GOLD AND SILVER ENTERING EXPONENTIAL PHASE

By

Egon von Greyerz

Founder and Chairman

April 7, 2024

The desire of gold is not for gold. It is for the means of freedom and benefit.

Ralph Waldo Emerson

Gold is now in a hurry and silver even more so.

The price moves in the coming months and year are likely to be spectacular. The combination of technical and fundamental factors can easily drive gold well above $3,000 and silver to new highs above $50.

Forecasting gold is a mug’s game, as I have often stated.

But that is in the short term.

In the medium to long term, forecasting the Gold price is a cinch.

How can I be so certain?

Well, since the history of gold and money began, gold has always increased in value measured against fiat money.

Voltaire gave us the formula in 1729 when he said:

PAPER MONEY EVENTUALLY RETURNS TO ITS INTRINSIC VALUE – ZERO

So why has no investor or layman ever heeded the simple fact that –

ALL CURRENCIES HAVE WITHOUT FAIL GONE TO ZERO.

What most people, including experienced investors, don’t understand is that gold doesn’t increase in value.

Gold just maintains stable purchasing power. A Roman toga 2000 years ago cost 1 ounce of gold and a tailored suit today also costs 1 ounce of gold.

So it is really totally wrong to talk about gold going up when it is the unit we measure gold in that goes down. Just as all fiat money has done.

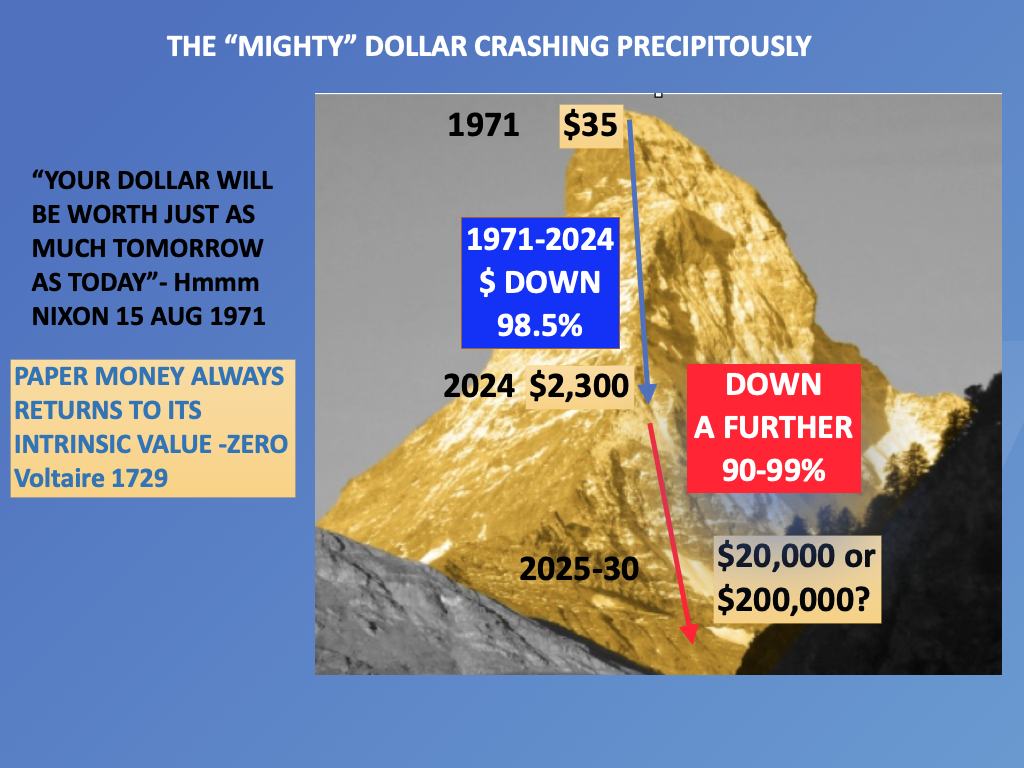

Just take gold measured in US dollars. As the illustration below shows, the value of the dollar since 1971 has crashed, measured in real terms which is gold.

As the picture shows, 1 ounce of gold cost $35 in 1971. Today 53 years later 1 ounce of gold costs $2,300. So has gold increased in value 66x since 1971?

No of course not, it is the dollar which has declined in value and purchasing power by 98.5% since 1971.

So what will gold be worth in the next 5 years? That is of course the wrong question.

Instead we must ask how much will the dollar and all currencies decline in real terms in the next few years?

Gold and silver have not increased in line with money supply or inflation and are severely undervalued.

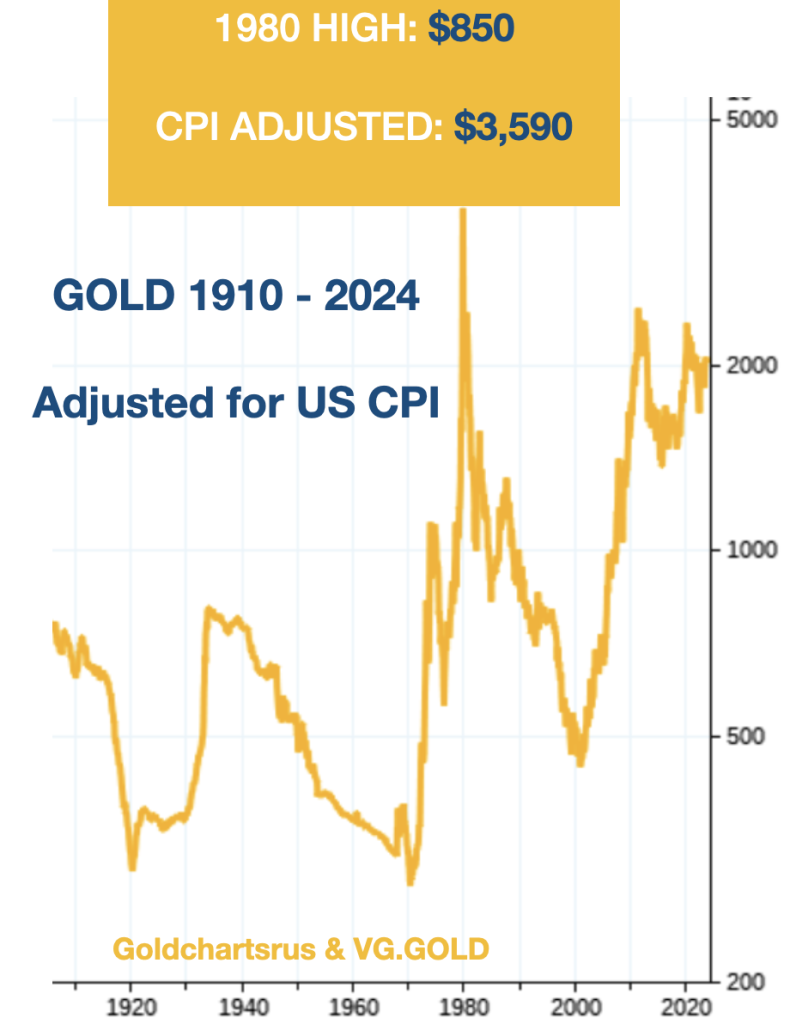

Just look at gold adjusted for US CPI (Consumer Price Index) in the graph below.

So if we inflation adjust the gold price, the 1980 high at $850 would today be $3,590.

But if we adjust the gold price for REAL inflation based on Shadow Government Statistics calculation, the gold price equivalent of the $850 high would today be $29,200.

In the 1980s the inflation calculation was adjusted, by the US government, to artificially improve/reduce official inflation figures.

And if we adjust the silver price for US CPI, the 1980 silver high of $50 would today be $166.

Adjusted for REAL inflation, the $50 high silver in 1980 would today be $1,350.

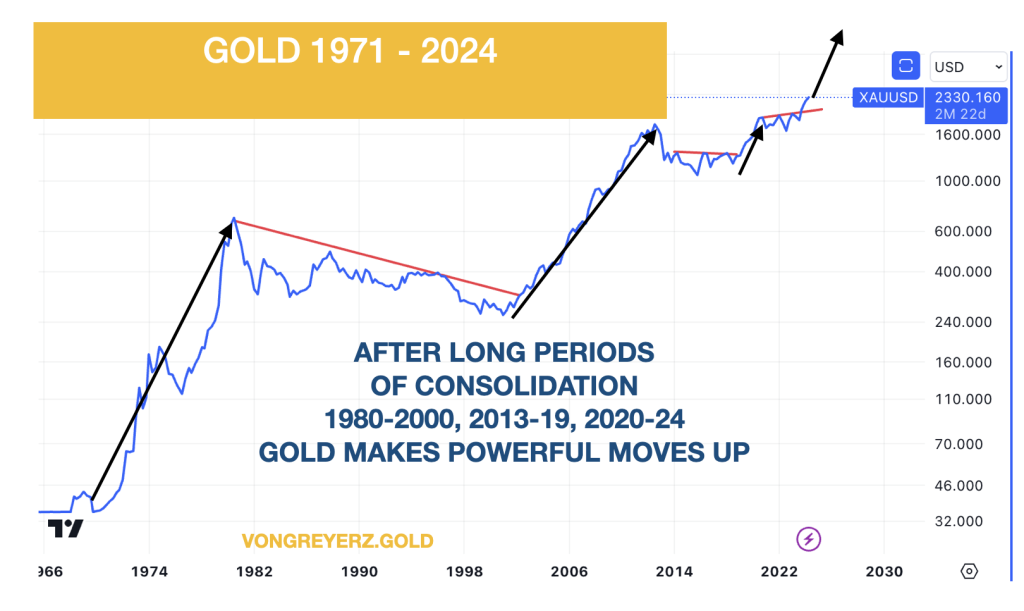

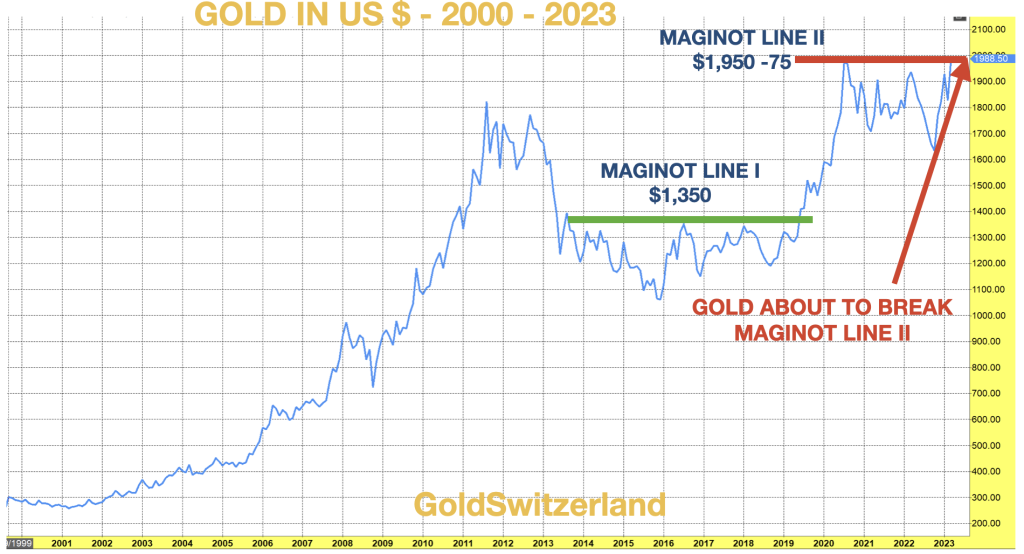

GOLD – LONG SIDEWAYS MOVES FOLLOWED BY EXPLOSIONS

Gold makes powerful moves and then goes sideways for long periods. After the gold explosion from $35 in 1971 to $850 in 1980, gold spent 20 years correcting until 2000.

That was the time that we decided that gold was now ready for the next run at the same time as risk in stock markets, debt and derivatives was starting to look dangerous.

So in 2002 we made major investments into physical gold at $300 for investors and for ourselves. At the time I recommended up to 50% of financial assets into gold based on wealth preservation principles and also the fact that gold at the time was unloved and oversold and thus represented excellent value.

WE HAVE LIFTOFF!

As gold went through $2,100 in early March, I declared

“GOLD – WE HAVE LIFTOFF!”

Since then gold has moved up another $200 but that is the mere beginning of a secular move.

After the move from $300 in 2002 to $1920 in 2011 gold had a long correction again between 2013 and 2016. The break of the first Maginot Line (see chart) was predictable (

article Feb 2019). Then in March 2023 it was clear that the second Maginot Line would break and we were seeing the beginning of the demise of the financial system as four US banks and Credit Suisse collapsed within a mater of days.

I discussed this in my March 2023 article

“THIS IS IT! THE FINANCIAL SYSTEM IS TERMINALLY BROKEN”

HOLDING GOLD REQUIRES PATIENCE

The message I want to convey with the two graphs above is that gold investing requires patience and obviously timing of the entry points. But in the long term investors will be extravagantly rewarded and at the same time hold the best insurance against a rotten system that money can buy.

Gold has consolidated under $2,000 since August 2020. The recent breakout is extremely important and not the end of a move.

No, this is the beginning of a move that will reach heights that today are unfathomable.

I am in no way intending to be sensational, but just trying to explain that fundamental and technical factors are now pointing to a secular bull market in gold and silver.

Also, normal measures of overbuying will not be valid. Gold and silver will in the coming months be overbought for long periods of time.

But don’t forget that there will also be vicious corrections, especially in silver which is not for widows and orphans.

I want to emphasise again that our intention to invest heavily in gold and much less heavily in silver (much more volatile), was primarily for long term wealth preservation reasons. That reason is more valid than ever today.

THE EVERYTHING COLLAPSE WILL COME

Since we have been expecting the “Everything Bubble” to turn into the

“Everything Collapse” (see my article April 2023), all the bubble assets like stocks, bonds and property are likely to decline substantially in real terms which means measured in gold.

I willingly admit that I have been premature in predicting the Everything Bubble to collapse in nominal terms. But in real terms almost all major asset classes have underperformed compared to gold since 2000 including stocks.

It is only the illusion of growth and prosperity based on worthless money creation that keeps this circus travelling on. But the circus acts will soon run out of tricks as the world discovers that this is only a mirage which has totally deluded us.

If we take stocks as an example, gold has outperformed the Dow and S&P since 2000.

Here is what I wrote 2 weeks ago:

The world’s best kept investment secret is GOLD.

- Gold has gone up 7.5X this century

- Gold Compound annual return since 2000 is 9.2%

- Dow Jones Compound annual return since 2000 is 7.7% incl. reinvested dividends

- So why are only 0.6% of global financial assets in gold?

- The simple answer is that most investors don’t understand gold because governments suppress the virtues of gold.

See my article on this subject

Stocks are now in position where we could have a major decline/collapse at any time.

WOLVES IN SHEEP’S CLOTHING

So back to the circus. The leaders of the Western World, whether we take the US, UK, Canada, Germany, France etc are mere clowns trying to fool their people with fake costumes (wolf in sheep’s clothing) and fake acts whether it is:

Money printing, debts, vaccines, climate, war, migration, more lies, propaganda, moral and ethical decadence to mention but a few of the problems that are leading us to the collapse of the Western World.

Real clowns would probably do a better job than current leaders. They would at least entertain us instead of bringing the misery that a majority of people are currently experiencing.

Yes, I am aware that there is a small elite that is benefiting dramatically from the shameful mismanagement of the world economy whilst the majority suffers badly from inept leadership around the world.

So how will this end? In my view, as I have outlined in many articles, it can only end one way which is a total collapse of the financial system as well as of the political system.

Will we first have hyperinflation and then a deflationary implosion or will it go straight to the implosion. Will there be a global war. Well, the US and most Western leaders are doing their utmost to start a World War against the will of the people. There is absolutely no attempt to find a peaceful solution.

Instead it is more weapons and more money to escalate the war as well as pushing as many countries as possible into NATO. Both Biden and Stoltenberg (NATO leader) also want Ukraine – a warring nation – to join NATO.

And with today’s sophisticated and dangerous weapons, no one can win a war.

Obviously, China, Russia, North Korea and Iran would win a war with boots on the ground at a cost of 100s of millions of lives. But modern wars are won in the air. And with around 15,000 nuclear warheads, the world can be destroyed many times over in a few minutes.

The world has never had a global economic and political crisis of this magnitude with so many destructive weapons, both financial (debt, derivatives) and military.

So to forecast the outcome is clearly impossible. One can only hope that people power will prevail and that incompetent leaders will be pushed out.

Otherwise there is little us ordinary people can do.

Wealth preservation in the form of physical gold, owned directly and in a safe jurisdiction (countries like the US, Canada or EU are not safe politically) is clearly the best insurance investors can buy.

Also we must assist family and friends in the difficult times ahead and make that circle the kernel of our lives (if it isn’t already).

And remember that most of the wonderful things in life are free like nature, music, books etc.

Egon von Greyerz Latest Article: Gold prices in the coming months and year are likely to be spectacular.

vongreyerz.gold