Update on earlier ZH post

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com

UBS To Buy CS For $3 Billion As Bank's $17BN In AT1 Bonds Get Wiped Out In Record "Bail-In"; SNB Offers $100 Billion Liquidity Backstop

Tyler Durden's Photo

BY TYLER DURDEN

SUNDAY, MAR 19, 2023 - 12:11 PM

Update (1500ET): It appears that what was first a CHF1 BN acqusition price, which then rose to CHF 2 BN, has now cranked up one final time to CHF 3BN, or 0.76 per share, specifically shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse.

More importantly, however, the bank's entire AT1 tranche - some CHF16BN of Contingent Convertible bonds - will be bailed in and written down to zero, to wit: "FINMA has determined that Credit Suisse’s Additional Tier 1 Capital (deriving from the issuance of Tier 1 Capital Notes) in the aggregate nominal amount of approximately CHF 16 billion will be written off to zero."

This wipe out, pardon, bail-in is the biggest loss yet for Europe’s $275 billion AT1 market, far eclipsing the approximately €1.35 billion loss suffered by junior bondholders of Spanish lender Banco Popular SA back in 2017, when it was absorbed by Banco Santander SA to avoid a collapse.

AT1 bonds were introduced in Europe after the global financial crisis to serve as shock absorbers when banks start to fail. They are designed to impose permanent losses on bondholders or be converted into equity if a bank’s capital ratios fall below a predetermined level, effectively propping up its balance sheet and allowing it to stay in business.

As Bloomberg notes, investors had been concerned that a so-called bail-in would result in the AT1s being written down, while senior debt issued by the holding company, Credit Suisse would be converted into equity for the bank.

In retrospect, they were right to be worried... meanwhile equityholders get CHF3 billion; we are confident Swiss pensions will be delighted they are getting a doughnut while the Saudis get a not immaterial recovery.

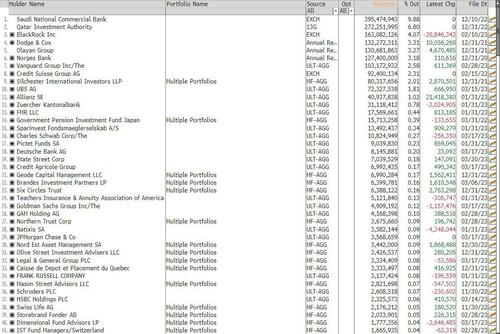

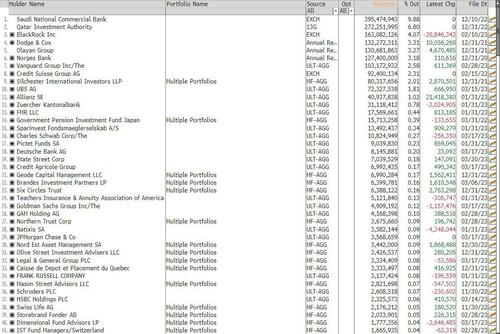

PIMCO, Invesco and BlueBay Funds Management SA were among the many asset managers holding Credit Suisse AT1 notes. Pimco and BlueBay declined to comment when contacted by Bloomberg News on Friday, before the deal was announced. A spokeswoman for Invesco said that “due to portfolio disclosure policies, we wouldn’t disclose any current movements in portfolios but our investment teams are continuing to monitor developments and prudently managing our clients’ assets in light of current market conditions.”

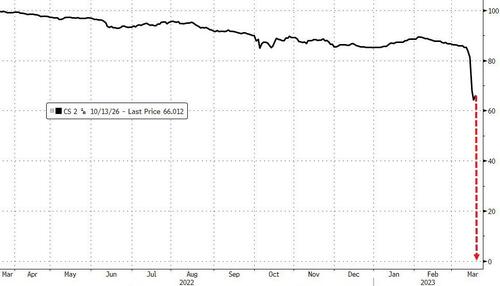

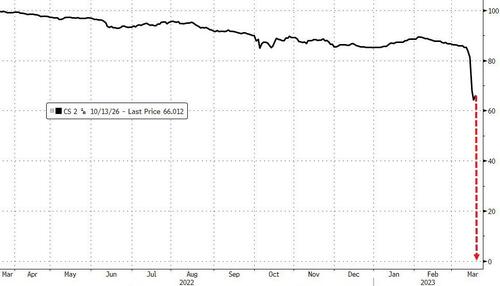

The bonds were by Friday already trading at levels usually reserved for companies about to go bust. A slice of the bank’s $1.65 billion note, issued less than a year ago, changed hands at about 35 cents on the dollar, according to trade reporting system Trace.

According to Bloomberg, pricing fluctuated on Sunday as traders weighed two contrasting scenarios: either the regulator would nationalize part or the whole bank, possibly writing off Credit Suisse’s AT1 bonds entirely, or a UBS buyout with potentially no losses for bondholders.

Well, as of this moment, those bonds have been Lehmaned, or rather Lehmanned in honor of the CS Chairman.

Here is the

full press release from Credit Suisse with final terms of the deal:

Credit Suisse and UBS have entered into a merger agreement on Sunday following the intervention of the Swiss Federal Department of Finance, the Swiss National Bank and the Swiss Financial Market Supervisory Authority FINMA (FINMA). UBS will be the surviving entity upon closing of the merger transaction.

Under the terms of the merger agreement all shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse. Until consummation of the merger, Credit Suisse will continue to conduct its business in the ordinary course and implement its restructuring measures in collaboration with UBS. The Swiss National Bank will grant Credit Suisse access to facilities that provide substantial additional liquidity. On March 19, 2023, Swiss Federal Department of Finance, the Swiss National Bank and FINMA have asked Credit Suisse and UBS to enter into the merger agreement. Pursuant to the emergency ordinance which is being issued by the Swiss Federal Council, the merger can be implemented without approval of the shareholders. The consummation of the merger remains subject to customary closing conditions.

Credit Suisse and UBS have entered into a merger agreement on Sunday with UBS being the surviving entity. After negotiations that took place during the weekend leading up to the signing of the merger agreement, UBS and Credit Suisse concluded that it would be in the best interest of their shareholders and their stakeholders to enter into the merger. This move comes after the Swiss Federal Department of Finance, the Swiss National Bank and FINMA asked both companies to conclude the transaction to restore necessary confidence in the stability of the Swiss economy and banking system.

The merger transaction provides for the following key terms:

- All shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse as merger consideration. This exchange ratio reflects a merger consideration of CHF 3 billion for all shares in Credit Suisse.

- The merger transaction remains subject to customary closing conditions. Both parties are confident that all conditions can be met. The merger is expected to be consummated by end of 2023 if possible.

- The Swiss National Bank will grant Credit Suisse access to facilities that provide substantial additional liquidity.

- For the purpose of a seamless integration of Credit Suisse into UBS, UBS is expected to appoint key personnel to Credit Suisse as soon as legally possible.

- Credit Suisse continues to operate in the ordinary course of business and implement its restructuring measures in collaboration with UBS.

- UBS has expressed its confidence that the employment of the staff of Credit Suisse will be continued.

On Sunday, Credit Suisse has been informed by FINMA that FINMA has determined that Credit Suisse’s Additional Tier 1 Capital (deriving from the issuance of Tier 1 Capital Notes) in the aggregate nominal amount of approximately CHF 16 billion will be written off to zero.

In consideration of the unique circumstances affecting the Swiss economy as a whole, the Swiss Federal Council is issuing an emergency ordinance (Notverordnung) tailored to this particular transaction. Most importantly, the merger will be implemented without the otherwise necessary approval of the shareholders of UBS and Credit Suisse to enhance deal certainty.

Axel P. Lehmann, Chairman of the Board of Directors of Credit Suisse said: “Given recent extraordinary and unprecedented circumstances, the announced merger represents the best available outcome. This has been an extremely challenging time for Credit Suisse and while the team has worked tirelessly to address many significant legacy issues and execute on its new strategy, we are forced to reach a solution today that provides a durable outcome.”

And here is the

press release from UBS's side, which repeat all of the above and informs us that "the combination of the two businesses is expected to generate annual run-rate of cost reductions of more than USD 8 billion by 2027." Translation: virtually all CS workers will be laid off.

UBS to Acquire Credit Suisse

- Creates leading global wealth manager with USD 5 trillion of invested assets across the Group

- Extends UBS lead in Swiss home market

- UBS strategy unchanged, including focus on growth in Americas and APAC

- Attractive financial terms which include downside protection

- Annual run-rate of cost reduction of more than USD 8 billion expected by 2027

- UBS remains strongly capitalized well above our target of 13% and committed to progressive cash dividend policy

- A focused Investment Bank, remaining committed to UBS’s model; strategic Global Banking businesses to be retained, majority of Credit Suisse markets positions moved to non-core

UBS plans to acquire Credit Suisse. The combination is expected to create a business with more than USD 5 trillion in total invested assets and sustainable value opportunities. It will further strengthen UBS’s position as the leading Swiss-based global wealth manager with more than USD 3.4 trillion in invested assets on a combined basis, operating in the most attractive growth markets.

The transaction reinforces UBS’s position as the leading universal bank in Switzerland. The combined businesses will be a leading asset manager in Europe, with invested assets of more than USD 1.5 trillion.

UBS Chairman Colm Kelleher said: “This acquisition is attractive for UBS shareholders but, let us be clear, as far as Credit Suisse is concerned, this is an emergency rescue. We have structured a transaction which will preserve the value left in the business while limiting our downside exposure. Acquiring Credit Suisse’s capabilities in wealth, asset management and Swiss universal banking will augment UBS’s strategy of growing its capital-light businesses. The transaction will bring benefits to clients and create long-term sustainable value for our investors.”

UBS Chief Executive Officer Ralph Hamers said: “Bringing UBS and Credit Suisse together will build on UBS’s strengths and further enhance our ability to serve our clients globally and deepen our best-in-class capabilities. The combination supports our growth ambitions in the Americas and Asia while adding scale to our business in Europe, and we look forward to welcoming our new clients and colleagues across the world in the coming weeks.”

The discussions were initiated jointly by the Swiss Federal Department of Finance, FINMA and the Swiss National Bank and the acquisition has their full support.

Under the terms of the all-share transaction, Credit Suisse shareholders will receive 1 UBS share for every 22.48 Credit Suisse shares held, equivalent to CHF 0.76/share for a total consideration of CHF 3 billion. UBS benefits from CHF 25 billion of downside protection from the transaction to support marks, purchase price adjustments and restructuring costs, and additional 50% downside protection on non-core assets. Both banks have unrestricted access to the Swiss National Bank existing facilities, through which they can obtain liquidity from the SNB in accordance with the guidelines on monetary policy instruments.

The combination of the two businesses is expected to generate annual run-rate of cost reductions of more than USD 8 billion by 2027.

UBS Investment Bank will reinforce its global competitive position with institutional, corporate and wealth management clients through the acceleration of strategic goals in Global Banking while managing down the rest of Credit Suisse’s Investment Bank. The combined investment banking businesses accounts for approximately 25% of Group risk weighted assets.

UBS anticipates that the transaction is EPS accretive by 2027 and the bank remains capitalized well above its target of 13%.

Colm Kelleher will be Chairman and Ralph Hamers will be Group CEO of the combined entity.

The transaction is not subject to shareholder approval. UBS has obtained pre-agreement from FINMA, Swiss National Bank, Swiss Federal Department of Finance and other core regulators on the timely approval of the transaction.

* * *

Update (1430ET): The Swiss government, SNB and various regulators hold an ad hoc press conference on the Credit Suisse takeover by UBS.

During the press conference, the Swiss president says the surge in deposit outflows on Friday showed that stabilization of Credit Suisse was necessary, i.e., the bank would have collapsed absent a takeover by a larger bank.

And here are some more highlights from the presser:

- *KELLER-SUTTER: SOLUTION WILL STABILIZE CS, FINANCIAL MARKETS

- *KELLER-SUTTER: TOP PRIORITY WAS INTERESTS OF SWITZERLAND

- *KELLER-SUTTER: GUARANTEE ONLY KICKS IN ON CERTAIN THRESHOLD

- *CREDIT SUISSE TAKEOVER TO TRIGGER CHF16B WRITEDOWN ON AT1S

- *JORDAN: BANKRUPTCY OF CS WOULD HAVE HAD SEVERE CONSEQUENCES

- *JORDAN: CS BANKRUPTCY TO HAVE SEVERELY DAMAGED SWISS REPUTATION

- *JORDAN: US BANKING CRISIS AGGRAVATED CREDIT SUISSE CRISIS

- *JORDAN: SNB TO PROVIDE LIQUIDITY IF NEEDED

Here is the full SNB statement:

Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank.

With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation.

Both banks have unrestricted access to the SNB’s existing facilities, through which they can obtain liquidity from the SNB in accordance with the ‘Guidelines on monetary policy instruments’.

In addition, and based on the Federal Council’s Emergency Ordinance, Credit Suisse and UBS can obtain a liquidity assistance loan with privileged creditor status in bankruptcy for a total amount of up to CHF 100 billion.

Furthermore, and based on the Federal Council’s Emergency Ordinance, the SNB can grant Credit Suisse a liquidity assistance loan of up to CHF 100 billion backed by a federal default guarantee. The structure of the loan is based on the Public Liquidity Backstop (PLB), the key parameters of which were already decided by the Federal Council in 2022.

The substantial provision of liquidity will ensure that both banks have access to the necessary liquidity. By providing substantial liquidity assistance, the SNB is fulfilling its mandate to contribute to the stability of the financial system, and it continues to work closely with the federal government and FINMA to this end.

* * *

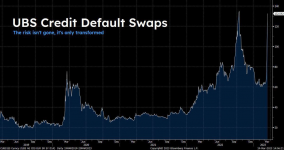

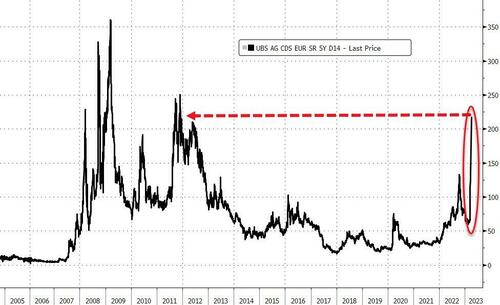

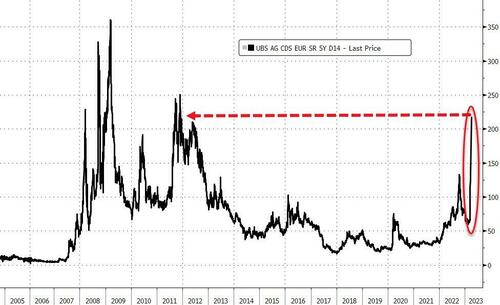

Update (1415ET): As attention turns to the bailoutee, it appears that the market is not convinced that not even the SNB's $100BN liquidity backstop will be sufficient as UBS Credit Default Swaps are starting to move in the wrong direction, and during Sunday's emergency trading session, BBG reports that UBS CDS have widened by at least 40bps (so far) to 215 bps for five-year contracts. Should this move accelerate, the deal MAC may still be triggered and the deal could fall apart.

* * *

Update (1300ET): The Financial Times reports that

UBS has agreed to buy Credit Suisse after increasing its offer to more than $2bn, with Swiss authorities poised to change the country’s laws to bypass a shareholder vote on the transaction as they rush to finalize a deal before Monday.

The purchase price is

a fraction of the $8 billion market cap the company was valued at on Friday's close; it means that UBS will now pay slightly more than CHF0.50 a share in its own stock, up from a bid of SFr0.25 earlier today, but far below Credit Suisse’s closing price of CHF1.86 on Friday.

We also learn that UBS agreed to a softening of a material adverse change clause that would void the deal if its credit default spreads jump; it wasn't immediately clear if that entire clause was scrapped or if the CDS trigger was merely pulled wider.

UBS shareholders - who will not be consulted on the deal which will circumvent normal corporate governance rules by preventing a UBS shareholder vote - are angry. As FT notes, Vincent Kaufmann, chief executive of Ethos Foundation, which represents Swiss pension funds that own between 3% and 5% of Credit Suisse and UBS, told the Financial Times that the move to bypass a shareholder vote on the deal was poor corporate governance.

“I can’t believe our members and UBS shareholders will be happy about this,” he said. “I have never seen such measures taken; it shows how bad the situation is.”

As a reminder, here is a list of the 40 biggest investors.

Finally,

The Wall Street Journal reports that, in an effort to smooth the deal, the

Swiss National Bank has offered UBS a whopping $100 billion in liquidity to help it take on Credit Suisse’s operations,

In other words, the Swiss government has extended a liquidity line equal to ~$11.5MM on a per capita basis: said

otherwise, every family of 4 is backstopping almost $50MM in UBS assets.

Using UBS to save Credit Suisse

marks a turnaround from nearly 15 years ago, when Switzerland bailed out UBS after it got stuck with billions of toxic assets in its U.S. business. Credit Suisse declined state aid at the time and emerged from the crisis in stronger shape.