Doc1

Has No Life - Lives on TB

First of all, bookmark this link:

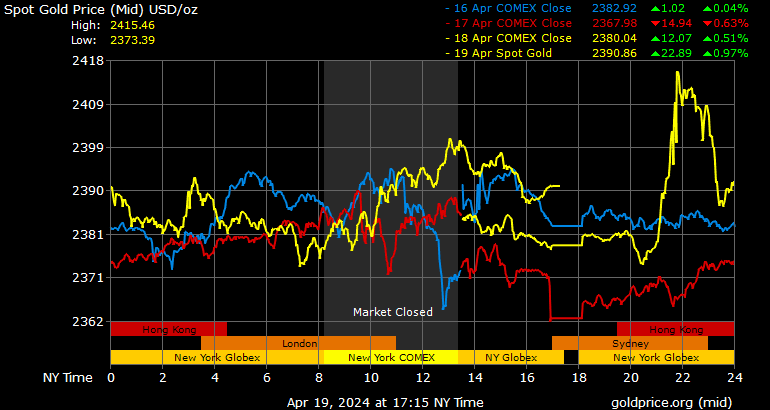

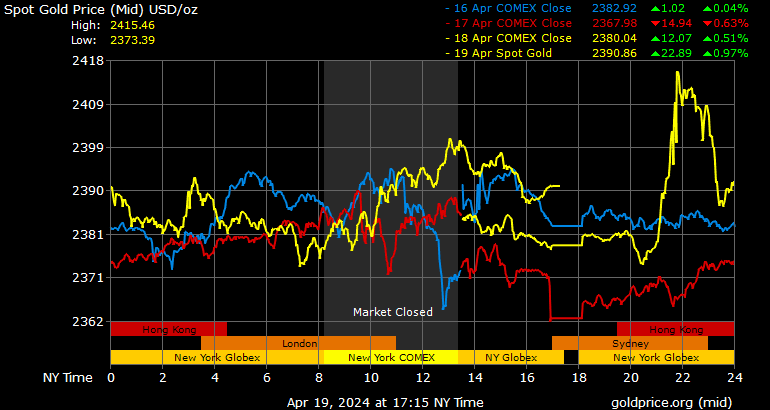

Secondly, as of a few minutes ago, Gold was up $34.66 and Silver was up $0.69. This follows on its great gains of Friday. Something is up, folks and it behooves you to pay attention.

Oh - before I forget - I was at Mississippi's largest gun show on Saturday and didn't see any vendors selling precious metals. This is highly unusual and I strongly suspect that this was in reaction to Friday's gains, as vendors decided to keep their PMs to see what they would do today.

Best

Doc

Secondly, as of a few minutes ago, Gold was up $34.66 and Silver was up $0.69. This follows on its great gains of Friday. Something is up, folks and it behooves you to pay attention.

Oh - before I forget - I was at Mississippi's largest gun show on Saturday and didn't see any vendors selling precious metals. This is highly unusual and I strongly suspect that this was in reaction to Friday's gains, as vendors decided to keep their PMs to see what they would do today.

Best

Doc