You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GOV/MIL There is a "Real Risk" The Government Will Shut Down At The End Of The Month

- Thread starter marsh

- Start date

SmithJ

Veteran Member

Not if they run out of moneyI think I'm right in that Fed retirees and Social Security recipients will be receiving their payments as usual, health benefits/Medicare/Medicaid will continue uninterrupted, etc. The Treasury just won't be adding to those giant appropriations, only adding what is needed to pay beneficiaries (recipients). I believe this also will mean SNAP benefits will continue (the old food stamps program).

I think the USPS is classed as essential services and will continue to function as it does now.

Melodi

Disaster Cat

No, only as long as it is just a "regular" sort of government shut-down, that does keep a lot of mandatory services going (including military pay).I think I'm right in that Fed retirees and Social Security recipients will be receiving their payments as usual, health benefits/Medicare/Medicaid will continue uninterrupted, etc. The Treasury just won't be adding to those giant appropriations, only adding what is needed to pay beneficiaries (recipients). I believe this also will mean SNAP benefits will continue (the old food stamps program).

I think the USPS is classed as essential services and will continue to function as it does now.

But if the Debt Ceiling isn't raised then there is no money for ANYTHING, the Federal Reserve has a few "tricks" to try to keep the military paid and the lights on in the nuclear bunkers but it is a fragile setup at best and may not work very well, and I don't think it covers Social Security (it might, there are varying stories out there).

Again, two things are happening at the same time, which makes it confusing enough to give even me a headache and as a former US Federal Personnel Clerk, I do understand the situation, though you would think that some in Congress don't really "get it."

Those audits are a state run/funded thing zilch fed involvement not their circus not their monkeys or moneyWait a minute...can the 2020 election be fully audited if the government goes into default and hard shutdown?

Sleeping Cobra

TB Fanatic

Seems we go through this every year. Things will be fine.

pinkelsteinsmom

Veteran Member

Oh look, Nasty P has been re-stretched. Would love to know the costs of her plastic surgery we are paying for.

The Snack Artist

Membership Revoked

I'm going to bet the back of her head looks like a football all laced up. Doc puts a foot on her neck and gives the laces a tug every six months. She will be knee deep in the fire pit soon. How does one sleep at night knowing that?Oh look, Nasty P has been re-stretched. Would love to know the costs of her plastic surgery we are paying for.

Doomer Doug

TB Fanatic

Melodi is right we are dealing with several separate items. The first being the government shut down which can be dealt with a "clean" continuing resolution up to the 18th. Or they both can be merged.

The problem is the demoncrat progressives want their $3.5 trillion bill voted on first and won't budge. This is why I think they will stall on the shut down.

A real clown show this year.

The problem is the demoncrat progressives want their $3.5 trillion bill voted on first and won't budge. This is why I think they will stall on the shut down.

A real clown show this year.

separate diz-org for finance they do get $$$ from treasury so they may, may be in play tooWill mail delivery stop? Or is USPS funded differently?

We all know its Obama running everythingNancy about keeping government open and implementing the agenda....

16 seconds

Sometimes the truth slips out.

Meemur

Voice on the Prairie / FJB!

We all know its Obama running everything

Ultimately the Chinese Communist Party . . . they run Obama, who is probably one of Joe's handlers.

marsh

On TB every waking moment

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Government Shutdown And Debt Ceiling Drama: What Comes Next

TUESDAY, SEP 28, 2021 - 11:09 AM

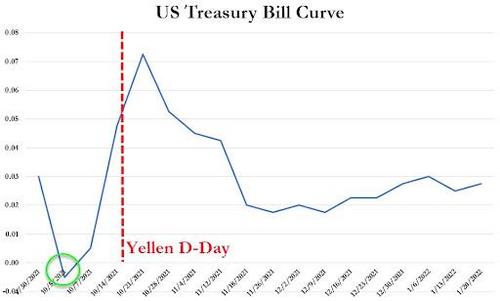

Now that we know that the debt ceiling "drop-dead date" will fall on (or around) October 18, as per Janet Yellen's latest letter, attention turns to what's next. As readers know, the bond market is showing signs of concern around the D-date, with the T-Bills kink peaking today just after the Oct 18 data.

But the bigger question is how will Congress extricate itself from Biden's game of debt ceiling chicken which we discussed recently.

Before we get into the most likely scenarios, Goldman's Alec Phillips reminds us that a complicating factor is that the House is scheduled to be in recess after Oct. 1 until Oct. 18, and the Senate after Oct. 8 until Oct. 18. House Democratic leaders already suggested that some of that recess might need to be cancelled, and that looks more likely in light of this deadline.

So turning to Congress, following yesterday's failed Senate vote on the continuing resolution (CR) and debt limit suspension, Goldman notes that Democratic leaders will now need to decide whether to bring a "clean" CR to the floor that omits the debt limit, something which Nancy Pelosi said this morning is "the plan". Goldman thinks that such a vote could happen potentially as soon as today, as it seems to be only way to avoid a shutdown in light of likely continued Republican opposition to a CR paired with a debt limit suspension.

So looking at the upcoming calendar, Goldman observes that the main question is whether to extend spending authority until around Oct. 18, aligning the two deadlines, or to pass the same CR the Senate just blocked (minus the debt limit suspension), which lasted until Dec. 3.

The former would suggest that Democratic leaders might make another attempt at passing the debt limit with Republican support, which would increase the risks around the issue. The latter would reduce the risks to the debt limit, as it would suggest that Democratic leaders might plan to increase the debt limit via the reconciliation process.

The latter approach also requires some lead time, as it would mean first passing a revised budget resolution in the House and Senate, followed by a reconciliation bill raising the debt limit, which would also need to pass both chambers.According to Phillips, that would likely take at least a week, though the closer to the deadline the process starts, the more likely it is that Republicans would agree to waive some of the required time for debate. If so, Democratic leaders seem incentivized to let the clock run down before acting.

marsh

On TB every waking moment

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Jamie Dimon Warns JP Morgan Bracing For "Potentially Catastrophic" US Default Debt-Ceiling Battle Drags On

TUESDAY, SEP 28, 2021 - 03:45 PM

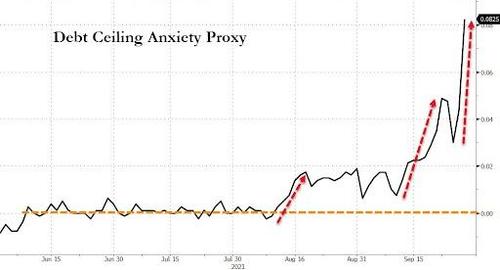

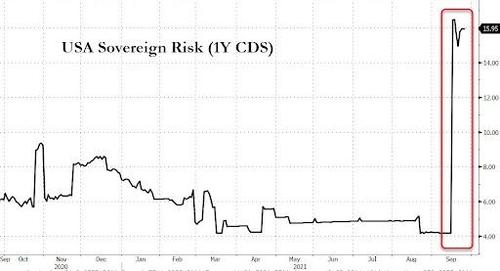

Now that Janet Yellen has confirmed Oct. 18 is the "drop dead" for Congress to lift the federal debt borrowing limit, progressives are pushing even harder against the Democratic leadership, which is stuck between appeasing the "Squad", and moderates like Sens. Joe Manchin and Kyrsten Sinema. Markets are starting to get anxious as there's no obvious path toward raising the debt limit and passing the Dems' financial agenda.

So, with stocks in free-fall on Tuesday, JP Morgan CEO Jamie Dimon told Reuters that America's biggest bank by assets has begun preparing for the possibility that the debt ceiling might not be lifted in time. Dimon said that while he ultimately expects politicians to find a solution, a "catastrophic event" like what Yellen described during her Senate testimony today could still be imminent.

Specifically, JPM has begun planning for a scenario for the US to default on its debt, and how this would impact repo and money markets, client contracts, the bank's capital ratios while also trying to discern how ratings' agencies might react.

What Dimon is referencing are down-to-the-wire debt-ceiling battles in 2011 and 2017 under presidents Barack Obama and Donald Trump, respectively."This is like the third time we’ve had to do this, it is a potentially catastrophic event," he said. "Every single time this comes up, it gets fixed, but we should never even get this close. I just think this whole thing is mistaken and one day we should just have a bipartisan bill and get rid of the debt ceiling. It’s all politics," Dimon added.

But while Dimon has seen this show before, many market participants are growing increasingly worried that this time, the US might actually default.

As far as the ratings agencies are concerned, markets are already pricing in higher credit risk for the US via short-term CDS, where insurance against a US default in September has skyrocketed.

A major part of this preparation involves the bank combining through its client contracts, which is a resource-intensive process that cost the bank $100 million "if I remember correctly," Dimon said.

Dimon, who was speaking to Reuters ahead of a ribbon-cutting ceremony at a new Chase branch in southeast Washington DC, part of a promise made by Dimon in a letter to shareholders, where he outlined certain efforts to recruit more customers and employees from "under-served" communities. Per Reuters, the branch is the eleventh of its kind JPMorgan has opened since 2019 in cities including New York, Detroit, LA and Chicago. As well as providing traditional services, the branches will also work with local community groups to provide free skills training and other support for minority-owned small businesses.

Dimon also took a few minutes to criticize the Community Reinvestment Act, which requires regulators to "score" megabanks based on how well they accommodate "under-served" communities. Dimon said the law needs to be "modernized" to account for "technology-driven changes" to the banking business."It’s not a traditional bank branch, we want it to be very welcoming, we want it to be attractive," said Dimon.

Biden’s acting Comptroller of the Currency Michael Hsu said earlier this month that's he planning to dump changes to fair-lending laws that had been imposed by his Trump-appointed predecessor.“It is very complicated, very slow, very late, very hard to measure," Dimon said, adding that CRA assessments should be conducted in real time, as opposed to a retrospective review every few years. "Does it actually capture everything? No. Is it real time? No. Is it politicized? Absolutely."

While Dimon used Tuesday's interview to flex JPM's ESG credentials, it's too bad nobody asked him for his thoughts on other looming market risks, like the Evergrande situation. We'd also be curious to know how much JPM lost on the Didi IPO, where it served as one of the lead underwriters alongside Goldman and Morgan Stanley.

marsh

On TB every waking moment

Schumer says he'll try to get debt limit raised with simple majority vote, GOP vows to defeat effort

Texas GOP Sen. Ted Cruz said Republicans will block Schumer's effort.

Schumer says he'll try to get debt limit raised with simple majority vote, GOP vows to defeat effort

Texas GOP Sen. Ted Cruz said Republicans will block Schumer's effort.

Updated: September 28, 2021 - 2:37pm

Senate Majority Leader Chuck Schumer said Tuesday he will try to bypass the legislative filibuster so that he and fellow Senate Democrats can increasing the country's borrowing limit – a move that brought immediately opposition from Republicans.

The New York Democrat said he'll make a formal request later in the day, following Senate Republicans on Monday night blocking a House-passed government-funding/debt ceiling bill from getting the 60 votes needed to break a legislative filibuster.

Schumer said that he will ask the Senate for "unanimous consent," which sets up a vote on the debt-ceiling increase that can pass by a simple majority. That would allow Democrats to suspend the ceiling on their own, because Republican don't want to do that amid rising inflation and so much recent government spending.

The unanimous consent requests can also be nixed by opposition from just one Republican senator.

Texas GOP Sen. Ted Cruz said Republicans will block Schumer's effort, according to The Hill newspaper.

"There is no universe in which I am going to consent to lower the the threshold and make it easier for him to do so. He’s playing games," he reportedly said. "The games aren’t going to work."

Fellow GOP Sen. Ron Johnson, of Wisconsin, also said that he would object, The Hill also reports.

Meemur

Voice on the Prairie / FJB!

The games have always worked before ....

However, if the CCP has called for the US to default, their games may not work this time.

night driver

ESFP adrift in INTJ sea

SURE!!

They ALWAYS WORK...until they don't.

They ALWAYS WORK...until they don't.

Doomer Doug

TB Fanatic

Increasing the debt limit isn't going very well for the demoncrats in the US Senate. It failed to pass on Monday, so they tried it on Tuesday and it failed to pass a second time. Are they going to keep voting on it? Weds or Thursday?

Thursday at midnight is when TSWHTF.

Pelosi is talking about passing a clean continuing resolution to prevent the government shutdown and fund spending, but not increase the debt limit.

Whatever happens in the house, the senate doesn't have the Demoncrat votes to increase the debt limit. And the demoncrat progressives will not vote for either a debt increase or the smaller infrastructure bill, the $1.2 Trillion one, UNTIL they pass the $3.5 Trillion bill FIRST.

If there is NO vote at all, or it doesn't pass, the $3.5 trillion liberal fantasy bill will be like a kidney stone in the bowels of the US House of Representatives.

Remember BOTH BILLS, plus the debt increase, must pass both chambers.

We should all take steps to prepare for financial chaos starting on Oct 1st, followed on October 18th.

Get some cash on hand for the next three months. Make sure you can pay your rent and utilities at LEAST till the end of the year.

I realize this budget and debt theater happens every year. Unless Jaypal backs off, which I see NO sign of happening, then the debt limit won't be increased, and the government will shut down midnight Thursday.

Thursday at midnight is when TSWHTF.

Pelosi is talking about passing a clean continuing resolution to prevent the government shutdown and fund spending, but not increase the debt limit.

Whatever happens in the house, the senate doesn't have the Demoncrat votes to increase the debt limit. And the demoncrat progressives will not vote for either a debt increase or the smaller infrastructure bill, the $1.2 Trillion one, UNTIL they pass the $3.5 Trillion bill FIRST.

If there is NO vote at all, or it doesn't pass, the $3.5 trillion liberal fantasy bill will be like a kidney stone in the bowels of the US House of Representatives.

Remember BOTH BILLS, plus the debt increase, must pass both chambers.

We should all take steps to prepare for financial chaos starting on Oct 1st, followed on October 18th.

Get some cash on hand for the next three months. Make sure you can pay your rent and utilities at LEAST till the end of the year.

I realize this budget and debt theater happens every year. Unless Jaypal backs off, which I see NO sign of happening, then the debt limit won't be increased, and the government will shut down midnight Thursday.

Barry Natchitoches

Has No Life - Lives on TB

I believe you are correct, Melodi.No, only as long as it is just a "regular" sort of government shut-down, that does keep a lot of mandatory services going (including military pay).

But if the Debt Ceiling isn't raised then there is no money for ANYTHING, the Federal Reserve has a few "tricks" to try to keep the military paid and the lights on in the nuclear bunkers but it is a fragile setup at best and may not work very well, and I don't think it covers Social Security (it might, there are varying stories out there).

Again, two things are happening at the same time, which makes it confusing enough to give even me a headache and as a former US Federal Personnel Clerk, I do understand the situation, though you would think that some in Congress don't really "get it."

My wife gets SSDI. It is my understanding that her next check - which should hit before the government hits its debt ceiling in mid-October, will arrive as scheduled.

But any Social Security checks destined to be issued after the debt ceiling has been hit are in danger of being delayed or maybe even not ever being issued, if the idiots in DC can’t resolve this problem.

coalcracker

Veteran Member

Political theatre.

After the farce of the 2020 election, I find myself too cynical to care much about anything the “elected” dems/repubs say or do.

I know they have a plan, and that they’re all in it together. There is no good side or no white hats to save the day politically. They are following a script, and the current chapter is “Preparing for the Dark Winter.”

“Alexa, how can we maximize the chaos?”

After the farce of the 2020 election, I find myself too cynical to care much about anything the “elected” dems/repubs say or do.

I know they have a plan, and that they’re all in it together. There is no good side or no white hats to save the day politically. They are following a script, and the current chapter is “Preparing for the Dark Winter.”

“Alexa, how can we maximize the chaos?”

Blacknarwhal

Let's Go Brandon!

Just to be safe, I sent the birthday cards to seniors (they don't use the Internet) and some other stuff today.

A good plan, no matter how it turns out. Those seniors do love their cards. Old family friend of ours lives across the street from me. Dear lady, but she has a tendency to panic a bit since her husband died. I left my garage door open a little too long once and she called my mom and dad to make sure I was okay. Dad had to go out and spend about a half-hour talking her down and convincing her there was no problem.

Started sending her a Christmas card a few years ago thanking them--back when her husband was alive--for being such good neighbors, and one year she actually commented on it to my mom, saying how glad she was to see the cards.

It's kind of amazing how happy you can make someone for a few bucks and maybe 20 minutes of time, so if you've got any old folks around you, send a card at Christmas. Oh, and tip your mail carrier, too; you'd be surprised how far that goes.

phloydius

Veteran Member

It's kind of amazing how happy you can make someone for a few bucks and maybe 20 minutes of time, so if you've got any old folks around you, send a card at Christmas. Oh, and tip your mail carrier, too; you'd be surprised how far that goes.

Every year, I buy our Christmas Cards on clearance (for up to about 75-90% off) around New Years, for use the following Christmas. The first year I did this, I bought 5 or 6 sets, so I always have several to choose from, or if there are no good ones left.

We also leave a gift bag with cookies, drinks, some special treats, and a card thanking them for our USPS carrier and the Trash / Recycling pickup crew. They are always surprised & happy about it, and the good will last a long time.

Blacknarwhal

Let's Go Brandon!

Every year, I buy our Christmas Cards on clearance (for up to about 75-90% off) around New Years, for use the following Christmas. The first year I did this, I bought 5 or 6 sets, so I always have several to choose from, or if there are no good ones left.

We also leave a gift bag with cookies, drinks, some special treats, and a card thanking them for our USPS carrier and the Trash / Recycling pickup crew. They are always surprised & happy about it, and the good will last a long time.

It really does wonders; my mail carrier will actually bring large packages to my door instead of leaving the slip that makes me go to the post office later to sign for them. I favor a Christmas card with a thank-you note and $20 inside.

phloydius

Veteran Member

It really does wonders; my mail carrier will actually bring large packages to my door instead of leaving the slip that makes me go to the post office later to sign for them. I favor a Christmas card with a thank-you note and $20 inside.

I used to give a $20 bill or a gift card, years ago. But one of the best mail carriers I used to have came to the door and returned it. He thanked me, but told me that he was prohibited from accepting any cash or cash equivalents no matter the amount as a gift.

Blacknarwhal

Let's Go Brandon!

I used to give a $20 bill or a gift card, years ago. But one of the best mail carriers I used to have came to the door and returned it. He thanked me, but told me that he was prohibited from accepting any cash or cash equivalents no matter the amount as a gift.

I have NEVER heard of that being a thing. I'm downright shocked.

Honestly, I would have preferred to leave food, or at least a grocery store gift card, but I'm never sure about people's allergies. Would hate to leave a big bowl of death out for someone with a peanut allergy.

phloydius

Veteran Member

I have NEVER heard of that being a thing. I'm downright shocked.

Honestly, I would have preferred to leave food, or at least a grocery store gift card, but I'm never sure about people's allergies. Would hate to leave a big bowl of death out for someone with a peanut allergy.

I don't know for sure that they can't receive cash or gift cards, only that it is what he told me. I have not researched it. I have known several people who leave $20 in a card, and as far as I know, to no ill effects.

For the food, I'm always mindful of the allergies. So I make sure the stuff I choose does not have any of the dangerous ones (like any nuts). I also try to select multiple things that have different components: gluten as an example. I will often put in cookies, but include something that doesn't have gluten such as a type of candy. There for a while, I was even putting in a dried meat snack, in case they were on Atkins or diabetic.

rob0126

Veteran Member

...How does one sleep at night knowing that?

Because she hasnt received punishment for her evil deeds, yet. (Ecclesiastes 8:11)

Doomer Doug

TB Fanatic

So, did schumer try to pass the debt limit increase today?

Even with a goverment shutdown they got the money for October, Social Security etc. After the 18th with NO DEBT INCREASE means no money for November, which means no holiday season, no Thanksgiving and no Christmas.

Even with a goverment shutdown they got the money for October, Social Security etc. After the 18th with NO DEBT INCREASE means no money for November, which means no holiday season, no Thanksgiving and no Christmas.

Intestinal Fortitude

Have Faith

October is going to be rough

Sid Vicious

Veteran Member

My agency will be running the advance appropriation budget contingency to continue operations. That is until the government runs out of money.

TxGal

Day by day

This is from WTOP.com, a major news source in the DC metro area. Please note, I tried to insert some spacing in this article, but the darn bullet notes are making that impossible:

FAQ: What you need to know about a possible 2021 government shutdown | WTOP

FAQ: What you need to know about a possible 2021 government shutdown

Jack Moore | jmoore@wtop.com

September 29, 2021, 11:57 AM

Thursday marks the end of the federal government’s fiscal year and with it comes the threat of a government shutdown.

A stopgap government funding bill needs to pass both houses of Congress and be signed by President Joe Biden by 11:59 p.m. Thursday to avert a shutdown. Here’s a rundown of what could happen during a government shutdown.

FAQ: What you need to know about a possible 2021 government shutdown | WTOP

FAQ: What you need to know about a possible 2021 government shutdown

Jack Moore | jmoore@wtop.com

September 29, 2021, 11:57 AM

Thursday marks the end of the federal government’s fiscal year and with it comes the threat of a government shutdown.

A stopgap government funding bill needs to pass both houses of Congress and be signed by President Joe Biden by 11:59 p.m. Thursday to avert a shutdown. Here’s a rundown of what could happen during a government shutdown.

- Q: What's going on in Congress that could lead to a shutdown?

- Every year, Congress must pass 12 routine bills containing funding for federal agencies by the start of the new fiscal year: Oct. 1.

This year, the process is complicated by the fact that the deadline to raise the debt limit — a cap on the amount the U.S. government can borrow — is also approaching. The debt limit been raised or suspended nearly 80 times since 1960, but in recent years it has evolved into a political weapon.

Republicans in Congress say they won’t approve a funding bill that is tied to raising the debt limit. Democrats have since separated the two measures, which means a temporary government funding bill is more likely to pass. - Q: Would this be a full or partial government shutdown?

- If a funding bill isn’t passed by Thursday night, the lapse in appropriations would trigger a full government shutdown, since Congress hasn’t approved any of the 12 annual funding bills required to keep the lights on at federal agencies.

That’s different from the last government shutdown, which was historic for its length — 35 days — but was a partial shutdown since Congress had approved a handful of the funding bills. - Q: How many workers would be affected?

- During the last government shutdown — again, a partial shutdown — about 800,000 workers were impacted. That’s out of a total federal workforce of 2.1 million people.

The Congressional Budget Office later estimated about 300,000 employees — 38% of the affected employees — were furloughed during the shutdown, meaning they were sent home without pay. The remaining federal workers, including federal law enforcement, Border Patrol, the Coast Guard and others, remained on the job. While they were eventually paid, their paychecks were delayed. - Q: What is the Biden administration telling federal workers?

- In a statement last week, the White House Office of Management and Budget has urged federal agencies to being prepping for the possibility of a shutdown.

“We fully expect Congress to work in a bipartisan fashion to keep our government open, get disaster relief to the Americans who need it, and avoid a catastrophic default, especially as we continue to confront the pandemic and power an economic recovery,” Abdullah Hasan, spokesman for the Office of Management and Budget, said in a statement, as reported by Federal News Network. “In the meantime, prudent management requires that the government plan for the possibility of a lapse in funding.”

A number of federal agencies have updated shutdown plans, including the Internal Revenue Service, the Justice Department and the Smithsonian Institution, according to Federal News Network. The latter would send home nearly 80% of its staff with limited staff remaining on the job to care for animals at the National Zoo and secure buildings. The famous Smithsonian museums would close to the public. - Q: Is backpay guaranteed?

- Yes, but only for federal workers.

One result of the last shutdown was the Government Employee Fair Treatment Act, which required the government to provide backpay for all federal employees who were furloughed or required to work during the shutdown — and to be compensated “on the earliest date possible” after the shutdown was resolved. The law applies to any government shutdown after Dec. 22, 2018, meaning it would also apply if there’s a government shutdown this time around. - Q: What about contractors' pay?

- Federal contractors are not guaranteed backpay. During the last shutdown, an estimated 800,000 contractors were affected — and many were never made whole.

There were a few attempts to pass legislation that would require contractors to get backpay after the resolution of a government shutdown, those efforts fell short. - Q: When was the last shutdown?

- The last partial government shutdown happened in late 2018 and stretched for 35 days into early 2019. The shutdown, which lasted from Dec. 22, 2018, through Jan. 25, 2019, was the longest partial government shutdown in U.S. history.

The shutdown impacted nine of the 15 Cabinet-level departments and dozens of agencies, including the departments of Homeland Security, Transportation, Interior, Agriculture, State and Justice as well as national parks.

During that shutdown, the Pentagon and the Department of Health and Human Services were not affected because Congress had already approved funding.

There have been other shutdowns.

There was a brief three-day shutdown in January 2018 and a 16-day shutdown in October 2013.

And there was a 21-day government shutdown from December 1995 into early 1996. - Q: What would the economic effect of a shutdown be?

- The good news, according to the experts, is that the government would continue to disburse payments for Social Security, Medicare and Medicaid since those are mandatory spending programs that do not require annual funding approval by Congress.

Still, experts say a government shutdown would have a significant economic impact, especially if it drags on.

During the 2018-2019 shutdown, the Congressional Budget Office estimated the 35-day shutdown reduced the nation’s gross domestic product by a total of roughly $11 billion, including a permanent economic hit of $3 billion.

A big chunk of that came from the D.C. region, according to an analysis by regional economist Stephen Fuller, with George Mason University. He estimated there were more than 145,000 federal employees and more than 100,000 federal contractors in the area who missed paychecks during the shutdown — and another 100,000 other workers, such as restaurant and retail workers around the area who were indirectly affected. - Q: What about the debt limit?

- The rough deadline to raise the debt limit is Oct. 18, Treasury Secretary Janet Yellin told lawmakers this week. Failing to raise the debt limit would trigger an unprecedented default on the government’s obligations and likely lead to a financial crisis and economic recession, Yellin said.

The Democratic-controlled House is preparing to extend the debt limit through Dec. 16, however it’s unclear if the measure could pass the Senate because of Republican obstruction. Senate Majority Leader Mitch McConnell has said, since Democrats control both chambers, they can pass the measure on their own.

Democrats helped Republicans suspend the debt limit when Republicans controlled Congress. After Democrats retook the House in 2019, Speaker Nancy Pelosi negotiated a broader spending package with the Trump administration that included a debt ceiling hike.

The Associated Press contributed to this report.

night driver

ESFP adrift in INTJ sea

Ahhh, uuuuuhhmm.

WHICH FACTION of the D team is in the cat-bird seat??

ANd why are they quite so RAUCOUS about their internecine fights, any way?

WHICH FACTION of the D team is in the cat-bird seat??

ANd why are they quite so RAUCOUS about their internecine fights, any way?

night driver

ESFP adrift in INTJ sea

Small pleasure when I'm roasting a Thanksgiving Squirrell over as small a fire as I can manage to cut down on interlopers.

Doomer Doug

TB Fanatic

Nah Dozdoats. IT'S F-TROOP.The D Team is in chaaaaage ....