#2

these banking crises are caused again and again by governments screwing up banks though ill conceived or outright insane policy.

2008 was the story of the community reinvestment act forcing banks to lend to subprime borrowers as rates akin to prime so that they could buy homes they could not afford. cuz, ESG.

the banks were (understandably) terrified about this but had no choice. fail to do so, lose your charter. so they laid this risk off as fast as they could. the got freddie and fannie (the classic quasi governmental agencies that privatize profits and collectivize risk/losses) to guarantee the loans. these companies basically got to run amok with the federal credit card selling cheap mortgage insurance that took all the risk out of making liar loans (once they changed the rules to allow it).

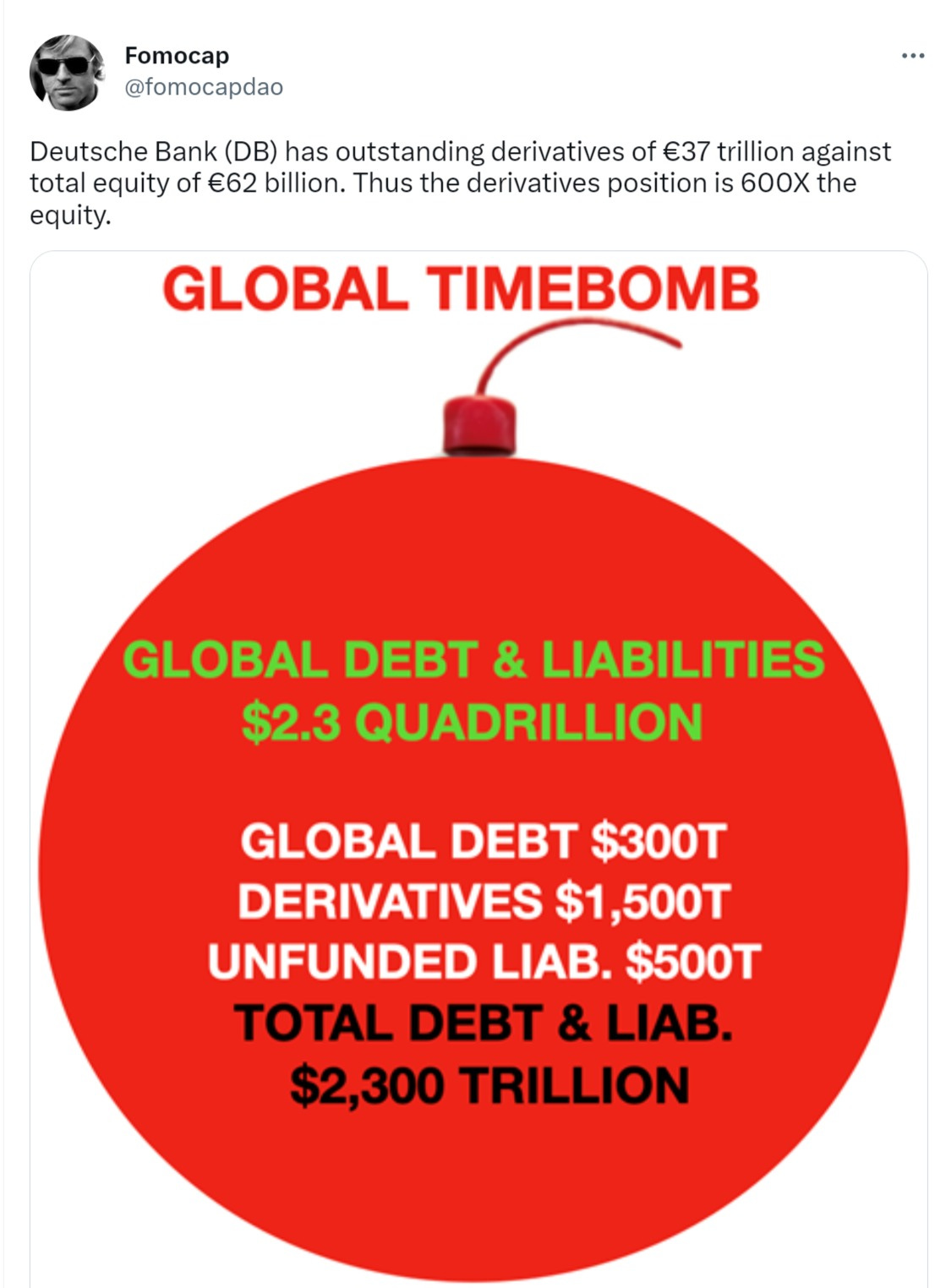

these guaranteed loans were then packaged, sliced, diced, and derivitived into MBS’s (mortgage backed securities) that spread the risk of US mortgages globally and left uncle sammy on the hook for the impending global whammy.

combined with insanely low rates, this injected insane leverage. it all ended in quite the mess.

and we’ve just done the whole fricking thing again.

instead of learning “banks should lend based on credit quality” the smooth brains up at treasury now want ESG and DEI lending. because that’ll definitely work better this time. swearsies.

and what was the learning from “wow, we sure got hosed guaranteeing all that debt?” let’s grab more power and guarantee even more debt! these agencies are currently acquiring

~2/3 of US mortgage origination.

it’s inflationary and dangerous.

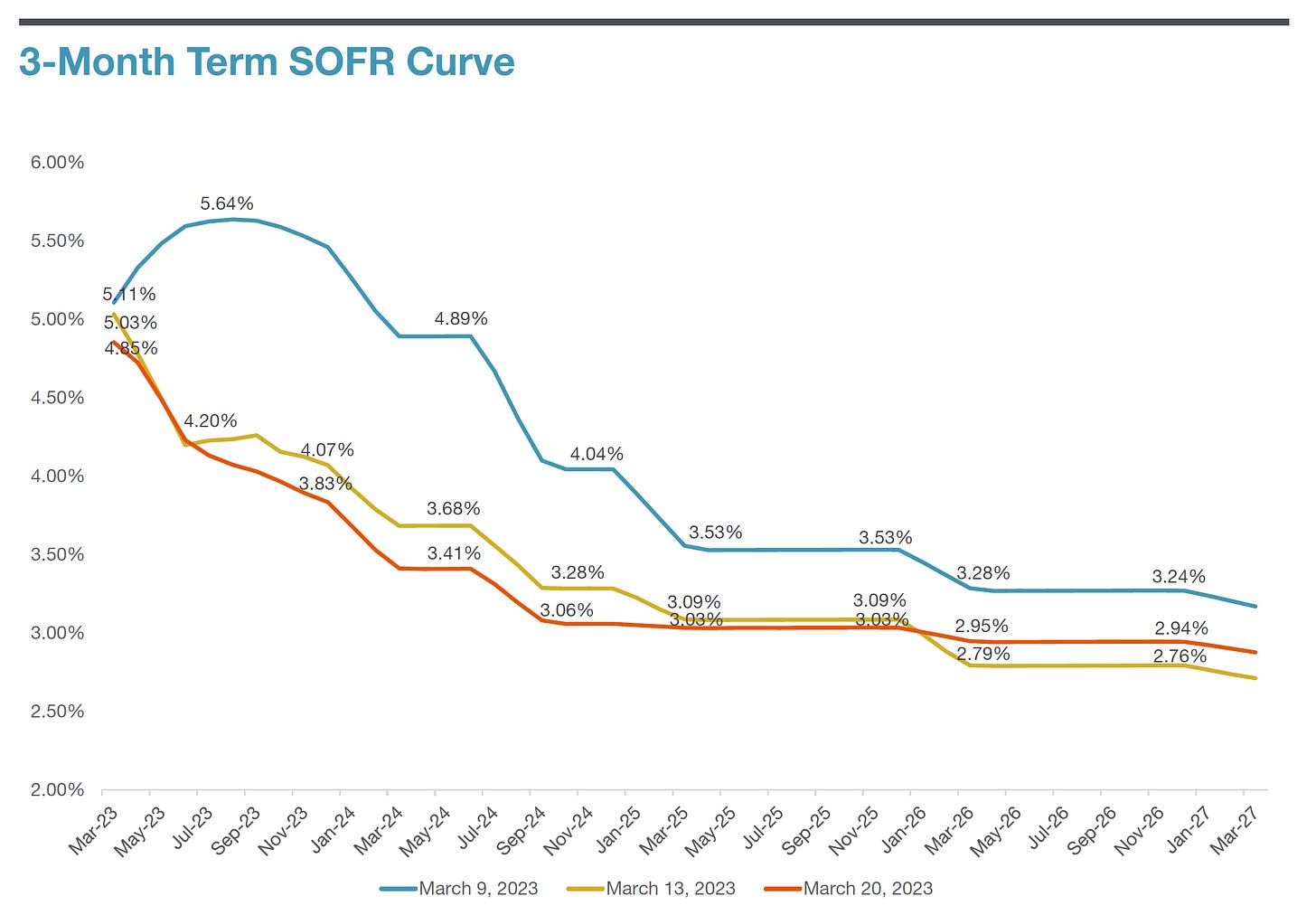

and as our pals over at SVB just learned, the MBS’s made from it sure can drop in value when rates rise. worse, they also suddenly become much longer dated assets because they are not being taken out by refi. you thought you had a 5 year bond. suddenly it’s 15.

that sure does change the “hold to maturity” equation (where you do not have to mark it to market). and that is a terrible mismatch to a huge pool of depositors that are venture funded jet engines of capital destruction masquerading as “new economy growth companies” whose bank balances are a melting iceberg that needs constant top-up from the next round of VC’s looking to immolate a billion or two.

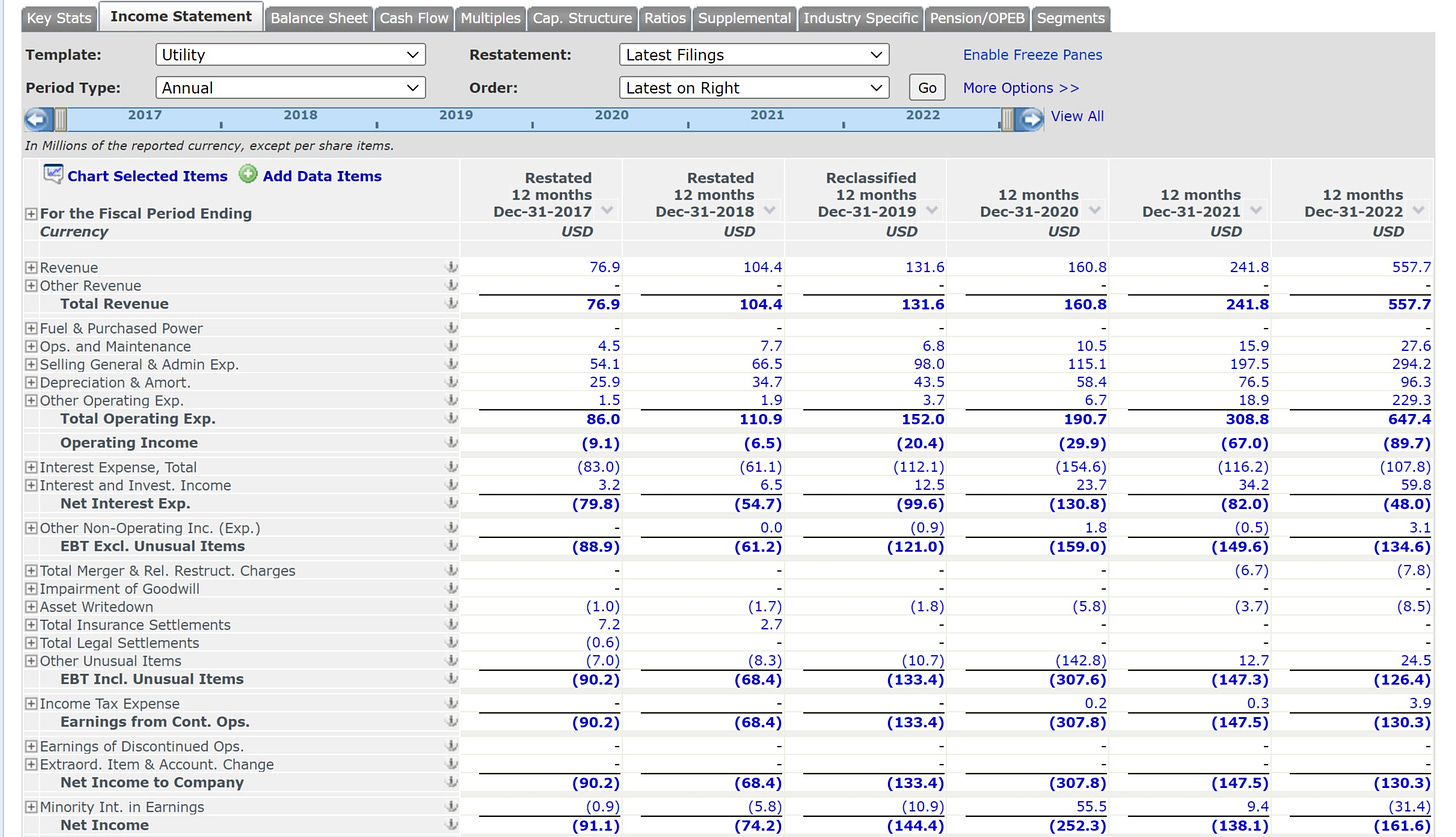

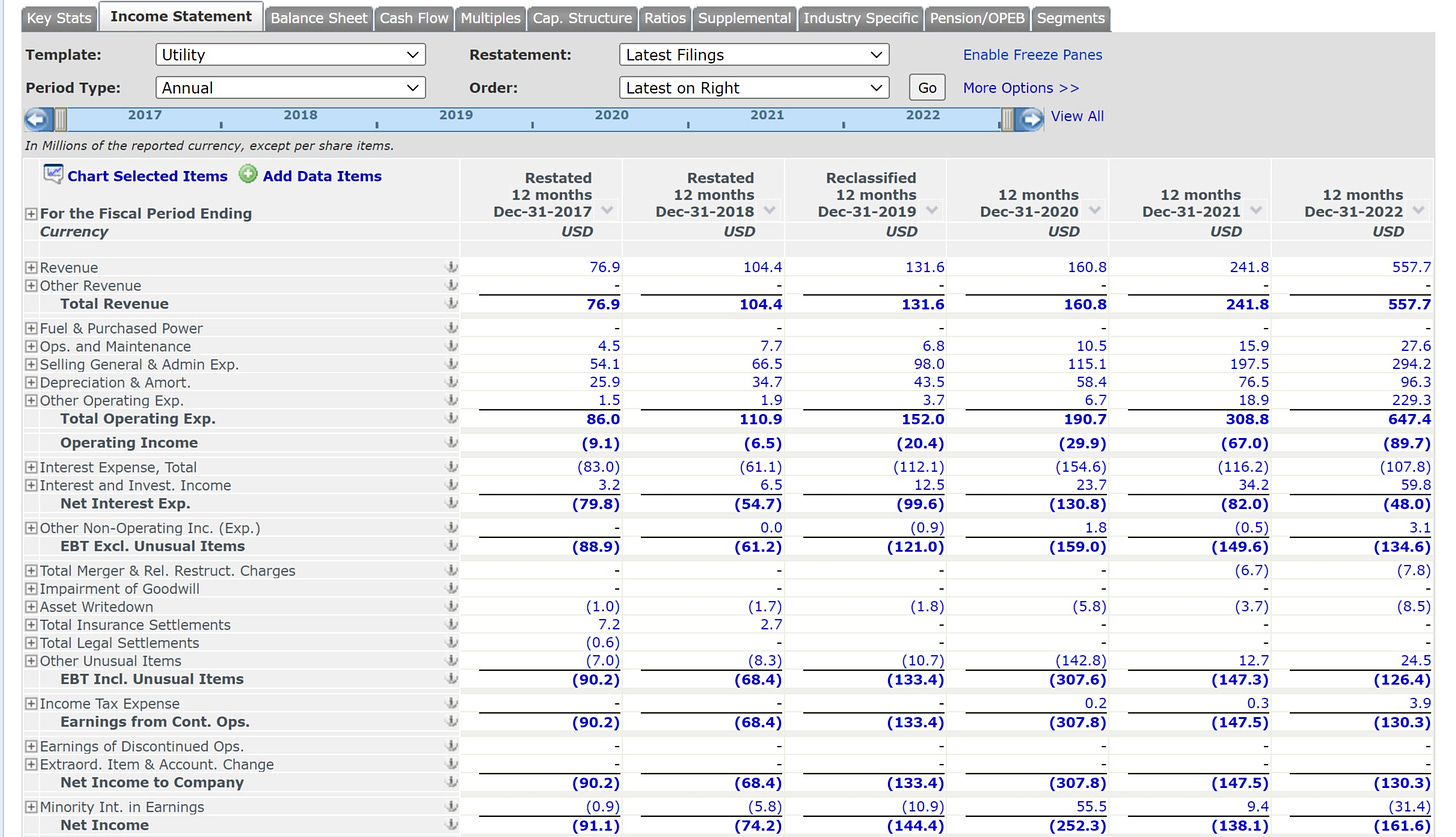

here’s a typical depositor. it doesn’t matter who they are or what they do. their primary business is selling dollars for 80 cents. and these companies are currently legion. because if you make money basically free, folks are going to take you up on it.

this company has over $5billion in debt and keeps $360 million of cash on hand.

they have no plans nor ability to make money they had cash flow from ops of negative $330 million last year.

who on earth would take on long term bonds held to maturity while using these guy’s deposits as a source of capital?

yeah, that was always gonna work out delightfully.

and why would anyone keep large uninsured deposits at a bank that does this?

you do it because you believe they (or perhaps more importantly, the other depositors) are sufficiently connected that it will not be allowed to fail and that you will be made money good. and, assuming you get your politics right, this generally winds up being a sound bet. it certainly did here.

once the federales and the FDIC stepped in and said “it’s all covered” the companies that pulled money and caused the bank run came flooding back. it was easier than getting a new bank and the literal canon in the valley became “this is now the safest bank in the US.”

and it’s probably true.

but this is also a serious problem because the moral hazard you create with this sort of backstop (explicit or otherwise) is grievous and it lets people do dumb things (like trusting black box banks with wicked leverage ratios and far flung exposures) with impunity.

and there is basically no practice on earth more assured of ending in tears than letting people do dumb things with impunity.

and it does not have to be like this.

we can do much, much better but to do so requires dismantling centuries of government prerogative and privilege and bankster oligopoly and creating an actual market for banking and for money.

there is nothing remotely difficult about doing it. there is no meaningful technical or systemic hurdle. it’s just vested interest.

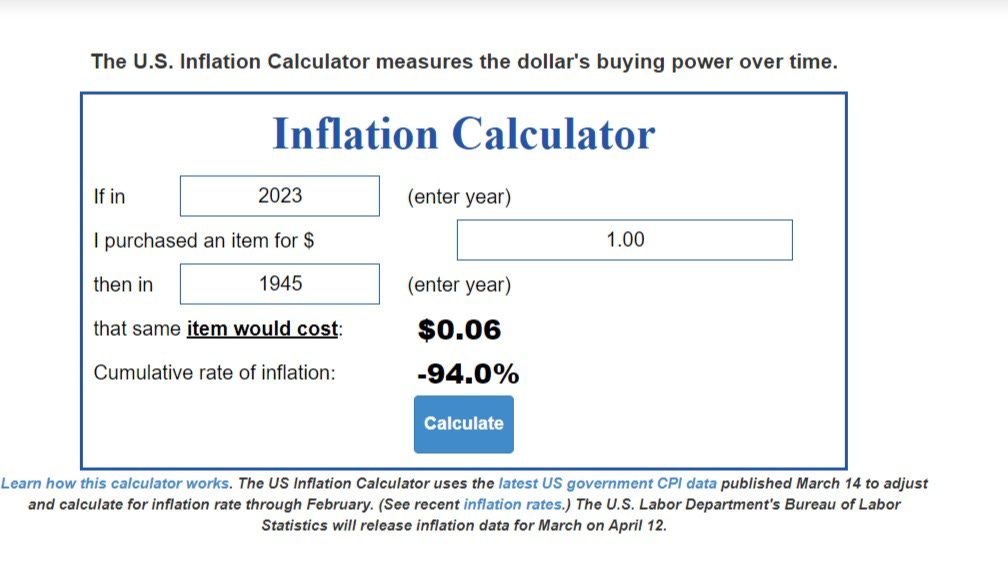

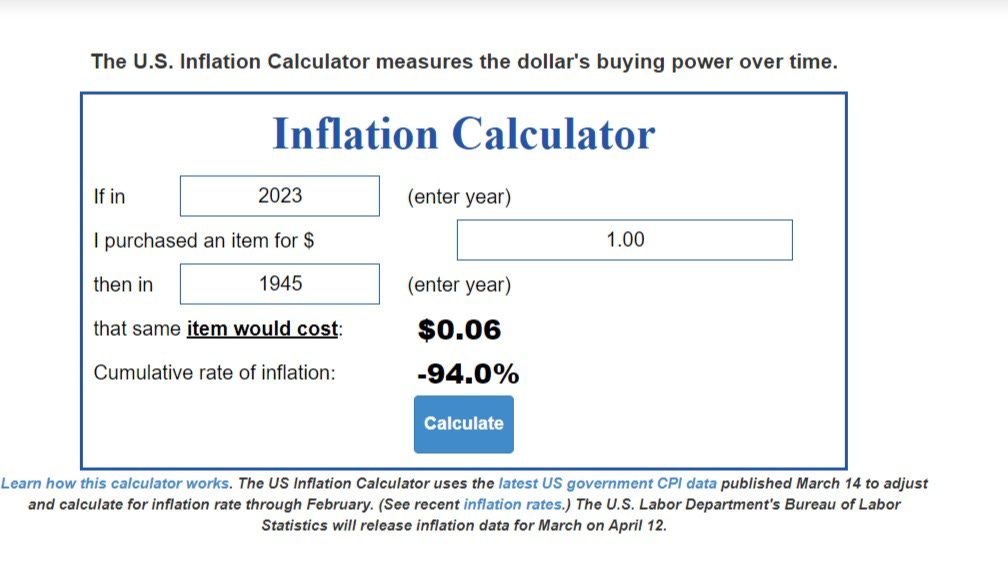

governments have always coveted the ability to control the money. once, they just took a % of all the gold and silver and copper they struck into coins for you. in a fiat system, they just print more money and devalue the cash everyone is holding. this creates massive sort term profits that accrue to those closest to the money printer when it goes BRRRRRRR! this is called the

cantillion effect. (named in 1600’s france, so hardly a new idea)

new money is inflationary, but not right away. the first person to spend one of these new dollars gets the old market price. but as more and more new dollars are spent and re-spent it drives price levels higher. maybe the second and third guys still get some benefit if they move fast enough. but at some point, far enough from the wellspring of made up money, this flip and you become a bagholder who is losing wealth. and this cycle rapidly accelerates as people get used to it. you wanna get that cash out of your hot little hands as fast as you can before someone else inflates it away. it’s a race to the bottom.