ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com

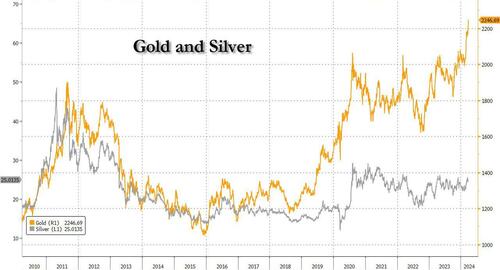

Futures Rise In First Day Of New Quarter As Gold Explodes To Record Highs

by Tyler Durden

Monday, Apr 01, 2024 - 07:14 AM

US futures extend their record-breaking meltup following the long weekend (which was to be expected with

hedge funds piling into shorts last week, hoping for a reversal), with most European markets still closed and Asian stocks closing lower. As of 7:30am, S&P futures were 0.3% higher, but trading near session lows; Nasdaq futures gained 0.4%. Bond yields are 1-3bp higher with the USD unchanged from its Friday close. Commodities are mixed: oil down and metals are mostly higher this morning as China PMIs beat expectations. While bitcoin suffered one of its trademark futures slamdowns overnight to push it back below $70K despite relentless ETF inflows, gold was on a tear and rose 1.6% to hit a new all time high of $2,265 before easing back. after upbeat China factory data added to Friday’s relatively benign US core PCE figures. This week, keep an eye on Payrolls, ISMs, and Fedspeak (8x this week), and today, we get the Mfg ISM at 10am ET where consensus expects a 48.3 print vs. 47.8 prior.

In premarket trading, megacap tech names were mostly higher with NVDA/MU/AMD up more than 1%. AT&T fell as much as 2% in premarket trading after the telecom giant said that personal data from about 7.6 million current account holders and 65.4 million former customers was leaked onto the dark web. Nikola rose as much as 16% in premarket trading, set to extend gains for a record-setting ninth consecutive session.

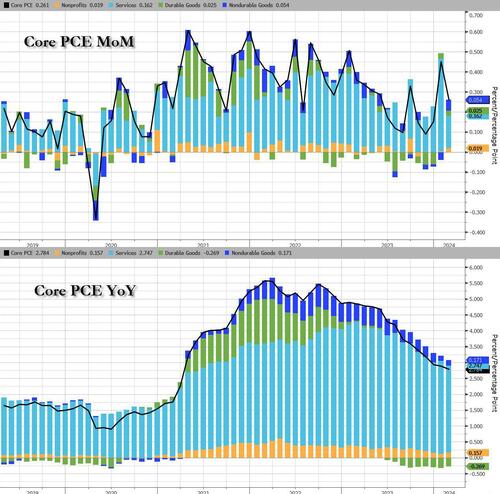

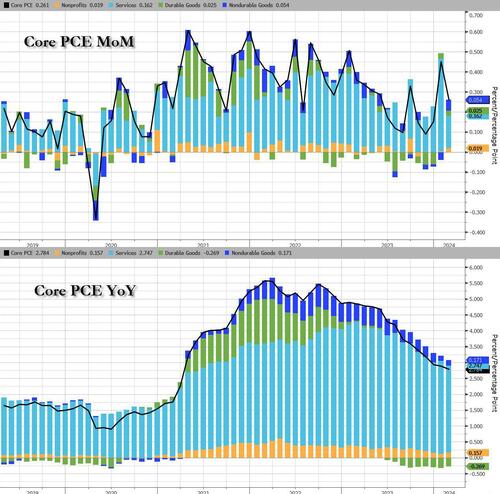

A slow down in the Fed’s preferred measure of inflation last month, coupled with a rebound in household spending, suggests that bullish narratives that propelled stocks to records this year remains intact. The core PCE price index, which strips out the volatile food and energy components, rose 0.3% from the prior month, slowing from January’s surprisingly strong reading, suggesting the Fed is still on pace for a June rate cut.

With markets in Europe, Australia and Hong Kong still shut for the Easter holiday, Asian stock benchmark which were open fell in the first trading day of the second quarter, as investors sold Japanese shares following a record-breaking rally and bought into Chinese equities. The MSCI Asia Pacific Index declined as much as 0.7%, with Toyota and Mitsubishi UFJ Financial among the biggest drags. Following the strongest quarter for the Nikkei 225 average in almost 15 years, investors booked profits as Japan’s new fiscal year kicked off and Japanese equities fell after a report showed confidence among the country’s large manufacturers weakened.

Meanwhile, China stocks led gains in Asia on Monday following a rebound in domestic manufacturing activity that reinforced hopes that economic growth is gaining traction. Chinese stocks rallied as a rebound in manufacturing activity reinforced hopes that the nation’s economic recovery may be starting to gain traction. The benchmark CSI 300 Index rose 1.6% to lead gains in Asia. “Emerging optimism about China is real,” said Vishnu Varathan, chief economist for Asia ex-Japan at Mizuho Bank in Singapore. Benchmarks in Taiwan and Indonesia were lower, while those in India, South Korea and Singapore climbed. Markets in Hong Kong, Australia and New Zealand were shut for a holiday.

In FX, the yen held near 152 per dollar, a closely watched level that some traders say could spur an intervention from officials. Japanese Finance Minister Shunichi Suzuki said the government is monitoring currency developments with a high sense of urgency, and will take appropriate measures against any excessive moves. Elsewhere, the greenback fluctuated in thin holiday trading as major markets in Europe and Asia were closed for Easter Monday.

In rates, the Treasury yield curve remained steeper vs Thursday’s close after gapping wider at the Asia open. Front-end yields are richer by around 2bp after opening gapping lower, with many European markets still closed. Front-end outperformance steepens 2s10s spread by nearly 3bp, 5s30s by more than 3bp.

10-year yields around 4.21%, up ~1bp; 30-year yields are cheaper by almost 3bp on the day at around 4.37% The front-end outperformance stems from February PCE deflators released Friday and comments by Fed Chair Powell that left intact expectations for rate cuts this year. US session includes manufacturing PMIs; ahead this week are several Fed speakers and March jobs report. Fed-dated OIS contracts price in slightly more rate cuts for the year vs Thursday, with 74bp of easing expected by December vs 70bp prior.

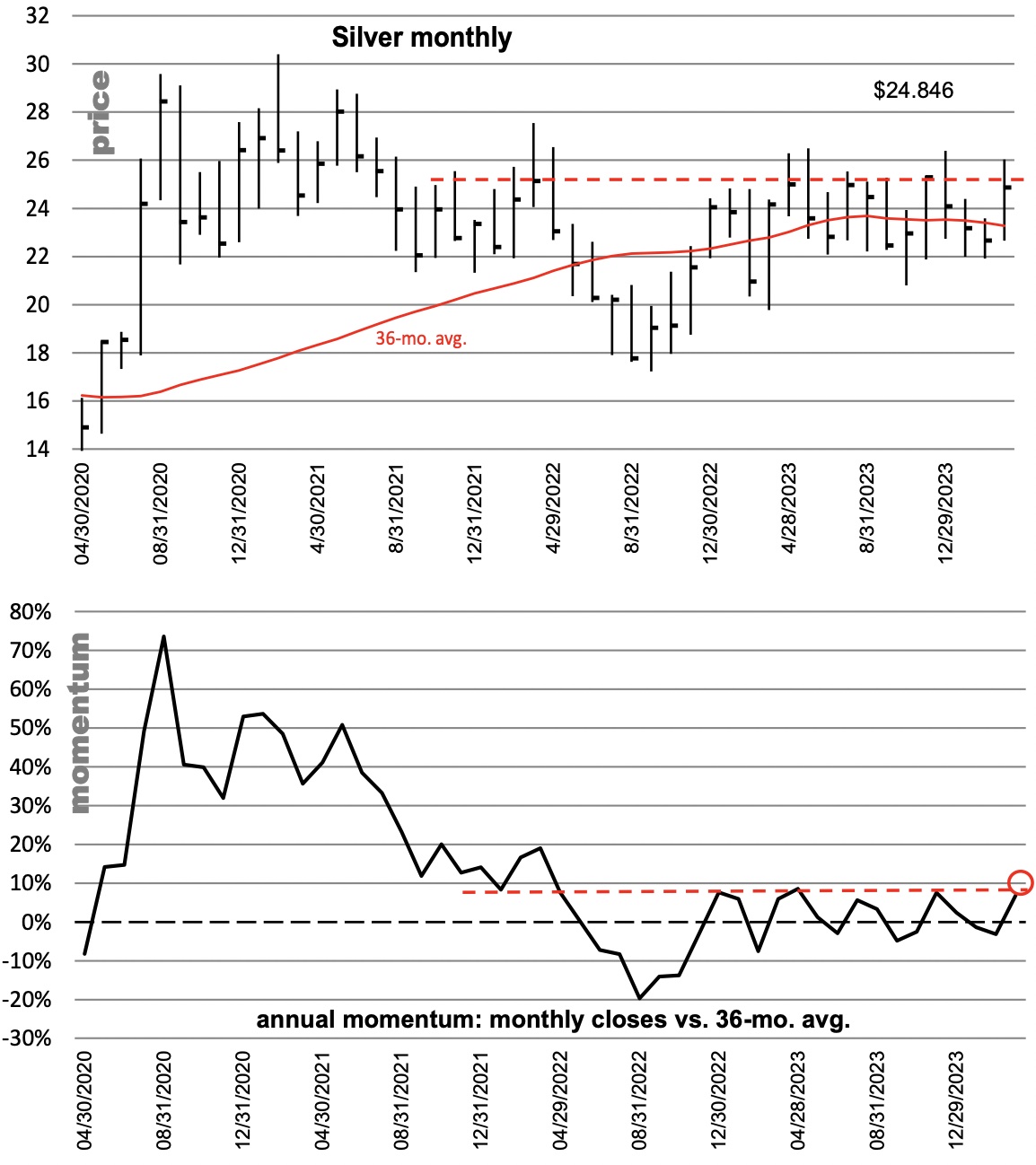

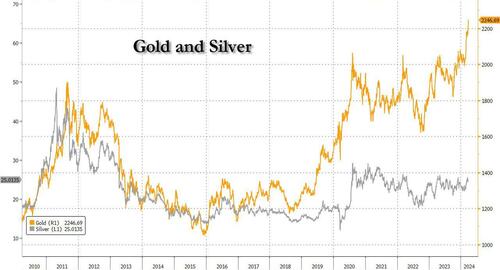

In commodities, oil dipped after hitting a fresh 5 month high last week. Gold jumped to a record as indications the Federal Reserve is getting closer to cutting interest rates added impetus to a rally that’s also been driven by geopolitical tensions and robust Chinese demand. Bullion jumped to as much as $2,265.73 an ounce on Monday, up 1.6% from Thursday’s close, after setting a series of peaks in recent sessions. Silver meanwhile continue to underperform and remains about 50% below its 2011 highs.

A host of positive drivers have pushed up bullion by around 14% since the middle of February. The prospect of monetary easing by major central banks, and elevated tensions in the Middle East and Ukraine have underpinned the rally. There’s also been strong buying by central banks, particularly in China, while consumers there have been loading up on the metal amid ongoing problems in Asia’s largest economy.

US economic data slate includes the US manufacturing PMI (9:45am), February construction spending and March ISM manufacturing (10am); ahead this week are JOLTS job openings and factory orders (Tuesday), ADP employment change and services PMIs (Wednesday), and the March jobs report. Fed speaker slate includes Cook at 6:50pm; Bowman, Williams, Mester, Daly, Goolsbee, Powell, Barr, Kugler, Harker, Barkin, Musalem and Logan have appearances scheduled.