You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CORP/BIZ GameStop Is Rage Against the Financial Machine

- Thread starter Plain Jane

- Start date

Tarryn

Senior Member

The CNBC financial guys are whining and crying.

I kinda see this as similar to how Trump got elected. The "little" people voted for Trump 4channed made memes. The big media, big hollywood, big everything shat all over Trump. The politicos took Trump away.

Now it's happening with the stock market. GME is a huge meme right now. The big financial guys are pissed.

How many companies have been destroyed by these hedge funds, now the internet people are out to destroy them .

I kinda see this as similar to how Trump got elected. The "little" people voted for Trump 4channed made memes. The big media, big hollywood, big everything shat all over Trump. The politicos took Trump away.

Now it's happening with the stock market. GME is a huge meme right now. The big financial guys are pissed.

How many companies have been destroyed by these hedge funds, now the internet people are out to destroy them .

Sid Vicious

Veteran Member

Looking around, it appears that the big boys had a come to Jesus moment this week. Most of them have no idea how social media works and are in an absolute panic. Its going to be interesting to watch how fast government works to try and shut this down. The rallying cry is: "We can be retarded longer than you can be solvent"

PghPanther

Has No Life - Lives on TB

Truly hilarious the media writing stories about how unfair it is for individual investors to ‘manipulate’ the sacred sainted market!!!!

Bbbbwwwwaaaaaa

Hey! Only us big money hedge fund traders for the elites are allowed to manipulate the markets.

The hedge funds may be prostitutes in the house of wall street but the financial media are the pimps.

If options expire Friday the powers only have 2 trading days to put the ‘fix’ in to save the big money on the other side. It would be interesting to learn how many of ‘our’ elected representatives have positions with or through the hedge funds on the current very wrong side.

"The hedge funds may be prostitutes in the house of wall street but the financial media are the pimps."

That's gold...........an amazing analogy.................do you mind if I borrow that in conversation with others?...........

Feel free, we be family I am just the crazy uncle nobody talks about."The hedge funds may be prostitutes in the house of wall street but the financial media are the pimps."

That's gold...........an amazing analogy.................do you mind if I borrow that in conversation with others?...........

Tarryn

Senior Member

I read this last night.

Open letter

https://www.reddit.com/r/wallstreetbets/comments/l6omry View: https://www.reddit.com/r/wallstreetbets/comments/l6omry/an_open_letter_to_melvin_capital_cnbc_boomers_and/

An Open Letter to Melvin Capital, CNBC, Boomers, and WSB

Discussion

Mods do not delete, this is important to me, please read

I was in my early teens during the '08 crisis. I vividly remember the enormous repercussions that the reckless actions by those on Wall Street had in my personal life, and the lives of those close to me. I was fortunate - my parents were prudent and a little paranoid, and they had some food storage saved up. When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year. Ever since then, my parents have kept a food storage, and they keep it updated and fresh.

Those close to me, my friends and extended family, were not nearly as fortunate. My aunt moved in with us and paid what little rent she could to my family while she tried to find any sort of work. Do you know what tomato soup made out of school cafeteria ketchup packets taste like? My friends got to find out. Almost a year after the crisis' low, my dad had stabilized our income stream and to help out others, he was hiring my friends' dads for odd house work. One of them built a new closet in our guest room. Another one did some landscaping in our backyard. I will forever be so proud of my parents, because in a time of need, even when I have no doubt money was still tight, they had the mindfulness and compassion to help out those who absolutely needed it.

To Melvin Capital: you stand for everything that I hated during that time. You're a firm who makes money off of exploiting a company and manipulating markets and media to your advantage. Your continued existence is a sharp reminder that the ones in charge of so much hardship during the '08 crisis were not punished. And your blatant disregard for the law, made obvious months ago through your (for the Melvin lawyers out there: alleged) illegal naked short selling and more recently your obscene market manipulation after hours shows that you haven't learned a single thing since '08. And why would you? Your ilk were bailed out and rewarded for terrible and illegal financial decisions that negatively changed the lives of millions. I bought shares a few days ago. I dumped my savings into GME, paid my rent for this month with my credit card, and dumped my rent money into more GME (which for the people here at WSB, I would not recommend). And I'm holding. This is personal for me, and millions of others. You can drop the price of GME after hours $120, I'm not going anywhere. You can pay for thousands of reddit bots, I'm holding. You can get every mainstream media outlet to demonize us, I don't care. I'm making this as painful as I can for you.

To CNBC: you must realize your short term gains through promoting institutions' agenda is just that - short term. Your staple audience will soon become too old to care, and the millions of us, not just at WSB but every person affected by the '08 crash that's now paying attention to GME, are going to remember how you stuck up for the firms that ruined so many of us, and tried to tear down the little guys. I know for sure I'll remember this. In response, here is a list of CNBC sponsors and partners. They include, but are not limited to, IBM, Cisco, TMobile, JPMorgan, Oracle, and ZipRecruiter. Their parent company is NBCUniversal, owned by Comcast and GE.

To the boomers, and/or people close to that age, just now paying attention to these "millennial blog posts": you realize that, even if you weren't adversely effected by the '08 crash, your children and perhaps grandchildren most likely were? We're not enemies, we're on the same side. Stop listening to the media that's making us out to be market destroyers, and start rooting for us, because we have a once in a lifetime opportunity to punish the sort of people who caused so much pain and stress a decade ago, and we're taking that opportunity. Your children, your grandchildren, might have suffered as I described because of the institutions that we're fighting against. You really want to choose them, over your own family and friends? We're not asking you to risk your 401k or retirement fund on a single GME bet. We're just asking you to be understanding, supportive, and to not support the people that caused so much suffering a decade ago.

To WSB: you all are amazing. I imagine that I'm not the only one that this is personal for. I've read myself so many posts on what you guys went through during the '08 crash. Whether you're here for the gains, to stick it to the man as I am, or just to be part of a potentially market changing movement - thank you. Each and every one of you are the reason that we have this chance. I've never felt this optimistic about the future before. This is life changing amounts of money for so many of you, and to be part of a rare instance of a wealth distribution from the rich to the poor is just incredible. I love you all.

Note: I can't seem to get a hold of mods and they keep ****ing removing the post. I have no idea how to get this to stick and its important to me that the people I'm addressing read it.

Open letter

https://www.reddit.com/r/wallstreetbets/comments/l6omry View: https://www.reddit.com/r/wallstreetbets/comments/l6omry/an_open_letter_to_melvin_capital_cnbc_boomers_and/

An Open Letter to Melvin Capital, CNBC, Boomers, and WSB

Discussion

Mods do not delete, this is important to me, please read

I was in my early teens during the '08 crisis. I vividly remember the enormous repercussions that the reckless actions by those on Wall Street had in my personal life, and the lives of those close to me. I was fortunate - my parents were prudent and a little paranoid, and they had some food storage saved up. When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year. Ever since then, my parents have kept a food storage, and they keep it updated and fresh.

Those close to me, my friends and extended family, were not nearly as fortunate. My aunt moved in with us and paid what little rent she could to my family while she tried to find any sort of work. Do you know what tomato soup made out of school cafeteria ketchup packets taste like? My friends got to find out. Almost a year after the crisis' low, my dad had stabilized our income stream and to help out others, he was hiring my friends' dads for odd house work. One of them built a new closet in our guest room. Another one did some landscaping in our backyard. I will forever be so proud of my parents, because in a time of need, even when I have no doubt money was still tight, they had the mindfulness and compassion to help out those who absolutely needed it.

To Melvin Capital: you stand for everything that I hated during that time. You're a firm who makes money off of exploiting a company and manipulating markets and media to your advantage. Your continued existence is a sharp reminder that the ones in charge of so much hardship during the '08 crisis were not punished. And your blatant disregard for the law, made obvious months ago through your (for the Melvin lawyers out there: alleged) illegal naked short selling and more recently your obscene market manipulation after hours shows that you haven't learned a single thing since '08. And why would you? Your ilk were bailed out and rewarded for terrible and illegal financial decisions that negatively changed the lives of millions. I bought shares a few days ago. I dumped my savings into GME, paid my rent for this month with my credit card, and dumped my rent money into more GME (which for the people here at WSB, I would not recommend). And I'm holding. This is personal for me, and millions of others. You can drop the price of GME after hours $120, I'm not going anywhere. You can pay for thousands of reddit bots, I'm holding. You can get every mainstream media outlet to demonize us, I don't care. I'm making this as painful as I can for you.

To CNBC: you must realize your short term gains through promoting institutions' agenda is just that - short term. Your staple audience will soon become too old to care, and the millions of us, not just at WSB but every person affected by the '08 crash that's now paying attention to GME, are going to remember how you stuck up for the firms that ruined so many of us, and tried to tear down the little guys. I know for sure I'll remember this. In response, here is a list of CNBC sponsors and partners. They include, but are not limited to, IBM, Cisco, TMobile, JPMorgan, Oracle, and ZipRecruiter. Their parent company is NBCUniversal, owned by Comcast and GE.

To the boomers, and/or people close to that age, just now paying attention to these "millennial blog posts": you realize that, even if you weren't adversely effected by the '08 crash, your children and perhaps grandchildren most likely were? We're not enemies, we're on the same side. Stop listening to the media that's making us out to be market destroyers, and start rooting for us, because we have a once in a lifetime opportunity to punish the sort of people who caused so much pain and stress a decade ago, and we're taking that opportunity. Your children, your grandchildren, might have suffered as I described because of the institutions that we're fighting against. You really want to choose them, over your own family and friends? We're not asking you to risk your 401k or retirement fund on a single GME bet. We're just asking you to be understanding, supportive, and to not support the people that caused so much suffering a decade ago.

To WSB: you all are amazing. I imagine that I'm not the only one that this is personal for. I've read myself so many posts on what you guys went through during the '08 crash. Whether you're here for the gains, to stick it to the man as I am, or just to be part of a potentially market changing movement - thank you. Each and every one of you are the reason that we have this chance. I've never felt this optimistic about the future before. This is life changing amounts of money for so many of you, and to be part of a rare instance of a wealth distribution from the rich to the poor is just incredible. I love you all.

Note: I can't seem to get a hold of mods and they keep ****ing removing the post. I have no idea how to get this to stick and its important to me that the people I'm addressing read it.

Jubilee on Earth

Veteran Member

I’m sorry, but I’m never going to think negatively toward a business for not complying with shutting down for COVID lockdowns. I certainly would never call them assholes. Good for them for staying open! I have supported any businesses that had the backbone to do so. Had I known this, I myself probably would have bought some of their stock just to support them.GameStop is a DUMPSTER FIRE. These assholes were sufficiently asshole to stay open through the pandemic's early days claiming they were an "essential business" because they sold computer mice. Then, when the cops starting showing up, GameStop told its employees to tell the cops they weren't closing, and that the cops should refer to the company's legal department.

Their entire business model is a pocket catastrophe and with digital game delivery catching on, they were trying frantically to hang on until the new consoles came out. That helped, but who knows how much?

If you want to know more about this collection of scumbags, former GameStop employee and YouTube personality Camelot331 will fill you in.

doctor_fungcool

TB Fanatic

Sorry I missed the ACTION. Here's a quote from the original article

Instead of greed, this latest bout of speculation, and

especially the extraordinary excitement at GameStop, has a different emotional driver: anger. The people investing today are driven by righteous anger, about generational injustice, about what they see as the corruption and unfairness of the way banks were bailed out in 2008 without having to pay legal penalties later, and about lacerating poverty and inequality. "......so GREED had nothing to do with it?

The BLACKSWAN that was GAMESTOP...was a harbinger.....a warning if you will....there is a dystopian

emptiness embracing the land. Years of financial manipulation by the WALL STREET wise guys is coming to an end. We here in CONUS have believed in(some more than others)

the tricks of the ..stock market Houdinis .....

WHAT NOW? Smoke and mirrors? The mirrors are gone.

Just ashes and smoke

Anger...indigntion....and KARMA. are words that pop into my mind as I write this post. Please pardon my negative mood......I see what's coming and it ain't pretty. The collective mood of this nation is depressive IMHO.

Watch blackberry...closely.

..

.

.

Instead of greed, this latest bout of speculation, and

especially the extraordinary excitement at GameStop, has a different emotional driver: anger. The people investing today are driven by righteous anger, about generational injustice, about what they see as the corruption and unfairness of the way banks were bailed out in 2008 without having to pay legal penalties later, and about lacerating poverty and inequality. "......so GREED had nothing to do with it?

The BLACKSWAN that was GAMESTOP...was a harbinger.....a warning if you will....there is a dystopian

emptiness embracing the land. Years of financial manipulation by the WALL STREET wise guys is coming to an end. We here in CONUS have believed in(some more than others)

the tricks of the ..stock market Houdinis .....

WHAT NOW? Smoke and mirrors? The mirrors are gone.

Just ashes and smoke

Anger...indigntion....and KARMA. are words that pop into my mind as I write this post. Please pardon my negative mood......I see what's coming and it ain't pretty. The collective mood of this nation is depressive IMHO.

Watch blackberry...closely.

..

.

.

Last edited:

Plain Jane

Just Plain Jane

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Gamestop Soars To $500 As Most-Shorted Stocks Resume Surge

BY TYLER DURDEN

THURSDAY, JAN 28, 2021 - 7:32

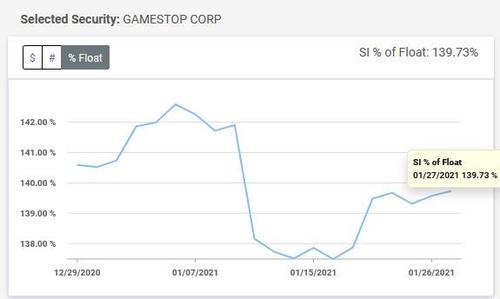

Late last night (after a quick scare that sent GME stock sliding when the r/wallstreetbets subreddit briefly went private) we said that the "real short covering hasn't even started yet" in Gamespot because as we showed, despite speculation that hedge funds had largely covered their shorts, the truth is that the short interest as a % of float hadn't even budged, and the bulk of the move higher was on simple long buying and a giant gamma squeeze.

This morning, both Reddit and the broader investing public appear to have read this, and GME stock exploded for a 4th consecutive day, rising almost 50% to a new all time high of $500...

... and because where GME goes, so does the rest of the most shorted universe, shares in most of the stocks that have seen huge surges in recent days amid a frenzy of retail trading continued to rally in U.S. premarket trading.

Other Reddit favorites and heavily shorted stocks with gains also included Sundial, up 38%; Castor Maritime +68%; and Naked Brand +75%. First Majestic Silver, another stock that’s been cited as a short-squeeze target, rose about 20%, while Nokia ADRs fell 17% initially but we expect this move to reverse once the Barstool crowd - under Dave Portnoy who said he had bought $1MM in NOK shares - joins the WSB autists in ramping stocks higher. Also among most-active stocks in Thursday premarket trading, AMC was roughly flat; expect fireworks here too.

Finally, now that it is becoming clear that the GME shorts may be trapped in the stock, which can technically drift in perpetuity since the SI simply can't drop, one way this could end is when Gamestop sells stock to the shorts who are desperate to get out but just can't find enough freely floated shares.

And since GME has all the leverage, and can demand any price for said equity offering, one wonders if this time next year GME won't have billions and billions in cash on its balance sheet.

TammyinWI

Talk is cheap

That is because you don't understand what is happening.

Oh? Okaaaaaaaaaaaay.

PghPanther

Has No Life - Lives on TB

this is a very difficult thing to say but here it goes.................

What this man has expressed is the result of his future prospects being destroyed by a system that controls the money supply (aka Fed Reserve).........and the elite/financial institutions they bail out at the expense of the general population through inflating the money supply and destroying the economy for the worker..........and most importantly the control of the media by this group that rationalizes this behavior as "too big to allow to fail" and being done for the good of everyone (aka our economy).

Well folks look at who controls the money supply..............the financial markets and the media...................

The same folks have been doing this for 1,000s of years and keep over playing their hands until they get people pissed off and fighting back.....................from Rome to Germany 108 times they've been revolted against and kicked out.......

and now the fighting back begins here for the 109th time....whether those fighting them even realize who is behind it or not............................and they are hitting them at their own game this time.

There is another problem...............if you had enough money in early January to get in on GME say a thousand shares or so...............you'd be looking at work 149K + as of last nights close.........this morning at 500K!!!.......I'd have to say there are some in this group buying the long bull squeeze on the shorts will get to a point where the anger will switch over to greed and will cash out........

That could lead to a run for the exits to the point where the short squeeze is over....and their purpose collapses....

Those banding together refusing to sell must be careful to avoid a switch from anger to greed doesn't turn them into the very monster they are fighting

Last edited:

batterbiscuts

Veteran Member

Three thoughts.

The ghost of CMKX just rose from the grave.

Somebody needs to get patrick byrne involved somehow.

This could be like a hole in a dyke. Cause if it keeps up the derivative market is going to start taking pressure. In 08 they sacrificed a couple hedge funds to keep order. they either do that again or print to infinity.

Then again printing to infinity could be the plan because it looks like we are repeating germany before world war 2.

The ghost of CMKX just rose from the grave.

Somebody needs to get patrick byrne involved somehow.

This could be like a hole in a dyke. Cause if it keeps up the derivative market is going to start taking pressure. In 08 they sacrificed a couple hedge funds to keep order. they either do that again or print to infinity.

Then again printing to infinity could be the plan because it looks like we are repeating germany before world war 2.

desert_fox

Threadkiller

Now I am totally ignorant when it comes to the markets. I prefer to loose my money through other means.

What will happen when the .fedgov steps in for the big guys who control their checks?

What will happen when the .fedgov steps in for the big guys who control their checks?

mzkitty

I give up.

this is a very difficult thing to say but here it goes.................

What this man has expressed is the result of his future prospects being destroy a system that controls the money supply (aka Fed Resv).........and the elite/financial institutions they bail out at the expense of the general population through inflating the money supply and destroying the economy for the worker..........and most importantly the control of the media by this group that rationalizes this behavior as "too big to allow to fail" and being done for the good of everyone (aka our economy).

Well folks look at who controls the money supply..............the financial markets and the media...................

The same folks have been doing this for 1,000s of years and keep over playing their hands until they get people pissed off and fighting back.....................from Rome to Germany 108 times they've been revolved against and kicked out.......

and now the fighting back begins here for the 109th time....whether those fighting them even release who is behind it or not............................and they are hitting them at their own game this time.

There is another problem...............if you had enough money in early January to get in on GME say a thousand shares or so...............you'd be work 149K + as of last nights close................I'd have to say there are some in this group buying the long bull squeeze on the shorts will get to a point where the anger will switch over to greed and will cash out........

That could lead to a run for the exits to the point where the short squeeze is over....and their purpose collapses....

Those banding together refusing to sell must be careful to avoid a switch from anger to greed doesn't turn them into the very monster they are fighting

Blacknarwhal

Let's Go Brandon!

I’m sorry, but I’m never going to think negatively toward a business for not complying with shutting down for COVID lockdowns. I certainly would never call them assholes. Good for them for staying open! I have supported any businesses that had the backbone to do so. Had I known this, I myself probably would have bought some of their stock just to support them.

My problem was that they tried to fob off the responsibility on their staff. You don't tell Joey Minimum-Wage that he's going to have to tell the COPS to get lost.

Plain Jane

Just Plain Jane

I've been wondering about that myself. Under the rubric of "climate change ", President Biden just gutted 10s of thousands of union jobs by canceling Keystone Pipeline, and more by stopping the leases for oil and gas drilling on federal land.What will happen when the .fedgov steps in for the big guys who control their checks?

Indian tribes and the New Mexico are up in arms about that and they all voted for Biden. Despair is spreading in the oil patch. What does that turn into when they see fellow "little guys" being trounced on by Ol' Joe because of those hedge funds?

mzkitty

I give up.

I've been wondering about that myself. Under the rubric of "climate change ", President Biden just gutted 10s of thousands of union jobs by canceling Keystone Pipeline, and more by stopping the leases for oil and gas drilling on federal land.

Indian tribes and the New Mexico are up in arms about that and they all voted for Biden. Despair is spreading in the oil patch. What does that turn into when they see fellow "little guys" being trounced on by Ol' Joe because of those hedge funds?

Like you said, they voted for him. And the "big guy" ain't gonna bail them out either. They're remorseless predators.

Plain Jane

Just Plain Jane

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Is The Reddit Rebellion About To Descend On The Precious Metals Market?

BY TYLER DURDEN

THURSDAY, JAN 28, 2021 - 8:56

Precious metals ETFs and mining stocks are suddenly snapping higher this morning, raising questions about whether the Reddit Rebellion is migrating to one of the most manipulated markets of all.

One WallStreetBets user (jjalj30) posted the following last night:

Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation.

Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at 1000$ instead of 25$. Link to post removed by mods.

Why not squeeze $SLV to real physical price.

Think about the Gainz. If you don't care about the gains, think about the banks like JP MORGAN you'd be destroying along the way.

Edit 1: ALL IN ON $AG. LETS GET THE MINERS.

Edit: $AG UP 40% PM. YOU ****ING RETARDS. SLV TO THE ****ING MARZ. I have got some interesting ifo from Gold Ventures. Here he goes---

Hi master!! In our debate about of which ETF is the best for our purposes (PSLV or SLV) I think that obviously the choice is SLV. Many people try to discredit it putting in doubt that it holds all the silver that it should, but I think that this had been always biased propaganda by the bullion dealers. SLV is run by BlackRock, who has many, many, many more assets under management than the SLV (in fact SLV is one of their smallest funds). Will such a leader of the investment industry put its reputation in risk??? Some years ago (in the darknest recent age of silver, about 2013-2015), the short interest in SLV was much higher than nowadays (about 25-30%). Ted Buttler always defended that shorting the SLV was not permitted by the ETF prospectus itself, because shorting one share inhibits the adding os one Oz of silver (you can sell one share to a new investor without issuing it). He initiated a public campaign against BlackRock by permitting it. The result was a legal threat of BlackRock to Buttler, he had to retreat, but magically the short interest started to decrease during the next weeks/months till "simbolic" levels. Even during this last year, where we witnessing silver inflow to the trust of several hundreds os Moz over the year before, the short interest of SLV itself didn't rise. SLV itself has no meaningful short interest itself, but the arbitrage among it and the spot/futures market make the concentrated shorts of the Comex very vulnerable. And remember, the master of the crooks, the one with the biggest and more corrupt influences, JPM, is no longer in the short side, so it will be no threated and by that will do nothing.

On the heels of that, SLV is spikingAdvantages of SLV over PSLV are clear:

Much more available on brokers (unless in Europe due to MiFid II)

Much more liquid

And of course, it has options!!

Tldr- Corner the market. GV thinks its possible to squeeze $SLV, **** AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. **** THE BANKS.

Disclaimer: This is not Financial advice. I am not a financial services professional. This is my personal opinion and speculation as an uneducated and uninformed person.

And GLD...

But it is the miners that are flying... for instance AG...

readynwaiting

Contributing Member

Robinhood "buy" option has been shut down for the big 4 stocks.

If this guy used his rent money to ride the horse, he ain't very bright. Go long refrigerator boxes.I read this last night.

Open letter

https://www.reddit.com/r/wallstreetbets/comments/l6omry View: https://www.reddit.com/r/wallstreetbets/comments/l6omry/an_open_letter_to_melvin_capital_cnbc_boomers_and/

An Open Letter to Melvin Capital, CNBC, Boomers, and WSB

Discussion

Mods do not delete, this is important to me, please read

I was in my early teens during the '08 crisis. I vividly remember the enormous repercussions that the reckless actions by those on Wall Street had in my personal life, and the lives of those close to me. I was fortunate - my parents were prudent and a little paranoid, and they had some food storage saved up. When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year. Ever since then, my parents have kept a food storage, and they keep it updated and fresh.

Those close to me, my friends and extended family, were not nearly as fortunate. My aunt moved in with us and paid what little rent she could to my family while she tried to find any sort of work. Do you know what tomato soup made out of school cafeteria ketchup packets taste like? My friends got to find out. Almost a year after the crisis' low, my dad had stabilized our income stream and to help out others, he was hiring my friends' dads for odd house work. One of them built a new closet in our guest room. Another one did some landscaping in our backyard. I will forever be so proud of my parents, because in a time of need, even when I have no doubt money was still tight, they had the mindfulness and compassion to help out those who absolutely needed it.

To Melvin Capital: you stand for everything that I hated during that time. You're a firm who makes money off of exploiting a company and manipulating markets and media to your advantage. Your continued existence is a sharp reminder that the ones in charge of so much hardship during the '08 crisis were not punished. And your blatant disregard for the law, made obvious months ago through your (for the Melvin lawyers out there: alleged) illegal naked short selling and more recently your obscene market manipulation after hours shows that you haven't learned a single thing since '08. And why would you? Your ilk were bailed out and rewarded for terrible and illegal financial decisions that negatively changed the lives of millions. I bought shares a few days ago. I dumped my savings into GME, paid my rent for this month with my credit card, and dumped my rent money into more GME (which for the people here at WSB, I would not recommend). And I'm holding. This is personal for me, and millions of others. You can drop the price of GME after hours $120, I'm not going anywhere. You can pay for thousands of reddit bots, I'm holding. You can get every mainstream media outlet to demonize us, I don't care. I'm making this as painful as I can for you.

To CNBC: you must realize your short term gains through promoting institutions' agenda is just that - short term. Your staple audience will soon become too old to care, and the millions of us, not just at WSB but every person affected by the '08 crash that's now paying attention to GME, are going to remember how you stuck up for the firms that ruined so many of us, and tried to tear down the little guys. I know for sure I'll remember this. In response, here is a list of CNBC sponsors and partners. They include, but are not limited to, IBM, Cisco, TMobile, JPMorgan, Oracle, and ZipRecruiter. Their parent company is NBCUniversal, owned by Comcast and GE.

To the boomers, and/or people close to that age, just now paying attention to these "millennial blog posts": you realize that, even if you weren't adversely effected by the '08 crash, your children and perhaps grandchildren most likely were? We're not enemies, we're on the same side. Stop listening to the media that's making us out to be market destroyers, and start rooting for us, because we have a once in a lifetime opportunity to punish the sort of people who caused so much pain and stress a decade ago, and we're taking that opportunity. Your children, your grandchildren, might have suffered as I described because of the institutions that we're fighting against. You really want to choose them, over your own family and friends? We're not asking you to risk your 401k or retirement fund on a single GME bet. We're just asking you to be understanding, supportive, and to not support the people that caused so much suffering a decade ago.

To WSB: you all are amazing. I imagine that I'm not the only one that this is personal for. I've read myself so many posts on what you guys went through during the '08 crash. Whether you're here for the gains, to stick it to the man as I am, or just to be part of a potentially market changing movement - thank you. Each and every one of you are the reason that we have this chance. I've never felt this optimistic about the future before. This is life changing amounts of money for so many of you, and to be part of a rare instance of a wealth distribution from the rich to the poor is just incredible. I love you all.

Note: I can't seem to get a hold of mods and they keep ****ing removing the post. I have no idea how to get this to stick and its important to me that the people I'm addressing read it.

Unrelated...most sobering comment/reality check I read this morning...Can the market "action" be this illiquid? Apparently so. The whole game is showing it's bare rear end.

Last edited:

hiwall

Has No Life - Lives on TB

Revenge: An Internet Mob Is Turning The Stock Market Into "A Video Game", And The Establishment Is Freaking Out

Retail investors have banded together to turn over the tables on Wall Street, and it has created a wild frenzy that is making headlines all over the globe. Unprecedented short squeezes have pushed the share

theeconomiccollapseblog.com

Retail investors have banded together to turn over the tables on Wall Street, and it has created a wild frenzy that is making headlines all over the globe. Unprecedented short squeezes have pushed the share prices of GameStop, AMC, Macy’s and BlackBerry to insane heights, and prominent voices in the financial world are complaining that trading in those stocks has become completely divorced from the fundamentals. In fact, these young retail investors are actually being accused of turning the market into “a video game”. Infamous investor Michael Burry, who made crazy amounts of money betting against the housing market during the last financial crisis, even had the gall to claim that recent trading in GameStop was “unnatural, insane, and dangerous”.

Of course Burry is right, but the truth is that the entire market has been transformed into a giant casino and has been “unnatural, insane, and dangerous” for a very long time.

If the entire market fell 50 percent tomorrow, stock prices would still be overpriced.

So it is more than just a little bit hypocritical for the Wall Street establishment to be complaining about GameStop when they have been gaming the system for years.

Ultimately, GameStop is not a good long-term investment. Most people download video games these days, and so a brick and mortar retail chain that sells physical copies of video games shouldn’t be attractive to anyone.

GameStop lost money last year, and they will lose money again this year.

But a group on Reddit known as “WallStreetBets” noticed that some big hedge funds had taken ridiculously large short positions against GameStop, and they sensed an opportunity. They realized that if they all started to buy GameStop all at once, it would likely create a short squeeze of epic proportions.

And that is precisely what has happened.

A year ago, a single share of GameStop was going for about four dollars.

At the beginning of the month, GameStop was sitting at $17.25.

On Wednesday, it closed at $347.51.

In addition to making huge profits, the investors on “WallStreetBets” also wanted to get revenge on the big hedge funds for all the evil things they have done in the past.

Every great story needs a great enemy, and in this case the great enemy is a hedge fund called Melvin Capital…

Melvin Capital, the $12.5 billion hedge fund founded by Gabriel Plotkin, was one of the main targets of the Reddit campaign, after an SEC filing revealed that the fund had a large short position in GameStop.

‘By the end of the week (Or even the end of the day), Plotkin is going to have less than a college student 50k in debt who works part time at starbucks,’ one Reddit user wrote on Wednesday morning.

Nobody knows for sure how much money Melvin Capital has lost, but it appears to be in the billions…

CNBC could not confirm the amount of losses Melvin Capital took on the short position. Citadel and Point72 have infused close to $3 billion into Gabe Plotkin’s hedge fund to shore up its finances. On Wednesday’s “Squawk Box,” Sorkin said Plotkin told him that speculation about a bankruptcy filing is false.

Melvin Capital has supposedly closed all of their short positions in GameStop now, but not everyone is buying that claim.

In any event, the crowd on WallStreetBets intends to continue to drive up the prices of GameStop, AMC, Macy’s and Blackberry for the foreseeable future.

Eventually, each of those mini-bubbles will collapse, but for now the big short sellers are squealing in pain.

Needless to say, the large hedge funds have been reaching out to their “friends” for help, and the SEC just released a statement which indicated that they are watching developments closely…

We are aware of and actively monitoring the on-going market volatility in the options and equities markets and, consistent with our mission to protect investors and maintain fair, orderly, and efficient markets, we are working with our fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants.

And White House Press Secretary Jen Psaki told reporters just a few hours ago that the White House is “monitoring” the situation.

But what is there to “monitor”?

All is fair in love and investing, and the retail investors of “WallStreetBets” caught some big hedge funds with their pants down and punished them for it.

After everything that big hedge funds have gotten away with over the years, many would argue that a little bit of revenge was definitely in order.

But Wall Street has never seen anything like this before.

Retail investors are supposed to be small fish that get eaten alive by the bigger fish, but now technology has changed the rules of the game…

The way people trade stocks has been upended by the rise of no-fee apps like Robinhood. That technology has democratized investing, giving armchair investors far removed from traditional banks free access to sophisticated trading instruments, like options.

You could pay an analyst to tell you what stocks to buy, or you could create a Reddit account and follow forums like WallStreetBets. Millions of young people are opting for the latter, which is partly why the sudden surges in GameStop and AMC have caught Wall Street veterans by surprise.

Nobody should shed a tear for the short sellers.

They have made obscene amounts of money over the years by manipulating the markets and by preying on weak companies.

Now an Internet mob is preying on them, and many that are involved believe that revenge is a dish best served cold.

If you can’t handle the pain, don’t play the game.

In the end, this entire farce of a market is going to utterly collapse anyway. So the truth is that very few are going to get out of this thing unscathed.

Since the financial crisis of 2008 and 2009, investors have seen their portfolios increase in value by trillions of dollars, but this bubble only exists because of unprecedented manipulation by the Federal Reserve and others.

Now a relatively small group of retail investors is manipulating stock prices to punish a couple of hedge funds and everyone is in an uproar over it?

What a joke.

Our financial markets are fraudulent, and they have been for many years.

Nobody should be accusing retail investors of turning the stock market into “a video game”, because the Federal Reserve already did that a long time ago.

Warm Wisconsin

Easy as 3.141592653589..

doctor_fungcool

TB Fanatic

"Precious metals ETFs and mining stocks are suddenly snapping higher this morning, raising questions about whether the Reddit Rebellion is migrating to one of the most manipulated markets of all."

from zerohedge

from zerohedge

doctor_fungcool

TB Fanatic

We could see a monumental spike in PM'S.

We could see a monumental spike in PM'S.

Physical has been disconnected from paper for some time.

How will it correlate?

Warm Wisconsin

Easy as 3.141592653589..

I just pulled all my money out of Robinhood!

Let’s pillage the ones that protect the rich #CancelRobinhood

Better get out before Robinhood has to close down withdraws.

We are going after Robin hood now

Let’s pillage the ones that protect the rich #CancelRobinhood

Better get out before Robinhood has to close down withdraws.

We are going after Robin hood now

doctor_fungcool

TB Fanatic

Silver may really rally in this environment.

In a nutshell.I barely understand what is going on.

The "big boys" wanted to trash the value of of Game Stop stock by betting for it's price to drop.

Then small investors united to buy the stock and drive the share price higher?

Summerthyme

doctor_fungcool

TB Fanatic

from zerohedge

Retail Brokerages Suffer Another 'Coordinated' Outage As Short-Squeeze Surge Spreads

BY TYLER DURDEN

THURSDAY, JAN 28, 2021 - 9:54

As retail panic trades most shorted stocks, a widespread outage of popular brokerage houses is being reported as the cash session begins. This seems to be the norm in the last couple of sessions, preventing some retail traders from participating in massive squeezes of Gamestop and AMC.

Downdetector reports Thursday morning that users of Robinhood, TD Ameritrade, E-Trade, Charles Schwab, Fidelity, and Webull are reporting issues and outages.

Retail Brokerages Suffer Another 'Coordinated' Outage As Short-Squeeze Surge Spreads

BY TYLER DURDEN

THURSDAY, JAN 28, 2021 - 9:54

As retail panic trades most shorted stocks, a widespread outage of popular brokerage houses is being reported as the cash session begins. This seems to be the norm in the last couple of sessions, preventing some retail traders from participating in massive squeezes of Gamestop and AMC.

Downdetector reports Thursday morning that users of Robinhood, TD Ameritrade, E-Trade, Charles Schwab, Fidelity, and Webull are reporting issues and outages.

doctor_fungcool

TB Fanatic

Tptb or an unknown entity is disconnecting the financial. Infrastructure.

Last edited:

Next question, could this trickle down to retail banking, in some convoluted way?

Or more importantly, access to one's cash.

Or more importantly, access to one's cash.

From what I gather.I barely understand what is going on.

The "big boys" wanted to trash the value of of Game Stop stock by betting for it's price to drop.

Then small investors united to buy the stock and drive the share price higher?

I think the key is that they borrowed money on a short term loan to buy these stocks...more or less.

That loan is coming due and they can't get rid of the hot potato.

That loan is coming due and they can't get rid of the hot potato.

doctor_fungcool

TB Fanatic

Next question, could this trickle down to retail banking, in some convoluted way?

Or more importantly, access to one's cash.

IMHO....at some point in time access to cash will be limited.

20Gauge

TB Fanatic

Yes, but there is more.I barely understand what is going on.

The "big boys" wanted to trash the value of of Game Stop stock by betting for it's price to drop.

Then small investors united to buy the stock and drive the share price higher?

The big guys actually borrowed to trash the value of Game Stop.

The big guys promised to pay that borrowing back on Friday the 29th with stock.

The small guys bought ALL available stock of Game Stop.

The big guys will be out of business Friday 5pm if they fail to get that stock.

Short and simple.