marsh

On TB every waking moment

Under Joe Biden, Americans see 'most severe' pay cut in 25 years due to inflation

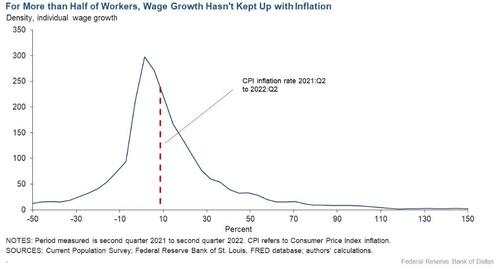

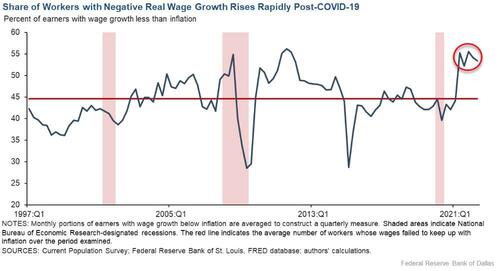

The Fed reports more than half of Americans saw a decrease in wages in the last 12 months.

Biden's energy policies costing U.S. economy $100 billion a year: study

A new analysis finds the U.S. would be producing significantly more oil and natural gas today if Trump policies had continued.

By Aaron Kliegman

Updated: October 5, 2022 - 11:06pm

President Biden and senior officials in his administration have repeatedly said this year that the U.S. is near "record levels" of domestic oil and gas production. According to a new study, however, that's not exactly the case.

The analysis by economists Stephen Moore and Casey Mulligan found that the Biden administration's policies have caused the U.S. to produce significantly less oil and gas during Biden's presidency than it would have during a second term for former President Trump — to the detriment of the national economy.

"The U.S. would be producing between 2 and 3 million more barrels of oil a day and between 20 and 25 more billion cubic feet of natural gas under the Trump policies," states the report, which was published by the Committee to Unleash Prosperity. "This translates into an economic loss — or tax on the American economy — of roughly $100 billion a year."

The figures are based on production numbers adjusted for the energy price spikes that have occurred since President Biden entered office in 2021.

"Both the domestic and international evidence show that when we adjust for the higher international price for oil and gas, the U.S. is drilling not record amounts of oil and gas, but far below what market conditions would dictate," Moore and Mulligan argue. "It takes a higher oil price to motivate the same supply during the Biden administration."

The new report came out two days before the Organization of the Petroleum Exporting Countries (OPEC) and its non-member allies, a coalition known as OPEC+ led by Russia and Saudi Arabia, announced Wednesday they're going to slash oil production by 2 million barrels a day, a move that could push up already high global energy prices.

The White House, which had been desperately lobbying OPEC+ members to vote against the proposed production cut, decried the decision.

"The president is disappointed by the shortsighted decision by OPEC Plus to cut production quotas while the global economy is dealing with the continued negative impact of [Russian President Vladimir] Putin's invasion of Ukraine," White House officials said in a statement.

Experts say OPEC+ has increased sway in part because Biden's policies have limited U.S. domestic energy production.

"It's frustrating as someone who worked with the Trump administration on energy policy," Moore told Just the News. "We broke the back of OPEC under Trump because the U.S. was the leading energy power. You can't have a cartel without the world's no. 1 producer."

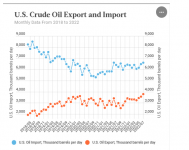

Under Trump in 2019, the U.S. achieved energy independence, becoming for the first time a net energy exporter of oil, gas, and coal. In November of that year, the U.S. oil and gas industry reached peak production at a record 13 million barrels of oil a day, according to the Department of Energy's Energy Information Administration.

By comparison, U.S. oil production was at roughly 11.6 million barrels in April 2022 (the latest data available). Production has likely risen a bit since then.

In raw numbers, production is down 1 to 1.5 million barrels today from the Trump peak, according to Moore and Mulligan's estimates. That equates to somewhere from $100 million to $150 million a day in lost revenue for the U.S. oil industry, using the average price this year of roughly $100 a barrel.

But today's oil price is much higher than the price when Trump was president.

During Trump's presidency, the average world price was $54 a barrel, adjusted for 2019 inflation figures. Under Biden, the average was $71 through April 2022 and averaged $86 just in 2022.

The calculation that the U.S. would produce 2 to 3 million more barrels of oil a day comes from estimating what would happen if the Trump supply conditions had remained in place after January 2021 (when he left office) while accounting for the price spikes since then.

"Biden is playing right into OPEC's hands, allowing this cartel to dominate the oil market in ways it couldn't under Trump," Moore said.

Regarding natural gas, production today is near its peak of 3 billion cubic feet under Trump.

However, throughout most of Trump's presidency, the price of natural gas ranged from $3 to $4 per thousand cubic feet. This year, by comparison, the price has ranged from $6 to $8 per thousand cubic feet.

"In other words, prices have doubled, but U.S. production has been basically flat," stated the report, which estimated Trump-era production under Biden-era prices would translate to about 23 billion more daily cubic feet of natural gas.

Taken together, the oil and natural gas figures would mean about $100 billion a year more in U.S. GDP as long as the Trump policies could be continued, according to Moore and Mulligan. They also noted higher production would likely bring down energy prices, resulting in a "win-win for America."

Biden has blamed the oil and gas industry for higher energy prices and lower energy supply, noting companies have been raking in high profits and calling on them to work with his administration to bring down energy costs.

"At a time of war — historically high refinery profit margins being passed directly onto American families are not acceptable," Biden wrote to oil executives this summer. "Companies must take immediate actions to increase the supply of gasoline, diesel, and other refined product."

However, critics argue the real problem is Biden creating a hostile environment for the industry.

Moore and Mulligan cited historically high inflation and "a failure to maintain an investment-friendly business tax code" as two forces hitting the oil and gas industry especially hard because it relies so much on capital.

They also argued this issue is being exacerbated by the Biden administration's energy policies, which aim to transition away from fossil fuels to green, renewable energy.

The administration has announced a "whole-of-government" approach to climate policy, which includes trying to drive financing and investment away from the oil and gas industry.

Part of that effort has included Biden's Special Envoy for Climate John Kerry, who has been pressuring banks and financial institutions not to make loans to U.S. oil and gas companies and embrace the commitment to a future economy of zero carbon emissions.

Such an environment disincentivizes investing in significant oil and gas production, according to experts.

"It might cost a company $5 billion to develop a large new refining facility, which will only pay for itself after 20 years," Richard Morrison, senior fellow at the Competitive Enterprise Institute, recently told Just the News. "Why would any corporate board green light such an investment when the White House is planning on a carbon pollution-free power sector by 2035 and net zero emissions economy by no later than 2050?"

The U.S. also doesn't have the necessary energy infrastructure to increase production to where it needs to be, according to Moore, who cited Biden canceling pipelines, restricting drilling on federal land and imposing various regulations that raise the price of drilling.

Despite Biden's letter to oil companies this summer, refineries cannot just ramp up output, with U.S. refiners already utilizing over 90% of their current capacity in an effort to meet demand.

Neither the White House nor the Energy Department responded to requests for comment for this story.

As gas prices reached record levels earlier this year amid a global supply shortage intensified by Russia's invasion of Ukraine, Biden attempted to make up for a lack of supply by continuously tapping into the country's Strategic Petroleum Reserve, which is now at its lowest level of emergency oil reserves since 1984.

"The United States would not have had to sell a single barrel of oil from the Strategic Petroleum Reserve if the Trump drilling policies had remained in place," wrote Moore and Mulligan.

They calculated the amount of domestic oil production lost under Biden is about four times greater (600 million barrels) than the amount of oil extracted (150 million barrels through July 2022) from the SPR.

In other words, the U.S. would've produced much more oil than what it had to deplete from the national reserves — a fact that, Moore argues, has resulted in Biden giving more power to OPEC and Russia.

"The only result of Biden's war on oil and gas is a war on American energy, not energy in these other countries, some of which are our enemies," Moore said.