Quiet Man

Nothing unreal exists

So transparent...

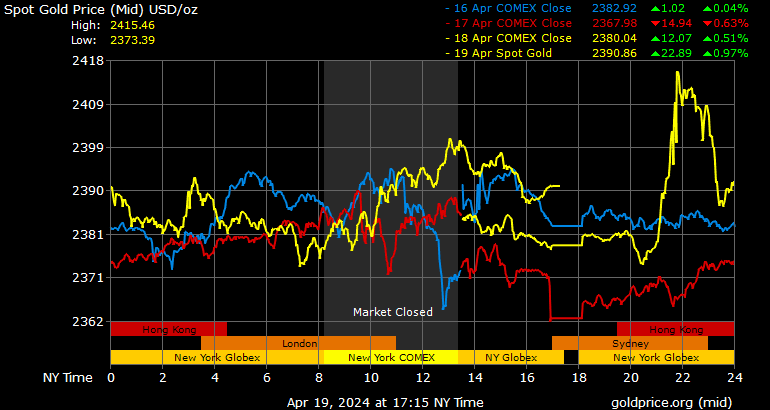

"Gold prices could move to $1,725 by year end ($1,700-$1,750/oz range) ..."? Yes, and much further -- higher.

J.P. Morgan: Can gold continue to shine?

www.jpmorgan.com

www.jpmorgan.com

(Don't bother reading IMO).

"Gold prices could move to $1,725 by year end ($1,700-$1,750/oz range) ..."? Yes, and much further -- higher.

J.P. Morgan: Can gold continue to shine?

Can gold continue to shine?

Gold can play an important role against an uncertain outlook for markets.

(Don't bother reading IMO).

Last edited: