EXCERPT:

Futures Tumble, Yields Crater, Banks Plunge As Market Realizes Latest Bailout Is Insufficient

by Tyler Durden

Yesterday, when describing the nuances of the latest bank bailout (and big bank subsidy) we explained why the "Treasury is quietly freaking out" and asked rhetorically

"ETA until market realizes $25BN is nowhere near enough and futs react appropriately?"

Turns out the answer was about 12 hours, because after initially spiking, and rising just shy of 4,000 amid widespread acceptance that the Fed's tightening cycle is finally over, fears have shifted back to the growing bank crisis and depositor run, and futures were back down to 3,900, up just 0.2%, and wiping out most of their overnight gains...

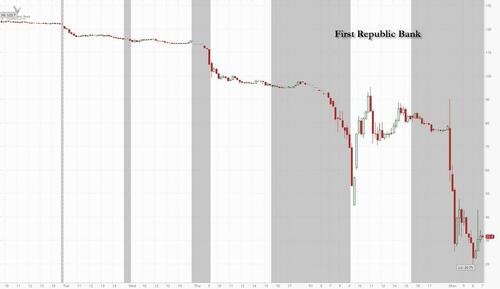

... as bank stocks have resumed their plunge led by small US banks such as First Republic, which is down 60% this morning as the market realizes the bank run is only starting...

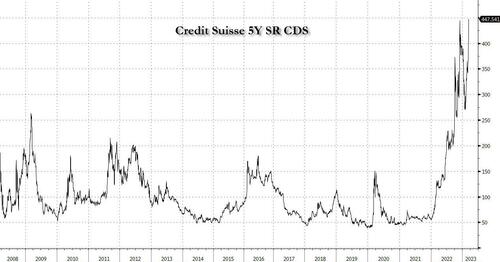

... but it's not just the regional US banks which we warned were about to be wiped out: big international banks are also getting crushed with Italian bank giant UniCredit shares halted, while Credit Suisse shares are not only 10% lower to new all time lows, but its Credit Default Swaps just hit a record wide.

Here are some notable premarket movers:

- Most US banking stocks cede early gains to trade around flat or in the red, as initial optimism fueled by US authorities’ decisive action on SVB fades and fears mount for the health of the broader financial system. JPMorgan (JPM US) -2%; Bank of America (BAC US) -6.3%, Wells Fargo (WFC US) -3.5%, Citigroup (C US) -2.7%, Charles Schwab (SCHW US) -18%, Western Alliance Bancorp (WAL US) -25%, PacWest Bancorp (PACW US) -36%

- First Republic Bank (FRC US) shares fell 63% after the US lender moved to try and quell concern about its liquidity following the failure of Silicon Valley Bank. The declines came after the bank said late Sunday it had more than $70 billion in unused liquidity from agreements that included the Federal Reserve and JPMorgan.

- US-listed Chinese stocks rise in premarket trading, on track to halt five days of declines, as China’s new premier Li Qiang called for better cooperation between the two countries and signaled support to the private sector. Alibaba (BABA US) +0.8%, Baidu (BIDU US) +1.4%, PDD Holdings (PDD US) +1.2%, NetEase (NTES US) +1.9%, Trip.com (TCOM US) +1.2%, Li Auto (LI US) +2.8%

- Cryptocurrency-exposed stocks rose after Bitcoin jumped on US agencies’ pledge to fully protect all Silicon Valley Bank depositors following the lender’s collapse. Marathon Digital (MARA US) +7.3%, Riot Platforms (RIOT US) +2.8%, Hut 8 Mining (HUT US) +5.6%, Coinbase (COIN US) +4%

- Provention Bio (PRVB US) shares rise as much as 264% to $24.40 in US premarket trading after Sanofi agreed to buy the biotech for $25/share in cash, in a $2.9 billion deal intended to bolster the French drugmaker’s portfolio of diabetes medicines with a new therapy recently approved in the US.

- Gold miners could be active on Monday as gold kept rising, with investors flocking to havens following the collapse of SVB. Watch shares including Barrick (GOLD US), Agnico Eagle (AEM US), Kinross (KGC US).

Meanwhile, with Goldman joining ZH in calling a Pause in the Fed's hiking cycle,

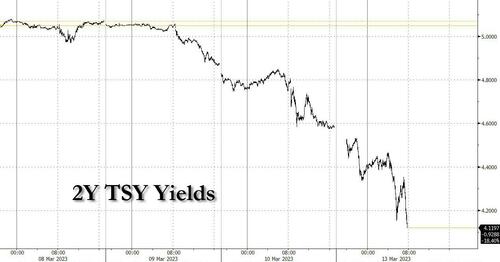

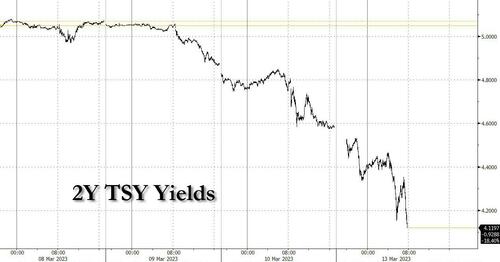

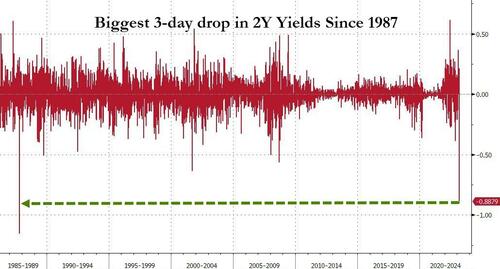

2Y yields have plummeted an insane 50bps...

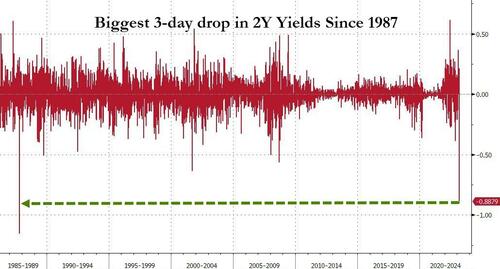

... suffering the biggest 2-day drop since Black Monday in October 1987!

... suffering the biggest 2-day drop since Black Monday in October 1987! So much for all those macrotourists preaching

"higherer for longerer" (but please buy their newsletter, they need the money to fund their own bailout).

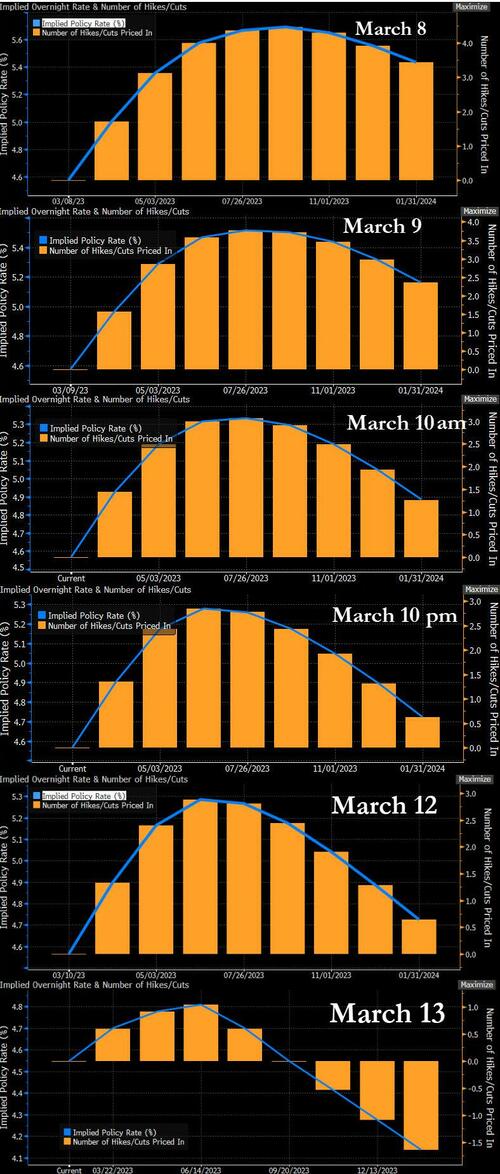

And here is how the Fed's rate hike narrative died a gruesome death in just 3 trading days.

While not nearly as pronounced as the collapse in the short end, the 10-year yield fell to a one-month low and the dollar extended a decline against major peers. The yield on two-year German debt plunged 38 basis points to 2.72%, putting them on course for the steepest two-day fall on record.

The turmoil following SBV’s demise has caused a rapid repricing in markets for where the Federal Reserve will take policy. Swaps traders now only roughly even odds the central bank will raise rates at its meeting next week, especially after

Goldman economists said they expect no change in the policy rate following the collapse of SVB. Expectations had built for a hike of as much as 50 basis points after Chair Jerome Powell addressed lawmakers Tuesday.

“The failure of SVB puts the Fed’s focus on financial stability,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets.

“This is a difficult position Fed is in, on the one hand it needs to keep hiking to arrest inflation, but also it needs to protect the financial system. Feels like a lose-lose situation for the Fed and the market" which of course is a paraphrase of what we said last Thursday.

While US futures faded fast, Europe was a mess from the start as shares of European banks and insurers slumped on Monday, while yields on European bonds fell on anticipation that the Silicon Valley Bank collapse could force central banks to slow the pace of interest rate hikes.

The pan-European bank stocks index was down by the most in a year, while real estate stocks also slipped but outperformed the broader index as the sector typically benefits from dovish monetary policy shifts. Banking stocks index is down 5.7%, worst performing European sector, while the broader market loses about 2.8% Commerzbank -12%, Banco de Sabadell -9.4% and ING -9% are top losers; and of course, as noted above

Credit Suisse shares down 13% to new record low.

Earlier in the session, Asian stocks erased earlier declines as bond yields slid after Goldman Sachs Group Inc. said the Federal Reserve will stand pat next week. Equities in China and Hong Kong rallied the most. The MSCI Asia Pacific Index advanced as much as 0.6%, reversing a loss of up to 0.9%. Chinese shares led the charge higher as traders bet on policy continuity after the nation retained several familiar faces in its economic leadership team, including the central bank governor. Tech shares in the region also got a boost from falling US Treasury yields as Goldman Sachs economists said the recent stress in America’s banking system may prompt the Fed to pause its monetary tightening cycle next week. It also flagged uncertainty about the rate path in the months ahead. READ: Rate Bets Unwind Is Savage Enough to Evoke Black Monday Meanwhile, Japanese benchmarks were weighed down by financial shares as investors assessed the fallout of Silicon Valley Bank’s collapse. Asia’s benchmark stock gauge is trying to recover from last week’s 2% drop as SVB’s downfall highlighted the impact of higher interest rates on the US economy and financial system. “Although we do not think there is any material fundamental impact on Asian stocks, equity investor sentiment will likely remain fragile for now,” Nomura strategists including Chetan Seth wrote in a note. Market focus will likely remain on factors such as whether there are deposit outflows from other relatively smaller regional banks, they added.

Japanese stocks fell for a second day as investors continued to assess whether Silicon Valley Bank’s failure poses risks for the broader financial markets. The Topix Index fell 1.5% to 2,000.99 as of market close Tokyo time, while the Nikkei declined 1.1% to 27,832.96. The Topix’s gauge for banks and insurers was among the biggest sector losers. Mitsubishi UFJ Financial Group Inc. contributed the most to the Topix Index decline, decreasing 3.5%. Out of 2,160 stocks in the index, 202 rose and 1,906 fell, while 52 were unchanged. “SVB’s bankruptcy news and yen’s appreciation both dragged Japanese equities lower,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities. “On the other hand, as the pace of US monetary tightening is expected to slow down given the situation, there might be some positive impacts as well.”

In FX, a gauge of the dollar fell for a third session as US government measures to ease concern over the collapse of Silicon Valley Bank curbed demand for havens. There’s expectation that the US emergency measures will limit the shock from SVB’s failure, including contagion risks, according to Teppei Ino, head of global markets research at MUFG Bank Ltd.

“Dollar-yen was bought back to a certain extent as traders and investors welcomed measures including protection of depositors and securing of liquidity”.

In rates, treasury futures just off highs of the day after gapping up, as investors remained in risk-off mode as the collapse of Silicon Valley Bank reverberates through financial markets. Yields richer by more than 25bp across front-end of the curve with 2s10s, 5s30s spreads steeper by 15bp-16bp on the day; 10- year yields lower by around 12bp at 3.58% with bunds outperforming by 8bp in the sector.

Curve is aggressively steepening as Fed-dated OIS swaps gap lower and rate-hike premium erodes from front-end of the curve; the 2s10s has moved from -110bps last week to 67% today after Goldman Sachs economists said they no longer expect the Fed to deliver a rate increase next week. Fed-dated OIS pricing in around 15bp of rate hikes for the March policy meeting with Fed peak gapping lower to around 4.90% for the June decision, implying around 35bp of additional hikes for this cycle.

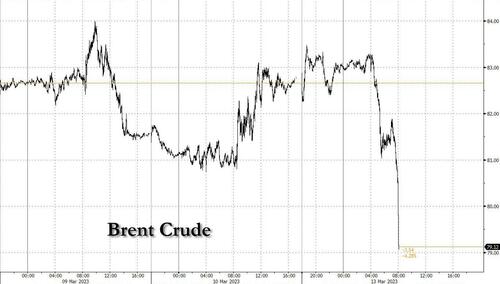

Commodities have, ex-spot gold, come under marked pressure as risk sentiment deteriorates throughout the European morning. Specifically, WTI and Brent front months have suddenly tumbled, accelerating an earlier loss, as the market prices in a recession.

Base metals are well off best levels, given the risk tone, but are somewhat cushioned by the USD continuing to slip. Action which is assisting spot gold, alongside traditional haven allure, with the yellow metal up to USD 1893/oz at best.

Lluckily, there is nothing scheduled on todays' econ calendar; instead we will be focusing mostly on the worsening bank crisis.

Market Snapshot

- S&P 500 futures down 0.6% to 3,876.5

- STOXX Europe 600 down 1.1% to 448.71

- MXAP up 0.2% to 158.26

- MXAPJ up 1.0% to 508.50

- Nikkei down 1.1% to 27,832.96

- Topix down 1.5% to 2,000.99

- Hang Seng Index up 1.9% to 19,695.97

- Shanghai Composite up 1.2% to 3,268.70

- Sensex down 1.2% to 58,442.44

- Australia S&P/ASX 200 down 0.5% to 7,108

- Brent Futures down 0.2% to $82.65/bbl

- Gold spot up 0.5% to $1,878.19

- U.S. Dollar Index down 0.56% to 103.99

- German 10Y yield little changed at 2.38%

- Euro up 0.6% to $1.0710

Top Overnight News

- US authorities took extraordinary measures to shore up confidence in the financial system after the collapse of Silicon Valley Bank, introducing a new backstop for banks that Federal Reserve officials said was big enough to protect the entire nation’s deposits.

- The turmoil following the collapse of Silicon Valley Bank continued to spread Monday, with First Republic Bank shares falling about 60% in pre-market trading despite efforts by the US regional lender to reassure investors on its liquidity.

- HSBC Holdings Plc is buying the UK arm of Silicon Valley Bank, the culmination of a frantic weekend where ministers and bankers explored various ways to avert the SVB unit’s collapse.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed with financials hit amid the fallout from the SVB collapse and subsequent failure of Signature Bank, although US equity futures were supported and there was also a gradual improvement in Asia following efforts to stabilise the financial system with bank deposits guaranteed and the Fed announced to make additional funding available to eligible depository institutions to assure that banks have the ability to meet the needs of their depositors. ASX 200 was lower with weakness seen across most industries including the top-weighted financials sector although closed off its lows owing to the resilience in commodity-related stocks and with money market rates pricing in over 75% probability of a pause at next month’s RBA meeting. Nikkei 225 retreated to beneath the 28,000 level with financial stocks dominating the list of worst performers. Hang Seng and Shanghai Comp. were positive with Hong Kong boosted by gains in tech after President Xi advocated strengthening science and technology at the closing remarks of the NPC and with Bilibili boosted following the inclusion of its Z shares to the Stock Connect, while the mainland was also kept afloat after China reported stronger-than-expected loans/financing data and surprisingly retained PBoC Governor Yi Gang as the head of the central bank.

European bourses are under substantial pressure, Euro Stoxx 50 -2.8%, with banking names leading the downside as contagion concern continues, SX7P -5.5%. Action which comes despite US and UK regulators stepping in over the weekend/Monday morning (details above) as concern remains over regional banks such as First Republic and Western Alliance Bank., -62% and -22% in the pre-market respectively. Stateside, futures have been faring comparably better given the backstop measures and strength in large-cap banking names; however, this has since eroded as broader sentiment deteriorated further, ES +0.1%, RTY -0.4%. Specifically, large-cap banking names in the US are now negative; JPM -2.5%, WFC -3.3% & BAC -5.0% in the pre-market.

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com