ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com

'Negative Efficacy' Should Have Stopped COVID Vaccine Recommendations In Their Tracks

TUESDAY, NOV 29, 2022 - 09:05 PM

Authored by Dr. Sean Lin and Mingjia Jacky Guan via The Epoch Times (emphasis ours),

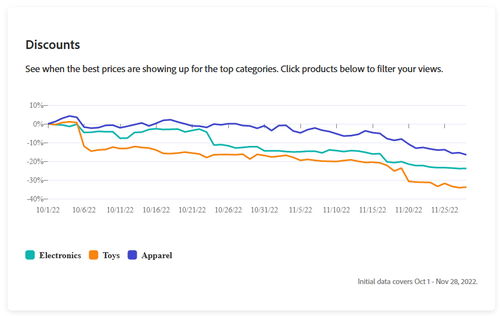

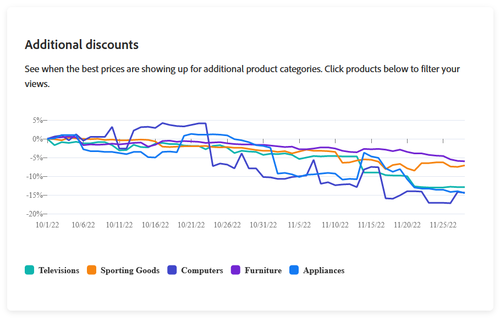

Recently, various health agencies around the world have approved and are actively pushing for another COVID booster shot, meant to enhance the vaccine efficacy against a COVD-19 infection.

However, many studies have found that the boosters do not make a significant difference in protection, especially in terms of protection against reinfection. In fact, the latest data shows vaccine efficacy against the coronavirus tends to even drop into the negatives after just a few months.

What Does Negative Efficacy Mean?

It is a well known fact that COVID vaccine effectiveness wanes quickly as time goes on; this is confirmed by countless studies.

Although the official narrative for COVID-19 vaccines nowadays only emphasizes its efficacy on protection against ICU admission and death rates, it actually implies the indisputable fact that vaccines don’t protect, contrary to their design, against infection or even symptomatic infection, especially after the emergence of various Omicron variants.

Even the protection two shots offers against hospitalization drops to about 40 percent after less than a year. It’s actually looking worse for protection against severe symptoms, as efficacy rates seem to drop into the negatives about five months into full vaccination.

When a vaccine’s efficacy drops into the negatives, it means that vaccination actually elevates the risks of hospitalization and severe diseases rather than reducing the risks. In simple terms, it does more harm than good when the efficacy is negative.

During the time prior to the pandemic, any vaccine with an efficacy less than 50 percent would be regarded as a poor product. When a product shows negative efficacy, it should be banned. It seems that the pandemic isn’t only bad for our health, but also is tugging at our common sense.

COVID Vaccines’ Declining Usefulness

It has been around three years since the first COVID-19 case was discovered in Wuhan, China. Since then, more than 600 million cases of the virus have been recorded, translating into a little less than 1 in 10 people around the world already being infected with the virus. In many countries, “living with COVID” has become the norm, along with getting “fully vaccinated” and getting those booster shots.

According to the Centers for Disease Control and Prevention (CDC), it is recommended that everyone 6 months and older should receive a full vaccination and everyone 5 years and older should receive a booster shot. Booster shots are recommended as they “are an important part of protecting yourself from getting seriously ill or dying from COVID-19” according to the CDC.

However, emerging data paints a different picture.

At its crux, the vaccines were developed with the earlier strains of the coronavirus, meaning developers primarily used the original Wuhan strain in their testing. The Delta strain that came along was particularly infamous as it was known to have a high death rate, but vaccines fared quite well against it. The results, however, went south as time went on and as the Omicron strain rolled out.

Trying to Outrun Nature

Making its debut in South Africa, the Omicron strain started to dominate the world by the beginning of 2022, which caused even more turmoil in terms of vaccine efficacy. The most shocking result is the extent it dragged down the vaccine’s efficacy against infection. Data shows that the vaccine used to be around 90 percent effective for weeks on end after vaccination.

After Omicron came along, infection prevention dropped to less than 50 percent after about a month after two shots and dived into the negatives four months later. It doesn’t seem to stop after that.

This clearly suggests that the COVID-19 vaccination campaigns should’ve been suspended as soon as the Omicron variant began to dominate over Delta.

In a study which analyzed COVID-19 cases from the beginning of this year in children that were previously infected, it was discovered that vaccine effectiveness wasn’t keeping up with pre-Omicron levels. The effects of a full vaccination against a second infection drops into the negatives within a few months, and it seems that the earlier one got the vaccination, the more likely it would lose its efficacy during the omicron waves.

The results from a September 2022 British Medical Journal study highlights again the fact that vaccine potency drops rapidly with time. It concluded that protection against severe symptoms drops well below half within a few weeks of administering the full two doses, or even after a third dose is administered. It also showed that in the immunocompromised, two doses never had an efficacy rate against hospitalization over 50 percent. Things do look a little better for three doses, but not by much.

Another study published data on the efficacy of the third dose relative to primary doses and found that the mean efficacy of three doses of the Moderna vaccine against the Omicron variants are, in fact, below 0.

It is interesting to note a logical assumption made by many, which is that the more you take the vaccine the better prepared you are against the virus, isn’t necessarily true.

Data published shows that neutralizing antibody count doesn’t necessarily correlate with the number of doses.

They found that people who took the fourth dose sometimes had higher, but mostly lower, antibody concentrations in the body compared with those who took the third dose.

Also, the hazard ratio calculated by researchers for the third and fourth vaccine doses provide us with mixed results. Sometimes, it seems like a good option to stick with the third dose, as the hazard ratio actually rises for taking the second booster compared with the first one.

One possible reason vaccine data is going downhill after Omicron appeared is that the new variant had a lot of changes in its spike protein composition.

This changes the way the virus enters the body and allows it to better “bypass” the security system set up by the old vaccines, which were developed from the very first SARS-CoV-2 Wuhan strain. One can understand it as if the variants have new toys to play with the old security guards.

Another potential mechanism that leads to the significant decline of vaccine efficacy is that repeated vaccination also damages people’s immunity via immune imprinting, a phenomenon in which an initial exposure to a virus–such as the original strain of SARS-CoV-2, by infection or vaccination–limits a person’s future immune response against variants.

Meanwhile, there are numerous underlying factors that would contribute to the disease’s progression from mild to severe, or even into fatal stages. Even if the vaccination groups during clinical trials were carefully chosen to have similar comorbid medical conditions as the control or unvaccinated group, there are still many other unknown factors that would dictate the outcome of the disease progression.

It is inconceivable and overtly overambitious that any pharmaceutical company would aim so high to design a vaccine which can protect against severe diseases from the onset of research, especially since the resulting vaccine can’t seem to keep up with preventing infection in the first place.

If a vaccine reaches negative efficacy, it means that people have higher chances to get infected than if you didn’t get the shot in the first place, meaning that not getting vaccinated might just reduce the chance of infection, unwanted symptoms, and severe disease. This is not just a vaccine failure or breakthrough infection issue, but a good time to halt COVID vaccines for good. Humans will never win in this cat-and-mouse game against nature.

Are Previous Infections Still Protective?

As time goes on, the likelihood of reinfection is quite high. Studies do show that in reinfected people the chances of death, hospitalization, and some form of sequela is much higher in those infected for the first time. It also seems like a logical conclusion for the CDC to recommend that everyone gets vaccinated.

However, the data we have is rather conflicting as the aforementioned study doesn’t show much of a difference between the unvaccinated, the half vaccinated, or the fully vaccinated. They all have just about the same values for cardiovascular, thrombotic, renal, or pulmonary sequelae post infection, or chances of getting a tough COVID-19 infection in the first place.

Data also shows that previously infected and unvaccinated children were better at preventing a second infection compared with children who were in the same age category but who were vaccinated. Generally speaking, vaccine induced immunity doesn’t seem to be quite as effective as that induced by a previous, natural infection.

What this essentially means is that the vaccines cannot keep up with the constantly emerging variants and that a waning efficacy was frankly inevitable. The only question left is, what is the driving force behind the Omicron variants, or SARS-CoV-2 variants on a broad scale? What accounts for variants emerging at the same time around the world?

Microevolution cannot explain everything.

Over the past 3 years, scientists have applied the theory of evolution to describe and explain the trajectory of SARS-CoV-2. Delta was the deadly variant and now Omicron is the road runner. In theory, the virus developed these strains to best adapt to the objective environment, yet scientists are still looking for more answers.

For example, when much of the world’s population was in different degrees of “lockdown” or restriction of movements, when international travel was severely impaired, how did the Alpha and Delta variants emerge and quickly spread widely, and even become dominant globally?

If the only factor that determines which variant to become dominant or not was its fitness, i.e., its transmissibility and replication efficiency, why were there not multiple variants with better fitness that emerged and all became dominant regionally, just like how divergent strains of flowers blossom at the same time in distinct locations? Why does it appear as if there is a coordinating force behind the virus such that one strain was able to uniformly retire the previous one?

In order to answer all these questions, I believe that there needs to be a more holistic evaluation of the current pandemic. At the same time, it’s important to note that viruses adapt to the vaccines, and not the other way around.

Read more

here...

Via Adobe

Via Adobe