This suggests that (1) the Omicron virus may have been transmitted in Tianjin for almost 2 weeks; and (2) other travelers might have already carried the Omicron virus from Tianjin to elsewhere in China.

Looking at the recent data,

China's Covid outbreak this winter could be worse than in the previous winter - as shown in the chart below more provinces have detected Covid outbreaks this winter. Entering Q4, there are 12 provinces which have found more than 19 local cases in the past 14 days. More significantly,

the total number of new cases in the past 14 days in Shann’xi has already exceeded 1500, which is a record high, except for in Hubei when Covid first occurred in early 2020, and this has happened despite China now having very high vaccination rates and strict regulations such as lockdowns. In addition, comparing the differences between months near Chinese New Year in 2021 and 2022, not only have the number of news cases been larger this year,

the provinces hit by Covid outbreaks this year also tend to have higher GDP and population density.

As Bloomberg adds, Henan and Guangdong, which also has an outbreak, are centers of electronics production. If cases continue rising there, it could impact the supply of iPhones and other smartphones.

This also brings us to what Bloomberg calls the paradox of China’s aggressive “Covid-zero” strategy:

while on one hand it helps contain the virus spread, to do so usually requires significant disruption or lockdowns as authorities limit the movement of people. The repeated mandatory testing of whole cities interrupts businessess and production, although nothing to the extent seen in places like the US, where the omicron wave caused an estimated 5 million people to stay home sick last week, leading to further economic slowdown (as discussed in "

A March Rate Hike? Not So Fast")

That risk of disruption for factories is already prompting companies to spread their risk by ensuring they have alternative production facilities, Stephanie Krishnan, a supply chain expert at IDC in Singapore, told Bloomberg.

“We are starting to see companies mitigating risk, seeing where they can increase capabilities for production of different products in different factories so they can shift that around,” she said.

Echoing what we said last night in "

New Year Brings New All-Time High For Shipping's Epic Traffic Jam", Krishnan doesn’t see an end to the global supply crunch anytime soon and cautions it could take several years for the snarls to unwind. It’s a sobering outlook to start a year that many had hoped would mark the beginning of the end of the Big Crunch which dogged producers and consumers through much of last year.

Clearly what happens next is critical, and how China’s control of the virus plays out will ultimately be crucial, said Deborah Elms, executive director of the Singapore-based Asian Trade Centre. Those companies whose supply chains are fully located inside China may be insulated by the country’s mitigation strategy. But that won’t apply to everyone, she said.

“Lots of products in supply chains come from outside China,” Elms said. “Given challenges elsewhere, even zero Covid doesn’t solve all the issues of disruption.”

* * *

In its assessment of next steps, Deutsche Bank expects the government will try to contain the Omicron outbreak with more lockdowns and quarantines rather than taking a "live with Covid" approach.

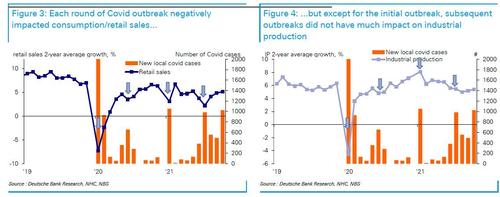

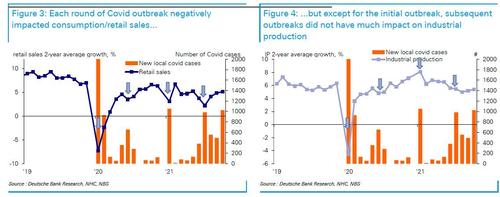

This will pose downside risks to near-term growth. The impact on consumption could be significant, although probably not as large as what happened in 2020.

While Omicron is far less deadly than other Covid variants, it is still deadly enough to cause healthcare service shortages in China, at least in some regions. Vaccination has proven to be ineffective in preventing Omicron from spreading, and while it offers protection against hospitalization,

China still has some 20% of the population who are not vaccinated and will face serious health risks if Omicron becomes widespread. As such, DB says that a containment approach is still the government's optimal choice for this winter regardless of how fast Omicron spreads in the next few weeks. It will be good news if travel restrictions, lockdowns and large-scale testing and contact tracing work in containing the outbreak. Even if outbreaks cannot be contained in some regions, these measures will still be considered necessary in flattening the curve and preventing hospitals from being overwhelmed nationwide.

What is much more important for the US, global capital markets and the Fed's monetary policy - which has assumed much stronger growth in 2022 - is that

China's Omicron outbreaks are significant downside risks for near-term consumption demand. Restrictions will likely be imposed nationwide to reduce travel before the Chinese New Year and encourage people to stay where they are. Cities where new cases were found will reimpose lockdowns and social distancing measures. The impact in each city will depend on local authorities. Experience from the past 2 years was that while some cities (such as Shenzhen and Shanghai) can manage outbreaks in a less disruptive way, other cities (such as Xi'an) have resorted to stricter and larger scale lockdowns, causing severe disruptions to consumption and service sector activities.

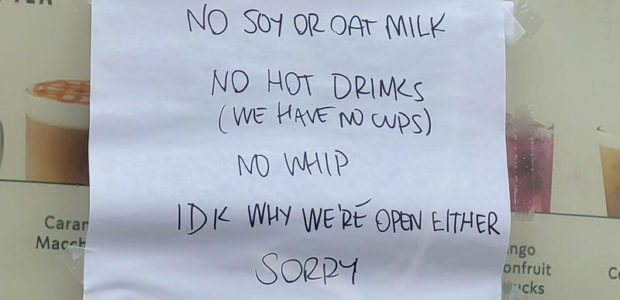

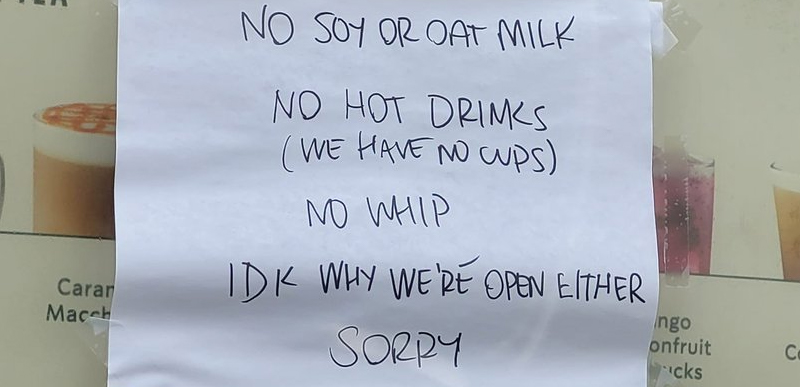

Businesses such as restaurants, as well as those linked to travel, and leisure & entertainment will suffer from sharp revenue reductions or even temporary shutdowns. This may also cause temporary job and income losses and negatively impact consumer goods purchases. Retail sales growth dropped by 3ppt in Jan-Feb 2021 (in 2-year average terms). Retail sales might weaken again in Jan-Feb 2022, though the YoY growth rate might not drop much owing to the low base in 2021.

Nevertheless, consumption will likely recover rapidly once lockdowns are lifted. Similar to what happened before, such negative shocks will likely be transitory and will be followed by strong recovery once lockdowns are lifted and businesses reopen.

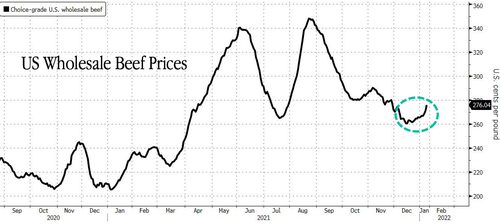

Still, the notorious bull-whip effect will emerge once again, as supply chains once again become stretched, and like in 2021 the question will be how the trade off between rising costs - as goods in transit end up stuck on a ship far longer than expected - and slowing growth will impact the Fed's view on what the optimal policy response is. While the Fed's prerogative for now is clearly to contain inflation, the reality is that much of the inflation experienced today is on the supply side, something which Brainard told the Senate in her confirmation hearing the Fed is powerless to address. Meanwhile, if we see a "surprise" drop in growth in the coming months, the Fed will have no choice but to delay or at least stagger its tightening as the last thing the Fed can afford to do is hike into another recession, which will then quickly be followed with even more easing.

Liner networks use Panama Canal route to Atlantic to get around LA/LB congestion (Photo: ACP)

Liner networks use Panama Canal route to Atlantic to get around LA/LB congestion (Photo: ACP)