It's time to forget about bitcoin! These virtual currencies have much more to offer over the long run.

Sean Williams

(TMFUltraLong)

Dec 23, 2017 at 10:39AM

It may be hard to believe, but it's the truth: Cryptocurrencies are considerably closer to hitting $1 trillion in total value than $100 billion in value.

When the year began, the combined market cap of all virtual currencies was just $17.7 billion, and bitcoin made up nearly 88% of that total. However, as of Dec. 20, the aggregate market cap of the better than 1,360 digital currencies had soared to $635 billion, representing a year-to-date increase of almost 3,500%, and bitcoin's contribution was less than 50%. By comparison, the stock market historically gains about 7% a year, inclusive of dividend reinvestment and adjusted for inflation. Cryptocurrencies have simply whooped traditional equities in 2017.

The buzz behind cryptocurrencies

Why such bullishness, you ask? A number of catalysts have played a role in pushing virtual currencies higher. For example, the emergence of blockchain is creating a lot of buzz on Wall Street.

Blockchain is the digital and decentralized ledger that records all transactions without the need for a financial intermediary like a bank. Think of it as the infrastructure that underlies digital currencies like bitcoin. Blockchain has the potential to speed up transaction settlement times, reduce transaction fees, and could be considerably more secure than current databases, just to name a few advantages.

Dollar weakness has also been helpful, especially to bitcoin. A falling dollar is great news for U.S. exporters, but it's not such positive news for investors holding cash. These investors will often seek the safety of gold as a store of value, given gold's scarcity and use as a currency for more than 2,700 years. Yet some cryptocurrencies, like bitcoin, have protocols that limit the number of coins that can be mined. This creates the perception of scarcity, which has pushed some investors to choose bitcoin, or other cryptos, over traditional commodities, like gold.

Emotions are clearly playing a role, too. The fear of missing out, or "FOMO," and watching everyone else make money has coerced both novice and experienced investors into buying cryptocurrencies.

Forget bitcoin: These cryptocurrencies appear far more enticing

As you might imagine, the buzz is almost always about bitcoin -- and with good reason. It comprises nearly 46% of the aggregate cryptocurrency market cap, is the most popular virtual coin in the world, was the first tradable digital currency, and is accepted by more merchants relative to any other cryptocurrency.

Yet, if you ask this investor, it's pretty far down the list of cryptocurrencies worth considering for purchase. Bitcoin, and Litecoin, for that matter, are laser-focused on growing their partnerships with merchants, and have largely ignored the enterprise-based application of their blockchains. While there's value to be had as a means of money transmittance, I personally believe that blockchain is where the bigger long-term opportunity lies. As such, I believe the following three cryptocurrencies may be worth buying over bitcoin.

Ethereum

There's a good reason why Ethereum is the second-largest cryptocurrency by market cap: It has a really popular blockchain. Formed earlier this year, the Enterprise Ethereum Alliance is comprised of 200 organizations that are currently testing a version of Ethereum's blockchain in demo, pilot, and small-scale projects. These testers include governments, financial-service companies (which are expected to be the biggest benefactor of blockchain technology), and tech and energy companies.

What makes Ethereum really stand out is its incorporation of smart contracts, which help facilitate, verify, or enforce the negotiation of a contract. While Ethereum's blockchain is somewhat similar to that of bitcoin, these smart contract protocols allow it to move beyond currency-only applications. Its blockchain could be used to store information about an application, or can function as a multi-signature account that allows money to be spent when a certain percentage of people agree. Or in the case of integrated oil and gas giant BP (NYSE:BP), it could speed up transaction settlement times to improve energy futures trading efficiency.

The one knock on Ethereum is that its coin, Ether, is almost exclusively used to cover transaction fees and doesn't have a clear path, like bitcoin, to being accepted by merchants. Again, I believe the smarter path for the Ethereum Foundation is to focus on blockchain, which is what they're doing, but it's unclear how exactly the Ether coin ties into its future.

Ripple

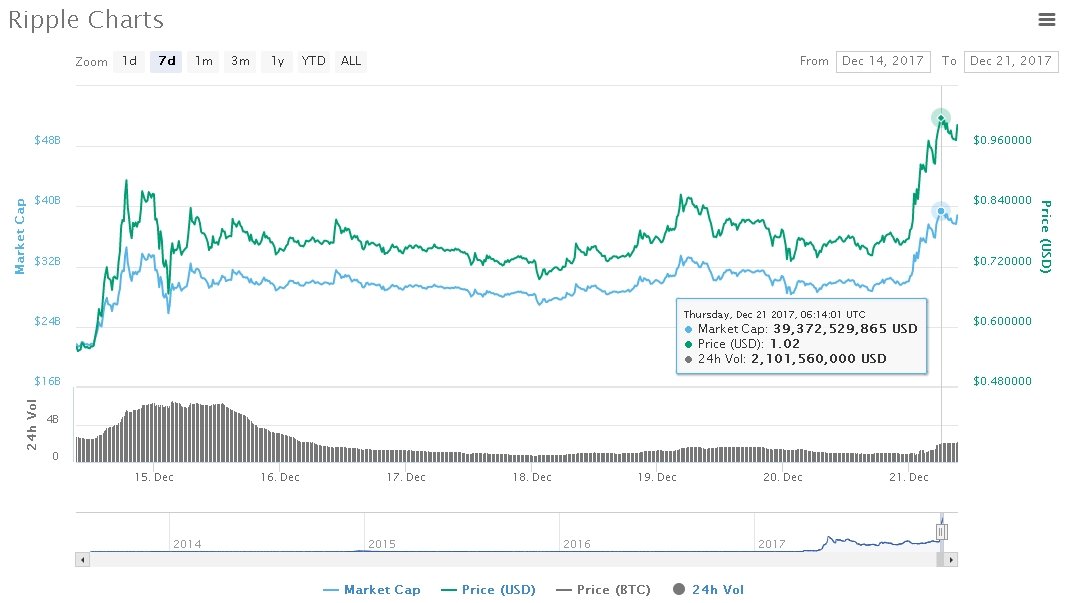

Another cryptocurrency that's been very impressive of late is Ripple. Its token, the XRP, has galloped higher by more than 12,000% since the year began.

As with Ethereum, the buzz here is all about the company's blockchain technology. But unlike Ethereum, which is partnering with a number of industries, Ripple is focused on becoming the go-to blockchain for the financial-services industry. The company's blockchain offers the ability to rapidly proof payments and transactions, which could drastically improve the time it takes for settlement. In particular, Ripple's blockchain may offer the potential for instantaneous cross-border payments and transactions.

In June 2016, Ripple announced that four major banks were testing out its distributed ledger technology in some small capacity: Canadian Imperial Bank of Commerce, UBS, Banco Santander (NYSE:SAN), and Unicredit. But it wasn't until Nov. 2017 that Ripple really put itself on the radar. American Express (NYSE:AXP) and Banco Santander announced that they were partnering to test Ripple's blockchain in non-card cross-border payments across AmEx's FX International Payment network to U.K. Santander accounts. These payments are expected to process instantly.

What's more, it looks like the XRP is going to play a vital role in the growth of Ripple's blockchain. In particular, it could be used as an intermediary in cross-border transactions that allows for one currency, say Japanese yen, to be exchanged to another currency, like the euro, instantly. Ripple is certainly worth keeping a close eye on, and it looks to be far more intriguing than bitcoin.

Stellar

Sticking with the theme that blockchain is king, one under-the-radar cryptocurrency you should be following is Stellar (formerly Stellar Lumens), and its coin, the XLM. This is a virtual currency that holds true to its name, as the XLM has been "stellar" this year with a 10,400% year-to-date gain.

Stellar's focus is similar to that of Ripple: building financial products for transactions around the globe. In other words, it's targeting enterprise clients with high volumes of cross-border transactions. But whereas Ripple is sinking its teeth into big banks and financial-service companies, Stellar is looking at servicing multinational corporations that conduct billions in revenue outside of their home country. Stellar's blockchain suggests that cross-border payments could settle in just two-to-five seconds.

What's more, Stellar also incorporates smart contract protocols into its blockchain. Though they aren't exactly the same as Ethereum's, they nonetheless are an attractive addition for enterprise customers.

In October, Stellar announced a partnership with IBM (NYSE:IBM) and KlickEx to facilitate quicker cross-border transactions. IBM generates tens of billions of dollars from global clients, signaling that this could be Stellar's opportunity to prove the value of its blockchain to other multinationals. Currently, a dozen banks in the South Pacific region are deploying this project, with IBM expected to scale the project beyond this region if it's successful.

Nevertheless, keep in mind that the word "consider" is paramount with all three of these cryptocurrencies. While this investor views them as far more intriguing over the long run than bitcoin, I wouldn't suggest chasing these valuations at this time. The risks in cryptocurrencies are aplenty, and it wouldn't take much for this bubble to burst.

https://www.fool.com/investing/2017/12/23/3-cryptocurrencies-to-consider-buying-over-bitcoin.aspx

No Big Brother to step in and calm the markets. The line was held by HODLers, those holding their coins and linking arms refused to let any more Bears beat them up. Yeah, we are bruised, a few broken teeth and bones, but we survived.

No Big Brother to step in and calm the markets. The line was held by HODLers, those holding their coins and linking arms refused to let any more Bears beat them up. Yeah, we are bruised, a few broken teeth and bones, but we survived.