Are you suggesting that if we used the 1970 method, the current inflation rate would be 29% or something?Our federal government has changed how they figure inflation so the current system is completely different to how it was done in the 70's.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON History Sometimes Rhymes – Will There be an American Hyperinflation 2019-2023?

- Thread starter SageRock

- Start date

hiwall

Has No Life - Lives on TB

More like 10% to 12%.Are you suggesting that if we used the 1970 method, the current inflation rate would be 29% or something?

Alternate Inflation Charts

Chapwood Index

chapwoodindex.com

chapwoodindex.com

hiwall

Has No Life - Lives on TB

Here is an excellent video that explains some of the changes our gov made to how they figure inflation.

Video is 20 minutes

View: https://www.youtube.com/watch?v=kpNt2JdCcFA&list=PLRgTUN1zz_ofJoMx1rB6Z0EA1OwAGDRdR&index=19

Video is 20 minutes

ECON - Jim Sinclair Weekly Discussion - If money is free what is it worth? is a must hear in relation to this thread and current economic events. Well worth the time ...

China Connection

TB Fanatic

The Coronavirus Economy Will Bring Inflation

By MARTIN HUTCHINSON

A worker wearing a protective suit takes body temperature measurement of a man inside the Shanghai Stock Exchange at the Pudong financial district in Shanghai, China, February 28, 2020. (Aly Song/Reuters)As supply chains are reconstituted and some production re-domesticated

A worker wearing a protective suit takes body temperature measurement of a man inside the Shanghai Stock Exchange at the Pudong financial district in Shanghai, China, February 28, 2020. (Aly Song/Reuters)As supply chains are reconstituted and some production re-domesticated

If you think too much money creation causes inflation, we will get inflation. If you think budget deficits cause inflation, we will get inflation. If you are old-fashioned enough to think that rising costs and increasing economic inefficiency cause inflation, we will get inflation. It really doesn’t matter which economic theory you subscribe to, they all arrive at the same destination — more inflation.

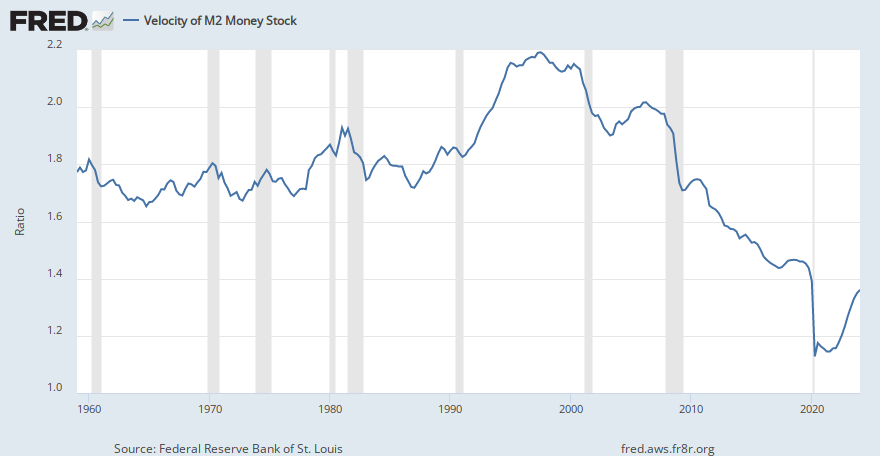

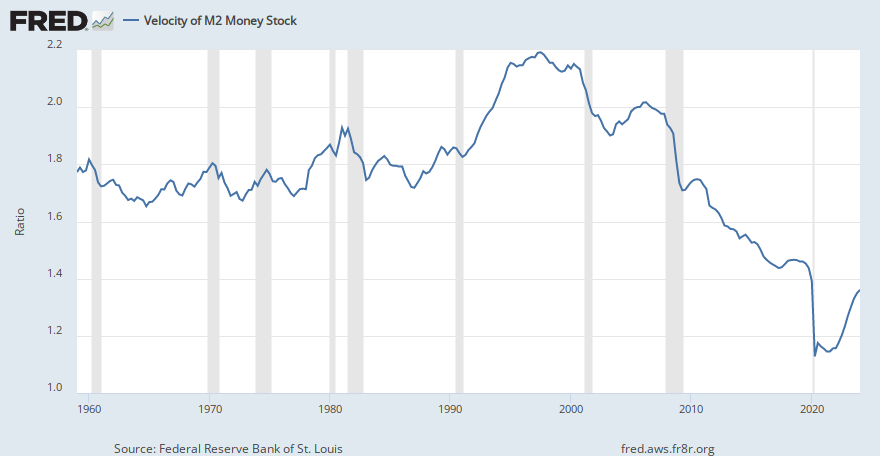

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output,” said Milton Friedman in 1970. Well, we’ve had the money-supply growth; in the ten years to February 2020, M2 money supply increased by 6.3 percent per annum (data from Federal Reserve Bank of St. Louis). The problem is, we did not get the inflation that was promised. Nominal GDP grew only 4 percent per annum in the ten years to the fourth quarter of 2019, so the other 2.3 percent per annum of money supply got lost somewhere. Monetary economists wave their hands and talk about “velocity,” but monetary velocity is supposed to increase, not shrink, as our payments systems get more efficient. For the ten years before the coronavirus, therefore, Friedman’s central principle did not work; we should have had about 4 to 5 percent inflation rather than the 2 percent we actually got.

Since February, it’s a different story, however. In the six weeks to April 6, M2 money supply has increased by 7.7 percent, an annual compounded rate of 90.4 percent. That reflects all the money the Fed has pumped into the system; the statistics are not wrong. But at that rate of money creation, if Friedman is right, we should get inflation close to triple digits, 18 to 24 months from now. You can’t produce money at that rate without the dollar going the way of the continental, the assignat, the reichsmark or the 1946 Hungarian pengo, exchanged for the new forint at a conversion rate of 1029 to 1.

Okay, let’s abandon the monetarists for a moment and look at fiscal policy. The Congressional Budget Office projected a $1.1 trillion deficit in the year to September 30, 2020, to which the recent CARES act added around another $2 trillion. (Updated CBO projections are not yet available, unsurprisingly.) So, in round numbers, the U.S. looks like it will run a $3 trillion deficit in the current fiscal year, around 14 percent of GDP (and with output falling, it is likely to end up higher).

Maynard Keynes would tell you that this is all good, and Keynesians appear to be running our lives right now. But Keynes’s “stimulus” theory depends on there being a recession from outside, so productive resources are unutilized and can be put to use with an extra government boost. (Even in those circumstances, Say’s Law suggests Keynesian stimulus doesn’t work, but let that pass.)

That’s not what we have here. There are not long lines of pathetic, 1930s unemployed fathers of families laid off by the Great Depression, who can easily be put to work. Here we have around 20 million people who have been forcibly prevented from working by the government and the coronavirus. At least in the short term, there is no way to put them back to work and make them productive. The output they would have produced is lost forever; a restaurant meal not served in April cannot be served in August. Hence the extra money inserted into the economy has no goods to buy. That is the position we had in World War II — “too much money chasing too few goods.” It caused inflation.

NOW WATCH: 'Trump Says ReopeningThe Economy Will Be His Decision'

Okay, take away the monetary and the fiscal arguments. The world economy in general and the U.S. economy in particular were humming like a top as recently as February, running at full employment, producing goods and services through a globalized distribution system that had been optimized over the preceding decade of increasing prosperity. The whole economic machine was running at maximum efficiency, producing maximum output.

Then it stopped. Even where factories could still operate, global supply chains were optimized on the “just in time” principle. That meant if any one supplier in the chain stopped production, the entire output had to be halted until alternative suppliers could be found. So production will not be able to restart unless all the suppliers are in place. Some key workers will be missing, some key factories will have gone out of business.

19

If you think of the world economy as a gigantic machine, it will no longer be operating smoothly; horrible grinding noises will emit from its innards, and smoke will billow everywhere. Inevitably, that will cause increased costs; it has to. Then there are the costs of shortening the global supply chains and perhaps re-domesticating some production. Entirely without economic theory, simply from observing how the world economy will operate for the rest of 2020 and probably 2021, you come to an inevitable conclusion: There will be inflation.

How much inflation? On that question, the crystal ball is still clouded. But if you asked me for a guess, I’d say low double digits in the United States by the first months of 2022.

www.nationalreview.com

www.nationalreview.com

By MARTIN HUTCHINSON

If you think too much money creation causes inflation, we will get inflation. If you think budget deficits cause inflation, we will get inflation. If you are old-fashioned enough to think that rising costs and increasing economic inefficiency cause inflation, we will get inflation. It really doesn’t matter which economic theory you subscribe to, they all arrive at the same destination — more inflation.

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output,” said Milton Friedman in 1970. Well, we’ve had the money-supply growth; in the ten years to February 2020, M2 money supply increased by 6.3 percent per annum (data from Federal Reserve Bank of St. Louis). The problem is, we did not get the inflation that was promised. Nominal GDP grew only 4 percent per annum in the ten years to the fourth quarter of 2019, so the other 2.3 percent per annum of money supply got lost somewhere. Monetary economists wave their hands and talk about “velocity,” but monetary velocity is supposed to increase, not shrink, as our payments systems get more efficient. For the ten years before the coronavirus, therefore, Friedman’s central principle did not work; we should have had about 4 to 5 percent inflation rather than the 2 percent we actually got.

Since February, it’s a different story, however. In the six weeks to April 6, M2 money supply has increased by 7.7 percent, an annual compounded rate of 90.4 percent. That reflects all the money the Fed has pumped into the system; the statistics are not wrong. But at that rate of money creation, if Friedman is right, we should get inflation close to triple digits, 18 to 24 months from now. You can’t produce money at that rate without the dollar going the way of the continental, the assignat, the reichsmark or the 1946 Hungarian pengo, exchanged for the new forint at a conversion rate of 1029 to 1.

Okay, let’s abandon the monetarists for a moment and look at fiscal policy. The Congressional Budget Office projected a $1.1 trillion deficit in the year to September 30, 2020, to which the recent CARES act added around another $2 trillion. (Updated CBO projections are not yet available, unsurprisingly.) So, in round numbers, the U.S. looks like it will run a $3 trillion deficit in the current fiscal year, around 14 percent of GDP (and with output falling, it is likely to end up higher).

Maynard Keynes would tell you that this is all good, and Keynesians appear to be running our lives right now. But Keynes’s “stimulus” theory depends on there being a recession from outside, so productive resources are unutilized and can be put to use with an extra government boost. (Even in those circumstances, Say’s Law suggests Keynesian stimulus doesn’t work, but let that pass.)

That’s not what we have here. There are not long lines of pathetic, 1930s unemployed fathers of families laid off by the Great Depression, who can easily be put to work. Here we have around 20 million people who have been forcibly prevented from working by the government and the coronavirus. At least in the short term, there is no way to put them back to work and make them productive. The output they would have produced is lost forever; a restaurant meal not served in April cannot be served in August. Hence the extra money inserted into the economy has no goods to buy. That is the position we had in World War II — “too much money chasing too few goods.” It caused inflation.

NOW WATCH: 'Trump Says ReopeningThe Economy Will Be His Decision'

Okay, take away the monetary and the fiscal arguments. The world economy in general and the U.S. economy in particular were humming like a top as recently as February, running at full employment, producing goods and services through a globalized distribution system that had been optimized over the preceding decade of increasing prosperity. The whole economic machine was running at maximum efficiency, producing maximum output.

Then it stopped. Even where factories could still operate, global supply chains were optimized on the “just in time” principle. That meant if any one supplier in the chain stopped production, the entire output had to be halted until alternative suppliers could be found. So production will not be able to restart unless all the suppliers are in place. Some key workers will be missing, some key factories will have gone out of business.

19

If you think of the world economy as a gigantic machine, it will no longer be operating smoothly; horrible grinding noises will emit from its innards, and smoke will billow everywhere. Inevitably, that will cause increased costs; it has to. Then there are the costs of shortening the global supply chains and perhaps re-domesticating some production. Entirely without economic theory, simply from observing how the world economy will operate for the rest of 2020 and probably 2021, you come to an inevitable conclusion: There will be inflation.

How much inflation? On that question, the crystal ball is still clouded. But if you asked me for a guess, I’d say low double digits in the United States by the first months of 2022.

The Coronavirus Economy Will Bring Inflation | National Review

As supply chains are reconstituted and some production re-domesticated, look for inflation, possibly in double digits.

TrueNorthNomads

Contributing Member

Ultimately, the real “essentials” are water, food, and energy to stay warm (or cool). our circumstances have changed dramatically in the last two months, and everyone now should be able to comprehend that having “essentials” is what should be everyone’s primary agenda. Money is only #1 if it allows you to access water, food, and energy. If it stops “working”, then we will all need to find other ways of obtaining the real “essentials”.

Jed, you forgot shelter and medicine. Millions of people have already lost their homes, and millions more are going to, and many lifesaving medicines are already unavailable at any price.

Food (well cached) is the new gold.

Sláinte!

Kathy.

T-34 battle tomato?Putin Grows Organic Indoor Farming

By Callie

November 5, 2016

Putin Grows Organic Indoor Farming | Garden Culture Magazine

Agriculture has become of huge interest to Vladimir Putin and business leaders in Russia, particularly interesting is the rise of organic indoor farming. Why? The investment and markets crowd paint a picture that the Russians just don’t have what it takes to succeed. They already tried agriculture, and failed miserably. They don’t have the technology, or up to date equipment. Of course, these people are talking about monocropping, computerized mega tractors, pesticides, etc. But Putin’s farms are growing organically, and it appears they’re in error…

Russia Tops US Wheat Exports 2016

Captured on Russia Beyond the Headlines

This development is met with the conjecture that it’s probably poor quality wheat – only fit for animal feed. The analyst suggests levels of contamination could be too high for it to be of any value, but these are only assumptions. You know what they say – never assume anything. Like assuming that sanctions would change Putin’s point of view. It did, but every road heads in two directions.

Even though it was sanctions and volatile import prices that brought this rebirth of national food production about, Putin is ahead, not behind. While they may indeed need to acquire new tractors and implements, Russia holds lots of water, and a vast expanse of the richest soil on the planet. Since it has not been in constant production under a Big Ag program, that natural nutrient base is still there sans residual pesticides. It’s also 3-4 feet deep, unlike cropland in places like the US Heartland where a good field still has 12 inches of arable soil. This comes from a most interesting article by William Engdahl, strategic risk consultant and author, who reports that the wheat and grains exported from Russia is indeed organic. It’s also very high quality. Meanwhile, he says, Heartland grain quality is below par.

So, it’s not so surprising after all, that Russian farms can outproduce all other countries in export grains. But man can’t live on bread alone. Take a look at what’s under that headline in the photo above: Russia is now the world’s largest exporter of cilantro. And the most efficient way to grow cilantro? Hydroponics in an indoor farming system, which is well… hi-tech. So, saying that Russia lacks the modern equipment or technology with which to pull off Putin’s goal of eradicating his country’s reliance on imported foods appears incorrect.

Let’s look past the posturing of Wall Street and the Big Ag cartels. First of all, we know that you can grow organic crops with the most basic equipment, and without the latest pesticide and seed technology. Secondly, since Putin banned GMO seed and food imports last November, stating that Russia would only grow good, healthy food… Big Seed is naturally a bit miffed over the snub. Banning even GMO ingredients from food with totally transparent labeling isn’t likely making him a favorite with Big Food either. And organic? Well, ‘everyone’ knows you can’t feed the world that way.

But Putin could care less about feeding the world, though exporting the surplus is definitely of economic interest to him. His concern is feeding his people good, healthy food, regardless of what happens elsewhere around the globe. The best way to ensure that is having a nation that has total food self-sufficiency. He wants to achieve that by 2020, because most of the food in Russia is imported. No doubt the climate has a lot to do with that, and oil and weapons exports have been the major economic. But oil is a limited resource, and food is perpetually renewable. And non-GMO organic food is perpetually in demand – somewhere. All GMOs are banned in Russia.

The shining star in Russia’s blossoming organic indoor farming industry may be operating in an existing greenhouse complex built years ago, but it is massive. And they aren’t film-wrapped hoop houses. In fact, the Yuzhny Agricultural Complex has an incredible amount of climate-controlled growing space – over 132 million square feet (almost 356 acres). And while the structures themselves were already in place in the 1990s, if kept in good repair, with some environmental control updating, there’s no reason they cannot produce a lot of food, continually and reliably.

And Yuzhny is churning out a lot of fresh, pesticide-free vegetables for the Moscow market. The huge greenhouse complex uses sustainable practices that include all water supplied from a nearby mountain’s pristine ice melt. Production for 2015 was 43,000 tons of hydroponic tomatoes and cucumbers grown in a system that looks no different than operations in the US and Europe. Yuzhny is in the process of updates and expansions allowing for a 70% increase in annual harvests. Like an echo from Kimbal Musk, the wealthiest businessmen in Russia also see the promise in growing the future of organic food. They’re investing in everything from land to dairy operations, and new greenhouse complexes.

An article in Bloomberg this summer makes much of a Russian hybrid tomato, the T-34 battle tomato. According to the author, it is the star of Yuzhny harvests, but what is most interesting about this is not the name of the tomato coming from the tank that defeated Hitler. There are no images of this particular tomato being grown there. So, if you were this new power grower with an incredible hybrid tomato that gave you heavy production with great flavor that also transports very well, and is a big hit with consumers – wouldn’t it be the crop you’d want to make sure the photographer for a major international publication gets at least a shot or two of?

The T-34 tomato is not in one image in this splashy feature story. The photos show a large slicing tomato throughout the article. But T-34 is a cluster type with fruits like a grape tomato! How odd that a fruit said to be “a symbol of patriotic capitalism” is not proudly displayed. It’s not like it’s something top secret. No one can grow it without the seeds. It’s just a tomato.

The Real T-34 Tomato: Russia's Organic Indoor Farming Star

The Real T-34 Tomato in Russia’s indoor organic farming industry. (Gavrish)

And there’s a lot more going on in indoor farming than is easily found. A new 238 hectare greenhouse complex is underway in the Kaluga region. The video below shows the partially completed phase one block installation by the Dutch greenhouse company, Dalsem, in coordination with the automation expertise of Hoogendoorn. More hi-tech growing on a massive scale. Here they will produce organic tomatoes, cucumbers, herbs, and lettuce using state-of-the art hydroponics and computerized environmental control under the guidance of a Russian manager, and a greenhouse growing consultant from the Netherlands. The complex produces it’s own energy, and the auxiliary crop lighting design includes both overhead and intermediate fixtures.

Local and national government is encouraging small farms, as much as large industrial growing. There’s a keen interest in building local economies, and incentives to build a self-sufficient food system include subsidies and reduced energy rates. In some regions, free land is available for people who want to get into agriculture. And China is investing in this new development too.

It will take a lot of food production to feed the largest country in the world, but they’ve already accomplished quite a bit toward the goal. And while there are those who seem to think this is simply not possible, it is doable, thanks to indoor farming and sustainable practices. The reason agriculture failed before? In addition to the climate, there was no ownership or financial gain. Why excel when just going through the motions was sufficient to stay out of prison? Farming in Russia will be totally different than it was in the past. Now there are reasons to succeed.

More info:

Greenhouse Expansion in Russia (Dalsem)

Trading Kalashnikovs for Tomatoes

Putin Growing Organic Power

Sustainable Pulse

Putin Grows Organic Indoor Farming | Garden Culture Magazine

China Connection

TB Fanatic

Have to subscribe to download

Putin takes a break with his massive greenhouse plans?

www.hortidaily.com › article › putin-takes-a-break-wit...

Jul 1, 2015 - According to Russian estimates, it will have to produce over 1.7 million tons of greenhouse vegetables to accomplish that task. How are things

Putin takes a break with his massive greenhouse plans?

www.hortidaily.com › article › putin-takes-a-break-wit...

Jul 1, 2015 - According to Russian estimates, it will have to produce over 1.7 million tons of greenhouse vegetables to accomplish that task. How are things

China Connection

TB Fanatic

Download PDFPrint

Wednesday 23rd May 2018, 11:18 London

Greenhouse veg rise in Russia

Russia’s self-sufficiency has increased steadily since the country banned food imports from the EU, US and others, with greenhouse vegetable production rising sharply

total of 333,600 tonnes of greenhouse vegetables have been harvested in Russia since the start of the year, according to a report on Russian site Fruit News.

That figure represents an increase of 40.4 per cent over the same period in 2017, with the biggest increases seen in cucumbers (23.6 per cent), tomatoes (51.9 per cent) and other vegetable crops (53.4 per cent).

The huge increases are the result of sizeable investments made in greenhouse production since the Russian ban on EU produce was introduced in 2014, with considerable support from the government.

The ultimate aim is to make Russia self-sufficient in most items of fresh produce, as it currently is in just onions, carrots and beetroot.

This has required significant investments in Dutch technology, which itself has increased Russia’s self-reliance. The Russians are now able to build up to up to 200ha of greenhouses each year, with 95 per cent of all processes performed by Russian companies themselves, according to Dutch horticultural fair GreenTech.

Fruit News revealed that the leading production regions for greenhouse vegetables were in Krasnodar (27,700 tonnes), Moscow (23,200 tonnes), Stavropol (21,900 tonnes) and Volgograd (19,800 tonnes).

www.fruitnet.com

www.fruitnet.com

Wednesday 23rd May 2018, 11:18 London

Greenhouse veg rise in Russia

Russia’s self-sufficiency has increased steadily since the country banned food imports from the EU, US and others, with greenhouse vegetable production rising sharply

total of 333,600 tonnes of greenhouse vegetables have been harvested in Russia since the start of the year, according to a report on Russian site Fruit News.

That figure represents an increase of 40.4 per cent over the same period in 2017, with the biggest increases seen in cucumbers (23.6 per cent), tomatoes (51.9 per cent) and other vegetable crops (53.4 per cent).

The huge increases are the result of sizeable investments made in greenhouse production since the Russian ban on EU produce was introduced in 2014, with considerable support from the government.

The ultimate aim is to make Russia self-sufficient in most items of fresh produce, as it currently is in just onions, carrots and beetroot.

This has required significant investments in Dutch technology, which itself has increased Russia’s self-reliance. The Russians are now able to build up to up to 200ha of greenhouses each year, with 95 per cent of all processes performed by Russian companies themselves, according to Dutch horticultural fair GreenTech.

Fruit News revealed that the leading production regions for greenhouse vegetables were in Krasnodar (27,700 tonnes), Moscow (23,200 tonnes), Stavropol (21,900 tonnes) and Volgograd (19,800 tonnes).

Greenhouse veg rise in Russia

Russia's self-sufficiency has increased steadily since the country banned food imports from the EU, US and others, with greenhouse vegetable production rising sharply

An average 10% annual inflation rate would be quite noticeable.More like 10% to 12%.

View attachment 196701

Alternate Inflation Charts

www.shadowstats.com

View attachment 196702

Chapwood Index

chapwoodindex.com

10-12%? Really? In the 1970, the rate was in that neighborhood and nobody needed a number, everybody noticed it.More like 10% to 12%.

View attachment 196701

Alternate Inflation Charts

www.shadowstats.com

View attachment 196702

Chapwood Index

chapwoodindex.com

Today, not so much, if at all. In fact the only one that notices seems to be Shadowstats.

Interesting.

The Cub

Behold, I am coming soon.

Hyperinflation HAS OCCURRED and IS OCCURRING.

Most people use the term inflation incorrectly. It is the MONEY SUPPLY which is being INFLATED.

Inflation of the money supply RESULTS in a corresponding decreased purchasing power of the inflated fiat currency. Most people realize this effect in terms of higher prices of goods and services.

In summary, it is the money supply which is inflated; and such INFLATION IS MANIFESTED in decreased purchasing power/higher prices of goods and services.

Search for a chart of the growth in the US money supply over the last few decades (John Williams Shadow Statistics is best source.), and you will see that the US money supply was hyperinflated due to the Lehmans incident, et al in 2008.....and even more so during the Fall of 2019.

The following chart is a year or two old...does not include the massive inflating of the money supply during Fall 2019, but still is a good pic

In 1913, a pair of average mans leather shoes cost $.41 (that is cents); today about $120.....same shoes. What changed? The purchasing power of FRNs....due to massive inflation over time..

Most people use the term inflation incorrectly. It is the MONEY SUPPLY which is being INFLATED.

Inflation of the money supply RESULTS in a corresponding decreased purchasing power of the inflated fiat currency. Most people realize this effect in terms of higher prices of goods and services.

In summary, it is the money supply which is inflated; and such INFLATION IS MANIFESTED in decreased purchasing power/higher prices of goods and services.

Search for a chart of the growth in the US money supply over the last few decades (John Williams Shadow Statistics is best source.), and you will see that the US money supply was hyperinflated due to the Lehmans incident, et al in 2008.....and even more so during the Fall of 2019.

The following chart is a year or two old...does not include the massive inflating of the money supply during Fall 2019, but still is a good pic

In 1913, a pair of average mans leather shoes cost $.41 (that is cents); today about $120.....same shoes. What changed? The purchasing power of FRNs....due to massive inflation over time..

Last edited:

hiwall

Has No Life - Lives on TB

I believe it and I notice it. For the last 5 or 6 years my health insurance has gone up by at least 25% per year. I noticed that. My car insurance and my house insurance has gone up but I honestly did not check how much.An average 10% annual inflation rate would be quite noticeable.

10-12%? Really? In the 1970, the rate was in that neighborhood and nobody needed a number, everybody noticed it.

Today, not so much, if at all. In fact the only one that notices seems to be Shadowstats.

Interesting.

Many things I buy have gone up.

A Ford F150 pickup goes up about 10% per on average.

I'm quite sure you could find your own examples.

Shadowstats is the one in a hurry. And so are some others around here. As I have stated in other places, eventual wage and price controls and then allocation of scarce resources. (Rationing) Give me that power and I will control every facet of your life.Give it time, Troke. Why are you in so much of a hurry to see it all fall down?

Last edited:

And for some weird reason, the Lesser Classes are a lot better off now than they were in 1913.Hyperinflation HAS OCCURRED and IS OCCURRING.

Most people use the term inflation incorrectly. It is the MONEY SUPPLY which is being INFLATED.

Inflation of the money supply RESULTS in a corresponding decreased purchasing power of the inflated fiat currency. Most people realize this effect in terms of higher prices of goods and services.

In summary, it is the money supply which is inflated; and such INFLATION IS MANIFESTED in decreased purchasing power/higher prices of goods and services.

Search for a chart of the growth in the US money supply over the last few decades (John Williams Shadow Statistics is best source.), and you will see that the US money supply was hyperinflated due to the Lehmans incident, et al in 2008.....and even more so during the Fall of 2019.

The following chart is a year or two old...does not include the massive inflating of the money supply during Fall 2019, but still is a good pic

View attachment 197540

In 1913, a pair of average mans leather shoes cost $.41 (that is cents); today about $120.....same shoes. What changed? The purchasing power of FRNs....due to massive inflation over time..

In 1913, the Main Man in my village lived on the peak of the highest hill. (Tall grass prairie, 50' above everybody else.)". He had a windmill with a tank about halfway down the tower with a pipe running from it down and into the house which meant he had running water. Everybody else used a pump.

He had a carriage house room for two horses and a carriage. Room above was for the coachman/gardener. Nobody else in the village had a carriage.

Today, his house has hot and cold running water. So does everybody else.

His auto is air-conditioned. So is everybody else.

His house is air-conditioned. So are most others of newer vintage.

And we pay those awful prices for shoes.

In 1913, a pair of average mans leather shoes cost $.41 (that is cents); today about $120.....same shoes. What changed? The purchasing power of FRNs....due to massive inflation over time..

So did wages. How long would you work for 41 cents then? 120 bucks today?

A Ford F150 pickup goes up about 10% per on average.

And, the amount borrowed goes up along with the period to repay the loan. Rate down to zero now.

And for some weird reason, the Lesser Classes are a lot better off now than they were in 1913.

Because of debt. National debt. Debt by the state. Personal debt. All creeping up over time. Everything and everybody are leveraged. Last I heard, risky auto loans had been bundled and sold as derivatives long before the 'rona hoe sashayed into town.

Betty_Rose

Veteran Member

If the only consequence of this train wreck is a 10% inflation rate twelve months from now, I will dance the happy dance.

Is that really the worst of it? Is that really our biggest problem?

Is that really the worst of it? Is that really our biggest problem?

The Cub

Behold, I am coming soon.

"And for some weird reason, "

The world has been living and "thriving" in a multi-decade debt bubble.....Total stated Global debt (exclusive of present discounted values of national transfer payment/social programs (e.g. US Social Security & Medicare); State/Provincial/County/Municipal debt; and derivatives......recently reported at US$230 Trillion (equivalency) at a time when corresponding Global GDP was US$71 Trillion. That is Total Global Debt of 3.3 times what is effectively "Total Global Revenue".......NOT "Total Global Profit" [emphasis added]

The world is saturated in debt.....worthless fiat currency backed by debt.

People of our times are DEBT JUNKEES....and they do not realize it.

For those who are confused.....Consider a family where their earning ability has been IMPAIRED over time....BUT their appetite for consumption/spending INCREASES over the same period. What do they do?.....they whip out the plastic and charge the deficiency on their VISA/Mastercard. During this period of time, they live significantly beyond their means....even 'big time".

Question: During such time was the family 'prosperous', or were they debt junkees?

Question: Is the state of debt saturation a healthy state? Is it a good thing to be indebted up to your eyeballs? especially when the family spent a good amount of the excess borrowed funds on a good time?

The demand for the US Dollar as the world reserve currency is and has been artificially supported via crude sales previously being required to be settled in dollars, the SWIFT system only transferring in dollars, etc.

For those who do not know what I am referring to, begin your research by running a search on the "Petro Dollar". (Hint: In 1971, Nixon abandoned the gold standard. In so doing, the US dollar became increasingly backed by 'air' instead of gold. So, they devised mechanisms creating artificial demand for dollars, even though FRNs are only paper backed by air.

Without these facilities...........the true value of the US Dollar would be, nothing more than 'fire starters with pics of old guys' on them.

The world has been living and "thriving" in a multi-decade debt bubble.....Total stated Global debt (exclusive of present discounted values of national transfer payment/social programs (e.g. US Social Security & Medicare); State/Provincial/County/Municipal debt; and derivatives......recently reported at US$230 Trillion (equivalency) at a time when corresponding Global GDP was US$71 Trillion. That is Total Global Debt of 3.3 times what is effectively "Total Global Revenue".......NOT "Total Global Profit" [emphasis added]

The world is saturated in debt.....worthless fiat currency backed by debt.

People of our times are DEBT JUNKEES....and they do not realize it.

For those who are confused.....Consider a family where their earning ability has been IMPAIRED over time....BUT their appetite for consumption/spending INCREASES over the same period. What do they do?.....they whip out the plastic and charge the deficiency on their VISA/Mastercard. During this period of time, they live significantly beyond their means....even 'big time".

Question: During such time was the family 'prosperous', or were they debt junkees?

Question: Is the state of debt saturation a healthy state? Is it a good thing to be indebted up to your eyeballs? especially when the family spent a good amount of the excess borrowed funds on a good time?

The demand for the US Dollar as the world reserve currency is and has been artificially supported via crude sales previously being required to be settled in dollars, the SWIFT system only transferring in dollars, etc.

For those who do not know what I am referring to, begin your research by running a search on the "Petro Dollar". (Hint: In 1971, Nixon abandoned the gold standard. In so doing, the US dollar became increasingly backed by 'air' instead of gold. So, they devised mechanisms creating artificial demand for dollars, even though FRNs are only paper backed by air.

Without these facilities...........the true value of the US Dollar would be, nothing more than 'fire starters with pics of old guys' on them.

hiwall

Has No Life - Lives on TB

No one knows the future. But it could be a 90% inflation rate twelve months from nowIf the only consequence of this train wreck is a 10% inflation rate twelve months from now, I will dance the happy dance.

Is that really the worst of it? Is that really our biggest problem?

The Cub

Behold, I am coming soon.

Note Rob Kirby's take on the release of the COVID bioweapon and the 9/2019 collapse of the Repo Mkt. I find it interesting....not sure if I agree or disagree...

View: https://www.youtube.com/watch?v=hsJ5H3N1adc

The demonetization of gold in the ZUSA, that barbarous relic which ties the inflationary hands of banksters and their pet pollytickians, was a two stage process. FDR took gold away from Joe Sixpak in 1933 by Executive Order, and Tricky Dick Nixon famously "closed the gold window" (but only temporarily, remember) to foreign nations who were still redeeming their FRN$s for gold in 1971. Thus ended the last faint connection of the FRN$ with actual money.

Look it up if you don't believe me.

Look it up if you don't believe me.

No one knows the future. But it could be a 90% inflation rate twelve months from now

It looks to me that we lost 30% of the economy or gdp. We have not put 10 trillion back in. Some of the cash was blown some was used to stock up some was put aside.

Savings Deposits: Total (DISCONTINUED)

Graph and download economic data for Savings Deposits: Total (DISCONTINUED) (SAVINGS) from 1975-01-06 to 2020-04-27 about savings, deposits, depository institutions, and USA.

fred.stlouisfed.org

Watch the part that was put aside. As it is depleted so is inflation. Short term some inflation. Down the road deflation in most goods, inflation in needed goods until the cash runs out.

A Word About the Current Chaos in Prices and Inflation

by Wolf Richter • May 12, 2020 • 187 Comments

Some prices collapsed, others skyrocketed, and the Consumer Price Index went haywire. Here’s what I’m seeing beyond the near term — and it’s not “deflation.”

By Wolf Richter for WOLF STREET.

Amid soaring prices of meat, beverages, fruit, veggies, and other food at home, and surging costs of personal goods, medical care services, and household furnishings, and amid a collapse in prices of gasoline, car rentals, public transportation, car insurance, lodging away from home, and other things – amid these diametrically opposed price movements, the Consumer Price Index went, as expected, haywire today. And we’re going to look at some of those gyrations beyond it.

First, here’s what got buffeted around:

The overall Consumer Price Index fell 0.8% in April from March, the steepest one-month drop since December 2008, when the economy was going through peak-Financial-Crisis 1. This brought the increase over the past 12 months down to 0.3%, the lowest since October 2015 during the oil bust at the time.

The “core” CPI – CPI without the volatile food components and the extremely volatile energy components – dropped 0.5% from March to April but was still up 1.4% from a year ago.

But wait…

What if we take out the most chaotic and largely temporary price movements at both ends to get to what the undying loss of the purchasing power of the dollar might be? Because that’s what consumer price inflation is.

There is a consumer price index that is not buffeted around by the month-to-month collapse of some prices and surge in other prices; The Cleveland Fed’s “Median CPI,” which is based on the data from the CPI, removes the extremes at both ends since these extremes are often temporary and distort long-term inflation trends.

The Median CPI rose 0.1% in April from March and rose 2.7% for the 12-month period. The chart shows the 12-month Median CPI (red line) as an indication of underlying inflation – vs the 12-month “core” CPI (CPI without food and energy):

The Median CPI tracks the mid-point (median) of the 45 major components of the CPI. Each component has a weight in the index – the “relative importance” (%). For example, in April, the “relative importance” of Motor Fuel was 3.0% of the total CPI.

Housing costs, which combined weigh about one-third of CPI, are split up: “Rent of Primary Residence” (to track inflation of rents) and “Owners’ Equivalent of Rent of Residence” (to approximate inflation of homeownership). But “Owners’ Equivalent” is split into the four regions of the US. Rent weights 8% in the Index. Owners’ Equivalent of Rent for all four regions combined weighs 24.5%. So total housing costs – rent and Owners Equivalent – weigh 32.5% of the index.

The table below shows the price movements of the major 45 CPI components in April, ranked from the biggest price decliners at the top to the biggest price gainers at the bottom, but converted to an annualized rate, meaning April’s price change extrapolated to an entire year (if you don’t see all four columns on your smartphone, hold your device in landscape position):

| Component | 1-Month Annualized % Change | Relative Importance % | Cumulative Relative Importance % |

| Motor Fuel | -93.5 | 3.0 | 3.0 |

| Car and Truck Rental | -88.6 | 0.1 | 3.2 |

| Fuel Oil and Other Fuels | -72.5 | 0.1 | 3.3 |

| Public Transportation | -69.3 | 1.2 | 4.5 |

| Motor Vehicle Insurance | -59.4 | 1.7 | 6.2 |

| Lodging Away From Home | -58.6 | 0.9 | 7.1 |

| Women’s and Girls’ Apparel | -48.9 | 1.2 | 8.3 |

| Men’s and Boys’ Apparel | -43.0 | 0.7 | 9.0 |

| Footwear | -38.3 | 0.7 | 9.6 |

| Infants’ and Toddlers’ Apparel | -36.3 | 0.1 | 9.7 |

| Watches and Jewelry | -35.9 | 0.2 | 9.9 |

| Motor Vehicle Fees | -12.1 | 0.6 | 10.5 |

| Motor Vehicle Parts and Equipment | -6.2 | 0.4 | 10.9 |

| Tobacco and Smoking Products | -4.9 | 0.6 | 11.5 |

| Used Cars and Trucks | -4.6 | 2.5 | 14.0 |

| Misc Personal Services | -3.7 | 1.0 | 15.0 |

| Recreation | -2.6 | 5.9 | 20.9 |

| Personal Care Products | -1.6 | 0.7 | 21.6 |

| Medical Care Commodities | -1.1 | 1.7 | 23.3 |

| New Vehicles | -0.5 | 3.8 | 27.0 |

| Personal Care Services | 0.0 | 0.7 | 27.7 |

| Communication | 0.8 | 3.8 | 31.5 |

| Midwest: Owners’ Equivalent Rent of Residences | 0.8 | 4.3 | 35.8 |

| Motor Vehicle Maintenance and Repair | 1.0 | 1.1 | 36.9 |

| Water/Sewer/Trash Collection Services | 1.0 | 1.1 | 38.0 |

| Energy Services | 1.2 | 3.1 | 41.1 |

| South: Owners’ Equivalent Rent of Residences | 1.3 | 8.3 | 49.4 |

| Food Away From Home | 1.8 | 6.3 | 55.7 |

| West: Owners’ Equivalent Rent of Residences | 1.8 | 6.8 | 62.5 |

| Rent of Primary Residence | 2.4 | 8.0 | 70.5 |

| Education | 2.8 | 3.1 | 73.6 |

| Alcoholic Beverages | 3.2 | 1.0 | 74.6 |

| Tenants’ and Household Insurance | 3.3 | 0.4 | 75.0 |

| Northeast: Owners’ Equivalent Rent of Residences | 4.5 | 5.1 | 80.1 |

| Household Furnishings and Operation | 5.8 | 4.6 | 84.7 |

| Medical Care Services | 6.3 | 7.4 | 92.1 |

| Miscellaneous Personal Goods | 11.3 | 0.2 | 92.3 |

| Fresh Fruits and Vegetables | 15.4 | 1.1 | 93.3 |

| Dairy and Related Products | 19.4 | 0.8 | 94.1 |

| Other Food At Home | 25.2 | 2.0 | 96.1 |

| Processed Fruits and Vegetables | 36.9 | 0.3 | 96.4 |

| Cereals and Bakery Products | 40.7 | 1.0 | 97.4 |

| Nonalcoholic Beverages and Beverage Matls | 41.1 | 0.9 | 98.3 |

| Meats, Poultry, Fish and Eggs | 66.6 | 1.7 | 100.0 |

So will the dollar gain purchasing power? Hardly.

In my entire lifetime, there were only a few quarters when the dollar gained purchasing power (deflation) – and only a little. The rest of the decades, it relentlessly lost purchasing power (inflation), and during some of these years the loss of purchasing power was in the double digits. There is no reason to think that this pattern will change going forward. So I’m never worried about deflation – if there is any, it’ll be brief.

But right now, prices and the data that attempt to reflect them are going haywire. Since late February, the supply chains have been thrown into turmoil as buying patterns changed, including a massive shift of consumption from businesses and institutions to consumers at home. There were episodes of panic-buying and empty shelves. In other parts of the supply chain – such as those for hotels and restaurants – similar items were piling up with no place to go.

Ecommerce boomed to the point of exceeding fulfillment capacity, and sales at stores that sold groceries boomed. But much of the rest of brick-and-mortar retail was shut down. New vehicle sales in April plunged by about 44%. Used vehicle sales plunged similarly.

All this has an impact on prices – and if you’ve been to the supermarket, you’ve seen the impact there, as stuff is getting pricier. But filling up your car got a lot cheaper.

The government is borrowing trillions of dollars – mostly monetized by the Fed’s money-printing machinery – and is distributing these funds to various entities including consumers via unemployment benefits and stimulus checks, to companies, and to investors in form of investor bailouts. Much of this money is going to get spent, even if it isn’t along normal spending patterns.

In this chaotic environment, the price measurements can produce chaotic results. The Median CPI eliminates the chaotic outliers on both sides of the CPI and shows that underlying inflation is ticking down some but isn’t plunging.

And you can already see the impact of fiscal stimulus at the grocery store. A lot of people are out of work, but many of them receive unemployment benefits, and just about all of them have already or will receive the stimulus payments. This money is getting spent.

There is now a huge amount of fiscal and monetary stimulus being thrown into the economy at the same time. The monetary stimulus has already led to a massive bout of asset price inflation in the financial markets since March 23. And the fiscal stimulus – the ca. $3 trillion already under way and whatever future stimulus package might still emerge – which will get spent in the economy will put upward pressure on consumer prices. And there is a good chance that beyond the very near term it will lead to more consumer price inflation – meaning, a steeper loss of purchasing power of the dollar than we have seen in recent years.

Well, what is one to think. The vehicle of 10 yrs ago ain't the vehicle of today. In fact the vehicle of three years ago aint the same. Consequently a difference in price.I believe it and I notice it. For the last 5 or 6 years my health insurance has gone up by at least 25% per year. I noticed that. My car insurance and my house insurance has gone up but I honestly did not check how much.

Many things I buy have gone up.

A Ford F150 pickup goes up about 10% per on average.

I'm quite sure you could find your own examples.

Auto insurance? Talk to the body repair people. With all the electronic gizmos hung on cars today, a bad dent is a major project.

Health? Check out the gizmos that hospitals need today compared to yesteryear.

My home insurance has pretty well hung in there, but that may be a local phenomenon.

We got inflation but it ain't no 10% per annum. I lived when it was and everybody noticed it. In fact Gerry Ford, the POTUS was sporting a WIN ( Whip Inflation Now.) button and handing them out.

We are going to have, if not already, major inflation. And I guarantee people will notice the moment it gets anywhere near 10%.

hiwall

Has No Life - Lives on TB

Well, what is one to think. The vehicle of 10 yrs ago ain't the vehicle of today. In fact the vehicle of three years ago aint the same. Consequently a difference in price. So it's not inflation then?

Auto insurance? Talk to the body repair people. With all the electronic gizmos hung on cars today, a bad dent is a major project. So that's not inflation then?

Health? Check out the gizmos that hospitals need today compared to yesteryear. So it's not inflation then?

My home insurance has pretty well hung in there, but that may be a local phenomenon.

We got inflation but it ain't no 10% per annum. I lived when it was and everybody noticed it. In fact Gerry Ford, the POTUS was sporting a WIN ( Whip Inflation Now.) button and handing them out. Sorry I disagree

We are going to have, if not already, major inflation. And I guarantee people will notice the moment it gets anywhere near 10%. I do agree it will go up and people will notice more

Nope and Nope. If it takes 10 man hours to repair something that used to take three man hours to repair, that is not inflation.

If you are driving a bare bones standard for a 10 yr old auto, and the base price of the current auto is more than yours was because it has a backup TEEVEE, a signal to tell you that you have crossed the center line, another that guides you to park, a GPS map in the center consol and heated seats to keep you toasty on a winter's day, that increased price is not inflation.

If you are driving a bare bones standard for a 10 yr old auto, and the base price of the current auto is more than yours was because it has a backup TEEVEE, a signal to tell you that you have crossed the center line, another that guides you to park, a GPS map in the center consol and heated seats to keep you toasty on a winter's day, that increased price is not inflation.

Trivium Pursuit

Has No Life - Lives on TB

I have noted that a number of commentators that have been posted by folks here, both on the Coronavirus and the GSM threads, are expecting deflationary depresssion.

The Cub

Behold, I am coming soon.

We are in a depression......now.

They do not officially make such a declaration until 120+days after the applicable calendar quarter......and with the liars in DC and CNBC types......they will cook the results.....and put everything on spin cycle.

But the stalling of the economy and the unemployment nos. ....the real nos......indicate otherwise. No one with one or more synapses believes that the US or world economies will be flipped back on after COVID lockdown.

What is coming in all likelihood is stagflation followed by the complete collapse of the FRN currency.

Gotta keep warm some how....FRNs will be the heat source of the near future:

They do not officially make such a declaration until 120+days after the applicable calendar quarter......and with the liars in DC and CNBC types......they will cook the results.....and put everything on spin cycle.

But the stalling of the economy and the unemployment nos. ....the real nos......indicate otherwise. No one with one or more synapses believes that the US or world economies will be flipped back on after COVID lockdown.

Velocity of M2 Money Stock

View data of the frequency at which one unit of currency purchases domestically produced goods and services within a given time period.

fred.stlouisfed.org

What is coming in all likelihood is stagflation followed by the complete collapse of the FRN currency.

Gotta keep warm some how....FRNs will be the heat source of the near future:

Donald Shimoda

In Absentia

Howdy, Folks!

Hyperinflation would be fantastic, as long as wages kept up.

Here's why...

Today, I go out and buy 20 years worth of preps for $350,000.00 on credit.

3 months from now because of hyperinflation, my wage goes up to $100,000.00 an hour (a loaf of bread by that date is going for $250k).

I only have to work for less than 4 hours to pay off 20 years worth of preps!

WooHoo! Thanks, hyperinflation!

[I can only wish it worked that way... ]

]

Peace and Love,

Donald Shimoda

Hyperinflation would be fantastic, as long as wages kept up.

Here's why...

Today, I go out and buy 20 years worth of preps for $350,000.00 on credit.

3 months from now because of hyperinflation, my wage goes up to $100,000.00 an hour (a loaf of bread by that date is going for $250k).

I only have to work for less than 4 hours to pay off 20 years worth of preps!

WooHoo! Thanks, hyperinflation!

[I can only wish it worked that way...

]

]Peace and Love,

Donald Shimoda

Still no.

FRNs will be the heat source of the near future:

What kind of stove burns digits?

SageRock

No digital ID, No CBDC!! Reject psyops!!

Still no.

Time will tell, Dennis, time will tell.

Donghe Surfer

Veteran Member

Martin Armstrong has been quite steady in saying that hyperinflation (even during Weimar Republic and other episodes in other countries) comes about due to collapse in people's confidence in their government.

I see from his writings during the past 6 months that he believes this collapse in confidence in government will occur in 2022.

As noted elsewhere, he is recommending stockpiling food and he has never ever said this before.

I see from his writings during the past 6 months that he believes this collapse in confidence in government will occur in 2022.

As noted elsewhere, he is recommending stockpiling food and he has never ever said this before.

China Connection

TB Fanatic

Inside America’s Broken Supply Chain

How industry failures to collaborate and

share information left the system vulnerable

By

David J. Lynch

Updated Oct. 2 at 7:00 p.m.Originally published Sept. 30, 2021

REPORTING FROM LOS ANGELES AND JOLIET, ILL.

The commercial pipeline that each year brings $1 trillion worth of toys, clothing, electronics and furniture from Asia to the United States is clogged and no one knows how to unclog it.

This month, the median cost of shipping a standard rectangular metal container from China to the West Coast of the United States hit a record $20,586, almost twice what it cost in July, which was twice what it cost in January, according to the Freightos index. Essential freight-handling equipment too often is not where it’s needed, and when it is, there aren’t enough truckers or warehouse workers to operate it.

As Americans fume, supply headaches that were viewed as temporary when the coronavirus pandemic began now are expected to last through 2022.

Dozens of cargo vessels stuck at anchor off the California coast illustrate the delivery disruptions that have become the signature feature of the recovery, fueling inflation, sapping growth and calling into question the global economic model that has prevailed for three decades.

[FAQ: Why inflation is rising and whether you should worry]

Today’s twisted supply chain is forcing companies to place precautionary orders to avoid running out of goods, which only compounds the pressure. Consumers are confronting higher prices and shortages of cars, children’s shoes and exercise gear, as the holiday shopping season looms.

“It’s going to get worse again before it gets better,” said Brian Bourke, chief growth officer at SEKO Logistics. “Global supply chains are not built for this. Everything is breaking down.”

Fallout from the once-in-a-century health crisis is the chief culprit behind soaring freight bills and delivery delays. Americans trapped at home slashed spending at restaurants, movie theaters and sporting events and splurged on goods such as laptops and bicycles, triggering an import avalanche that has overwhelmed freight channels.

But the pandemic also exposed weaknesses in the nation’s transport plumbing: investment shortfalls at key ports, controversial railroad industry labor cuts, and a chronic failure by key players to collaborate, according to interviews with more than 50 individuals representing every link in the nation’s supply chain.

“It’s like an orchestra with lots of first violins and no conductor. … No one’s really in charge,” said Fran Inman, a Los Angeles-based commercial real estate executive who has advised government agencies on supply issues.

Port of Los Angeles

On Sept. 1, 40 container ships belonging to companies such as Hyundai, NYK Line and Evergreen were anchored off California, waiting for a berth. (Less than three weeks later, the number reached 73.) Some vessels sit for two weeks or more, effectively cutting capacity on trans-Pacific shipping lanes and driving up costs.

“From an economic point of view, it’s a disaster because cargo is waiting,” said Markus Grote, captain of a Hapag-Lloyd container ship.

Unprecedented number of ships are waiting to dock

at Southern California ports

Three-day rolling average of container ships offshore and docked at either

the Port of Los Angeles or Port of Long Beach this year

100 container ships

75

50

Container ships

anchored offshore

25

Container ships

docked at port

0

January

March

July

Sept. 28

Source: Marine Exchange of Southern California

For goods to move seamlessly from overseas factories to American addresses, the oceangoing vessels, shipping containers, cargo terminals, truckers, chassis providers and railroads all must work together, like runners in a relay race. If equipment gets stuck at any point, delays ripple along the entire chain.

[From ports to rail yards, global supply lines struggle amid virus outbreaks in the developing world]

Yet the United States is “decades behind” foreign ports in getting carriers, terminals and shippers to provide each other access to commercial data for planning purposes, said Gene Seroka, executive director of the Port of Los Angeles. Concerns over data privacy, business secrets and security have resulted in a fragmented approach. Individual ports operate as separate fiefdoms rather than as part of a national system.

In the Dutch city of Rotterdam, Europe’s largest port, everyone involved in a cargo vessel’s arrival sees the same information on a common data-sharing platform. Called “PortXchange,” the software makes port calls “smarter and more efficient” than the use of separate systems or the telephone, according to the port’s website.

Seroka touts a tool called the Port Optimizer, which forecasts three weeks of incoming cargo. More information sharing — including over a longer time period — would allow carriers, terminals, truckers and dockworkers to better position equipment and people. But other than Los Angeles, New Orleans is the only U.S. port that is even testing the system.

“Information sharing and additional transparency is one of the few areas where indisputably we could get more capacity out of the current system,” said Dan Maffei, chairman of the Federal Maritime Commission.

To be sure, the United States is importing historic amounts of goods. The L.A. port expects this year to handle a record 10.8 million containers. To keep pace, the International Longshore and Warehouse Union has accelerated training of new workers. Twenty union members have died of covid-19 while working through the pandemic, the union said.

At Fenix Marine Services, workers move containers from vessel to truck at the Port of Los Angeles on Sept. 2. (Melina Mara/The Washington Post)

“Our members are tired. Our members are feeling the pain of these covid deaths,” said Mike Podue, president of ILWU Local 63. “We’re lucky there hasn’t been a major accident.”

[The pandemic marks another grim milestone: 1 in 500 Americans have died of covid-19]

When the supply chain works, goods flow continuously, as if borne along by a river. Today, one bottleneck follows another. The problems are especially acute on the Asia-to-U.S. trade route.

Once a berth becomes available, longshoremen operating massive blue cranes lift the metal containers and position them to head inland via truck or train.

Ideally, a truck driver who has been alerted to the presence of a customer’s goods arrives at a terminal to find a chassis waiting. The container is then hoisted aboard and the driver pulls the chassis to the customer’s warehouse.

But too often, congestion elsewhere keeps the port jammed. Shippers with full warehouses won’t dispatch drivers to collect additional containers. Many loaded chassis sit outside overstuffed warehouses for days waiting to be unloaded, leaving ports short of needed equipment.

Why containers are stacked up at the ports of L.A. and Long Beach

1:27

Dan Walsh from TRAC Intermodal shows how a chassis is critical to keeping everything moving. (Lee Powell/TWP)

Even as cargo piles up on the docks, almost a third of the port’s night-shift appointments for truckers go unfilled.

At APM Terminals, the largest container site in the Western Hemisphere, the air echoes with truck horns, air brakes and the warning beeps of mobile cranes.

This 484-acre facility boasts 12 miles of railroad tracks, linking the docks to points east for customers such as Walmart, Nike and Ikea. Across from the headquarters building, trucks wait to navigate canyons of containers stacked about 50 feet high.

Steven Trombley, the facility’s managing director, needs the agility of a hockey goalie to ward off the daily complications. Today, his berths are full and four of the ships loitering in San Pedro Bay are impatient for a spot.

Trombley has nearly a week’s worth of truck chassis on the dock. But truckers are scarce. Such mismatches help explain why containers destined to travel by rail sit dockside for an average of eight days, up from two before the pandemic.

“It’s a headache. Cargo is sitting here longer than planned,” Trombley said. “If I don’t get the cargo moving, then the next ship is not going to have space.”

TRAC Intermodal in Long Beach. (Melina Mara/The Washington Post)

Even as total federal ports spending has increased, the L.A. gateway has been neglected, Seroka said. West Coast ports, including the L.A.-Long Beach complex, which handles about 36 percent of U.S. imports, have lagged East and Gulf Coast facilities over the past decade, $11 billion to $1 billion.

With more money, the port could have expanded channels, fortified wharves and improved road and rail links, he said.

One shortcoming: The lack of a direct rail connection to the distribution centers for companies such as Amazon and Nordstrom 75 miles east in California’s “Inland Empire.” (Amazon founder Jeff Bezos owns The Washington Post.)

[West Virginia factory is center stage in supply chain crisis, showing economy’s strains]

Advocates of a rail link say it would eliminate from Southern California’s freeways thousands of daily truck trips and ease port congestion by moving millions of containers off the docks. But the railroads doubt the financial case.

The backlog got so bad last fall that port officials opened overflow lots to store thousands of containers.

How industry failures to collaborate and

share information left the system vulnerable

By

David J. Lynch

Updated Oct. 2 at 7:00 p.m.Originally published Sept. 30, 2021

REPORTING FROM LOS ANGELES AND JOLIET, ILL.

The commercial pipeline that each year brings $1 trillion worth of toys, clothing, electronics and furniture from Asia to the United States is clogged and no one knows how to unclog it.

This month, the median cost of shipping a standard rectangular metal container from China to the West Coast of the United States hit a record $20,586, almost twice what it cost in July, which was twice what it cost in January, according to the Freightos index. Essential freight-handling equipment too often is not where it’s needed, and when it is, there aren’t enough truckers or warehouse workers to operate it.

As Americans fume, supply headaches that were viewed as temporary when the coronavirus pandemic began now are expected to last through 2022.

Dozens of cargo vessels stuck at anchor off the California coast illustrate the delivery disruptions that have become the signature feature of the recovery, fueling inflation, sapping growth and calling into question the global economic model that has prevailed for three decades.

[FAQ: Why inflation is rising and whether you should worry]

Today’s twisted supply chain is forcing companies to place precautionary orders to avoid running out of goods, which only compounds the pressure. Consumers are confronting higher prices and shortages of cars, children’s shoes and exercise gear, as the holiday shopping season looms.

“It’s going to get worse again before it gets better,” said Brian Bourke, chief growth officer at SEKO Logistics. “Global supply chains are not built for this. Everything is breaking down.”

Fallout from the once-in-a-century health crisis is the chief culprit behind soaring freight bills and delivery delays. Americans trapped at home slashed spending at restaurants, movie theaters and sporting events and splurged on goods such as laptops and bicycles, triggering an import avalanche that has overwhelmed freight channels.

But the pandemic also exposed weaknesses in the nation’s transport plumbing: investment shortfalls at key ports, controversial railroad industry labor cuts, and a chronic failure by key players to collaborate, according to interviews with more than 50 individuals representing every link in the nation’s supply chain.

“It’s like an orchestra with lots of first violins and no conductor. … No one’s really in charge,” said Fran Inman, a Los Angeles-based commercial real estate executive who has advised government agencies on supply issues.

Port of Los Angeles

On Sept. 1, 40 container ships belonging to companies such as Hyundai, NYK Line and Evergreen were anchored off California, waiting for a berth. (Less than three weeks later, the number reached 73.) Some vessels sit for two weeks or more, effectively cutting capacity on trans-Pacific shipping lanes and driving up costs.

“From an economic point of view, it’s a disaster because cargo is waiting,” said Markus Grote, captain of a Hapag-Lloyd container ship.

Unprecedented number of ships are waiting to dock

at Southern California ports

Three-day rolling average of container ships offshore and docked at either

the Port of Los Angeles or Port of Long Beach this year

100 container ships

75

50

Container ships

anchored offshore

25

Container ships

docked at port

0

January

March

July

Sept. 28

Source: Marine Exchange of Southern California

For goods to move seamlessly from overseas factories to American addresses, the oceangoing vessels, shipping containers, cargo terminals, truckers, chassis providers and railroads all must work together, like runners in a relay race. If equipment gets stuck at any point, delays ripple along the entire chain.

[From ports to rail yards, global supply lines struggle amid virus outbreaks in the developing world]

Yet the United States is “decades behind” foreign ports in getting carriers, terminals and shippers to provide each other access to commercial data for planning purposes, said Gene Seroka, executive director of the Port of Los Angeles. Concerns over data privacy, business secrets and security have resulted in a fragmented approach. Individual ports operate as separate fiefdoms rather than as part of a national system.

In the Dutch city of Rotterdam, Europe’s largest port, everyone involved in a cargo vessel’s arrival sees the same information on a common data-sharing platform. Called “PortXchange,” the software makes port calls “smarter and more efficient” than the use of separate systems or the telephone, according to the port’s website.

Seroka touts a tool called the Port Optimizer, which forecasts three weeks of incoming cargo. More information sharing — including over a longer time period — would allow carriers, terminals, truckers and dockworkers to better position equipment and people. But other than Los Angeles, New Orleans is the only U.S. port that is even testing the system.

“Information sharing and additional transparency is one of the few areas where indisputably we could get more capacity out of the current system,” said Dan Maffei, chairman of the Federal Maritime Commission.

To be sure, the United States is importing historic amounts of goods. The L.A. port expects this year to handle a record 10.8 million containers. To keep pace, the International Longshore and Warehouse Union has accelerated training of new workers. Twenty union members have died of covid-19 while working through the pandemic, the union said.

At Fenix Marine Services, workers move containers from vessel to truck at the Port of Los Angeles on Sept. 2. (Melina Mara/The Washington Post)

“Our members are tired. Our members are feeling the pain of these covid deaths,” said Mike Podue, president of ILWU Local 63. “We’re lucky there hasn’t been a major accident.”

[The pandemic marks another grim milestone: 1 in 500 Americans have died of covid-19]

When the supply chain works, goods flow continuously, as if borne along by a river. Today, one bottleneck follows another. The problems are especially acute on the Asia-to-U.S. trade route.

Once a berth becomes available, longshoremen operating massive blue cranes lift the metal containers and position them to head inland via truck or train.

Ideally, a truck driver who has been alerted to the presence of a customer’s goods arrives at a terminal to find a chassis waiting. The container is then hoisted aboard and the driver pulls the chassis to the customer’s warehouse.

But too often, congestion elsewhere keeps the port jammed. Shippers with full warehouses won’t dispatch drivers to collect additional containers. Many loaded chassis sit outside overstuffed warehouses for days waiting to be unloaded, leaving ports short of needed equipment.

Why containers are stacked up at the ports of L.A. and Long Beach

1:27

Dan Walsh from TRAC Intermodal shows how a chassis is critical to keeping everything moving. (Lee Powell/TWP)

Even as cargo piles up on the docks, almost a third of the port’s night-shift appointments for truckers go unfilled.

At APM Terminals, the largest container site in the Western Hemisphere, the air echoes with truck horns, air brakes and the warning beeps of mobile cranes.

This 484-acre facility boasts 12 miles of railroad tracks, linking the docks to points east for customers such as Walmart, Nike and Ikea. Across from the headquarters building, trucks wait to navigate canyons of containers stacked about 50 feet high.

Steven Trombley, the facility’s managing director, needs the agility of a hockey goalie to ward off the daily complications. Today, his berths are full and four of the ships loitering in San Pedro Bay are impatient for a spot.

Trombley has nearly a week’s worth of truck chassis on the dock. But truckers are scarce. Such mismatches help explain why containers destined to travel by rail sit dockside for an average of eight days, up from two before the pandemic.

“It’s a headache. Cargo is sitting here longer than planned,” Trombley said. “If I don’t get the cargo moving, then the next ship is not going to have space.”

TRAC Intermodal in Long Beach. (Melina Mara/The Washington Post)

Even as total federal ports spending has increased, the L.A. gateway has been neglected, Seroka said. West Coast ports, including the L.A.-Long Beach complex, which handles about 36 percent of U.S. imports, have lagged East and Gulf Coast facilities over the past decade, $11 billion to $1 billion.

With more money, the port could have expanded channels, fortified wharves and improved road and rail links, he said.

One shortcoming: The lack of a direct rail connection to the distribution centers for companies such as Amazon and Nordstrom 75 miles east in California’s “Inland Empire.” (Amazon founder Jeff Bezos owns The Washington Post.)

[West Virginia factory is center stage in supply chain crisis, showing economy’s strains]

Advocates of a rail link say it would eliminate from Southern California’s freeways thousands of daily truck trips and ease port congestion by moving millions of containers off the docks. But the railroads doubt the financial case.

The backlog got so bad last fall that port officials opened overflow lots to store thousands of containers.

China Connection

TB Fanatic

At Pier S, on the other end of a harbor island from APM, about 7,300 containers and chassis are parked. Some have been sitting for almost three weeks.

One of the facility’s users is TRAC Intermodal, the nation’s largest chassis operator. CEO Dan Walsh, a wisecracking Australian, said current supply snags reflect Americans’ greater reliance upon e-commerce.

“They expect things to come faster, which puts pressure on everyone in the supply chain,” he said. “They also expect to be able to return things without cost.”

TRAC has spent $1 billion over the past decade upgrading its 180,000-vehicle fleet for what Walsh calls “the permanent whitewater of daily work.”

The company has increased spending by 20 percent this year, adding models that boast GPS locaters, LED lights and anti-lock brakes. But expanding more aggressively to meet the cargo emergency would not be cost effective: new tariffs have made Chinese models unaffordable at a time when domestic makers struggle to fill orders.

[U.S. tariffs on Chinese goods didn’t bring companies back to the U.S., new research finds]

As demand for shipping has soared, carriers have grown choosy about what they carry — eschewing hazardous chemicals and heavier products that increase vessel fuel costs. They often decline to send containers inland to collect American farm exports, preferring to rush them back to Asia to capitalize on high eastbound freight rates.

That’s why the L.A. port exports three times as many empty containers as full ones.

The Los Angeles and Long Beach ports exported a

record-breaking number of empty containers in 2021

to keep with shipping demands

Annual count of exported empty and loaded shipping containers between January and August

6 million

4

Exported empty containers

2

Exported loaded containers

0

2000

2005

2010

2015

2021

Source: Port of Los Angeles; Port of Long Beach

The seven largest publicly traded ocean carriers — including companies such as Maersk, COSCO and Hapag-Lloyd — reported more than $23 billion in profits in the first half of this year, compared with just $1 billion in the same period last year.

The soaring freight bills that fueled those profits, however, have put smaller shippers at a disadvantage to giants like Walmart or Amazon. The biggest companies not only can more easily absorb higher costs. They also negotiate more attractive contracts in the first place, which means they can reliably get their goods across the ocean while smaller companies struggle.

National Tree, a maker of artificial Christmas trees, was able over the past three months to import only half as many containers as planned, CEO Chris Butler said.

“We had contracts to bring in all of our containers. Those contracts were not worth the paper they were written on,” he said.

Supply interruptions first hit the United States in early 2020, as Chinese factories closed amid coronavirus shutdowns. Shortages of Clorox wipes, masks and other medical goods have evolved since then into a kaleidoscope of scarcity, with appliances, toys, industrial parts and semiconductors all proving hard to find.

Now, persistent cargo concerns are exposing the risks of ocean-spanning supply lines and hyper-efficient “just-in-time” production strategies that keep inventories and costs low.

A shortage of computer chips has shuttered General Motors and Ford auto plants and left Whirlpool scrambling to keep refrigerators and dishwashers in stock. Congestion in California prompted Levi Strauss to reroute Asian cargoes to less crowded East Coast ports despite longer, costlier journeys.

Cargo carriers are offering expedited VIP service for truly desperate shippers, some of whom offer to pay any price to get their goods moving.

Craig Grosscart, SEKO’s senior vice president for global ocean, said one desperate shipper recently asked: “Do you take bribes?”

Others have pleaded to use helicopters to retrieve containers from vessels offshore.

Long before the coronavirus, the United States lagged other major economies in moving goods efficiently. In 2018, the World Bank ranked the U.S. 14th out of 160 countries, down from ninth four years earlier, based on a periodic survey of freight forwarders and cargo carriers.

[Washington Post Live: Supply chain issues have caused deliveries to take two or three times longer, says Ethel’s Bakery CEO]

Likewise, regulators with the FMC warned in 2015: “Congestion at ports and other points in the nation’s intermodal system has become a serious risk factor to the relatively robust growth of the American economy and to its competitive position.”

Those earlier backlogs were sparked by unrest over a West Coast dockworkers’ contract. With that deal scheduled to expire July 1, businesses in coming months will probably order more than normal to avoid being caught short again, further aggravating congestion, executives said.

Steve Seeler, 51, chief executive of Seeler Industries in Joliet, Ill. Seeler said the lack of laborers is so dire that the executive team is also working in the plant. "We just don't have the people," he said. (Taylor Glascock For the Washington Post)

Seeler Industries in Joliet, a maker of chemical solutions used in household cleaners and municipal water treatment facilities, has been forced to turn down several million dollars in orders because of shortages of key ingredients and truckers to move them.