STORY AT A GLANCE The Federal Reserve recently ordered another “super-sized interest hike” — the fifth rate hike this year

americafirstreport.com

How to Turn the Tables on Tyrants Waging the Economic War

The Federal Reserve has ordered another 'super-sized interest hike' in what appears to be a hopeless effort to contain runaway inflation.

BY DR. JOSEPH MERCOLA October 5, 2022 in Cross-Posted, Opinions

Economic Tyrants

Don’t wait until the stock market takes a another dive. Move wealth or retirement to precious metals ASAP. Out of over two dozen precious metals companies we’ve vetted out, only TWO qualified as America-First companies. Their executives don’t donate to Democrats and they don’t do business with proxies of the Chinese Communist Party. Go to Our Gold Guy for the personal buying experience with Ira Bershatsky or go to GoldCo for the corporate touch.

STORY AT A GLANCE

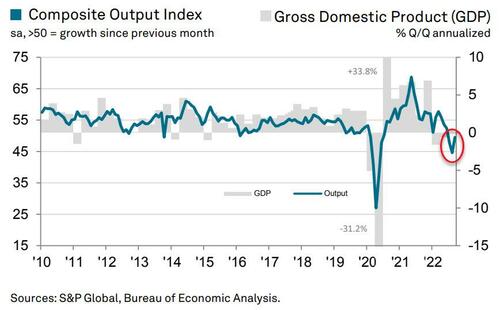

- The Federal Reserve recently ordered another “super-sized interest hike” — the fifth rate hike this year — in what appears to be a hopeless effort to contain runaway inflation. Additional rate hikes are also anticipated. Some fear the Federal Reserve may be pushing us too hard, which could bring us from recession into deflation

- Data from the Bureau of Labor statistics report the highest annual increase in food prices since the 1970s, with the cost of food rising 10.9% in the last 12 months. Overall, energy prices have seen the highest increases, rising by 41.6% between June 2021 and June 2022. For comparison, the Federal Reserve’s annual inflation target is 2%

- As bad as the economic trend appears, that’s not all we have to contend with. Financial crisis historian Adam Tooze predicts several crises may converge over the next six to 18 months, including food crises, energy crises, pandemic outbreaks, stagflation, a Eurozone sovereign debt crisis and potential nuclear war

- Our current situation is not accidental. It’s not even the result of pure ineptitude. Once you understand the globalist cabal’s plan for a Great Reset, you realize that all of these things need to happen in order for The Great Reset to be implemented. The rational conclusion, then, is that our food, energy, medicine and financial systems are being dismantled and hobbled on purpose

- We can’t stop these crises from happening, but we can prepare to survive the destruction and then rebuild systems to our own liking, rather than accept their slave systems

While the White House administration has tried to downplay the seriousness of inflation, reality has a stubborn way of paying no attention to fantasies and make-believe.

As reported by several news outlets in recent days,1 the Federal Reserve (which is not federal at all but rather a private entity that prints and lends fiat currency to the government) has ordered another “super-sized interest hike” — the fifth rate hike this year — in what appears to be a hopeless effort to contain runaway inflation. As reported by NPR, September 21, 2022:2

“The Federal Reserve ordered another super-sized jump in interest rates today, and signaled that additional rate hikes are likely in the coming months, as it tries to put the brakes on runaway prices.

The central bank raised its benchmark interest rate by 0.75 percentage points Wednesday, matching hikes in June and July. The Fed has been boosting borrowing costs at the fastest pace in decades. But so far, its actions have done little to curb the rapid run-up in prices.”

‘Exceptional Level of Economic Uncertainty’ Ahead

Higher interest rates, of course, increase the cost of borrowing, making home mortgages, car loans and credit card balances more expensive and, for many, unaffordable. And we haven’t even seen the worst of it yet. According to MSN,3 the Federal Reserve anticipates additional rate hikes after this, in the hopes of limiting stagflation, a situation in which prices rise and employment goes down.

America needs better media sources. Even many in conservative or alternative media are compromised by Big Tech. Learn why we’re launching Discern.tv and help if you have the means.

Some, however, fear the Federal Reserve may be pushing us from recession into deflation. As reported by MSN September 21, 2022:4

“The World Bank last week raised the specter of a global recession, driven by higher rates in the U.S. and abroad. Investors are increasingly worried that disruption in the U.S. government debt market could worsen as the Fed raises borrowing costs.

The housing and stock markets are reeling. And some executives like Tesla CEO Elon Musk even say the economy is in danger of entering a period of deflation … the Fed’s policies take time to feed through the economy, meaning the central bank could end up depressing economic activity more than necessary before realizing it, given the sheer speed at which it’s jacking up rates — the fastest pace in three decades.

‘There’s the old expression that sometimes they’ll tighten until something breaks,’ said Liz Ann Sonders, chief investment strategist at Charles Schwab. ‘It’s a legitimate concern at this point.’ The predicament creates an exceptional level of economic uncertainty for the country … Also at stake is the central bank’s own credibility as the nation’s chief inflation-fighting authority.”

Record Inflation in 2022

In early August 2022, President Biden claimed the U.S. had “zero-percent inflation” in the month of July. Alas, boasting about a single-month index change was a Jedi mind trick that didn’t work on most people. The federal Consumer Price Index earlier that day published data showing an annual inflation rate of 8.5% for July, down from 9.1% in June, which was the highest rate since 1981.5

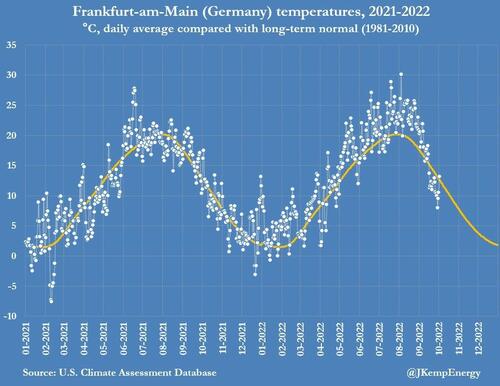

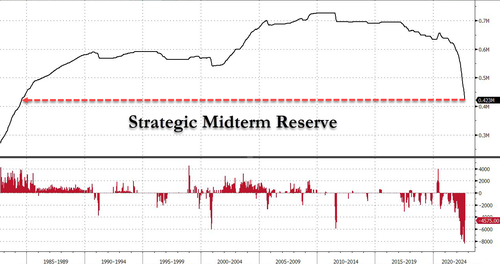

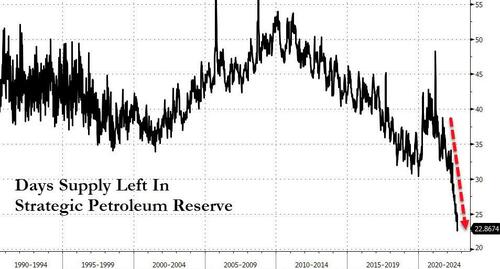

Data from the Bureau of Labor statistics also reported the highest annual increase in food prices since the 1970s, with the cost of food rising 10.9% in the last 12 months. Overall, energy prices have seen the highest increases, rising by 41.6% between June 2021 and June 2022. For comparison, the Federal Reserve’s annual inflation target is 2%.6

Later in that same speech, Biden “proceeded to accidentally step on his own message,” to quote the New York Post,7 by urging Congress to pass his Inflation Reduction Act.

Putting his foot even further down his own throat, Biden added the bill would “keep inflation from getting better.”8 Clearly, what he meant to say was that the bill would keep it from getting worse, but he spoke the truth in this instance nonetheless.

The better-titled Inflation Act is strongly biased toward financing of “green” programs, which will be funded by additional taxes, including a new 15% minimum corporate tax and massively increased IRS enforcement. Commenting on the bill shortly after it passed the Senate, Sen. Ron Johnson, R-Wis, said:9

“The Orwellian named ‘Inflation Reduction Act’ will do no such thing, as a number of prominent experts and economic policy groups have indicated. The Penn Wharton Budget Model,10 the Tax Foundation,11 and the Congressional Budget Office12 all found the bill won’t lower inflation and may make it worse.

The IRS would more than double in size, unleashing 87,000 new enforcement agents on American families … [and the] nonpartisan Joint Committee on Taxation says that 78% to 90% of the revenue raised from misreported income would likely come from those making under $200,000.”

Impending Polycrisis

As bad as the economic trend appears, that’s not all we have to contend with in coming days. As detailed in “Economy Expert Explains the Impending Polycrisis of Doom,” global citizens are currently facing a whole host of intersecting and interconnected crises.

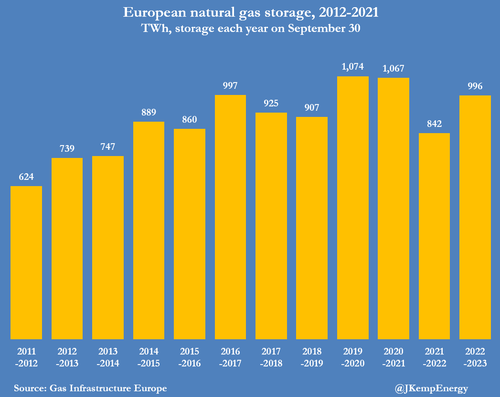

Adam Tooze, a financial crisis historian and director of the European Institute at Columbia University, predicts several crises may erupt and converge over the next six to 18 months, including food crises, energy crises, pandemic outbreaks, stagflation, a Eurozone sovereign debt crisis and potential nuclear war.

As explained by Tooze, “polycrisis” is not merely the presence of several crises at once. Rather, it’s “a situation … where the whole is even more dangerous than the sum of the parts.”13 These crises are hitting us all at once, and several of them reinforce and worsen each other. Also notable is the fact that there’s great uncertainty associated with some of them, making it extremely difficult to make predictions.

Beyond the influences highlighted by Tooze, others could also be added into the mix, such as the weaponization of the U.S. dollar, which is encouraging countries to de-dollarize and create alternative reserve currencies, NATO and U.S. meddling in the Russia-Ukraine conflict, the push to expand NATO, and allowing health agencies to dictate economic policy, just to name a few.

These Crises Are Not Accidental

What’s perhaps most infuriating about our current situation is that it’s not accidental. It’s not even the result of pure ineptitude. Once you understand the globalist cabal’s plan for a Great Reset, you realize that all of these things need to happen in order for The Great Reset to be implemented. Since the reset can’t happen unless all of the old systems are first destroyed, the rational conclusion is that they’re being dismantled and hobbled on purpose.

The global economic system is being dismantled to bring in a programmable central bank digital currency (CBDC), so they can monitor and control your spending from a centralized location.

When the food crisis hits, they’ll launch government breadlines. Proteins will run low by design, so the breadlines will be replaced by cricketlines. If you won’t be eating cricket, stock up on organic, freeze-dried chicken from Prepper Organics.

The energy grids of the Western world are being dismantled and incapacitated in order to justify a new “green” economy based on carbon credits. It will also push people to the brink of despair, which makes them more likely to accept “solutions” that would normally be rejected as unacceptable.

A “green” all-electric vehicle society — were it even possible, which it’s not — would also dramatically limit your ability to travel and, in fact, all travel could then be monitored and restricted from a central location, just like your bank account. Both CBDCs and electric vehicles are tools through which a centralized cabal can control your every move.

Agriculture and the food industry, meanwhile, are being crippled in part by irrational nitrogen reduction laws that will result in less food being grown and fewer livestock being raised, and in part by no longer coincidental fires, so that a new food system can be introduced — one based on “micro livestock,” i.e., insects, cultured meat, plant-based meat alternatives and GMO plant foods.

The common denominator is that all foods need to be patentable. Lack of food, like lack of energy, also makes people more “malleable” and willing to give up rights and liberties to survive.

Health care is also being undermined and getting more dangerous by the day as doctors are being muzzled through new laws, and the World Health Organization is pushing — using biosecurity as its justification — to grant itself the power to dictate and control health care worldwide. I think the reason for centralizing health care under the WHO is to make the transition to transhumanism easier.

The WHO is diligently working on a global vaccine passport, and President Biden recently signed an executive order14 that fast-tracks mRNA shots and other gene therapies “to be able to write circuitry for cells and predictably program biology in the same way in which we write software and program computers.” So, it’s no longer a stretch to imagine a world in which you have to get regular gene therapy injections in order to be able to function in society.

And, between Biden’s executive order and the Food and Drug Administration’s new “future framework” that allows reformulated mRNA shots to be rolled out without testing, it seems humanity at large will be the guinea pigs for untold numbers of genetic experiments to see what works and what doesn’t.

“The goal is to break everything apart, and then roll out a ‘new and improved’ society consisting of a ruling class, and disposable masses that will be controlled through technology-driven social engineering and control mechanisms like surveillance, ‘biosecurity,’ CBDCs, electric cars, gene therapies, carbon credits and social credit scores.”

In the end, the transhumanist cabal intends to make themselves immortal super-humans. But they need test subjects to perfect these radical technologies — and that’s going to be all of us. I could go on, but I think you get the gist. The breakdowns we’re experiencing are not by chance. They’re intentional.

The goal is to break everything apart, and then roll out a “new and improved” society consisting of a ruling class, and disposable masses that will be controlled through technology-driven social engineering and control mechanisms like surveillance, “biosecurity,” CBDCs, electric cars, gene therapies, carbon credits and social credit scores.

What You Can Do to Prepare

The central banking cabal and its many allies have infiltrated governments and institutions across the world for many decades, slowly turning the systems against us. We are now in the final chapter of their technocratic, transhumanist takeover.

They’ve told us their plans. It’s all spelled out in white papers, reports, books and on websites. The Great Reset is the overarching plan for the global takeover, previously referred to as the New World Order. The Fourth Industrial Revolution is the transhumanist piece of that plan, and the Green Agenda is the piece that will usher in essential control mechanisms.

Without a doubt, they wield formidable weapons. But before you drown in despair, remember that we still outnumber these megalomaniacs by tens of millions to one, if not more. And, believe it or not, they need our cooperation. If enough of us withhold our cooperation, their plans start falling apart. I’m not saying it will be easy. It’ll require sacrifice. But that’s nothing new. Freedom has always required sacrifice.

Don’t get caught unprepared as things go south. Order a case of five life-saving antibiotics prescribed directly to you by board certified physicians. Use promo code “RUCKER10” for $10 off. Having an emergency supply of antibiotics is crucial before the crap hits the fan.

Two of the most important things everyone can do right now is 1) prepare ourselves and our families for hard times (if you were not a prepper before, now’s the time), and 2) start building parallel structures and systems to replace the ones that are being dismantled.

The idea is to survive and rebuild a world of our own choosing rather than being forced to accept theirs out of sheer desperation. Strategies that can strengthen individual and local resilience to the stresses facing us include the creation of local food systems15 and the strengthening of neighborhood and community connections.

By building a strong local food system, you reduce food insecurity, and by building a community network of specialists, you reduce the effects of a crumbling financial system as you can simply barter goods and services. For those who aren’t skilled at growing food it is wise to align with local farmers that you resonate with and can add complementary skill sets. Remember it takes a community to get through this.

Social cohesion also offers many psychological benefits.16 Local food systems and community networks both also reduce individuals’ reliance on government handouts, and by extension, they’re less likely to be forced into these new Great Reset slave systems. A 2017 StrongTown article17 provides several excellent suggestions for those willing to spearhead a local food movement in their own hometown.

Additional Suggestions

It’s important that you continue to prepare for the inevitable financial catastrophe and become as independent and resilient as possible. Shore up supplies and figure out how to live in an “off grid” scenario, in case daily conveniences suddenly vanish. This year I have offered many articles on how you can prepare for food, water and other crises, which you can find in my Substack library.

Aside from “investing” in storable food, a water catchment system and other essentials that will only go up in price or become unobtainable, you may also consider buying physical precious metals, which can help protect against currency devaluation. Investing in real assets, such as land could be another.

It’s hard to make definitive recommendations, as your strategy will depend on your personal situation, so take some time to think things through. If you do nothing to hedge your bets, you may one day find yourself left with nothing — which is precisely what the World Economic Forum has declared will be our lot.

It’s also essential to become as healthy as possible. A recent study showed that 93% of U.S. adults are metabolically unhealthy, and those stats were four years old. It’s likely that number is now over 95%. You want to be the 1 person in 20 who is healthy. Make it your goal to be in that group.

This is so important that I’m devising a poll to find out what that percentage is for our subscribers. It would be a bit more accurate as I’ll include metrics like vitamin one hour a day of sun exposure and exercise. So, start getting metabolically fit now.

Also prepare yourself mentally, emotionally and spiritually for what could be stressful and challenging times as the globalist cabal continues to push The Great Reset forward, which will require more “emergencies.”