Moar:

Trading was temporarily halted in dozens of regional banks this morning as shares fell by up to 75 percent when the market opened after Joe Biden claimed 'US banking is safe.'

www.dailymail.co.uk

Biden says 'US banking is safe' as shares plummet up to 74% in pre-market trading despite president's guarantee scheme for SVB and Signature Bank - amid fears of a rout when stock market opens at 9.30am

- Biden spoke shortly before the market opened at 9.30am in attempt to shore up trust in the banking sector amid amid fears of a rout after the collapse of SVB

- 'Our actions should give Americans confidence that the US banking system is safe,' the president told the press conference

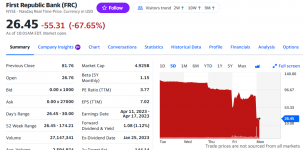

- But investors are smelling blood in the water. First Republic Bank saw its shares crash 74 percent to $21.50 from a high of $81.76 in premarket trading

By

ROSS IBBETSON FOR DAILYMAIL.COM

PUBLISHED: 07:33 EDT, 13 March 2023 | UPDATED: 10:01 EDT, 13 March 2023

Trading has been halted in First Republic Bank this morning after shares by a record 67 percent before the market opened after Joe Biden claimed 'US banking safe'.

The San-Francisco based bank, whose clientele include Mark Zuckerberg saw its share price plunge to $27.08 from $81.76 as fears of a contagion in the sector spooked traders after the collapse of Silicon Valley Bank.

Western Alliance Bancorp dropped nearly 75 percent as the opening bell sounded while shares in PacWest Bancorp dropped more than 35 percent.

Biden moved to shore up trust before Wall Street opened after the White House yesterday promised SVB customers would be 'made whole' and that 'no losses will be borne by the taxpayer.'

'Americans can have confidence that the banking system is safe,' the president told a press conference. But he warned that those who backed the failed bank 'knowingly took a risk and when the risk didn't pay off, investors lose their money. That's how capitalism works.'

SVB's swift downfall on Friday - the second-largest banking collapse in history - has ignited anxiety over a contagion amid the Fed's sharpest rate hike cycle since the early 1980s.

Biden defended his response to the financial meltdown in less than four minutes of remarks, stating the bosses at SVB should be fired and suggested that relaxed regulations under Donald Trump were partly to blame.

'If the bank is taken over by FDIC, the people running the bank should not work there anymore,' he said.

He called for a 'full accounting' of what led to the shutdown of SVB and 'why those responsible can be held accountable.'

'In my administration, no one is above the law. And finally, I must reduce the risk of this happening again,' the president said.

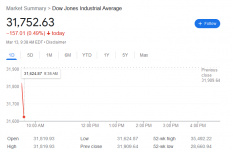

Biden tried to project calm amid fears of a financial meltdown and a run on the banks after shares plummeted 74 percent in pre-market trading amid the second-largest banking collapse in U.S. history.

He defended his administration's response in his less than four-minute remarks, said the executives at Silicon Valley Bank should be fired and pointed the finger at Donald Trump for rolling back regulations.

'Americans can have confidence that the banking system is safe,' he said from the Roosevelt Room before a trip to California. 'Your deposits will be there when you need them.'

The failure of SVB tore into global markets overnight as Biden slept, with European bank shares suffering their biggest drop in more than a year and bond markets seeing a gigantic repricing of rate hike bets.

The dollar slid too as Wall Street heavyweights such as Goldman Sachs predicted the Fed would no longer lift interest rates next week, capping the biggest three-day rally for short-dated Treasuries since 1987.

The yield on the 10-year U.S. Treasury note fell to 3.507 percent, from 3.694 percent Friday as Wall Street's so-called 'fear gauge' spiked, with the the Cboe Volatility Index (VIX) rising to a five-month high at 27.84.

Europe's bank index tanked 6 percent having shed 3.8 percent Friday.

In Britain, banking stocks across the FTSE 100 and FTSE 250 have slumped nearly 4 percent despite HSBC's takeover of the UK arm of SVB for £1 ($1.21).

'We are seeing a classic flight to safety,' said Tom Caddick managing director at Nedgroup Investments. 'Higher interest rates and a slowing economy was always going to bite.'

The fears have been sparked over a $620 billion ticking-time bomb that US banks are sitting on after buying Treasuries and bonds while interest rates were low.

When interest rates rise, newly issued bonds start paying higher rates to investors, which makes the older bonds with lower rates less attractive and less valuable. Most banks and pension funds are affected.

Martin Gruenberg, chair of the Federal Deposit Insurance Corporation (FDIC), told the Institute of International Bankers last week: 'Most banks have some amount of unrealized losses on securities. The total of these unrealized losses, including securities that are available for sale or held to maturity, was about $620 billion at year-end 2022.

'Unrealized losses on securities have meaningfully reduced the reported equity capital of the banking industry.'

First Republic's customers are businesses and high-net worth individuals who are no longer happy to leave their money in low-interest accounts.

Over the last three decades it has boomed from a small operation to the lender of choice for wealthy clients, including Facebook founder Zuckerberg who was offered a 1.05 percent mortgage rate on a $5.95m loan for his five-bedroom Palo Alto home in March 2011.

Customers are enticed by lavish perks including cocktail parties at its swanky branches from Manhattan to Palm Beach. Many clients are on a first-name basis with their branch manager and cite personal attention as their reason for banking with the lender.

The San Francisco-based bank said yesterday it had secured additional financing through JPMorgan, giving it access to a total of $70 billion in funds through various sources.

The bank's chairman and CEO said in a joint statement its 'capital and liquidity positions are very strong' and that 'its capital remains well above the regulatory threshold for well-capitalized banks.'

Despite the cash infusion, investment bank Raymond James double downgraded its stock to 'market perform' from 'strong buy', highlighting the risk of deposit outflows that First Republic faces from panicked large depositors after the bank run at SVB.

+6

View gallery

SVB's failure is the largest since Washington Mutual went bust in 2008, a hallmark event that triggered a financial crisis that hobbled the economy for years. The 2008 crash prompted tougher rules in the US and beyond.

Since then, regulators have imposed more stringent capital requirements for US banks aimed at ensuring individual bank collapses will not harm the wider financial system and economy.

Over the weekend, the Fed and US Treasury announced a range of measures to stabilize the banking system and said customers at SVB would have access to their deposits on Monday.

The Fed also said it would make additional funding available through a new 'Bank Term Funding Program', which would offer loans up to one year to depository institutions, backed by Treasuries and other assets these institutions hold.

Authorities have also taken over New York-based Signature Bank, the second bank failure in a matter of days.

Analysts noted that, importantly, the Fed would accept collateral at par rather than marking to market, allowing banks to borrow funds without having to sell assets at a loss.

Overnight in Asia, the ongoing concerns were seen in Japan's Topix bank index which lost 4 percent, while Singapore's largest banks also shed around 1 percent.

Monday's rout left more than 99 percent of companies listed on Europe's benchmark STOXX 600 trading in the red. Only three stocks evaded the fall, Qinetiq, Reckitt and Vantage Towers, up 0.4 percent, 0.2 percent and 0.1 percent, respectively.

One glimmer of hope was that futures markets showed the Wall Street's benchmark S&P 500 opening fractionally higher later.

Such was the concern about financial stability that investors speculated the Fed would now be reluctant to rock the boat by lifting interest rates by a super-sized 50 basis points next week - and might not even hike at all.

Fed fund futures surged to price out any chance of a half-point hike, compared with around 70 percent before the SVB news broke last week. Instead, futures implied around a 14 percent chance the Fed would stand pat.

The implied peak for rates came all the way down to 5.08 percent, from 5.69 percent last Wednesday, and markets were back to pricing in rate cuts by the end of the year.

'In light of the stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its next meeting on March 22,' wrote analysts at Goldman Sachs.

'We have left unchanged our expectation that the FOMC will deliver 25bp hikes in May, June, and July and now expect a 5.25-5.5 percent terminal rate, though we see considerable uncertainty about the path.'

Such talk, combined with the shift to safety, saw yields on two-year Treasuries rise 7 basis points at 0958 GMT to 4.63 percent, a world away from last week's 5.08 percent peak.

Yields were now down 66 basis points in just three sessions, a drop not seen since the Black Monday market crash in 1987.

Much will depend on what U.S. consumer price figures reveal on Tuesday, with an obvious risk that a high reading will pile pressure on the Fed to hike aggressively even with the financial system under strain.

The European Central Bank meets on Thursday and is still widely expected to lift its rates by 50 basis points and to flag more tightening ahead, though it will now have to take financial stability into account.

In currency markets, the dollar index, which measures the greenback's value against a basket of currencies, fell 0.3 percent. The pound and euro both rose around 0.2 percent while the safe-have Japanese yen surged more than 1 percent.

Gold climbed almost 1 percent as well to $1,885 an ounce, having jumped 2 percent on Friday. Oil prices lost over 1.5 percent though with Brent back at 81.48 a barrel and U.S. crude at $75.28 per barrel.