You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON [FINANCE] First Deathburger Thread of the 2023 Banking Crisis. ALL welcome (hall passes at the door). Have At It.

- Thread starter night driver

- Start date

- Status

- Not open for further replies.

night driver

ESFP adrift in INTJ sea

As folks discuss Berkshire Hathaway and Buffet, I am hearing echoes of Andy Carnegie standing on the floor of the m,arket, quietly buying ANYTHING people put into his hand to staunch the bleeding.

UNsuccessfully, I might add.

Need to remember that in 29, with the "CRASH", the Dow was back where it STARTED the Crash by April, 1930, and the REAL grind didn't start until later in the summer.

This is simple History, folks.

UNsuccessfully, I might add.

Need to remember that in 29, with the "CRASH", the Dow was back where it STARTED the Crash by April, 1930, and the REAL grind didn't start until later in the summer.

This is simple History, folks.

Samuel Adams

Has No Life - Lives on TB

I volunteer to be the axeman.

I’m pretty good with one.

bw

Fringe Ranger

I haven't looked for the list, but Weiss Ratings specializes in bank health. I used to read their stuff some years back, nothing recently.Another question. Who are the 186 banks at risk of collapse that the WSJ is mentioning? Anyone have a list?

somewherepress

Has No Life - Lives on TB

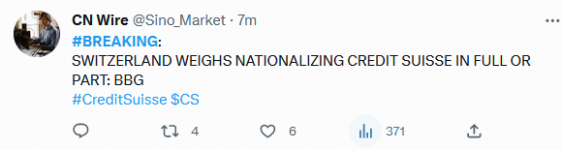

View: https://twitter.com/runews/status/1637438844009152514

Russian Market

@runews

Credit Suisse rejects UBS 0.25 offer - Blick - How about 0.04?

8:00 AM · Mar 19, 2023

Russian Market

@runews

Credit Suisse rejects UBS 0.25 offer - Blick - How about 0.04?

8:00 AM · Mar 19, 2023

The Hammer

Has No Life - Lives on TB

Yep, any distraction from a true economic crisis would be extremely temporary.When people can't get money, can't use charge cards, and grocery stores are closed, I think they'll notice.

somewherepress

Has No Life - Lives on TB

View: https://twitter.com/runews/status/1637451509884502016

Russian Market

@runews

The Saudis reject UBS 0.25 offer for Credit Suisse. Because.. because they bought it for 4.00 per share 5 months ago. Buy high, sell 0.25

GIF

Last edited8:50 AM · Mar 19, 2023

Russian Market

@runews

The Saudis reject UBS 0.25 offer for Credit Suisse. Because.. because they bought it for 4.00 per share 5 months ago. Buy high, sell 0.25

GIF

Last edited8:50 AM · Mar 19, 2023

I wonder why that video was age restricted?RT 5:52

View: https://youtu.be/UPl77UeHfd8

What it will look like when the world Economy collapses soon

TxGal

Day by day

That's from the article I posted not my words, of course!Hahahah…

I hope so. This one is stinking to high heaven!Will there be a fresh deathburger and doom thread tonight?

I just read that 1 billion offer would completely wipe out shareholders.

SmithJ

Veteran Member

Yes, sorry if the way I quoted it implied that. I didn’t mean that.That's from the article I posted not my words, of course!

psychgirl

TB Fanatic

West

Senior

What do you think this’ll mean??

It's Trumps fault. At least that's what the back stabbing POS pence is saying this morning on MSM. Trying not to throw TV out the door.

I think it means things are not going to be okay. But keep your digits in the banks.

IDK

Hfcomms

EN66iq

Why Credit Suisse is pushing back UBS’s $1 billion offer to buy the Swiss bank

Swiss authorities are seeking to broker a deal that would address a rout in Credit Suisse that sent shock waves across the global financial system.

Written by BloombergMarch 19, 2023 20:03 IST

Bloomberg: UBS Group AG is offering to buy Credit Suisse Group AG for as much as $1 billion, a deal that the troubled Swiss firm is pushing back on with backing from its biggest shareholder.

Credit Suisse, which ended Friday with a market value of about 7.4 billion francs ($8 billion), believes the offer is too low and would hurt shareholders and employees who have deferred stock, according to people with knowledge of the matter.

The UBS offer was communicated on Sunday with a price of 0.25 francs a share to be paid in stock. UBS also insisted on a material adverse change that voids the deal if its credit default spreads jump by 100 basis points or more, the Financial Times reported. Credit Suisse closed down 8% to 1.86 francs at the close on Friday.

Swiss authorities are seeking to broker a deal that would address a rout in Credit Suisse that sent shock waves across the global financial system over the past week when panicked investors dumped its shares and bonds following the collapse of several smaller US lenders. A liquidity backstop by the Swiss central bank briefly arrested the declines, but the market drama carries the risk that clients or counterparties would continue fleeing, with potential ramifications for the broader industry.

The complex discussions over what would be the first combination of two global systemically important banks since the financial crisis have seen Swiss and US authorities weigh in, according to people with knowledge of the matter. Talks accelerated Saturday, with all sides pushing for a solution that can be executed quickly after a week that saw clients pull money and counterparties step back from some dealings with Credit Suisse.

somewherepress

Has No Life - Lives on TB

My guess is it will do nothing much to stem the tidal wave of financial failure...What do you think this’ll mean??

Well, gold futures are way up this morning!

Gold futures under five figures (10,000) are NOT up ...

psychgirl

TB Fanatic

Well, it’s higher than it’s been on a long time.Gold futures under five figures (10,000) are NOT up ...

psychgirl

TB Fanatic

Right!If someone sold an oz of gold today at a coin shop what would they be paid?

I’d like to know the % the buyer takes out of the sale.

I think….jewelry stores are 60/40?

You take 60% of the sale.

But not positive

SmithJ

Veteran Member

That’s fine. We’ll bail them out!Switzerland doesn't have the bandwidth to nationalize CS. If they do this, CS will bring them down. It's suicide.

hiwall

Has No Life - Lives on TB

In the USA the only medium of exchange for people is US Dollars. Because of that those Dollars will be used even well into a crash (IF that Ever happens).Bear with me I haven't slept much but I was wondering if you withdraw most or some of your cash and then the whole system crashes and then there is a great depression will that cash be any good? Doesn't seem to me like it will. No more SS, no more welfare and no more US and end game for all but the toughest.

On here we often talk about using gold and silver but ever doing that on a wide-spread level would be almost impossible. Hardly anyone understands gold and silver and there is very little of each in the USA.

If there is ever crash (which sometimes I think will happen and sometimes do not think that) it will just be a very bad situation. Having something of real value whether it is cash or gold would likely not matter very much if there was nothing to buy.

alpha

Veteran Member

My coin shop charges 12%If someone sold an oz of gold today at a coin shop what would they be paid?

What time (Eastern,) does the Asian markets open?

The Nikkei (Japan) opens at 9:00 a.m. their time, which by the world time map on my ancient Treo says is just over 7 hours away.

Ok the close on Fri was 1993.70. So 12 % of that price?My coin shop charges 12%

I for one am very interested in what happens this coming Wednesday. Assuming things go as previously planned and they don't change the schedule in a fit of panic, the Federal Reserve is holding its next interest rate meeting March 21-22 and will announce its decision on the 22nd. Prior to this latest FUBAR circus there was a fair chance they would continue to raise rates, even if only a token amount, to combat an inflation that seems to befuddle TPTB (including the Secretary of the Treasury, the very person theoretically the best situated to understand inflation). If they raise rates now it could be the last straw for banks with crap in their investment portfolios (higher interest rates and declining government bond yields allegedly being what did in SVB).

- Status

- Not open for further replies.