You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON Report food and grocery price increases/shortages here: 2021 Edition

- Status

- Not open for further replies.

von Koehler

Has No Life - Lives on TB

Made up pickup orders today from my local Walmart and Hyvee stores. Had to use both because some items were out at one store but still available at the other.

Not terribly concerned about prices as I am more concerned about actually getting the item. A great deal on a out of stock item doesn't fill the tummy.

Prices continue to climb. I was surprised that something as basic as carrots were only available in one pound bags at Wally world.

Not terribly concerned about prices as I am more concerned about actually getting the item. A great deal on a out of stock item doesn't fill the tummy.

Prices continue to climb. I was surprised that something as basic as carrots were only available in one pound bags at Wally world.

okie-carbine

Veteran Member

Wasn't there a similar thread to this about Venezuela a few years ago?

mzkitty

I give up.

Will soaring US crop prices show up on a grocery shelf near you?

Prices of essential food commodities including wheat, corn and soybeans are surging to the highest levels since 2013, fueling concerns over food price inflation.

Kim Chipman and Megan Durisin

Bloomberg

26 Apr 2021

A crop rally in the U.S. is threatening to make essential food commodities dramatically more expensive, and the costs could soon spill over onto grocery store shelves.

Wheat, corn and soybeans, the backbone of much of the world’s diet, are all surging to the highest since 2013 after gains last week had some analysts warning that a speculative bubble was forming.

Bad crop weather in key-producing countries is a major culprit. Dryness in the U.S., Canada and France is hurting wheat plants, as well as corn in Brazil. Rain in Argentina is derailing the soy harvest. Add to that the fears of drought coming to the American Farm Belt this summer.

Meanwhile, China is gobbling up the world’s grain supplies, on track to take in its biggest haul of corn imports ever as it expands its massive hog herd. Rumors are swirling that the Asian nation is working on 1 million metric tons of new corn purchases, according to Arlan Suderman, chief commodities economist at StoneX.

“The agriculture sector looks very appealing right now and the money is chasing it,” Suderman said.

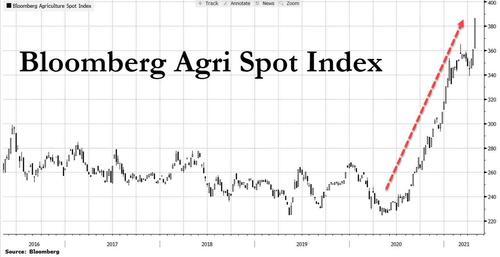

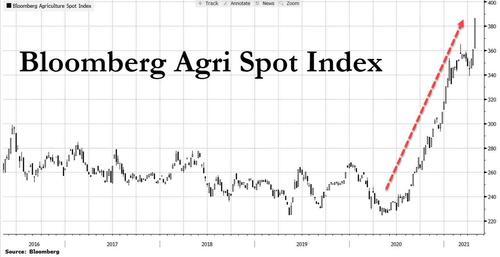

The agricultural rally is stirring food inflation fears, because staple crops heavily influence consumer prices for everything from bread and pizza dough to meat and even soda. The Bloomberg Agriculture Spot Index — which tracks key farm products — soared the most in almost nine years last week.

The higher prices are also helping to drive even broader gains across the commodities complex, with metals such as palladium and copper rallying on a comeback in industrial operations around the world.

Wheat climbed as much as 4.7% to $7.46 a bushel, the priciest since February 2013. Fresh buyers are starting to step in, with both Egypt and Bangladesh issuing new tenders.

Corn rose by the 25-cent exchange limit to as high as $6.575 a bushel, the highest since May 20, 2013. Soybeans increased as much as 1.9% to $15.44 a bushel, the highest since June 5, 2013.

Soybean oil traded at levels not seen in a decade. An expected increase in Canada’s canola acreage won’t be enough to alleviate tight inventories, according to Farmers Business Network. The U.S. will update planting progress and crop condition figures later Monday in Washington.

Bullish investor momentum has yet to fade. Net long soybean bets surged the most since September in the week through April 20, and money managers flipped to a positive stance on wheat.

Still, soybean, wheat and corn futures in Chicago are all trading in overbought territory with their 14-day relative strength indexes above 70, indicating that prices may have risen too far, too fast. Values declined in China, signaling a possible calming of shortage fears as summer crop plantings progress and hefty purchases of foreign supplies continue to arrive at ports.

Will soaring US crop prices show up on a grocery shelf near you?

Prices of essential crops including wheat, corn and soybeans are surging to the highest since 2013.

I know this is not really the place for this but this post reminded me of something I read.

On a history and physical at work today at my surgery center, it included a section I have never seen before. It stated the patient had fear of lack of food availability, had not had enough food sometime in the last year, had lack of transportation in general had lack of transportation for medical needs, and there were a few other items on it.. Then it had a section on how social he was, how many times he went out with friends. I need to look at it again because I can not remember the exact wording. It was weird and worrisome. I wonder who is collecting this information and how it will be used.

On a history and physical at work today at my surgery center, it included a section I have never seen before. It stated the patient had fear of lack of food availability, had not had enough food sometime in the last year, had lack of transportation in general had lack of transportation for medical needs, and there were a few other items on it.. Then it had a section on how social he was, how many times he went out with friends. I need to look at it again because I can not remember the exact wording. It was weird and worrisome. I wonder who is collecting this information and how it will be used.

annieosage

Inactive

I know this is not really the place for this but this post reminded me of something I read.

On a history and physical at work today at my surgery center, it included a section I have never seen before. It stated the patient had fear of lack of food availability, had not had enough food sometime in the last year, had lack of transportation in general had lack of transportation for medical needs, and there were a few other items on it.. Then it had a section on how social he was, how many times he went out with friends. I need to look at it again because I can not remember the exact wording. It was weird and worrisome. I wonder who is collecting this information and how it will be used.

That's crazy and very invasive

Maybe.... looking for whether a person has transportation affects whether or not they can do appropriate followup for medical appointments. Asking about food security - well, that might get you information about meals on wheels, help with applying for social programs (WIC, SSI, etc), or a visit from APS (adult protective services). Social interaction can affect how well someone does - hate to tell you, but loners tend to do worse medically.

However, I can see how this is really invasive.

However, I can see how this is really invasive.

von Koehler

Has No Life - Lives on TB

The Chinese are very clever traders. They will make a few, random nibbles at a commodity to gauge the market then followed by some serious purchases. Then when the private traders-speculators-start to pile on the trade, the Chinese stop buying and wait for prices to drop.

Repeat the cycle.

Repeat the cycle.

marsh

On TB every waking moment

Food Prices Are About to Soar Right Alongside Gas and Electricity Costs

It will only matter if you can still afford to eat after filling up your car with gas.

Food Prices Are About to Soar Right Alongside Gas and Electricity Costs

By Shipwreckedcrew | Apr 26, 2021 8:30 AM ET

In the weeks following the outbreak of the COVID-19 pandemic, costs of most of the food items found on the shelves of US grocery stores rose based on anticipated shortages of such items that might result from transportation and logistical problems that followed the shutdown of many parts of the economy.

There wasn’t so much a shortage of goods to go on the shelves as there was an anticipated interruption in the “just in time” delivery supply line that keeps such products moving from processes to wholesalers, wholesalers to distributors, and distributors to retailers. As those disruptions were solved — or didn’t happen as feared in many instances — consumer goods and staples reappeared on the store shelves without much difference from the pre-pandemic pricing.

But warning bells are starting to be heard about another impending shortage of consumer goods and food staples as wholesale prices of certain raw materials used in a wide variety of food preparations have risen sharply over the past several weeks. This steady upward price pressure is coming at a time when many fragile economies around the world are not in a position to handle a sharp rise in the cost of food for their populations.

Soaring raw material prices have broad repercussions for households and businesses, and threaten a world economy trying to recover from the damage of the coronavirus pandemic. They help fuel food inflation, bringing more pain for families that are already grappling with financial pressure from the loss of jobs or incomes. For central banks, a spike in prices at a time of weak growth creates an unwelcome policy choice and could limit their ability to loosen policy.

But early in the pandemic, the increased costs of some food products were offset by a steep drop in energy prices which resulted from enormous reductions in energy consumption as people stayed home rather than traveled.“There seems to be sort of a bullish force behind the prices internationally,” Abdolreza Abbassian, senior economist at the United Nations’ Food and Agriculture Organization, said in an interview. “The indications are that there is very little reason to believe prices would remain at these levels. It’s more likely they will rise further. Hardship is still ahead.”

But with current energy prices soaring, any increase in food costs in the months ahead will be just like pouring gasoline on a fire — excuse the pun.

Gas prices jumped over 9% in the past month and they’re not expected to slow down anytime soon.

Gas prices are up 22.5% from the previous year and were the biggest contributor to an overall increase in goods and services in the nation, according to the US Bureau of Labor Statistics’ Consumer Price Index. Fuel prices pushed a 1-month increase in the overall price of goods for March that was the highest in nearly 9 years.

But the rising prices for food are being driven not just by increased production costs or cutbacks in farm activity. A big part of the upward pressure on price is the increased presence of one particular country in the world market with plenty of money to spend — China.A recent government report shows gas prices are expected to climb to a three-year high this summer. Prices at the pump will average $2.78 per gallon — up 34% from 2020 — in the next six months, according to the Energy Information Administration (EIA).

The most recent crop spikes follow months of price gains fueled by booming import demand from China. Corn prices have doubled in the past year, while soybeans are up about 80% and wheat 30%. With China’s purchases continuing and a spate of adverse weather conditions threatening crops in Brazil and the U.S., there are few signs of respite. Analysts including those at Rabobank, Mintec and HSBC Global Research all see a risk of even higher prices as a result, though it will vary across markets.

Americans have been able to survive financially for the better part of a year due, to some degree, to a government-provided bubble. Various COVID-19 relief and stimulus programs, combined with such market-altering policies as eviction and foreclosure moratoriums, have sheltered Americans from some of the harsher financial realities of the economic shutdown.“Generally people see this inflation continuing,” said Tosin Jack, an analyst at Mintec, which monitors commodity prices. “The trend will continue for some time and it will translate into consumer goods.”

But those costs are going to come due soon for many. It is beginning to look like a triple whammy is about to be visited on American consumers — higher food costs, higher energy prices, and a day of reckoning in having to deal with financial pain that has been only delayed, not eliminated, resulting from the economic shutdown.

xtreme_right

Veteran Member

agmfan, did you say you work at a local butcher shop? Are the case prices what the shop charges the customers or is that the wholesale price? I’m not used to hearing case prices quoted when talking about retail sales.Chicken Breast is going to $90 a 40lb case next week, up from $74, western KY

psychgirl

Has No Life - Lives on TB

I’m not seeing much beef on sale either and even then, it’s still too high.I sure don't see much beef on sale..only pork. Maybe the Chinese are buying all of that too, like they are all our corn and soybeans.

Getting ready to go in Kroger right now actually, I’ll look

Central Indiana

Jubilee on Earth

Veteran Member

With all the latest "anti-beef" propaganda, I wouldn't be surprise if they're keeping prices inflated on purpose.I sure don't see much beef on sale..only pork. Maybe the Chinese are buying all of that too, like they are all our corn and soybeans.

psychgirl

Has No Life - Lives on TB

Kroger was wonderfully stocked but no sales on beef except for some rump roast things.

Or on chicken either.

Frozen veggies stocked really well, finally especially those pesky peas!

so I bought three jumbo size bags and other veggies

Bacon prices are so so

Good cheese sale on Sargento but I don’t need that right now.

I’m in the car so that’s it for now.

Or on chicken either.

Frozen veggies stocked really well, finally especially those pesky peas!

so I bought three jumbo size bags and other veggies

Bacon prices are so so

Good cheese sale on Sargento but I don’t need that right now.

I’m in the car so that’s it for now.

John Deere Girl

Veteran Member

Thank you for sharing this!Kroger was wonderfully stocked but no sales on beef except for some rump roast things.

Or on chicken either.

Frozen veggies stocked really well, finally especially those pesky peas!

so I bought three jumbo size bags and other veggies

Bacon prices are so so

Good cheese sale on Sargento but I don’t need that right now.

I’m in the car so that’s it for now.

Jaybird

Veteran Member

Just had the Blue & Gold delivered from this years FFA booster sale. The bacon and sausage freezer is full. Our local butcher has always had the best beef around. Last batch of ground chuck and ribeye's I picked up didn't look or taste the same. His meat counter was also very sparsely stocked. I'd like to ask him about it as I've been a customer going on two decades but think I may offend him if I do. Definitely different from what he normally sells. And the prices are going way up.

Bones

Living On A Prayer

I had the unfortunate need to go to our Walmart. As quickly as possible, in....out....done.

I didn't have my phone on me for a picture, but as I was shuffling out of the main grocery aisle. The aisle with the open top fridges and freezers, I had a double take.

There was an open topped freezer full to the brim with whole, cryovac wrapper, whole hog heads. An new item for this customer base.

The whole thing. A quick glance showed them at about $15 each.

I didn't have my phone on me for a picture, but as I was shuffling out of the main grocery aisle. The aisle with the open top fridges and freezers, I had a double take.

There was an open topped freezer full to the brim with whole, cryovac wrapper, whole hog heads. An new item for this customer base.

The whole thing. A quick glance showed them at about $15 each.

I saw the same thing in a northern CA Walmart several months ago. I couldn't believe my eyes! I moved away from it quickly and avoided looking at it again as it freaked me out...this from a girl who grew up with grandparents who slaughtered their own chickens, steer and pigs. I had to help with the chicken plucking, meat cutting, wrapping and all the rest. I can't imagine what todays sheltered masses would make of such a sight.I had the unfortunate need to go to our Walmart. As quickly as possible, in....out....done.

I didn't have my phone on me for a picture, but as I was shuffling out of the main grocery aisle. The aisle with the open top fridges and freezers, I had a double take.

There was an open topped freezer full to the brim with whole, cryovac wrapper, whole hog heads. An new item for this customer base.

The whole thing. A quick glance showed them at about $15 each.

We do have a larger Philipino and black population in town, still...does that make a difference these days? Sincere question...did you notice anyone purchasing these hogs heads? I wouldn't think the store would stock them if there were no demand. Maybe my years away from country life have made me a Twinkie, but I couldn't eat such a thing.

Bones

Living On A Prayer

I saw the same thing in a northern CA Walmart several months ago. I couldn't believe my eyes! I moved away from it quickly and avoided looking at it again as it freaked me out...this from a girl who grew up with grandparents who slaughtered their own chickens, steer and pigs. I had to help with the chicken plucking, meat cutting, wrapping and all the rest. I can't imagine what todays sheltered masses would make of such a sight.

We do have a larger Philipino and black population in town, still...does that make a difference these days? Sincere question...did you notice anyone purchasing these hogs heads? I wouldn't think the store would stock them if there were no demand. Maybe my years away from country life have made me a Twinkie, but I couldn't eat such a thing.

I've eaten everything home butchered clean down to the oink. However, given other options, the head would be aways down on my list of preferred meats.

I was paddling out of there asap, per my disdain for the wallymart, and didn't see any other curious shoppers picking up hog noggins.

Im guessing our growing Hispanic population is the target market.

psychgirl

Has No Life - Lives on TB

You’re quite welcome!Thank you for sharing this!

Loretta Van Riet

Trying to hang out with the cool kids.

Or the POLICE protestors. :-(I've eaten everything home butchered clean down to the oink. However, given other options, the head would be aways down on my list of preferred meats.

I was paddling out of there asap, per my disdain for the wallymart, and didn't see any other curious shoppers picking up hog noggins.

Im guessing our growing Hispanic population is the target market.

agmfan3

Veteran Member

Case price to the customer. We sell a lot of case stuff to folks, if I remember a 15lb half case of bacon is around $74, I think, I do know by the pound it is $5.99 (boss said it should be $6.15 but he isn't going to raise it) Yes, I work at a local butcher/meat processing store. The prices of everything is going up, had a rep come in last week, one of the big food service companies, had a man in the office interviewing for a good job, his phone rang, he said "my unemployment is approved, I don't need the job" and walked out.agmfan, did you say you work at a local butcher shop? Are the case prices what the shop charges the customers or is that the wholesale price? I’m not used to hearing case prices quoted when talking about retail sales.

psychgirl

Has No Life - Lives on TB

Wow.Case price to the customer. We sell a lot of case stuff to folks, if I remember a 15lb half case of bacon is around $74, I think, I do know by the pound it is $5.99 (boss said it should be $6.15 but he isn't going to raise it) Yes, I work at a local butcher/meat processing store. The prices of everything is going up, had a rep come in last week, one of the big food service companies, had a man in the office interviewing for a good job, his phone rang, he said "my unemployment is approved, I don't need the job" and walked out.

I don’t have another word I could even offer, after reading that post.

xtreme_right

Veteran Member

There was an open topped freezer full to the brim with whole, cryovac wrapper, whole hog heads.

We see them here in South Texas. They’re used for making tamales. Not sure what else. I don’t see them year round though.

On a history and physical at work today at my surgery center, it included a section I have never seen before. It stated the patient had fear of lack of food availability, had not had enough food sometime in the last year, had lack of transportation in general had lack of transportation for medical needs, and there were a few other items on it.. Then it had a section on how social he was, how many times he went out with friends. I need to look at it again because I can not remember the exact wording. It was weird and worrisome. I wonder who is collecting this information and how it will be used.

Food deserts are an enormous problem. They might be trying to track which areas are food deserts. I know of areas in cities where people do not live near a normal grocery store plus they have no transportation to get to one. The people tend to get most of their food from dollar stores and gas stations. Their nutrition sucks. Kids are the ones who suffer the most from poor nutrition. Some chain stores are targeting these areas and making stores available within a 1 mile (walkable) distance. If they can't get to a grocery store they sure can't get to a doctor either. There is a big push to correct this problem.

energy_wave

Has No Life - Lives on TB

View attachment 263719

Will soaring US crop prices show up on a grocery shelf near you?

Prices of essential food commodities including wheat, corn and soybeans are surging to the highest levels since 2013, fueling concerns over food price inflation.

Kim Chipman and Megan Durisin

Bloomberg

26 Apr 2021

A crop rally in the U.S. is threatening to make essential food commodities dramatically more expensive, and the costs could soon spill over onto grocery store shelves.

Wheat, corn and soybeans, the backbone of much of the world’s diet, are all surging to the highest since 2013 after gains last week had some analysts warning that a speculative bubble was forming.

Bad crop weather in key-producing countries is a major culprit. Dryness in the U.S., Canada and France is hurting wheat plants, as well as corn in Brazil. Rain in Argentina is derailing the soy harvest. Add to that the fears of drought coming to the American Farm Belt this summer.

Meanwhile, China is gobbling up the world’s grain supplies, on track to take in its biggest haul of corn imports ever as it expands its massive hog herd. Rumors are swirling that the Asian nation is working on 1 million metric tons of new corn purchases, according to Arlan Suderman, chief commodities economist at StoneX.

“The agriculture sector looks very appealing right now and the money is chasing it,” Suderman said.

The agricultural rally is stirring food inflation fears, because staple crops heavily influence consumer prices for everything from bread and pizza dough to meat and even soda. The Bloomberg Agriculture Spot Index — which tracks key farm products — soared the most in almost nine years last week.

The higher prices are also helping to drive even broader gains across the commodities complex, with metals such as palladium and copper rallying on a comeback in industrial operations around the world.

Wheat climbed as much as 4.7% to $7.46 a bushel, the priciest since February 2013. Fresh buyers are starting to step in, with both Egypt and Bangladesh issuing new tenders.

Corn rose by the 25-cent exchange limit to as high as $6.575 a bushel, the highest since May 20, 2013. Soybeans increased as much as 1.9% to $15.44 a bushel, the highest since June 5, 2013.

Soybean oil traded at levels not seen in a decade. An expected increase in Canada’s canola acreage won’t be enough to alleviate tight inventories, according to Farmers Business Network. The U.S. will update planting progress and crop condition figures later Monday in Washington.

Bullish investor momentum has yet to fade. Net long soybean bets surged the most since September in the week through April 20, and money managers flipped to a positive stance on wheat.

Still, soybean, wheat and corn futures in Chicago are all trading in overbought territory with their 14-day relative strength indexes above 70, indicating that prices may have risen too far, too fast. Values declined in China, signaling a possible calming of shortage fears as summer crop plantings progress and hefty purchases of foreign supplies continue to arrive at ports.

Will soaring US crop prices show up on a grocery shelf near you?

Prices of essential crops including wheat, corn and soybeans are surging to the highest since 2013.www.aljazeera.com

A days wages for a days ration of milk and bread. End times.

marsh

On TB every waking moment

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

One Bank Warns Soaring Food Prices Will Lead To Social Unrest

WEDNESDAY, APR 28, 2021 - 09:00 PM

Yesterday we explained why with prices already soaring, global inflation was about to go into overdrive as the leading food price indicator that is the Bloomberg Agri spot index hit the highest level in six years.

In a nutshell, this is a problem since food is a large component of CPI baskets in Asia, and "this large inflationary impulse in the region that houses more than half the world’s population should result in higher wage costs in the factory base of the world. As CPI and PPI rise in Asia, it will feed through globally in the months ahead."

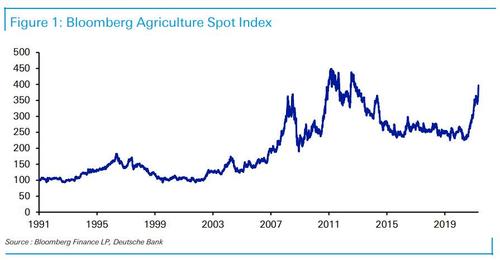

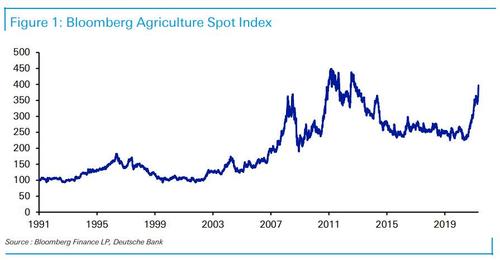

Today, DB's Jim Reid picked that chart as his "Chart of the day", repeating what readers already know, namely that Bloomberg’s agriculture spot index has risen by c.76% year-on-year, noting that "that’s the biggest annual rise in nearly a decade, and there are only a couple of other comparable episodes since the index begins back in 1991."

Like us, Reid then patiently tries to explain to all the idiots - like those employed in the Marriner Eccles building - that the importance of this record surge "extends far beyond your weekly shop, as there’s an extensive literature connecting higher food prices to periods of social unrest." Indeed, you’ll notice from the chart that the last big surge from the middle of 2010 to early 2011 coincided with the start of the Arab Spring, for which food inflation is regarded as a contributing factor.

While this is hardly new - we discussed it in "Why Albert Edwards Is Starting To Panic About Soaring Food Prices" and in "We Are Edging Closer To A Biblical Commodity Price Increase Scenario" - Reid also reminds us that emerging markets are more vulnerable to this trend, since their consumers spend a far greater share of their income on food than those in the developed world.

The DB strategist then goes all-in and says what everyone is thinking, namely that "this trend of higher food prices leading to social unrest extends far back into history and surrounds many key turning points. The French Revolution of 1789, which overthrew the Ancien Régime, came after a succession of poor harvests that led to major rises in food prices. It was a similar story at the time of Europe’s 1848 revolutions too, which followed the failure of potato crops in the 1840s and the associated severe famine in much of Europe. And the 1917 overthrow of the Tsarist regime in Russia took place in the context of food shortages as well."

So while it remains to be seen what the consequences of today’s surge in food prices could be, Reid cautions that "given the hardship that’s already occurred thanks to the pandemic, a fresh wave of unrest would be no surprise on a historical basis."

+++++++++++++++++++++

I personally know of several families in the cattle business who are now selling beef products direct. They are all located in Scott Valley in far northern CA.

Shop — Isbell Mountain Acres

All natural beef, grass-fed, grain finished, angus beef, grown on our farm in Northern California. Cuts are sold individually or in our family meat boxes. Can be shipped directly to you.

Jenner Family Beef

(multi-generational ranch. Distaff side runs direct sales.)

StarWalker Organic Farms - Certified Organic Beef & Pork

Certified Organic Grass Fed Beef and Certified Organic Pasture Raised Pork directly from our family farm to your family table. StarWalker Organic Farm ships Beef and Pork to your doorstep. Our third generation farm is proud to be certified organic and certified humane. Enjoy the flavors!

starwalkerorganicfarms.com

starwalkerorganicfarms.com

I don't know these folk. They came in from elsewhere but they are in the same geographic area

Some, if not all, of this beef may be grass fed and not grain finished.

This is a photo of one end of the valley:

bassaholic

Veteran Member

I go to Walmart 2-3 times a week and buy ALL the Dinty Moore beef stew. It's delicious and if you add it to rice you can make many meals.

Barry Natchitoches

Has No Life - Lives on TB

I don’t think the risk of rising food prices will lead to social unrest UNLESS they also cut back SNAP (food stamps), the free school lunch program, WIC, support for food banks, federal commodities programs, and other sources of free food.

But what happens when the eviction moratorium ends and people have to pay all that back due rent?

THAT is more likely to lead to major social unrest than higher food prices, given the fact that many potential rioters are getting most of their food free anyway.

But what happens when the eviction moratorium ends and people have to pay all that back due rent?

THAT is more likely to lead to major social unrest than higher food prices, given the fact that many potential rioters are getting most of their food free anyway.

Jubilee on Earth

Veteran Member

Exactly what I was thinking. The kind of people these rising prices will actually impact are not the kind to engage in civil unrest. Those kind of people are still out there happy and full from the food they bought on the dole.I don’t think the risk of rising food prices will lead to social unrest UNLESS they also cut back SNAP (food stamps), the free school lunch program, WIC, support for food banks, federal commodities programs, and other sources of free food.

But what happens when the eviction moratorium ends and people have to pay all that back due rent?

THAT is more likely to lead to major social unrest than higher food prices, given the fact that many potential rioters are getting most of their food free anyway.

mzkitty

I give up.

Exactly what I was thinking. The kind of people these rising prices will actually impact are not the kind to engage in civil unrest. Those kind of people are still out there happy and full from the food they bought on the dole.

I don't think you're quite understanding. Most people don't WANT to be on food stamps. At this point, it's kind of like you get TRAPPED in it. For a lot of people anyway. Depending on the situation. Be compassionate. Do you want them to starve to death?

Jubilee on Earth

Veteran Member

I don’t think you understood my comment.I don't think you're quite understanding. Most people don't WANT to be on food stamps. At this point, it's kind of like you get TRAPPED in it. For a lot of people anyway. Depending on the situation. Be compassionate. Do you want them to starve to death?

school marm

Veteran Member

Earlier this week I got an email from a local rancher offering direct sales of their organic beef. I guess their $6.68/lb for hamburger is better than the $8-10 posted by the ranchers in Scotts Valley, but I still find it a little steep.Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

One Bank Warns Soaring Food Prices Will Lead To Social Unrest

WEDNESDAY, APR 28, 2021 - 09:00 PM

Yesterday we explained why with prices already soaring, global inflation was about to go into overdrive as the leading food price indicator that is the Bloomberg Agri spot index hit the highest level in six years.

In a nutshell, this is a problem since food is a large component of CPI baskets in Asia, and "this large inflationary impulse in the region that houses more than half the world’s population should result in higher wage costs in the factory base of the world. As CPI and PPI rise in Asia, it will feed through globally in the months ahead."

Today, DB's Jim Reid picked that chart as his "Chart of the day", repeating what readers already know, namely that Bloomberg’s agriculture spot index has risen by c.76% year-on-year, noting that "that’s the biggest annual rise in nearly a decade, and there are only a couple of other comparable episodes since the index begins back in 1991."

Like us, Reid then patiently tries to explain to all the idiots - like those employed in the Marriner Eccles building - that the importance of this record surge "extends far beyond your weekly shop, as there’s an extensive literature connecting higher food prices to periods of social unrest." Indeed, you’ll notice from the chart that the last big surge from the middle of 2010 to early 2011 coincided with the start of the Arab Spring, for which food inflation is regarded as a contributing factor.

While this is hardly new - we discussed it in "Why Albert Edwards Is Starting To Panic About Soaring Food Prices" and in "We Are Edging Closer To A Biblical Commodity Price Increase Scenario" - Reid also reminds us that emerging markets are more vulnerable to this trend, since their consumers spend a far greater share of their income on food than those in the developed world.

The DB strategist then goes all-in and says what everyone is thinking, namely that "this trend of higher food prices leading to social unrest extends far back into history and surrounds many key turning points. The French Revolution of 1789, which overthrew the Ancien Régime, came after a succession of poor harvests that led to major rises in food prices. It was a similar story at the time of Europe’s 1848 revolutions too, which followed the failure of potato crops in the 1840s and the associated severe famine in much of Europe. And the 1917 overthrow of the Tsarist regime in Russia took place in the context of food shortages as well."

So while it remains to be seen what the consequences of today’s surge in food prices could be, Reid cautions that "given the hardship that’s already occurred thanks to the pandemic, a fresh wave of unrest would be no surprise on a historical basis."

+++++++++++++++++++++

I personally know of several families in the cattle business who are now selling beef products direct. They are all located in Scott Valley in far northern CA.

(small family ranch. just started direct sales.)

Shop — Isbell Mountain Acres

All natural beef, grass-fed, grain finished, angus beef, grown on our farm in Northern California. Cuts are sold individually or in our family meat boxes. Can be shipped directly to you.www.isbellmountainacres.com

Jenner Family Beef

(multi-generational ranch. Distaff side runs direct sales.)

(organic grower.)

StarWalker Organic Farms - Certified Organic Beef & Pork

Certified Organic Grass Fed Beef and Certified Organic Pasture Raised Pork directly from our family farm to your family table. StarWalker Organic Farm ships Beef and Pork to your doorstep. Our third generation farm is proud to be certified organic and certified humane. Enjoy the flavors!starwalkerorganicfarms.com

I don't know these folk. They came in from elsewhere but they are in the same geographic area

Some, if not all, of this beef may be grass fed and not grain finished.

This is a photo of one end of the valley:

View attachment 264081

mzkitty

I give up.

- Status

- Not open for further replies.