You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON M1 Money Stock Going Vertical

- Thread starter Gadsden

- Start date

-

- Tags

- gold inflation money supply

CaryC

Has No Life - Lives on TB

can you explain what this means for us non market, non money savvy people?

I don't know if you got your answer. I too, am not a money/financial person, but will give my take on the news. And here's hoping the financial people correct, if wrong.

One thing wrong in the OP is that the Federal Government has been monetizing the debt for several years now. So it's not a future thing.

My understanding of the OP is that the report means we are on the cusp of hyperinflation. Too much money in the system. Without people working to produce product. AND at the same time actual price increases because of shortages, in this case food, as the main driving force.

Once prices increase and eat up the currency, the only thing that can be done is print more currency, and give it to people to buy product, at again increased prices, print more money. Once that starts, it takes on a life of it's own.

The Federal government, in the last 4 weeks, spent 5 Trillion dollars that was off budget (stimulus). Where did they get that money, since they don't produce any products? The Federal Government borrowed it, by issuing bonds, (instead of raising taxes) which the Federal Reserve (not a part of the Federal Government) bought. They bought the bonds by printing money. Giving the Federal Government in essence a loan. So 5 Trillion new dollars have been printed, and injected into the economy. Without anything being produced.

Then the Federal Government gave the money to the people who didn't produce anything from the sale of a product. Meaning the US economy was flooded with money. To much money means the money isn't worth as much in product, thus prices go up. Inflation starts.

parsonswife

Veteran Member

Do you know if any country has gotten off of fiat money back to a gold standard since WW2? How did it play outI wonder if this isn't all happening to force the world back to a gold standard? Trump appointed gold bugs to the FED board of governors and has taken over monetizing operations through Treasury. They are monetizing everything and quickly. As distasteful as it might be, the only way to get out of the ginormous global debt is for the nation states to turn that debt into cash, drive up prices, and force gold up into the stratosphere. At some point, someone like the Saudis will demand payment in bullion, and then we would have the option of a gold backed dollar. This would be tantamount to a debt jubilee if the Federal Reserve Notes (crap dollars) floated against the Gold Dollars (real dollars). Minimum wage for a month could pay off a mortgage. The worst case scenario is for inflation not to happen and we go into Japanization, that is continuing to work and pay notes on our debt rather than buy and make things. I know hyperinflation is typically thought of as a terrible scenario, but it has its positives. It is usually a switch from a crap currency to a real currency and a purging of debt acquired in the crap currency. It's just really, really, really unpleasant during the transition.

bw

Fringe Ranger

I wonder if this isn't all happening to force the world back to a gold standard? Trump appointed gold bugs to the FED board of governors and has taken over monetizing operations through Treasury. They are monetizing everything and quickly. As distasteful as it might be, the only way to get out of the ginormous global debt is for the nation states to turn that debt into cash, drive up prices, and force gold up into the stratosphere. At some point, someone like the Saudis will demand payment in bullion, and then we would have the option of a gold backed dollar.

I think you have it backwards. Nothing forces countries into a gold standard. The gold standard is simply what's left when everything else is worthless. Nixon closed the gold window to force countries into a dollar standard. The window will reopen on its own, in due time.

CaryC

Has No Life - Lives on TB

Short answer - None.Do you know if any country has gotten off of fiat money back to a gold standard since WW2? How did it play out

No currencies in the world today are backed by gold.

In the modern world, there are different types of currencies: fiat currency and digital currency or cryptocurrency. Currently, there is no fiat currency in 2019 backed by gold since the gold standard was abandoned a long time ago.

Paladin1

"In Omnia Paratus" is more than just a phrase

I don't believe it's a question of "have they done this before" but rather "this is more than they've ever done before and we're not sure what it's going to do".Before everyone goes

Our government and the Federal Reserve Bank are now doing nothing that they have not done before.

I believe it will lead large inflation numbers but that is not sure thing.

We know that we're going to see inflation, but the question remains as to how much, how fast it'll show up, and how badly it's going to cripple the economy when we do get started back up again.

Personally, I agree with Jed that this is what's going to put us to the point of seeing a day's wages for a loaf of bread. There's a whole stack of prophecies that are about to start becoming very relevant.

Gadsden

Contributing Member

Do you know if any country has gotten off of fiat money back to a gold standard since WW2? How did it play out

Probably wishful thinking. Anyone who tried to get off of fiat got invaded. I suppose the issue that is unique now is that we have debt fiat currencies globally that have enjoyed value through high interest rates. Since about 1980 the central banks could encourage borrowing and spending by dropping their rates. Governments, people, and businesses gave them power because they liked the easy money at each step of reduction. The trouble for the central banks is that everyone is now up to their eyeballs in debt and interest rates are zero. There is nowhere else for them to go. Governments might see this as an opportunity to get out from under their thumb by stimulus and monetization. The danger is that monetizing debt basically involves the central banks buying real stuff so they would ultimately have to give that stuff back and they aren’t likely to do that without a fight. In a just world the big banks would just go out of business and everyone would use gold. But it isn’t a just world so much prayer is likely in order.

Our government and the Federal Reserve Bank are now doing nothing that they have not done before.

Actually they are. In the past the banksters paid lip service to the idea that we the taxpayers were on the hook for all the funny money they were cranking out. Remember the "full faith and credit" BS?

Well not any more. With MMT they have even cut that fragile mooring. We are completely adrift on a swelling sea of funny money - a sea that is destined to get stormy soon

Actually they are. In the past the banksters paid lip service to the idea that we the taxpayers were on the hook for all the funny money they were cranking out. Remember the "full faith and credit" BS?

Well not any more. With MMT they have even cut that fragile mooring. We are completely adrift on a swelling sea of funny money - a sea that is destined to get stormy soon

coalcracker

Veteran Member

The problem is that the eventual new system will be digital and cashless. All privacy will be gone since government will have access to all data from all transactions. Controlling spending (rationing) will be easily accomplished with such technology. Amazingly, this was all predicted 2,000 years ago in the book of Revelation.

As for gold, it will be no longer needed nor desired as a "store of value." I own some. In fact, I bought more a few months back. Local dealer markup in January was $100 an ounce over spot for half eagles ($850 a piece). It'll be interesting once the quarantine lifts to see what's available in physical gold and at what price. I like physical silver a lot too going forward. Both metals are way better than fiat. Where I depart from the golgbug camp is that I do not view the metals as necessary to back the new currency after the reset. I believe they, along with all other physical items, will receive an arbitrary value within the digital system, and that's what they will be "worth."

If I'm right, gold and silver will spike very high in the time of turmoil (priced in dollars) but will then later be bought and sold at much lower values (priced in the new digital).

There is also the government confiscation aspects (especially with bullion). Uncle Sam has a big boot and likes squashing goldbugs.

As for gold, it will be no longer needed nor desired as a "store of value." I own some. In fact, I bought more a few months back. Local dealer markup in January was $100 an ounce over spot for half eagles ($850 a piece). It'll be interesting once the quarantine lifts to see what's available in physical gold and at what price. I like physical silver a lot too going forward. Both metals are way better than fiat. Where I depart from the golgbug camp is that I do not view the metals as necessary to back the new currency after the reset. I believe they, along with all other physical items, will receive an arbitrary value within the digital system, and that's what they will be "worth."

If I'm right, gold and silver will spike very high in the time of turmoil (priced in dollars) but will then later be bought and sold at much lower values (priced in the new digital).

There is also the government confiscation aspects (especially with bullion). Uncle Sam has a big boot and likes squashing goldbugs.

I have heavily edited the following to remove most of the material pertaining to PMs given the hypersensitive nature of some here. The entire piece can be seen at the link. The author of this piece tracks and analyzes the PM markets and advocates PM ownership.

========================

Corona Vs 2008: The Difference Is Inflation

Stewart Thomson

What’s the difference between the financial crisis of 2008 and the Corona crisis of 2020? From a financial perspective, both are the same. They are “failure to prepare” and “failure to save” crises.

Governments from the left, the centre, and the right all have failed to prepare themselves or their citizens to handle war, famine, disease, and financial hardship. Propaganda about “big growth”, military-driven regime change, and debt worship have been the themes… instead of bomb shelters, food depots, germ warfare preparation, and saving money (both fiat and gold).

Governments have no savings, Western citizens have almost no savings, and the outlook for future savings is bleak.

In 2008, central bank money printing and government borrowing was deflationary for the mainstream economy because the money went to financial markets, banks, and governments. The banks didn’t put the money into the mainstream economy.

I’ve suggested that this time is different. There is still enormous money being printed and poured into financial markets, but small business lending programs are in play, and this may be only the beginning of printed money that flows into the mainstream economy.

Please click here now. Dave Kelly, chief global strategist for JP Morgan Asset Management, says this about the future: “(US govt) Borrowing at this pace, particularly when other governments around the world are also running fast-rising deficits, might be expected to result in higher interest rates, even in a deep recession.

Employees are being paid more to stay home than they received when going to work. Businesses are getting money for customer sales that don’t exist.

This is how significant inflation is unleashed. It takes time. The power of the dollar is a key factor to consider; with about 60% of all transactions in the world taking place in dollars, the central bank can print a lot of money and not create real economy inflation… as long as the money goes to government and financial markets.

That’s starting to change. The winds of real economy inflation are beginning to blow.

A Corona vaccine is probably 12-24 months away. Government propaganda would reach record levels if a vaccine was produced in even modest quantity. The stock market would almost certainly surge to a new high, but the real economy would still be receiving enormous amounts of government handouts.

Those handouts would be spent maniacally by the citizens in celebration of the vaccine, and more handouts would almost certainly follow. From there, the inflationary genie would rise out of her bottle ...

========================

Apr 28, 2020 Corona Vs 2008: The Difference Is Inflation Stewart Thomson 321gold ...inc ...s

321gold.com ...takes no prisoners!

www.321gold.com

Corona Vs 2008: The Difference Is Inflation

Stewart Thomson

What’s the difference between the financial crisis of 2008 and the Corona crisis of 2020? From a financial perspective, both are the same. They are “failure to prepare” and “failure to save” crises.

Governments from the left, the centre, and the right all have failed to prepare themselves or their citizens to handle war, famine, disease, and financial hardship. Propaganda about “big growth”, military-driven regime change, and debt worship have been the themes… instead of bomb shelters, food depots, germ warfare preparation, and saving money (both fiat and gold).

Governments have no savings, Western citizens have almost no savings, and the outlook for future savings is bleak.

In 2008, central bank money printing and government borrowing was deflationary for the mainstream economy because the money went to financial markets, banks, and governments. The banks didn’t put the money into the mainstream economy.

I’ve suggested that this time is different. There is still enormous money being printed and poured into financial markets, but small business lending programs are in play, and this may be only the beginning of printed money that flows into the mainstream economy.

Please click here now. Dave Kelly, chief global strategist for JP Morgan Asset Management, says this about the future: “(US govt) Borrowing at this pace, particularly when other governments around the world are also running fast-rising deficits, might be expected to result in higher interest rates, even in a deep recession.

Employees are being paid more to stay home than they received when going to work. Businesses are getting money for customer sales that don’t exist.

This is how significant inflation is unleashed. It takes time. The power of the dollar is a key factor to consider; with about 60% of all transactions in the world taking place in dollars, the central bank can print a lot of money and not create real economy inflation… as long as the money goes to government and financial markets.

That’s starting to change. The winds of real economy inflation are beginning to blow.

A Corona vaccine is probably 12-24 months away. Government propaganda would reach record levels if a vaccine was produced in even modest quantity. The stock market would almost certainly surge to a new high, but the real economy would still be receiving enormous amounts of government handouts.

Those handouts would be spent maniacally by the citizens in celebration of the vaccine, and more handouts would almost certainly follow. From there, the inflationary genie would rise out of her bottle ...

intothatgoodnight

. . .

Was it Andrew Jackson who so vehemently fought against the establishment of a central banking system, Stateside ?

Correct.

And, President Andrew Jackson was successful - though quite a multi-year story leading up to when Jackson was finally able to eliminate the Second National Bank.

Shortly after his 2016 Presidential win, Trump had Jackson's portrait put on display in the Oval Office. Suggests that this is one of Trump's goals - to eliminate the present-day (Third National Bank) U.S. central bank, aka the Federal Reserve (est. 1913).

intothegoodnight

Last edited:

Samuel Adams

Has No Life - Lives on TB

Wouldn’t that be a treat.

I know better than to go into the Pandora’s box that the Fed opened up for us Americans, but I also know you don’t need me to.

If that box got closed back up tight, along with, well.....

No wonder they’re pulling out all the stops.

I know better than to go into the Pandora’s box that the Fed opened up for us Americans, but I also know you don’t need me to.

If that box got closed back up tight, along with, well.....

No wonder they’re pulling out all the stops.

CaryC

Has No Life - Lives on TB

And here we were talking about some signs of hyperinflation, then today we get this report.

Doesn't this point to a tightening of money, meaning less in the system leading to a depression.

Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

www.zerohedge.com

2 mins read

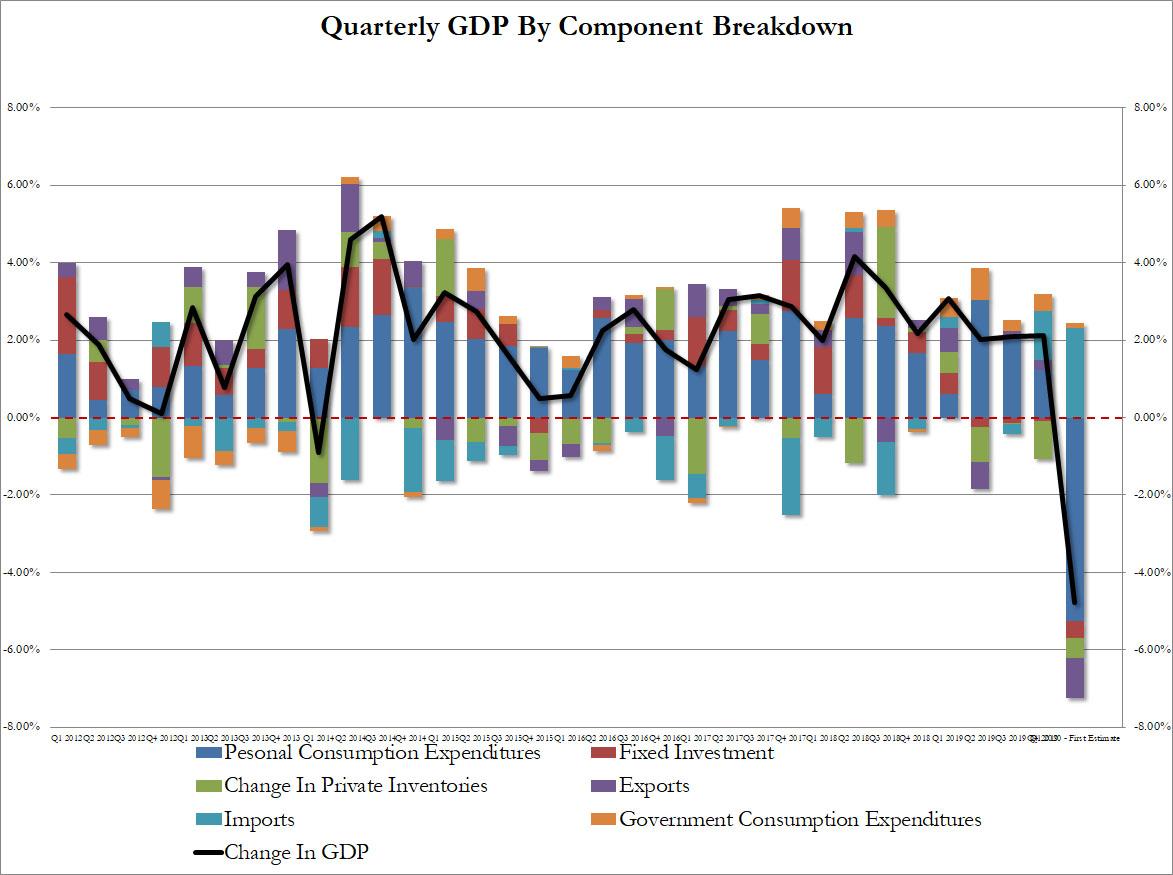

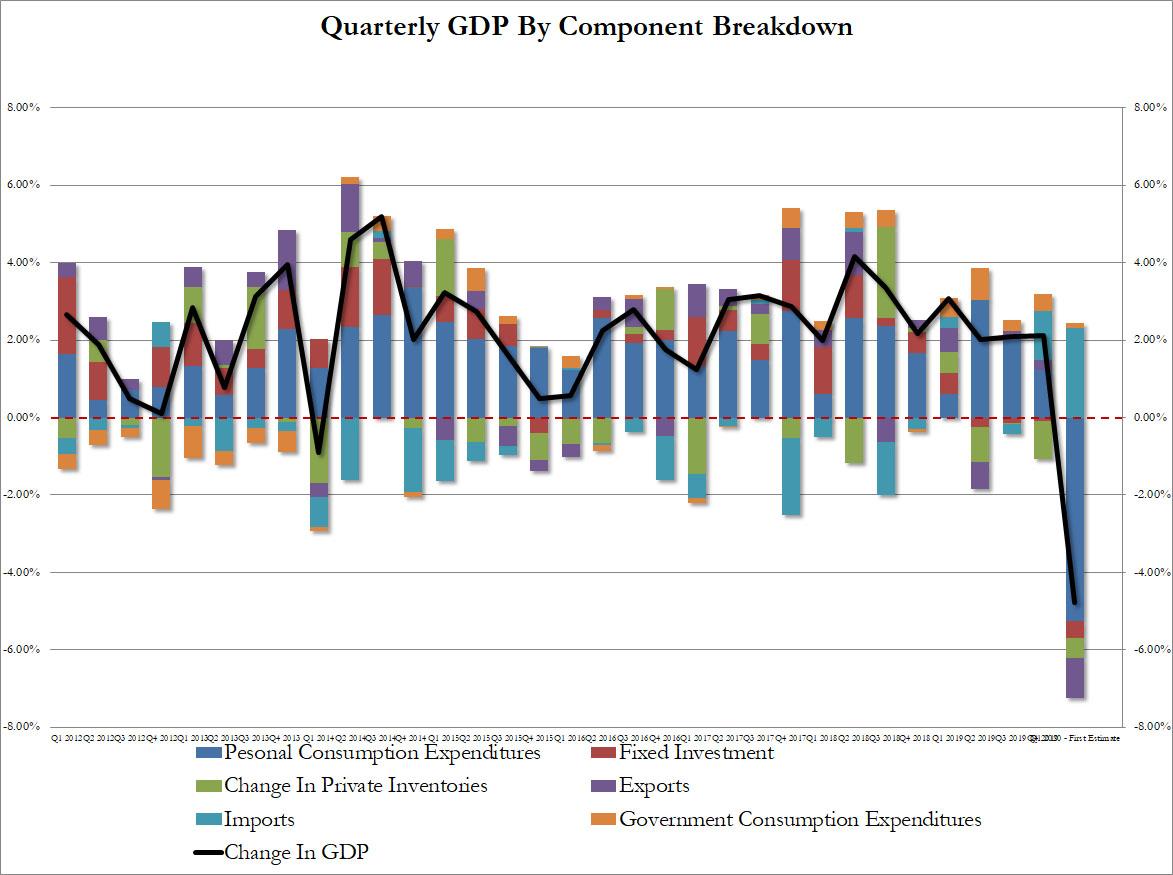

With news that the Gilead Remdesivir trial had reportedly met its primary endpoint hitting "coincidentally" just seconds before the Q1 GDP print, and with newswires initially reporting the GDP erroneously as a positive 4.8% print, it was clear that the real number would be a disaster, and sure enough moments later newswires reversed and reported that Q1 GDP was in fact, a worse than expected negative 4.8%, the biggest drop since March of 2009, and officially marking the start of the US recession. Current-dollar GDP decreased 3.5%, or $191.2 billion, in the first quarter to a level of $21.54 trillion, after increasing 3.5% in the fourth quarter.

The decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The decrease in PCE reflected decreases in services, led by health care, and goods, led by motor vehicles and parts. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

The increase in housing investment primarily reflected an increase in new single-family housing, while the increase in government spending reflected an increase in federal government.

Perhaps in response to demands from the White House, the BEA was quick to note that "the decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified."

The BEA nonetheless quantified the hit and found the following:

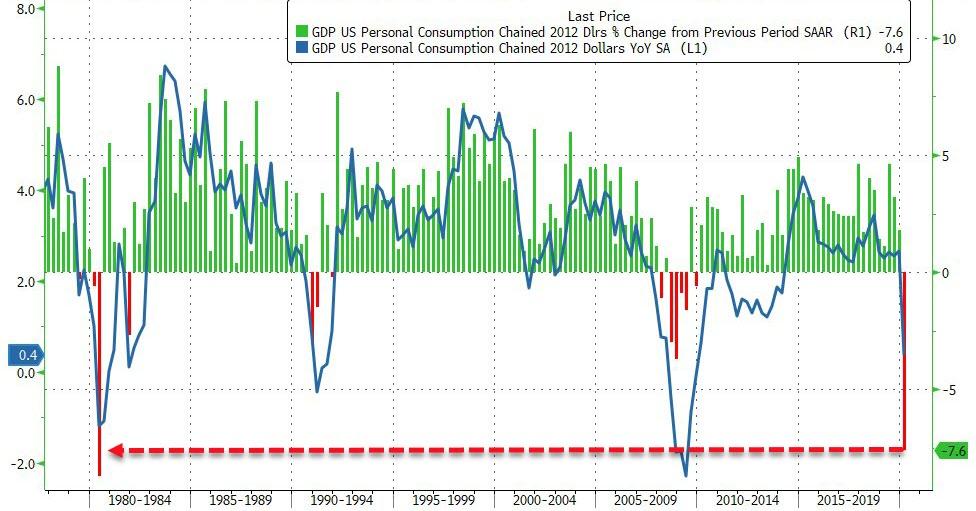

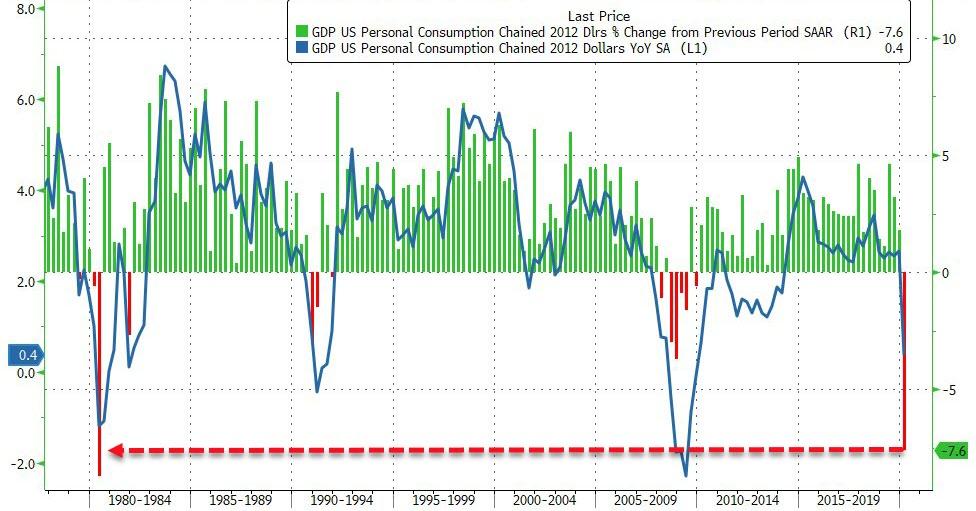

Of note, the collapse in consumption was the biggest since 1980 which was to be expected with the economy on lockdown.

Separately, real disposable personal income increased 0.5 percent in the first quarter after increasing 1.6 percent in the fourth quarter. Personal saving as a percent of disposable personal income was 9.6 percent in the first quarter, compared with 7.6 percent in the fourth quarter.

Prices of goods and services purchased by U.S. residents increased 1.6 percent in the first quarter of 2020, after increasing 1.4 percent in the fourth quarter of 2019. Meanwhile, food prices increased 3.1 percent, while energy prices decreased 11.0 percent in the first quarter. Excluding food and energy, prices increased 1.9 percent in the first quarter of 2020, compared with an increase of 1.3 percent in the fourth quarter.

Finally, recall that the sharp slowdown only reflects two weeks of March going offline. As such the real question is what happens to Q2 GDP, and whether the expected ~30% drop in GDP will be the trough and whether a V-shaped recovery will follow.

read:Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

Doesn't this point to a tightening of money, meaning less in the system leading to a depression.

Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

www.zerohedge.com

2 mins read

With news that the Gilead Remdesivir trial had reportedly met its primary endpoint hitting "coincidentally" just seconds before the Q1 GDP print, and with newswires initially reporting the GDP erroneously as a positive 4.8% print, it was clear that the real number would be a disaster, and sure enough moments later newswires reversed and reported that Q1 GDP was in fact, a worse than expected negative 4.8%, the biggest drop since March of 2009, and officially marking the start of the US recession. Current-dollar GDP decreased 3.5%, or $191.2 billion, in the first quarter to a level of $21.54 trillion, after increasing 3.5% in the fourth quarter.

The decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The decrease in PCE reflected decreases in services, led by health care, and goods, led by motor vehicles and parts. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

The increase in housing investment primarily reflected an increase in new single-family housing, while the increase in government spending reflected an increase in federal government.

Perhaps in response to demands from the White House, the BEA was quick to note that "the decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued “stay-at-home” orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified."

The BEA nonetheless quantified the hit and found the following:

- Personal Consumption contributed -5.26% to the bottom line -4.8% drop, the biggest drop since 1980

- Fixed Investment shrank -0.43%, a drop from the -0.09% decline in Q4

- The Change in Private Inventories detracted another -0.53% from GDP, a modest improvement from -0.98% in Q4

- Exports shrank -1.02%, a deterioration from the 0.24% increase in Q4

- Imports were the sole bright spot, jumping 2.32%, double the 1.27% in the last quarter

- Government consumption also added a modest 0.13% to the bottom line, a decline from the 0.44% in the prior quarter.

Of note, the collapse in consumption was the biggest since 1980 which was to be expected with the economy on lockdown.

Separately, real disposable personal income increased 0.5 percent in the first quarter after increasing 1.6 percent in the fourth quarter. Personal saving as a percent of disposable personal income was 9.6 percent in the first quarter, compared with 7.6 percent in the fourth quarter.

Prices of goods and services purchased by U.S. residents increased 1.6 percent in the first quarter of 2020, after increasing 1.4 percent in the fourth quarter of 2019. Meanwhile, food prices increased 3.1 percent, while energy prices decreased 11.0 percent in the first quarter. Excluding food and energy, prices increased 1.9 percent in the first quarter of 2020, compared with an increase of 1.3 percent in the fourth quarter.

Finally, recall that the sharp slowdown only reflects two weeks of March going offline. As such the real question is what happens to Q2 GDP, and whether the expected ~30% drop in GDP will be the trough and whether a V-shaped recovery will follow.

read:Recession Begins: Q1 GDP Plunges 4.8%, Biggest Drop Since The Financial Crisis

jed turtle

a brother in the Lord

Andrew Jackson was a lucky man. the man sent to assassinate him for destroying the first national bank had both his derringers mis-fire if iirc. Lincoln and JFK were not so lucky... Trump must have angels watching his six. Full time.View attachment 194365

Correct.

And, President Andrew Jackson was successful - though quite a multi-year story leading up to when Jackson was finally able to eliminate the Second National Bank.

Shortly after his 2016 Presidential win, Trump had Jackson's portrait put on display in the Oval Office. Suggests that this is one of Trump's goals - to eliminate the present-day (Third National Bank) U.S. central bank, aka the Federal Reserve (est. 1913).

intothegoodnight

NoDandy

Has No Life - Lives on TB

I believe that is correct !Was it Andrew Jackson who so vehemently fought against the establishment of a central banking system, Stateside ?

Gadsden

Contributing Member

CaryC

Has No Life - Lives on TB

Just a note:

The ECB President this morning is saying, Europe's economy will probably see a 12% contraction, in the next quarter, and inflation will be way down. I take that to mean, at least, entering a recession.

Doesn't that mean money is tight, and not circulating. Could be the Federal government is taking all the money being printed, with nothing left for banks.

One day it's inflation, next day it's recession. I don't get it.

The ECB President this morning is saying, Europe's economy will probably see a 12% contraction, in the next quarter, and inflation will be way down. I take that to mean, at least, entering a recession.

Doesn't that mean money is tight, and not circulating. Could be the Federal government is taking all the money being printed, with nothing left for banks.

One day it's inflation, next day it's recession. I don't get it.

It is simply because it is both. It is deflation and it is inflation.Just a note:

The ECB President this morning is saying, Europe's economy will probably see a 12% contraction, in the next quarter, and inflation will be way down. I take that to mean, at least, entering a recession.

Doesn't that mean money is tight, and not circulating. Could be the Federal government is taking all the money being printed, with nothing left for banks.

One day it's inflation, next day it's recession. I don't get it.

There can be no denial that there is massive deflation at present. 25 million people were put out of work and have no income. Which means no mortgage payments, no purchases, stores are closed, stock market is down.

And there can be no denial that there is massive inflation as evidenced by the expansion of the money supply with no corresponding creation of assets whether that be gold, silver, steel, or product.

Prices are a reflection of inflation and deflation but are a result of supply and demand. The best example of that is the iPhone. The price of an iPhone is not based on the cost to produce it. It is based on supply and demand.

In deflation, you can get an increase in price because the middle man who moves product to the shelf is unable to get short term credit to purchase the product while it is in transit to the store shelf. This is deflation - contraction of money supply.

This reduces the supply of product on the shelf which cause and increase in price. Inflation.

You only observe this during deflation because it hurts your pocket book.

During an expansion of credit markets - which increases the money supply (inflation) - short term credit to move the product to the shelf results in over supply creating competition which reduces the price (is this deflation or just a sale?).

However, these are not the only two causes. For example, meat. The reason meat prices will go up is that supply at the producer has been reduced not by contraction of the money supply but by the virus.

The reduction in creation of new product is deflation and can be seen in the GDP.

But the reduction in supply hitting the grocery shelf results in higher prices.

If bread is $2 a loaf and your house is worth $200,000, then your house is worth 100,000 loaves of bread.

If bread increases to $3 a loaf is your house still worth 100,000 loaves of bread if 25 million people are unemployed and unable to get a mortgage?

CaryC

Has No Life - Lives on TB

It is simply because it is both. It is deflation and it is inflation.

There can be no denial that there is massive deflation at present. 25 million people were put out of work and have no income. Which means no mortgage payments, no purchases, stores are closed, stock market is down.

And there can be no denial that there is massive inflation as evidenced by the expansion of the money supply with no corresponding creation of assets whether that be gold, silver, steel, or product.

Prices are a reflection of inflation and deflation but are a result of supply and demand. The best example of that is the iPhone. The price of an iPhone is not based on the cost to produce it. It is based on supply and demand.

In deflation, you can get an increase in price because the middle man who moves product to the shelf is unable to get short term credit to purchase the product while it is in transit to the store shelf. This is deflation - contraction of money supply.

This reduces the supply of product on the shelf which cause and increase in price. Inflation.

You only observe this during deflation because it hurts your pocket book.

During an expansion of credit markets - which increases the money supply (inflation) - short term credit to move the product to the shelf results in over supply creating competition which reduces the price (is this deflation or just a sale?).

However, these are not the only two causes. For example, meat. The reason meat prices will go up is that supply at the producer has been reduced not by contraction of the money supply but by the virus.

The reduction in creation of new product is deflation and can be seen in the GDP.

But the reduction in supply hitting the grocery shelf results in higher prices.

If bread is $2 a loaf and your house is worth $200,000, then your house is worth 100,000 loaves of bread.

If bread increases to $3 a loaf is your house still worth 100,000 loaves of bread if 25 million people are unemployed and unable to get a mortgage?

Thanks. As I have said in recent posts, not a financial guy at all. Doing extremely well just to balance the checkbook.

However, I'm still not following. Not being a hard nose, just dense.

You example concerning meat is a product that is in short supply compared to demand. And in my view has nothing to do with money supply. Whether there is a lot, or a little money in the system. Meat prices are going to go higher because there is a shortage. What am I missing.

Not to debate but out of interest I googled "steps to inflation" Here is the results:

Stages Of Hyperinflation

seekingalpha.com

4 mins read

There is a general pattern for the stages of hyperinflation. This can also be viewed as the stages of the "death of a fiat currency". Money can be seen as serving 3 roles. It is a medium of exchange, it is a store of value, and it is a unit of accounting. As we move through the stages of hyperinflation the money gradually gives up these 3 roles. Once it has given up all 3, it is dead.

- Government spending gets out of control to where deficit is 40% or more of spending and debt is over 80% of GNP. If this is for a war that the markets believe will be won and ended so that the government can make drastic cuts in spending, then there is some wiggle room in these numbers.

- This goes on for a couple years and investors move towards shorter-term bonds.

- It becomes clear the deficit is not going back down.

- The central bank starts buying up government debt with newly made money. If they are not naturally inclined to do this, the government changes the laws or people running the central bank. For the rest of this section, I will write as if the central bank were just part of the government and ignore bond certificates printed by the government and handed to the central bank as these will become worthless anyway. With this simplification, I will just say, "the government prints money".

- There is capital flight out of that currency and bond sales fail. If the government let bond interest rates rise to attract bond buyers, the interest payments on the debt would be huge compared to taxes collected, so they keep interest rates down by printing more money. However, the private investors become less and less inclined to "roll over" their government bonds.

- Government is forced to print money to cover their budget and inflation picks up. The more bonds coming due the worse the printing is. Many short-term bonds can make for huge amounts of printing, even more than the regular budget.

- Some people notice prices going up and spend their money before prices go up more, even for things they don't need yet. The velocity of money picks up. People start to realize that the local currency is not a good store of value, though still used for transactions. Some people start to use foreign currencies or gold as a store of value.

- So many people take money out of their bank accounts and exchange it for a foreign currency, or gold, or just buy something, which puts banks in danger of going under. So the government often freezes bank accounts. This is very bad for the account holders, both because times are hard and they can't get their money, and also because by the time they are able to get their money, it is worth much less.

- Wages and prices become indexed to something more stable, like a foreign currency or gold. So the local currency is losing the "unit of account" function. Wages become paid more often, like weekly or daily, instead of monthly. The velocity of money picks up more.

- People start to use a foreign currency or gold as store of value, even though the government may forbid it. The black market starts in currency exchange.

- Interest rates are very high and loans are for much shorter periods. Loans may be for a couple months instead of 30 years. Hyperinflation makes for hard times and many people are forced to sell their their land or house. Because of these things the real prices for things usually bought with long-term loans can drop in terms of something like gold. Houses may usually be bought with a bag of some foreign currency. Real estate is very different during hyperinflation and normal times.

- People start to use barter or a foreign currency or gold for trade, even though the government forbids it. This is a growing black market for commerce. If you trade a fish you caught for some potatoes your friend grew, neither of you is paying any taxes on the deal. In general, once people are breaking the law by using a foreign currency for trade, they don't pay any taxes on trade either. The black market is tax free.

- Being tax free and with better store of value, the black market eventually grows larger than the legal market. People no longer worry about the government requirement to use local paper currency, enforcement is impossible.

- A business that follows the law and sells for regulated prices in the local currency cannot buy enough new inventory and soon goes out of business. This makes the percentage of the economy that is black market go up.

- People start to not want to accept the local paper money. Regular taxes are down because hyperinflation has devastated the economy and much of the economy is now in the "black market". The government is finding it hard to buy things by printing money, as so much of the economy has moved to the black market. It is finding it hard to pay employees enough for them to live comfortably, even though it keeps printing more all the time. The government is losing economic power. Tax collectors may be skipping work to tend to their own vegetable garden. There is a very real risk of the government failing at this step.

- At this point, the government has some hard choices if it is not going to fail. It needs to do something so that the "black market" is legalized and taxable, and deficits are nearly eliminated. It could just legalize a foreign currency or gold. But then it would forever give up on collecting any "inflation tax". It could get rid of budget deficits and stop printing money. However, people will still fear that it could start again at any time and so be hesitant to use that money. I think the most frequent end to hyperinflation is by making a new fiat money but with enough governmental changes that bring deficits and inflation under control, people will use the new money. If they switch to a new currency then the old money is no longer used as a store of value, or unit of account, or even as a medium of exchange. It has died.

For more details on the stages of hyperinflation, and historical examples, I highly recommend Monetary regimes and inflation: history, economic and political relationships by Peter Bernholz.

read:https://seekingalpha.com/article/3272945-stages-of-hyperinflation

And what an interesting twist in the age old fiat money story, to toss in a viral pandemic and MMT at the same time.

Doesn't change the eventual outcome, but adds new plot twists to the storyline... and offers wonderful distractions to get the mob looking elsewhere.

Doesn't change the eventual outcome, but adds new plot twists to the storyline... and offers wonderful distractions to get the mob looking elsewhere.

Most of the time when real money is discussed, people talk about "real" money - gold.Thanks. As I have said in recent posts, not a financial guy at all. Doing extremely well just to balance the checkbook.

However, I'm still not following. Not being a hard nose, just dense.

You example concerning meat is a product that is in short supply compared to demand. And in my view has nothing to do with money supply. Whether there is a lot, or a little money in the system. Meat prices are going to go higher because there is a shortage. What am I missing.

Not to debate but out of interest I googled "steps to inflation" Here is the results:

Stages Of Hyperinflation

seekingalpha.com

4 mins read

There is a general pattern for the stages of hyperinflation. This can also be viewed as the stages of the "death of a fiat currency". Money can be seen as serving 3 roles. It is a medium of exchange, it is a store of value, and it is a unit of accounting. As we move through the stages of hyperinflation the money gradually gives up these 3 roles. Once it has given up all 3, it is dead.

- Government spending gets out of control to where deficit is 40% or more of spending and debt is over 80% of GNP. If this is for a war that the markets believe will be won and ended so that the government can make drastic cuts in spending, then there is some wiggle room in these numbers.

- This goes on for a couple years and investors move towards shorter-term bonds.

- It becomes clear the deficit is not going back down.

- The central bank starts buying up government debt with newly made money. If they are not naturally inclined to do this, the government changes the laws or people running the central bank. For the rest of this section, I will write as if the central bank were just part of the government and ignore bond certificates printed by the government and handed to the central bank as these will become worthless anyway. With this simplification, I will just say, "the government prints money".

- There is capital flight out of that currency and bond sales fail. If the government let bond interest rates rise to attract bond buyers, the interest payments on the debt would be huge compared to taxes collected, so they keep interest rates down by printing more money. However, the private investors become less and less inclined to "roll over" their government bonds.

- Government is forced to print money to cover their budget and inflation picks up. The more bonds coming due the worse the printing is. Many short-term bonds can make for huge amounts of printing, even more than the regular budget.

- Some people notice prices going up and spend their money before prices go up more, even for things they don't need yet. The velocity of money picks up. People start to realize that the local currency is not a good store of value, though still used for transactions. Some people start to use foreign currencies or gold as a store of value.

- So many people take money out of their bank accounts and exchange it for a foreign currency, or gold, or just buy something, which puts banks in danger of going under. So the government often freezes bank accounts. This is very bad for the account holders, both because times are hard and they can't get their money, and also because by the time they are able to get their money, it is worth much less.

- Wages and prices become indexed to something more stable, like a foreign currency or gold. So the local currency is losing the "unit of account" function. Wages become paid more often, like weekly or daily, instead of monthly. The velocity of money picks up more.

- People start to use a foreign currency or gold as store of value, even though the government may forbid it. The black market starts in currency exchange.

- Interest rates are very high and loans are for much shorter periods. Loans may be for a couple months instead of 30 years. Hyperinflation makes for hard times and many people are forced to sell their their land or house. Because of these things the real prices for things usually bought with long-term loans can drop in terms of something like gold. Houses may usually be bought with a bag of some foreign currency. Real estate is very different during hyperinflation and normal times.

- People start to use barter or a foreign currency or gold for trade, even though the government forbids it. This is a growing black market for commerce. If you trade a fish you caught for some potatoes your friend grew, neither of you is paying any taxes on the deal. In general, once people are breaking the law by using a foreign currency for trade, they don't pay any taxes on trade either. The black market is tax free.

- Being tax free and with better store of value, the black market eventually grows larger than the legal market. People no longer worry about the government requirement to use local paper currency, enforcement is impossible.

- A business that follows the law and sells for regulated prices in the local currency cannot buy enough new inventory and soon goes out of business. This makes the percentage of the economy that is black market go up.

- People start to not want to accept the local paper money. Regular taxes are down because hyperinflation has devastated the economy and much of the economy is now in the "black market". The government is finding it hard to buy things by printing money, as so much of the economy has moved to the black market. It is finding it hard to pay employees enough for them to live comfortably, even though it keeps printing more all the time. The government is losing economic power. Tax collectors may be skipping work to tend to their own vegetable garden. There is a very real risk of the government failing at this step.

- At this point, the government has some hard choices if it is not going to fail. It needs to do something so that the "black market" is legalized and taxable, and deficits are nearly eliminated. It could just legalize a foreign currency or gold. But then it would forever give up on collecting any "inflation tax". It could get rid of budget deficits and stop printing money. However, people will still fear that it could start again at any time and so be hesitant to use that money. I think the most frequent end to hyperinflation is by making a new fiat money but with enough governmental changes that bring deficits and inflation under control, people will use the new money. If they switch to a new currency then the old money is no longer used as a store of value, or unit of account, or even as a medium of exchange. It has died.

For more details on the stages of hyperinflation, and historical examples, I highly recommend Monetary regimes and inflation: history, economic and political relationships by Peter Bernholz.

read:https://seekingalpha.com/article/3272945-stages-of-hyperinflation

Gold is very real money - and one of its hard currency characteristics is "it does not rust, rot, shrink, etc". In other words its shelf life is almost infinite. Which makes it a good store of wealth.

There are many other things that are also real money. Silver, copper, steel, various ore, diamonds, AND corn, wheat, pork, black eyed peas, etc. Their value as a store of wealth is considerably different. Meat rots, so as a store of wealth it isn't great. But it is still money.

If meat is money. And they are producing less meat that means they are producing less meat money.

Less money is deflation.

CaryC

Has No Life - Lives on TB

Many overall factors contribute to an economy's fall into a recession, as we found out during the U.S. financial crisis, but one of the major causes is inflation. Inflation refers to a general rise in the prices of goods and services over a period of time. The higher the rate of inflation,...

What Causes a Recession?

www.investopedia.com

5 mins read

The National Bureau of Economic Research (NBER) defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in the real gross domestic product (GDP), real income, employment, industrial production, and wholesale-retail sales." A recession is also said to be when businesses cease to expand, the GDP diminishes for two consecutive quarters, the rate of unemployment rises, and housing prices decline.

Key Takeaways

Macroeconomic and Microeconomic Signs of a Recession

The standard macroeconomic definition of a recession is two consecutive quarters of negative GDP growth. (this is being factored in already) Private business, which had been in expansion prior to the recession, scales back production and tries to limit exposure to systematic risk. Measurable levels of spending and investment are likely to drop and a natural downward pressure on prices may occur as aggregate demand slumps. GDP declines and unemployment rates rise because companies lay off workers to reduce costs.

At the microeconomic level, firms experience declining margins during a recession. When revenue, whether from sales or investment, declines, firms look to cut their least-efficient activities. A firm might stop producing low-margin products or reduce employee compensation. It might also renegotiate with creditors to obtain temporary interest relief. Unfortunately, declining margins often force businesses to fire less productive employees.

General Causes of Recessions

In general, the major economic theories of recession focus on financial, psychological, and real economic factors that can lead to the cascade of business failures that constitute a recession. Some theories look at long term economic trends that lay the groundwork for recession in the years leading up to it, and some look only at the immediately visible factors that appear at the onset of a recession. Many or all of these various factors may be at play in any given recession.

What Causes Recessions?

A range of financial, psychological, and real economic factors are at play in any given recession.

Financial factors can definitely contribute to an economy's fall into a recession, as we found out during the U.S. financial crisis. The overextension of credit and debt on risky loans and marginal borrowers can lead to enormous build-up of risk in the financial sector. The expansion of the supply of money and credit in the economy by the Federal Reserve and the banking sector can drive this process to extremes, stimulating risky asset price bubbles. And when the music stops the repercussions can carry over into the real economy.

Even worse, artificially suppressed interest rates during the boom times leading up to a recession can distort the structure of relationships among businesses and consumer by making business projects, investments, and consumption decisions that are interest rate-sensitive, such as the decision to buy a bigger house or launch a risky long term business expansion, appear to be much more appealing than they ought to be. The ultimate failure of these decisions when rates rise to reflect reality constitutes a major component of the rash of business failures that make up a recession

Psychological factors are frequently cited by economists for their contribution to recessions also. The excessive exuberance of investors during the boom years that bring the economy to its peak, and the reciprocal doom-and-gloom pessimism that sets in after a market crash at a minimum amplify the effects of real economic and financial factors as the market swings. Moreover, because all economic actions and decisions are always to some degree forward looking, the subjective expectations of investors, businesses, and consumers are always involved in the inception and spread of an economic downturn.

Real changes in economic fundamentals, beyond financial accounts and investor psychology, also make critical contributions to a recession. Some economists explain recessions solely as a result of real economic shocks, such as disruptions in supply chains, and the damage they can cause to a wide range of businesses. Shocks that impact key industries such as energy or transportation can have such widespread effects that they cause many businesses across the economy to retrench and cancel investment and hiring plans simultaneously, with ripple effects on workers, consumers, and the stock market.

Some real economic factors can also be tied back into financial markets. Because market interest rates represent not only the cost of financial liquidity for businesses, but also the time preferences of consumers, savers, and investors for present versus future consumption, artificial suppression of interest rates by a central bank during the boom years before a recession distorts not just financial markets but real business and consumption decisions.

Interest Rates

Interest rates are a key linkage between the purely financial sector and the real economic preferences and decisions of businesses and consumers.

In turn, the real preferences of consumers, savers, and investors place limits on how far such an artificially stimulated boom can proceed. These manifest as real economic constraints on continued growth, in the form of labor market shortages, supply chain bottlenecks, and spikes in commodity prices (which lead to inflation) when not enough real resources can be made available to support all the overstimulated business investment plans based on easy-money policies. Once these set in, a rash of business failures begins in the face of increased production costs and the economy tips into recession.

Some Causes of the Current Recession

Though an official recession has not yet been declared, the economy is clearly heading in that direction. A major cause is obviously evident in the real economic shock of the widespread disruption of global and domestic supply chains and direct damage to businesses across all industries, due to the Covid-19 epidemic and the public health response. Both the impact of the epidemic and the fear and uncertainty surrounding it are important.

But a major underlying cause is also the overextension of supply chains, the overinvestment in marginal business, and the razor-thin inventories and fragile business models that have all become the norm over the decade of extreme low interest rates and monetary policy by central banks everywhere, and especially the Federal Reserve, since the last recession. The deep distortions in business, investment, and consumer behavior, that by 2020 have all become thoroughly addicted to an endless flow of easy money, laid the groundwork for the economic devastation that is currently underway by leaving the economy with zero margin of resilience to buffer against negative economic shocks.

Recession Warning Signs

Leading indicators were already flashing warning signs in 2019, long before Covid-19.

This had become clear as early as 2018 and 2019, when widespread shortages of needed employees and generally tight labor market conditions came to a head and spurred the Fed to very slightly slow the expansion of money and credit. The stock market plunged and leading indicators such as the yield curve quickly began flashing warning signs of impending recession. As serious a challenge as Covid-19 and the associated lockdowns represent over recent months, the economic fallout has been years in the making. The economy was sitting on a powder keg, and Covid-19 was a match.

read:What Causes a Recession?

What Causes a Recession?

www.investopedia.com

5 mins read

The National Bureau of Economic Research (NBER) defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in the real gross domestic product (GDP), real income, employment, industrial production, and wholesale-retail sales." A recession is also said to be when businesses cease to expand, the GDP diminishes for two consecutive quarters, the rate of unemployment rises, and housing prices decline.

Key Takeaways

- A recession is in essence a rash of simultaneous failures of businesses and investment plans.

- Explaining why they happen, and why some many businesses can fail at once, has been a major focus of economic theory and research, with several competing explanations.

- Financial, psychological, and real economic factors are at play in the causes and effects of recessions.

- Causes of the incipient recession in 2020 include the impact of Covid-19 and the preceding decade of extreme monetary stimulus that left the economy vulnerable to economic shocks.

Macroeconomic and Microeconomic Signs of a Recession

The standard macroeconomic definition of a recession is two consecutive quarters of negative GDP growth. (this is being factored in already) Private business, which had been in expansion prior to the recession, scales back production and tries to limit exposure to systematic risk. Measurable levels of spending and investment are likely to drop and a natural downward pressure on prices may occur as aggregate demand slumps. GDP declines and unemployment rates rise because companies lay off workers to reduce costs.

At the microeconomic level, firms experience declining margins during a recession. When revenue, whether from sales or investment, declines, firms look to cut their least-efficient activities. A firm might stop producing low-margin products or reduce employee compensation. It might also renegotiate with creditors to obtain temporary interest relief. Unfortunately, declining margins often force businesses to fire less productive employees.

General Causes of Recessions

In general, the major economic theories of recession focus on financial, psychological, and real economic factors that can lead to the cascade of business failures that constitute a recession. Some theories look at long term economic trends that lay the groundwork for recession in the years leading up to it, and some look only at the immediately visible factors that appear at the onset of a recession. Many or all of these various factors may be at play in any given recession.

What Causes Recessions?

A range of financial, psychological, and real economic factors are at play in any given recession.

Financial factors can definitely contribute to an economy's fall into a recession, as we found out during the U.S. financial crisis. The overextension of credit and debt on risky loans and marginal borrowers can lead to enormous build-up of risk in the financial sector. The expansion of the supply of money and credit in the economy by the Federal Reserve and the banking sector can drive this process to extremes, stimulating risky asset price bubbles. And when the music stops the repercussions can carry over into the real economy.

Even worse, artificially suppressed interest rates during the boom times leading up to a recession can distort the structure of relationships among businesses and consumer by making business projects, investments, and consumption decisions that are interest rate-sensitive, such as the decision to buy a bigger house or launch a risky long term business expansion, appear to be much more appealing than they ought to be. The ultimate failure of these decisions when rates rise to reflect reality constitutes a major component of the rash of business failures that make up a recession

Psychological factors are frequently cited by economists for their contribution to recessions also. The excessive exuberance of investors during the boom years that bring the economy to its peak, and the reciprocal doom-and-gloom pessimism that sets in after a market crash at a minimum amplify the effects of real economic and financial factors as the market swings. Moreover, because all economic actions and decisions are always to some degree forward looking, the subjective expectations of investors, businesses, and consumers are always involved in the inception and spread of an economic downturn.

Real changes in economic fundamentals, beyond financial accounts and investor psychology, also make critical contributions to a recession. Some economists explain recessions solely as a result of real economic shocks, such as disruptions in supply chains, and the damage they can cause to a wide range of businesses. Shocks that impact key industries such as energy or transportation can have such widespread effects that they cause many businesses across the economy to retrench and cancel investment and hiring plans simultaneously, with ripple effects on workers, consumers, and the stock market.

Some real economic factors can also be tied back into financial markets. Because market interest rates represent not only the cost of financial liquidity for businesses, but also the time preferences of consumers, savers, and investors for present versus future consumption, artificial suppression of interest rates by a central bank during the boom years before a recession distorts not just financial markets but real business and consumption decisions.

Interest Rates

Interest rates are a key linkage between the purely financial sector and the real economic preferences and decisions of businesses and consumers.

In turn, the real preferences of consumers, savers, and investors place limits on how far such an artificially stimulated boom can proceed. These manifest as real economic constraints on continued growth, in the form of labor market shortages, supply chain bottlenecks, and spikes in commodity prices (which lead to inflation) when not enough real resources can be made available to support all the overstimulated business investment plans based on easy-money policies. Once these set in, a rash of business failures begins in the face of increased production costs and the economy tips into recession.

Some Causes of the Current Recession

Though an official recession has not yet been declared, the economy is clearly heading in that direction. A major cause is obviously evident in the real economic shock of the widespread disruption of global and domestic supply chains and direct damage to businesses across all industries, due to the Covid-19 epidemic and the public health response. Both the impact of the epidemic and the fear and uncertainty surrounding it are important.

But a major underlying cause is also the overextension of supply chains, the overinvestment in marginal business, and the razor-thin inventories and fragile business models that have all become the norm over the decade of extreme low interest rates and monetary policy by central banks everywhere, and especially the Federal Reserve, since the last recession. The deep distortions in business, investment, and consumer behavior, that by 2020 have all become thoroughly addicted to an endless flow of easy money, laid the groundwork for the economic devastation that is currently underway by leaving the economy with zero margin of resilience to buffer against negative economic shocks.

Recession Warning Signs

Leading indicators were already flashing warning signs in 2019, long before Covid-19.

This had become clear as early as 2018 and 2019, when widespread shortages of needed employees and generally tight labor market conditions came to a head and spurred the Fed to very slightly slow the expansion of money and credit. The stock market plunged and leading indicators such as the yield curve quickly began flashing warning signs of impending recession. As serious a challenge as Covid-19 and the associated lockdowns represent over recent months, the economic fallout has been years in the making. The economy was sitting on a powder keg, and Covid-19 was a match.

read:What Causes a Recession?

In the mid 1980's, can't remember if '85 or '86, my new wife and I with help from both of ours parents we bought a small 2 Br home. The prime interest rate was about 9%, our mortgage rate was 13.25%. Early this year you could get a mortgage at 3.25%.

inflation was a massive problem at the time, Nixon had his "WIN" buttons...Whip Inflation Now

inflation was a massive problem at the time, Nixon had his "WIN" buttons...Whip Inflation Now

Accurate description... like a freight train.

Trouble is... most folks... especially young folks... don't have a clue what that means.

Hunker down.

Young people Hunker down?

Your kidding right?

Young people were told by the media they wouldn't get Corona virus, only the old people would be in danger. Then they said young people would have symptoms that were so mild they might not realize it....so they are out running around ignoring shelter-in-place spreading it to everyone, while they have minimal to no symptoms. The ones we do stay home have friends come and go to party, they don't know they are suppose to stay home ... Without friends.

Do you know if any country has gotten off of fiat money back to a gold standard since WW2? How did it play out

One middle eastern nation was talking about minting a gold coin for legal tender. I'm probably mistaken but I want to say it was Iraq in Saddam's early days. Don't think they ever did all we saw was sample coins.

It was Libya and Obama killed him for doing soOne middle eastern nation was talking about minting a gold coin for legal tender. I'm probably mistaken but I want to say it was Iraq in Saddam's early days. Don't think they ever did all we saw was sample coins.

Masterchief117

I'm all about the doom

Uhhh, 1980s and Nixon? You maybe thinking about Reagan if you're referring to the mid-1980s.In the mid 1980's, can't remember if '85 or '86, my new wife and I with help from both of ours parents we bought a small 2 Br home. The prime interest rate was about 9%, our mortgage rate was 13.25%. Early this year you could get a mortgage at 3.25%.

inflation was a massive problem at the time, Nixon had his "WIN" buttons...Whip Inflation Now

intothatgoodnight

. . .

Iraq, Libya and allegedly Iran were going to start a gold-coin currency called the dinar.One middle eastern nation was talking about minting a gold coin for legal tender. I'm probably mistaken but I want to say it was Iraq in Saddam's early days. Don't think they ever did all we saw was sample coins.

You can imagine how popular that idea was with western central bank/deep staters - the rest is history - Saddam Hussein and Muammar Gaddafi are no longer in power/amongst the living and Iran is struggling internally.

Your Tax Dollars Hard At Work®

intothegoodnight

Prepare for the Era of Recrimination | Guggenheim Investments

The unintended consequences and moral hazard of insufficient and misdirected policies.

Prepare for the Era of Recrimination

The unintended consequences and moral hazard of insufficient and misdirected policies.

April 26, 2020 | By Scott Minerd, Global CIO

To think that the economy is going to reaccelerate in the third quarter in a V-shaped recovery to the level where gross domestic product (GDP) was prior to the pandemic is unrealistic. Four years from now the economy will most likely recover to the same level of activity that it was in January.

The Economic Recovery Is Unlikely To Be V-Shaped

Source: Guggenheim Investments, Haver Analytics, CBO. Actual data as of 12.31.2019.

As this realization becomes clearer, we will be nearing the era of recrimination. Monetary and fiscal policymakers are pulling out all the stops to keep the economy and citizenry afloat during this crisis. Now is too early to determine the efficacy and durability of these crisis programs, but ultimately we will likely discover that they are insufficient, misdirected, and full of unintended consequences. Let the finger-pointing begin.

The recovery will be disappointing for several reasons. First, the end of the lockdown period is not absolute. Restrictions will only be lifted gradually, and with health experts seeing a strong chance of future waves of infections. According to a recent Harvard study, we will likely see rolling periods of lockdown going into 2022. Second, the jobs picture will not bounce back. Over 26 million people have applied for unemployment benefits in the last five weeks, more than all the total net jobs created in the 10 years of the prior economic expansion. Many of these people will not immediately be going back to work, even if the economy fully reopens by summer, which is probably unrealistic. The unemployment rate will probably spike to around 20 percent, maybe as high as 30 percent. By the end of the year the unemployment rate could still be in double digits, and then begins the long haul to get back to unemployment levels that we saw prior to the downturn. It took nearly 10 years for the unemployment rate to return to levels we saw before the Global Financial Crisis, and this labor market shock will likely be between three and five times more severe.

Consider that roughly half of all Americans had less than $500 in savings before this crisis hit. Most of these people were not prepared to weather a storm like this, and the damage that is being done to household balance sheets, let alone the damage to their confidence, is going to have long-term negative repercussions on consumption. Few people will immediately go out and buy automobiles and return to movie theaters. The damage to the household sector is so severe that it is going to impair living standards for most of the decade. This problem is compounded by the fact that the most financially vulnerable households are experiencing the majority of layoffs. Young, hourly workers in lower-paid service industry jobs are bearing the brunt of economic pain, and these are the people least able to deal with an interruption to income, which will compound the economic pain from layoffs as consumption falls even more sharply. Meanwhile, the disruption in corporate cash flows will be pervasive and will rebound unevenly. There will be few positive outcomes in credit as companies are encouraged to accumulate more debt in the already overleveraged corporate sector. These failures will stunt the eventual recovery and make it much more uneven.

The Lowest-Paid Workers Will Bear the Brunt of the Economic Crisis

Cumulative Change in Real Household Net Worth, by Net Worth Percentile

Source: Guggenheim Investments, Haver Analytics. Data as of 12.31.2019.

Policymakers have put in place numerous programs that are intended to soften the blow of the crisis. The increase in unemployment benefits was a phenomenally good idea. But sending checks for $1,200 to households does very little to solve the problem, because these payments are not targeted. Many people who are working and doing fine are going to get a check they don’t need. The people who really could use the money need more than $1,200. Longer-term, stronger incentives need to be put in place to get people back to work, such as introducing a payroll tax holiday for a period of time, along with entitlement reform.

The CARES Act Paycheck Protection Program (PPP) is another great idea. However, programs that cover this wage gap during the period of lockdown are not going to solve the problem of what happens when the lockdown ends. Eventually, companies that are keeping people on their payrolls right now—which is a good idea—will find that they can’t sustain longer term employment based upon diminished demand. Programs need to be instituted to address these issues today before facing the inevitable outcome.

The CARES Act targeted funds to help certain industries, but we will discover who is and who is not helped in these programs. Companies and voters alike will soon ask, “Why didn’t I get help? You bailed out the airlines, right? You bailed out all these other corporations. But you didn’t do anything for me.” And federal assistance still might not save the airlines. Their credit profiles are rapidly deteriorating as debt rises and earnings collapse.

I can’t fault the Federal Reserve (Fed) for the good intentions of trying to do virtually everything in its power in a time of crisis, but the unintended consequences of its policies are considerable. Most notably, buying investment-grade and high-yield debt and providing backstop liquidity to companies has resulted in credit spreads tightening dramatically.

High-Yield Market Approves of Fed Backstop

Bloomberg Barclays U.S. High-Yield Coroprate Option Adjusted Spread in Basis Points

Source: Guggenheim Investments, Bloomberg. Data as of 4.24.2020.

This policy is treating the symptoms of the problem, not the source. Many companies are even more vulnerable to damage in this cycle because they were already sitting at record levels of leverage which resulted from the low interest rate policies of the past decade and an unwillingness to allow even a mild economic slowdown or market decline. The underlying vulnerabilities in some of these industries are not being addressed. Fed purchases cannot turn bad debt into good debt. A buyer who is not careful can mistake Fed liquidity for credit strength and pay the price down the road when downgrades and defaults start in earnest.

The Fed has established a new market precedent. Our central bank will never be able to get back to what was viewed as normal prior to April 9. As the nearby charts demonstrate, the Fed’s balance sheet has expanded from $4.5 trillion to $6.6 trillion in just about a month, and it is likely on its way to exceed $9 trillion soon. The Fed is not alone in this endeavor. As Ed Hyman of Evercore ISI pointed out, G7 central banks collectively purchased in March $1.4 trillion in financial assets. This annual rate of $17 trillion is nearly five times the previous monthly record set in April 2009.

The Fed’s Balance Sheet Comes to the Rescue

Source: Guggenheim Investments, Haver Analytics. Data as of 4.23.2020. Other assets include unamortized discounts and premiums on securities held, foreign currency assets, gold, SDRs, Treasury currency outstanding, and other assets. Crisis facilities include FX swap lines, CPFF, PDCF, Maiden Lane LLCs, AIG credit, TALF, AMLF, and other programs.

If you go back 10 years to when the Fed started quantitative easing (QE), the debate was about how long QE would last and when would an exit strategy begin. I remember saying to people at the time, “The Fed will never be able to end quantitative easing; it’s here forever.” And now the new Fed backstop for credit for corporate America is here forever.

My fear is that this policy blunder will have long-term implications for our society. The Fed and Treasury have essentially created a new moral hazard by socializing credit risk. The United States will never be able to return to free market capitalism as we knew it before these policies were put in place.

The era of recrimination will have broad political and social implications. As the death toll mounts it will be used as political fodder. To say “These people died from coronavirus because of mistakes made in Washington” is an effective tactic. After the Civil War, politicians used the image of the Bloody Shirt to remind voters that honoring fallen Union soldiers demanded a Republican vote. Deservedly or not, today’s Republican administration will have a hard time fending off that argument. As the Hoover Administration bore the consequences of the economic collapse of the 1930s, so quite possibly the pandemic will be viewed as Washington’s failure. Eventually, a populist revolt to address the current massive inequality of income and wealth, will happen. Soon pressure will mount on policymakers to bolster the social safety net and increase things like healthcare and job security and maybe even institute a guaranteed living wage. My only concern is that it will be done in a way that is not productive for long-term growth. These programs will create incentives that will reduce overall productivity, Instead, policymakers should address fundamental reforms in the economy to restore growth and reduce inequality.

Fiscal and monetary programs that are being put in place are fundamentally redefining how the government interacts with businesses and individuals. Some programs will work, and some will not, but they will remain in some form or fashion forever. Now, we all need to figure out how to move forward, manage our businesses, and invest our capital in a new market regime.

CaryC

Has No Life - Lives on TB

Thought the following article interesting, and it mentions the M1. And it curtails with the article by Dozdoats above:

A Broken System: Trader Warns "The Fed Has Poisoned Everything"

www.zerohedge.com

9 mins read

Authored by Sven Henrich via NorthmanTrader.com,

The Fed poisons everything, and I mean everything. From markets, the economy, and I will even go as far as politics. Sounds far fetched? Let me make my case below. But as much as the Fed poisons everything, this crisis here again reveals a larger issue: The system is completely broken, it can’t sustain itself without the Fed’s ever more monumental interventions.

These interventions are absolutely necessary or the system collapses under its own broken facade. And this conflict, a Fed poisoning the economy’s growth prospects on the one hand, and its needed presence and actions to keep the broken system afloat on the other, has the economy and society on a mission to circle a perpetual drain.

So how does the Fed poison everything?

Let’s start with the Fed actual process of working towards its stated mission: Full employment and price stability.

How does it do that? Well, for the last 20 years mainly by extremely low interest rates and balance sheet expansion sprinkled with an enormous amount of jawboning. The principle effect: Asset price inflation.

It’s not a side effect, it’s the true mission. The Fed has been managing the economy via asset prices even though Jay Powell again insisted on saying the Fed is not targeting asset prices.

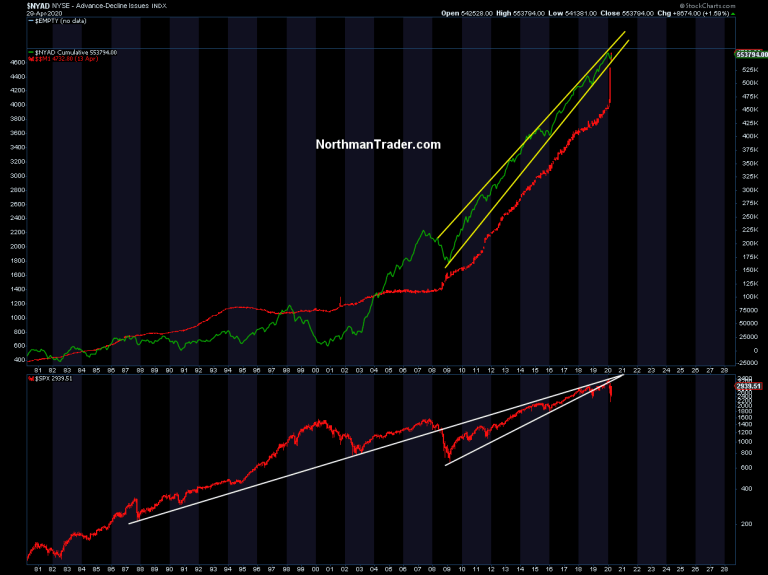

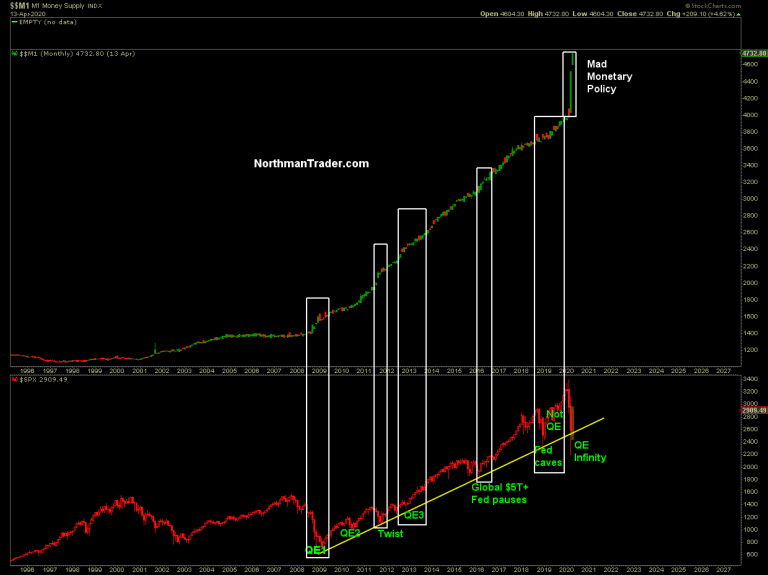

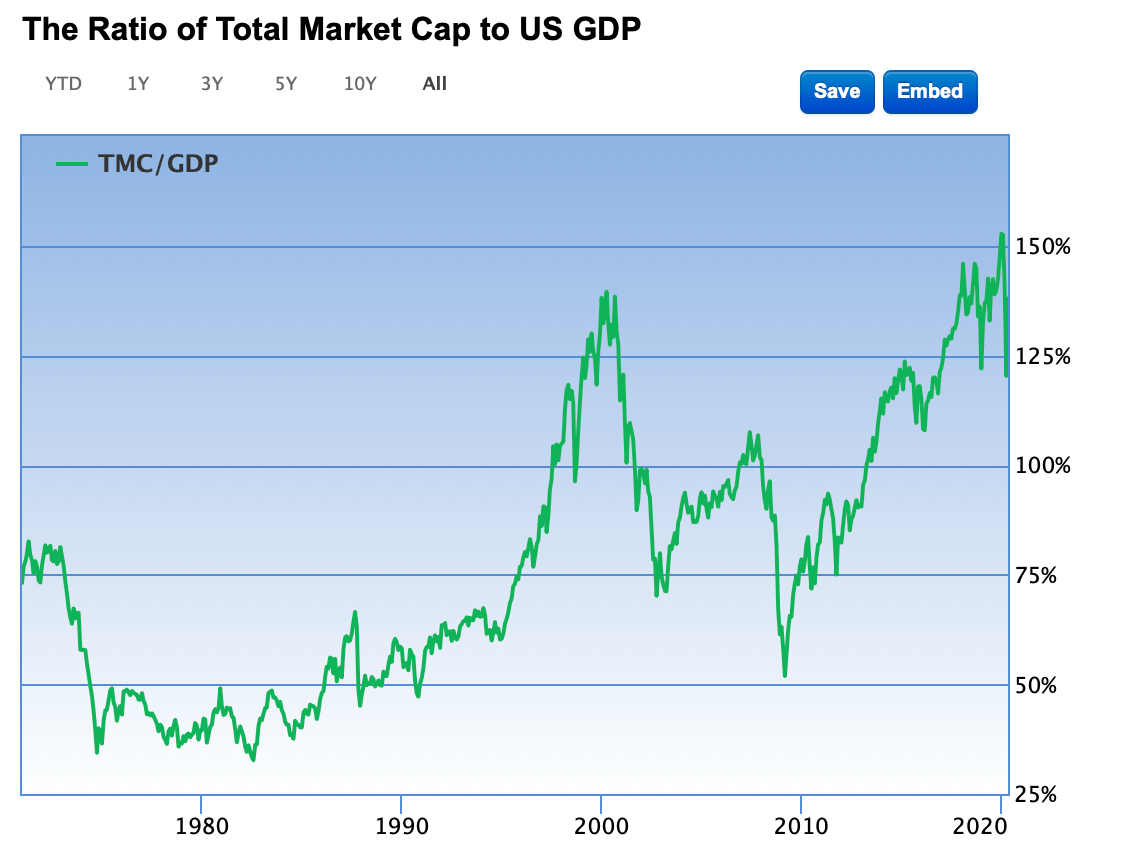

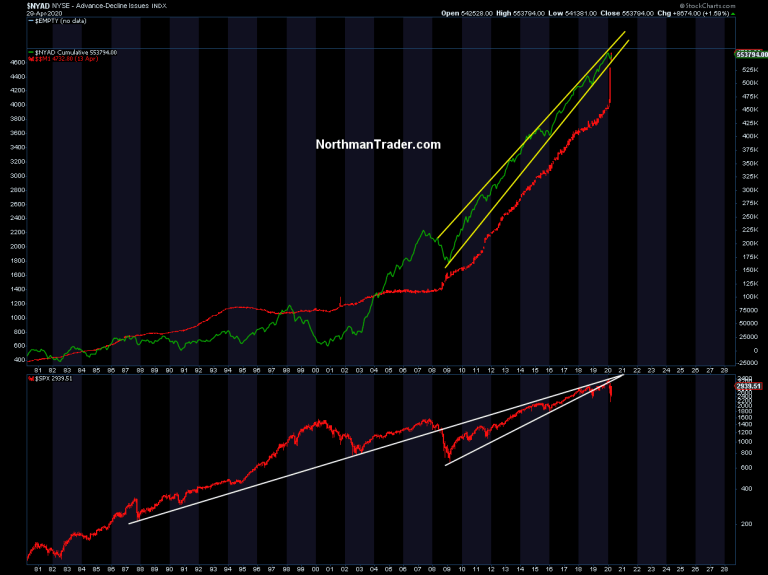

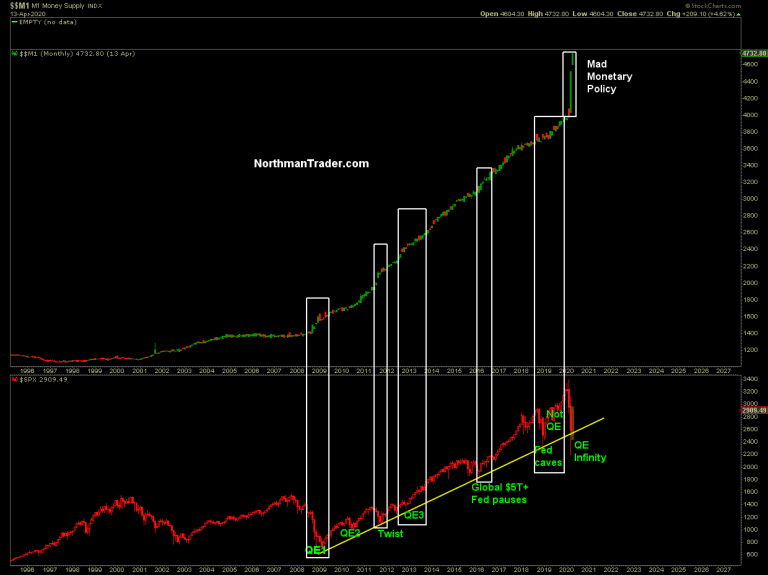

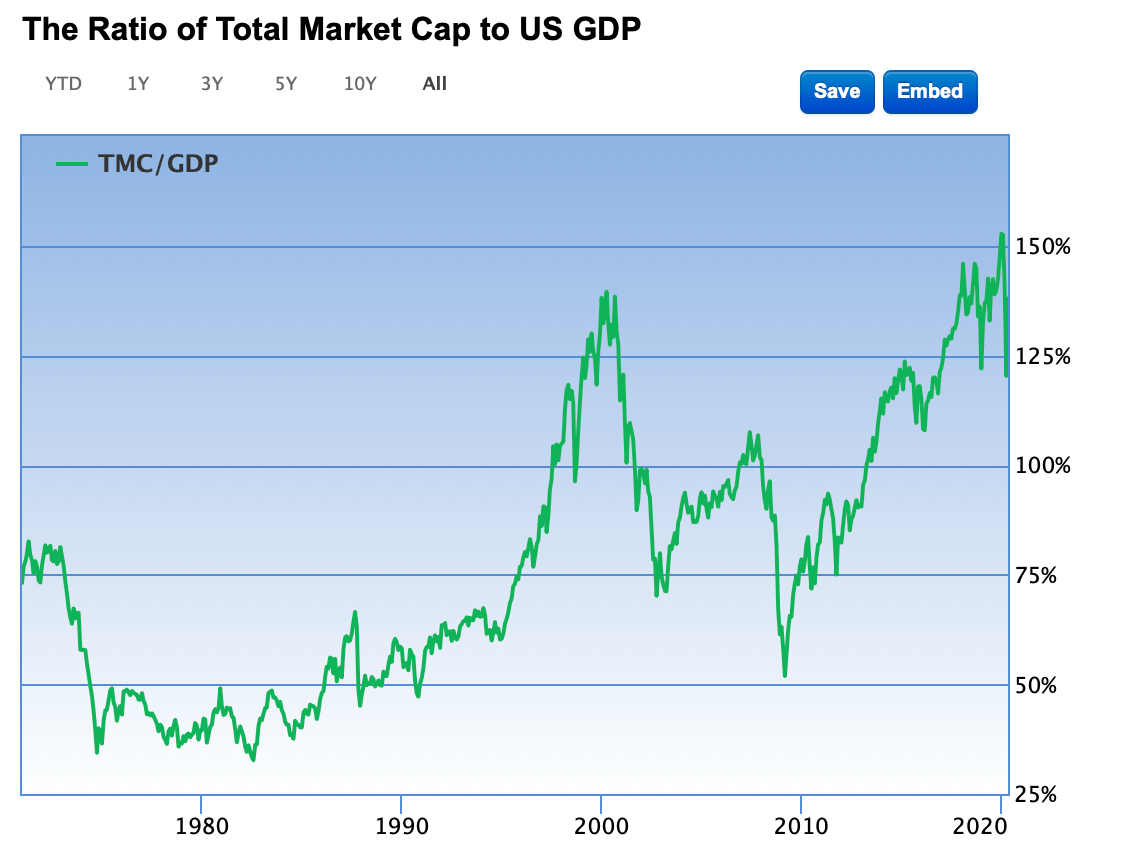

This is a lie. And I can prove it with one chart. Cumulative $NYAD, the flow into stocks versus M1 money supply:

It was not until the Fed flooded markets with cheap money creating the housing bubble that the $NYAD equation changed dramatically, and it was not until the GFC that the Fed went full hog wild on M1 money supply that $NYAD went full vertical alongside of M1. TINA! There is no alternative. Forcing money into equities to manage the economy with a rising stock market.

And guess what? They just saved the $NYAD trend again by going vertical on M1 in a fashion never seen before. All this despite $SPX clearly breaking its long term trend. So yes the Fed is targeting asset prices and Powell is lying when he says the Fed isn’t.

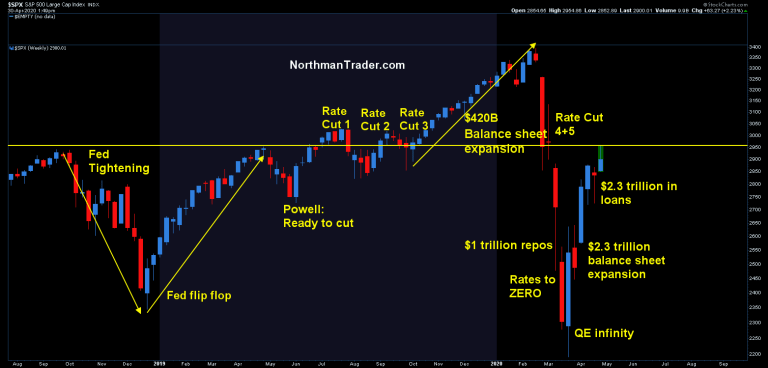

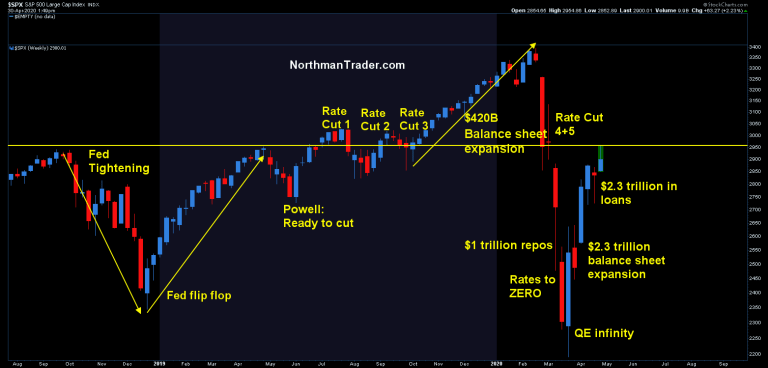

And the entire market knows this. Wall Street knows this. Why? Because the market is a follow the Fed machine long trained to jump back into equities at any sign of Fed action jawboning and promises. It’s no accident that “don’t fight the Fed” is popular mantra. It’s the very proof that market participants know that the Fed is in effect targeting asset prices. Just look at the past year and a half:

And of course this has been going on for years, whenever markets get into trouble here comes the Fed or other central banks with interventions and markets rally, here a long term with M1 money supply thrown in: