That won't happen. It didn't happen during any of the severe housing crashed we've experienced, not even the most recent one in 2007/2008.

You need to keep evictions and foreclosures as separate issues because they are. Very different.

Foreclosures are when someone holding a mortgage brings legal action against someone for breaking the mortgage agreement. If they break it for something like not carrying insurance then they forceplace an insurance policy and it doesn't have to go to foreclosure. There are some other options as well. You can "work with" someone to give them time to come up with a remedy for the foreclosure. There are also all of the new foreclosure laws that went into effect post 2007/2008 ... such as in Florida the person holding the mortgage must have the original documents in their possession. If you don't have the original documents you will not get a foreclosure. I know a bunch of people that got out of their foreclosure ... heck, their entire mortgage ... because the original documents have been lost. Then they wound up losing the property anyway, usually because they didn't pay their taxes.

Failure to pay taxes is yet a third situation that is very different from eviction or foreclosure. It generally takes a minimum of three years for a person to lose a property to failure to pay taxes. Municipalities don't like to run tax deeds, etc. because everyone loses and it costs a lot of money to get that done.

Evictions is a failure of one person/party to abide by a short term contract (generally one year as opposed to say a 30 year mortgage). They don't "own" the property, they are paying for the chance to live in a property. Most evictions are on multi-family type units (apartments of some type) rather than SFR (single family residential). Each state has their own laws how an eviction takes place. In Florida it goes like this ... first the landlord issues a three-day notice (3 business days) that there is a non-payment of rent. If the tenant does not take advantage of those three days to make a payment or arrangement for payment then the landlord serves an eviction ... but that's not to say the tenant is being evicted yet. Once served the tenant then has 5 days (business days) to respond to the court. If they don't respond then there is a summary judgment. If they respond but don't put money with the clerk of the court to cover the amount owed then there is a summary judgment. If they respond and put money with the court then there is a hearing.

What you have to remember whether there is a summary judgment or hearing, getting the judge/court to respond is generally a two week to two month process. And lets just assume there is a summary judgment. The writ is issued but it isn't executed until it is taken to the sheriff's office and it generally takes two weeks for the execution to be carried out. But wait, there's more. If the tenant makes an emergency plea during that time period between when the writ of possession being signed and the execution of the writ, the sheriff kicks it back to the court for clarification which ... is a pain in the butt and takes however long it takes. We've had tenants really play the system that make sure they file an emergency stay on the day that the write is to be served and executed multiple times until they've pissed off the sheriff enough and the judge/court enough that their pleas are simply denied. And they can do this even with no money being deposited with the court.

So ...

Sheriffs no the score. They will not be abdicating their job of serving and executing writs of possession.

Now, let's remind people what happened during covid when the government interfered with the law being carried out by putting mandates in place that prevented evictions and foreclosures.

It ran a lot of small, individual landlords out of the business, leaving it up to larger investment groups. Most of them it was because of the risk and the headaches. The benefit of the investment groups is that risk is spread among individual owners so if there is loss on an investment, it is generally small enough that it is simply a tax write-off ... and some of that may even be intentional. If there is only one investor, they take all the risk.

You want to know why rents are so high? Because of gov interference in the law. When they screwed around with the natural order of things everything went into inflation mode like a vicious catch-22. There was also the problem of the velocity of money in the system that also created inflation. The Fed has tried to slow that down by increasing interest rates but the gov screwed around too much and for now it is working a little but not much. SFR's haven't really come down all that much and income producing properties not at all and in fact are still climbing in value if somewhat slower. Rents are trying to stabilize but unsuccessfully in markets that are hot.

All of that inflation is now affecting the PMs market because those in control can't completely stop it. And the price of PMs have gone up but so has the cost of everything else. I don't think the market manipulators are really interested in allowing PMs to shoot to the moon, just allow it just enough to drive interest so that they make money off of any panic buying/selling, because let's be honest they are the ones that in the end are going to be making the money off of it.

We have PMs but don't really count on them to do much for us. They are more of a method of moving some of our wealth from one generation to the next in our strategy. It is one of the reasons that we haven't sold any of our real estate that is still "working" and providing a monthly income. We may over this next year or two, but that will be more of an issue of how we want to change our lifestyle rather than no longer being confident in real estate as an investment. We need to figure out a way to get that wealth to the next generation without it being taxed to oblivion by the feds. That's the real challenge we face in our decision making process.

And my apologies for the long post. It is an interesting topic but gets complicated when you go from generalities to individual needs and plans.

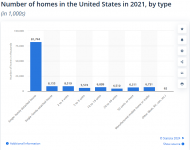

And just to explain the difference between the number of SFR's vs. Number of apartments here in the US, here's a chart I found:

View attachment 463816