You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON [FINANCE] 2023 Banking Crisis DEATHBURGER Thread 2023.2.0 will UBS actually eat Credit Suisse before the Open???

- Thread starter night driver

- Start date

- Status

- Not open for further replies.

Demodave

Veteran member

Good morning Bubble head!Trump or MAGA it won’t matter. It is what your holding that will count. That same rat commie bastard that mocked you for some preps will come after it to eat when the truckers don’t or can’t roll. So it’s like I said DD it comes down to what you are holding not what they think.

Good morning Brother.

I dont think they will like what I'm holding....

jward

passin' thru

unusual_whales

@unusual_whales

27m

Switzerland’s emergency rescue of Credit Suisse, $CS, could cost $13,500 for each and every Swiss person, per Forbes.

Business profile picture

Financial Times

@FT

5m

First Republic shares rebound after Yellen signals support for smaller banks

View: https://twitter.com/FT/status/1638174054023827458?s=20

@unusual_whales

27m

Switzerland’s emergency rescue of Credit Suisse, $CS, could cost $13,500 for each and every Swiss person, per Forbes.

Business profile picture

Financial Times

@FT

5m

First Republic shares rebound after Yellen signals support for smaller banks

View: https://twitter.com/FT/status/1638174054023827458?s=20

TxGal

Day by day

Yep, and demonizing the Trump supporters and opposition party, it would seem.First I heard of it. Considering the source, (Newsweek/MSN) I'll consider it targeted incitement, not grass-roots.

MAN I AM STARVING OVER HERE!Seems like everyone one was all-in for a sudden-death burger...wonder why?

KMR58

Veteran Member

Sammy55

Veteran Member

Same here! I will take every extra day that I can get!We've been on the slow slide for decades now

..I ain't complainin, pokey is my favourite speed when approaching issues o' thekind!

And since I'm older and more decrepit, my speed is usually always pokey.

But ---- try to hurt my family and you'll see how fast I can move!!

The Hammer

Has No Life - Lives on TB

The week is young...they may super-size that before it's all done.Death burger so far this week...............................

View attachment 403704

Or not, as the case may turn out to be.

RememberGoliad

Veteran Member

Death burger so far this week...............................

View attachment 403704

But when the settlin'-up is done, even for that tiny thing, it's gonna be painful.

Hfcomms

EN66iq

Death burger so far this week...............................

View attachment 403704

The structural damage taking place to the financial system isn’t visible to the naked eye. The angst from the Federal government and the unlimited intervention announced by several global central banks indicates you need to upsize that burger quite a bit. They are scared $hitless that this is morphing out of control.

Watch: Yellen Tries To Reassure World That "The US Banking System Remains Sound"

BY TYLER DURDENTUESDAY, MAR 21, 2023 - 08:55 AM

Watch Treasury Secretary Janet Yellen will address bank leaders from across the country at the American Bankers Association's annual Washington Summit (due to start at 1000ET):

Read Yellen's prepared remarks below: (emphasis ours)

Good morning, everyone. Thank you, Rob, for your leadership of the American Bankers Association. I greatly appreciate the invitation to be with all of you at an important moment.

As everyone in this room knows, the American economy relies on a healthy banking system that can provide for the credit needs of families and businesses. American households depend on banks to finance their homes, invest in an education, and otherwise improve their standards of living. Businesses borrow from these institutions to start new companies and expand existing ones.

I. RECENT DEVELOPMENTS IN THE BANKING SYSTEM

Almost two weeks ago, we learned of problems at two banks that could have had significant impacts on the broader banking system and the economy. The situation demanded a swift response. In the days that followed, the federal government delivered just that: decisive and forceful actions to strengthen public confidence in the U.S. banking system and protect the American economy.Let me be clear: the government’s recent actions have demonstrated our resolute commitment to take the necessary steps to ensure that depositors’ savings and the banking system remain safe.

Our approach had two main pillars.

First, we worked with the Federal Reserve and FDIC to protect all depositors in the resolutions of Silicon Valley Bank and Signature Bank. The steps we took were not focused on aiding specific banks or classes of banks. Our intervention was necessary to protect the broader U.S. banking system. And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion. I believe that our actions reduced the risk of further bank failures that would have imposed losses on the Deposit Insurance Fund, which is paid for through fees on insured banks.

Second, we announced a new facility to provide additional liquidity to the banking system. The Fed’s new lending facility – the Bank Term Funding Program – is designed to help banks meet the needs of all of their depositors.

The situation is stabilizing. And the U.S. banking system remains sound. The Fed facility and discount window lending are working as intended to provide liquidity to the banking system. Aggregate deposit outflows from regional banks have stabilized.

As you know, 11 banks – including the very largest and some regional banks – announced $30 billion in deposits into First Republic Bank last week. This support represents a vote of confidence in our banking system.

We are continuing to monitor conditions closely. My team and I have been in close communication with many of you, in addition to federal and state regulators, other market participants, and international counterparts.

While we don’t yet have all the details about the collapse of the two banks, we do know that the recent developments are very different than those of the Global Financial Crisis. Back then, many financial institutions came under stress due to their holdings of subprime assets. We do not see that situation in the banking system today. Our financial system is also significantly stronger than it was 15 years ago. This is in large part due to post-crisis reforms that provided stronger capital standards, among other important improvements.

In the coming weeks, it will be vital for us to get a full accounting of exactly what happened in these bank failures. Regulators have already announced a review into Silicon Valley Bank. We are currently focused on the situation at hand. But we will need to reexamine our current regulatory and supervisory regimes and consider whether they are appropriate for the risks that banks face today. We all share an interest in ensuring that the United States remains the strongest and safest financial system in the world.

II. IMPORTANCE OF A BROAD AND DIVERSE BANKING SYSTEM

Given recent developments, I think it is important to reaffirm a broader point: our dynamic and diverse banking system is critical to the American economy. Large banks play an important role in our economy, but so do small- and mid-sized banks. These banks are heavily engaged in traditional banking services that provide vital credit and financial support to families and small businesses. They also increase competition in the banking sector, and often have specialized knowledge and expertise in the communities they invest in.Indeed, many of these banks have played an important role in supporting our economic recovery. In the depths of the pandemic, Treasury was tasked with getting money quickly and responsibly to those who needed it. So, we worked closely with many of you to send economic impact payments to millions of families. You’ve also worked with us to deliver advance payments from the enhanced Child Tax Credit – which helped cut child poverty nearly in half in 2021. And we’ve collaborated to rapidly deploy assistance to hundreds of thousands of homeowners facing foreclosure.

I also know that many of you are working with state governments to inject new financing into small businesses as part of our State Small Business Credit Initiative. In the prior iteration of this program, lenders with less than $10 billion in assets accounted for 95 percent of all program-supported loans. Our Administration has also been focused on working with mission-oriented banks to put us on a path toward inclusive economic growth. For example, Treasury’s Emergency Capital Investment Program has invested almost $8.4 billion in depository institutions that are CDFIs and MDIs.

Treasury is committed to ensuring the ongoing health and competitiveness of our vibrant community and regional banking institutions.

III. CONCLUSION

To end, let me return to where I started. A safe and sound banking system is integral to the health of the American economy. We are squarely focused on doing our job. And you should rest assured that we will remain vigilant.I look forward to continuing to work together to strengthen our banking system and our nation’s economy.

Thank you.

* * *

As we detailed earlier, the sound and fury of demands for universal deposit insurance are growing with Bill Ackman and Elon Musk the latest to join the calls for this ultimate step and as we detailed last night, Bloomberg reports Washington is studying just how to guarantee all $18 trillion in US deposits (with just $125 billion in the FDIC's Deposit Insurance Fund).

But since US Treasury Secretary Janet Yellen's embarrassing and confusing comments about who gets saved and who doesn't (and who decides) during testimony before the Senate Finance Committee, it appears Washington thinks trotting out the little old lady once more to reassure nervous depositors is the right path back to financial stability."US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis."

As Reuters reports, in excerpts of prepared remarks to an American Bankers Association conference, Yellen said government steps taken in recent days to protect uninsured deposits in two failed banks and create new Federal Reserve liquidity facilities have shown a "resolute commitment to take the necessary steps to ensure that depositors’ savings and the banking system remain safe."

But she immediately switches to try to quell any 'picking winners' sentiment by assuring her audience that:

And crucially, she claims they will rescue ALL depositors again...“The steps we took were not focused on aiding specific banks or classes of banks. Our intervention was necessary to protect the broader U.S. banking system,” Yellen said.

Of course, there is the obligatory - 'do not worry, there is nothing to see here' comment (or "it's contained")...“And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

Tell that to First Republic Bank shareholders...“The situation is stabilizing. And the U.S. banking system remains sound,” Yellen said.

“The Fed facility and discount window lending are working as intended to provide liquidity to the banking system. Aggregate deposit outflows from regional banks have stabilized.”

Specifically, the Treasury chief didn’t directly address the issue of temporarily expanding federal deposit insurance to cover all deposits in the excerpts released by the Treasury Department.

Of course, the only path to this is actual legislation, which means Congress (i.e. no executive order)...“Treasury is committed to ensuring the ongoing health and competitiveness of our vibrant community and regional banking institutions,” she said.

...and that means, don't hold your breath for any blanket unlimited size deposit insurance.“Any universal guarantee on all bank deposits, whether implicit or explicit, enshrines a dangerous precedent that simply encourages future irresponsible behavior to be paid for by those not involved who followed the rules,” the House Freedom Caucus said in a statement, and we are confident most of the progressive wing will not be too excited about bailing out billionaires and corporations with orders of magnitude more in the bank than the FDIC limit.

Watch: Yellen Tries To Reassure World That "The US Banking System Remains Sound" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

psychgirl

Has No Life - Lives on TB

I was kind of wondering if this had calmed down just a bitThe structural damage taking place to the financial system isn’t visible to the naked eye. The angst from the Federal government and the unlimited intervention announced by several global central banks indicates you need to upsize that burger quite a bit. They are scared $hitless that this is morphing out of control.

Truthsearch

Doom is ALWAYS 6 Months Away...

I was kind of wondering if this had calmed down just a bit

I’m pretty sure that everyone on the Titanic was calm too in the first few minutes after it hit the iceberg. People were still dancing, drinking, etc

Southside

Has No Life - Lives on TB

Always the best view, in my estimation.I can get behind that!

jward

passin' thru

Charles V Payne

@cvpayne

46s

Not sure but this sounds serious. Anyone else having the same problem? $AN

View: https://twitter.com/cvpayne/status/1638244133960577035?s=20

@cvpayne

46s

Not sure but this sounds serious. Anyone else having the same problem? $AN

View: https://twitter.com/cvpayne/status/1638244133960577035?s=20

Death burger so far this week.............

That is actually the picture of a real deathburger. Or just the empty tray ...

night driver

ESFP adrift in INTJ sea

Guys, it is ONLY Tuesday, and I have a nagging feeling that this week will have some fireworks before 5:30 Friday.

bw

Fringe Ranger

Agree. I'm going out to work on the orchard some more. No point sitting here watching it play out.Guys, it is ONLY Tuesday, and I have a nagging feeling that this week will have some fireworks before 5:30 Friday.

Codeno

Veteran Member

Just got an email from the podunk town of 400 souls toy bank down the road that says regardless of what we might be seeing in the news, our deposits are "safe, sound and secure."

I never trusted them in the first place, and they never bothered telling us this before - if this was supposed to calm their small herd, I'm thinking backfire. Sometimes there is nothing left to do but laugh.

I never trusted them in the first place, and they never bothered telling us this before - if this was supposed to calm their small herd, I'm thinking backfire. Sometimes there is nothing left to do but laugh.

The Hammer

Has No Life - Lives on TB

The fact that they have to even say it makes one less confident...Just got an email from the podunk town of 400 souls toy bank down the road that says regardless of what we might be seeing in the news, our deposits are "safe, sound and secure."

I never trusted them in the first place, and they never bothered telling us this before - if this was supposed to calm their small herd, I'm thinking backfire. Sometimes there is nothing left to do but laugh.

coalcracker

Veteran Member

Just picked up two additional 7 gallon water containers from the camping section at Wal Mart ($20 each). Don’t really need more, but since they come with a spigot that threads thru the lid, I figure I’ll be able to wash down any Deathburger Yellin and pals are serving. Yum, yum.

Less fiat and more “stuff.”

Less fiat and more “stuff.”

KMR58

Veteran Member

I received an email yesterday from our small town credit union. Same message.Just got an email from the podunk town of 400 souls toy bank down the road that says regardless of what we might be seeing in the news, our deposits are "safe, sound and secure."

I never trusted them in the first place, and they never bothered telling us this before - if this was supposed to calm their small herd, I'm thinking backfire. Sometimes there is nothing left to do but laugh.

Hfcomms

EN66iq

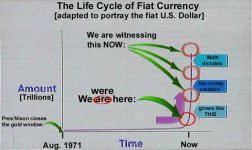

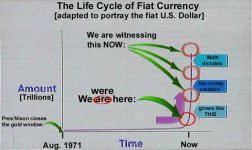

Liquidity is drying up and that is what is scaring the central banks. Once again the banks are not lending to each other and are not making loans. In a ponzi fiat currency scheme new cash has to constantly be brought into existence or the whole game is over. Once again my favorite graphic;

It's deadly serious because if credit seizes up the whole system comes to a halt with nobody being willing/able to extend credit. What that means is not only do the credit cards and ATM's not work but even to get a simple loaf of bread on the store shelves requires at least a half dozen or more uses of credit along the way.

The farmer needs credit for his seeds and for the fuel for his tractors, fertilizer and harvesters. The wheat once processed needs to be trucked to the mill (credit), the mill has to grind the wheat into flour and operate it's business (credit). The flour has to be trucked to the warehouses (credit) and then from the warehouses to the bakeries (credit) and then the bakery needs credit to run it's business and then to truck the bread to the stores (more credit).

Liquidity/credit is the grease the lubricates the gears of commerce and at any point along the way credit is impaired the food isn't hitting the shelves or any of the widgets we depend on for modern life. That is why the central banks are falling all over themselves now doing daily currency swaps.

March 19, 2023

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

To improve the swap lines' effectiveness in providing U.S. dollar funding, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 20, 2023, and will continue at least through the end of April.

The network of swap lines among these central banks is a set of available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses.

For media inquiries, please email media@frb.gov or call 202-452-2955

Coordinated central bank action to enhance the provision of U.S. dollar liquidity

Not only is this not over....it's just begun.

It's deadly serious because if credit seizes up the whole system comes to a halt with nobody being willing/able to extend credit. What that means is not only do the credit cards and ATM's not work but even to get a simple loaf of bread on the store shelves requires at least a half dozen or more uses of credit along the way.

The farmer needs credit for his seeds and for the fuel for his tractors, fertilizer and harvesters. The wheat once processed needs to be trucked to the mill (credit), the mill has to grind the wheat into flour and operate it's business (credit). The flour has to be trucked to the warehouses (credit) and then from the warehouses to the bakeries (credit) and then the bakery needs credit to run it's business and then to truck the bread to the stores (more credit).

Liquidity/credit is the grease the lubricates the gears of commerce and at any point along the way credit is impaired the food isn't hitting the shelves or any of the widgets we depend on for modern life. That is why the central banks are falling all over themselves now doing daily currency swaps.

March 19, 2023

Coordinated central bank action to enhance the provision of U.S. dollar liquidity

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

To improve the swap lines' effectiveness in providing U.S. dollar funding, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 20, 2023, and will continue at least through the end of April.

The network of swap lines among these central banks is a set of available standing facilities and serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses.

For media inquiries, please email media@frb.gov or call 202-452-2955

Coordinated central bank action to enhance the provision of U.S. dollar liquidity

Not only is this not over....it's just begun.

naegling62

Veteran Member

Be sure not to store them in the attic. I did that and they disintegrated.Just picked up two additional 7 gallon water containers from the camping section at Wal Mart ($20 each). Don’t really need more, but since they come with a spigot that threads thru the lid, I figure I’ll be able to wash down any Deathburger Yellin and pals are serving. Yum, yum.

Less fiat and more “stuff.”

Charles Gasparino

@CGasparino

·

56m

SCOOP (1/2): Bankers

@jpmorgan working on @firstrepublic

are facing difficulties finding a buyer without a significant government backstop. One last-ditch solution that has been discussed: Selling warrants in the bank to the government in exchage for capital. First Republic

SCOOP (2/2) remains a private co. The situation is fluid, and all options including a sale are still on the table. Bankers believe the biggest problem for First Republic is stabilizing the bank. Then they will move to fix its biz model and then find a buyer. More 345 @FoxBusiness

Can't find a buyer, selling warrants to the .gov? Why would rescue FRB after letting Signature and SVB go bankrupt? Is it because there isn't reserves enough in FDIC and they know they would have to leave depositors in the dirt and restart the bank runs? Is there a tub of sludge there they want to keep from spreading? Interesting.

@CGasparino

·

56m

SCOOP (1/2): Bankers

@jpmorgan working on @firstrepublic

are facing difficulties finding a buyer without a significant government backstop. One last-ditch solution that has been discussed: Selling warrants in the bank to the government in exchage for capital. First Republic

SCOOP (2/2) remains a private co. The situation is fluid, and all options including a sale are still on the table. Bankers believe the biggest problem for First Republic is stabilizing the bank. Then they will move to fix its biz model and then find a buyer. More 345 @FoxBusiness

Can't find a buyer, selling warrants to the .gov? Why would rescue FRB after letting Signature and SVB go bankrupt? Is it because there isn't reserves enough in FDIC and they know they would have to leave depositors in the dirt and restart the bank runs? Is there a tub of sludge there they want to keep from spreading? Interesting.

Hfcomms

EN66iq

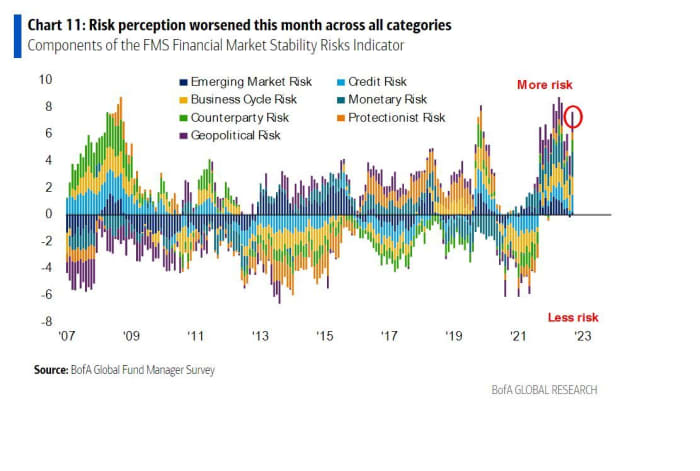

Fund managers fear a ‘systemic credit event’ as the biggest threat to markets: Bank of America

Last Updated: March 21, 2023 at 10:42 a.m. ETFund managers fear that a systemic credit crunch is the biggest tail risk this month, Bank of America strategists have said following data from their latest poll.

The bank’s latest global fund manager survey found 31% of the 212 fund managers polled elected systemic credit crunch as the biggest threat to markets, followed by 25% choosing stubborn inflation as the largest tail risk.

The most likely sources of a credit event, participants say, are U.S. shadow banking, U.S. corporate debt and developed-market real estate.

The participants, which manage $548 billion under management, were surveyed between Mar. 10 -16, in the midst of the bank panic when Silicon Valley Bank SIVB, -60.41%, followed by Signature Bank SBNY, -22.87%, collapsed.

Regarding interest rates, investors see an additional 75 basis points of Federal Reserve rate hikes in this cycle with rates peaking at 5.25%-5.5%. Almost a quarter expect the European Central Bank to lift its deposit rate by an additional 50 basis points. Almost two thirds (65%) say the Fed will not raise its 2% inflation target over the next 2 years. And nearly six in 10 (57%) investors expect lower short-term rates in the next 12 months.

Read: Elon Musk says Fed should cut interest rates by half-point after Bill Ackman asks for pause

Michael Hartnett, BofA investment strategist, said in the report that investor sentiment is near “levels of pessimism seen at lows of past 20 years” and the S&P 500 index SPX, +1.30% could see a floor of 3,800 and investors should look to fade any rallies when the index benchmark hits between 4,100 and 4,200.

The S&P 500 is down 3% in the last month and has gained almost 3% so far this year.

Additionally, investor fears of a recession are stronger than last month. Over four in 10 (a net of 42%) of fund managers say a recession is headed in the next 12 months. As these concerns grow, more investors (55%) are urging corporates to improve their balance sheets.

The survey also found fund managers are more bullish on Eurozone stocks than U.S. stock, the most overweight they have been on Europe since October 2017. They added that the most crowded trades include long European equities, long U.S. dollar and long China equities.

In the past month, investors rotated out of stocks in the banking, consumer, and REITs sectors, the report said, but they have dived into Eurozone stocks, staples, and bonds.

Fund managers fear a ‘systemic credit event’ as the biggest threat to markets: Bank of America

Fund managers said the biggest tail risk for March was a systemic credit crunch, according to Bank of America’s latest global fund manager survey.

parsonswife

Veteran Member

The only advantage to slow and agonizing is it gives us another few days, months. To prepare and Maybe another paycheck or two.Slow = agonizing (amt of stupidity, wrong moves, and blame-games) to my way of thinking.

Big and fast = ripping the bandaid off & letting fresh air & sunshine into those long-closed off smoke filled rooms where we were all sold down the river...

20Gauge

TB Fanatic

Not really. We just have as much fear and fewer banks to deal with the issue in the future.I was kind of wondering if this had calmed down just a bit

At some point it is going to be a Taco Bell situation.

There is ENDLESS liquidity. Do not believe bankster lies.

What there is not is endless money to backstop the digital liquidity. Money is money because it is, it exists. It requires no backstop, no second party guarantor/payer.

What money is considered to be now is the biggest lie of the modern era. Please do not buy the lie any more -final exam time is upon us and there is only one question. The test is pass/fail.

What there is not is endless money to backstop the digital liquidity. Money is money because it is, it exists. It requires no backstop, no second party guarantor/payer.

What money is considered to be now is the biggest lie of the modern era. Please do not buy the lie any more -final exam time is upon us and there is only one question. The test is pass/fail.

Southside

Has No Life - Lives on TB

And yet, Gold went down $40.There is ENDLESS liquidity. Do not believe bankster lies.

Our criminal .Gov at work.

SmithJ

Veteran Member

Money is effectively whatever people accept as money. Until they don't; be it digits, paper, grains of corn or gold.There is ENDLESS liquidity. Do not believe bankster lies.

What there is not is endless money to backstop the digital liquidity. Money is money because it is, it exists. It requires no backstop, no second party guarantor/payer.

What money is considered to be now is the biggest lie of the modern era. Please do not buy the lie any more -final exam time is upon us and there is only one question. The test is pass/fail.

It is a medium of exchange, nothing more.

TxGal

Day by day

I'm still trying to wrap my head around a deflationary depression...

www.zerohedge.com

www.zerohedge.com

TUESDAY, MAR 21, 2023 - 04:25 PM

Authored by Robert Stark via Substack,

Despite countless signs of economic volatility, the recent bank failures, with shockwaves to the entire financial system, are a turning point, where it is clear that there is going to be a severe economic downturn. For instance, Elon Musk recently said, lot of current year similarities to 1929, and Moody’s cut the outlook on the entire U.S. banking system to negative from stable, citing a "rapidly deteriorating operating environment." Even the perma bulls, mainstream media, and financial “experts,” can no longer deny the obvious signs of economic peril. However, the bullish propaganda was still strong as recently as January, which was really the bulls’ last gasp, with the monkey rally, in response to the Fed only raising interest rates by .25 points, plus economic data showing record low unemployment plus a dip in inflation.

It is important to emphasize that the same figures in media, banking, and government, who were recently shilling a soft landing or mild recession, were previously saying that inflation is transitory. It is especially laughable to think that there are people who take someone like CNBC’s, Jim Cramer, seriously, who in 2008 told his audience don’t be silly on Bear Stearns, right before it crashed, and more recently shilled for Silicon Valley Bank, and is still predicting a soft landing. A lot of the recent propaganda is practically identical to right before the 08 crash, as well as during stagflation in the 70s, and even before the Great Depression, as the media has vested economic and political interests in propping up the markets. The financial YouTuber, Maverick of Wall Street, brilliantly uses this “self-love” gif of Jack Nicholson, from the film, One Flew Over the Cuckoo’s Nest, as a metaphor for whenever perma-bulls see any data that may signify a Fed pivot, causing stocks to rally. As the desperation really kicks in, expect further talk of a soft landing, as well as more rallies in stocks, as we saw in response to the bailouts, as well as desperate investors switching back and forth between the NASDAQ and S&P500, which happened in 08. So any return to bullish sentiment is actually a sign of greater economic catastrophe. The stock market rallying over bad economy news, as a sign of a potential pivot, just further shows that the markets are not a good metric for the health of the economy. Not to mention that the top 1% own over half of all stocks.

It has always been the case with bubbles, that the greater the size of the bubble, the more copes to deny reality, and the more vested interests there are in preventing the inevitable crash. Certainly many corporations and banks have made economic decisions based upon an assumption of a soft landing or Fed pivot. This also explains the gaslighting to justify that the 2010s economic boom, especially in tech, was based upon productivity and innovation, when it was primary due to Fed monetary policy, plus data mining in the case of Big Tech. While it is silly for conservatives to blame wokeness as the primary culprit of bank failures, wokeness and bullshit DEI jobs, are a symptom of the corruption that Fed policy enabled.

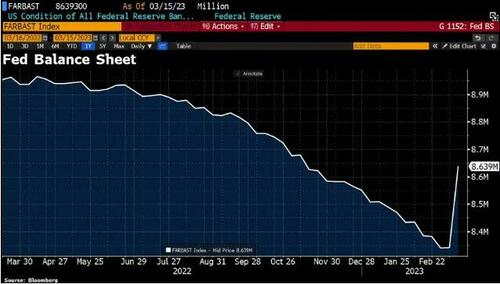

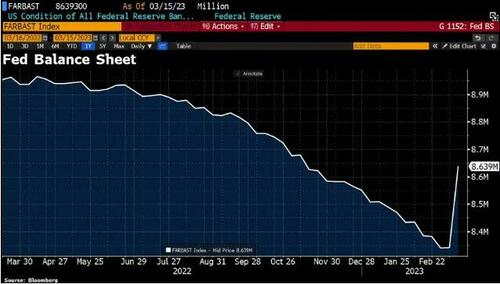

Fed Balance Sheet: Return to QE

Source

The current banking crisis is triggering more stock buybacks, and a return to Quantitative Easing with the bank bailouts, including plans to inject another $2 Trillion into the banking system, on top of the $300 billion increase in the Fed’s Balance Sheet, in just the last week. This seems counter intuitive, as QE caused inflation, but the economy is so addicted to the “Cocaine,” that is cheap money. So basically quantitative tightening is being implemented and interest rates raised to stop inflation, but as soon as the first major economic disruption of raising rates is felt, then a return to financial policies to further prop up the bubble, causing more inflation. Now the Fed is trapped with two bad options, raise rates or pivot, both of which will lead to inevitable economic doom.

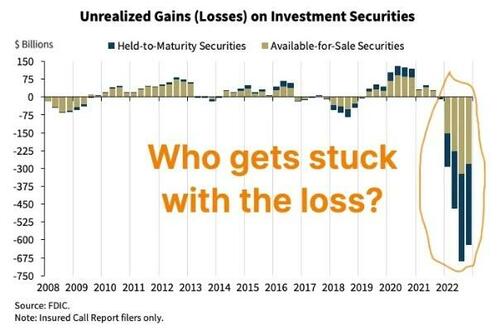

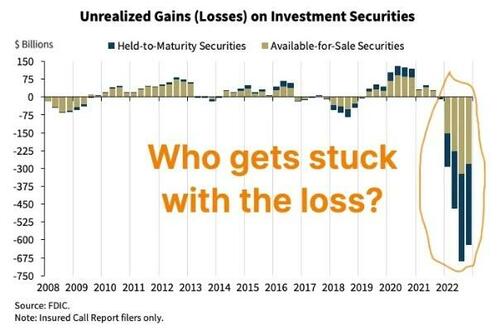

Populists can talk about nationalizing the banks into public debt free banking, and Austrian School libertarians can call for ending the Fed, and returning to a gold standard. While it is true that the Federal Reserve is a corrupt system, that is quasi private in how private banks own shares, the reality is that we are stuck with this system of relying upon the Fed’s interest rates, for the incoming economic crisis. If the Fed continues raising rates, there will be a liquidity crisis, with more bank failures. While interest rates were close to zero, banks used uninsured deposits to both invest in securities and purchase bonds, and thanks to fractional reserve banking, banks are only required to hold a fraction of deposits. So when rates rose, bonds fell in value and unrealized losses surged, so the banks were not able to pay off their depositors.

source

Regional banks make up about half of all US banking, so any contagion in the banking system, as people and businesses move their deposits to mega banks, deemed “too big to fail,” could trigger a Depression. One of the main reasons that the economy has not crashed sooner is because more people have been tapping into their savings and maxing out their credit cards. However, high interest rates will cause many people to default on their credit card debt, which will exacerbate the banking crisis. Not to mention Auto loans defaults wiping out credit unions, and the potential for another mortgage crisis, due to rising mortgage rates. There is a ripple effect, as far as rising interest rates being felt by debt holders, and now is just the tip of the iceberg. This could end up being a multifaceted debt crisis, in banking, corporate debt, personal debt, and government debt.

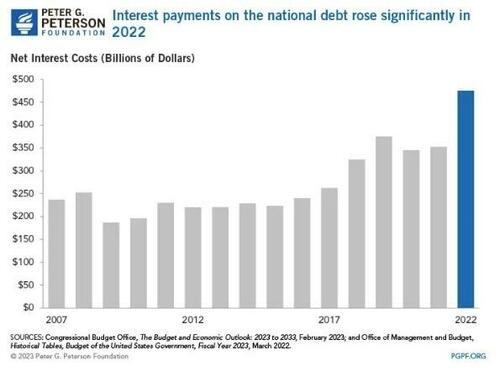

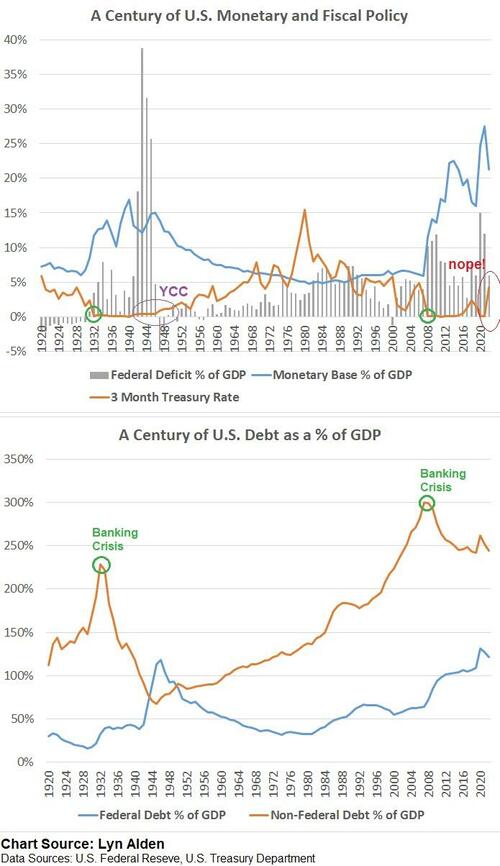

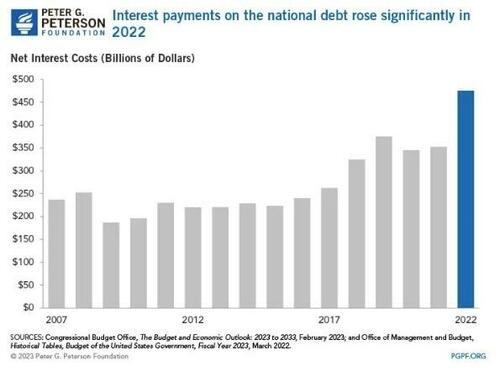

Besides the Fed likely pivoting soon due to the banking crisis, higher rates will make interest payments on the National Debt too expensive to pay off, risking a default on government debt. Overall levels of debt, both public and private, are much worse than when Fed Chair, Volcker, raised rates very high to successfully quell inflation. Any freeze in Federal spending or a default on the national debt, in response to the debt ceiling, will crash the economy, and any major extension in the debt ceiling will accelerate inflation. There is a good chance that inflation will be tolerated, with the dollar greatly devalued, to make government debt cheaper so that creditors eat the costs.

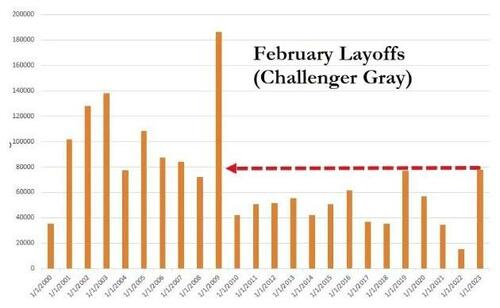

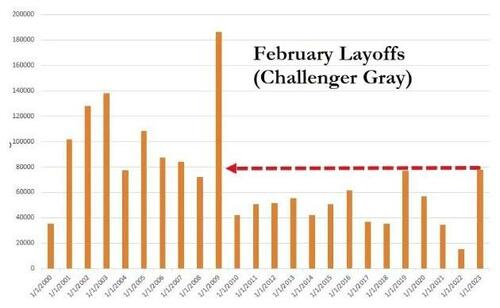

Source: Peter G. Peterson Foundation

A tight labor market is the main case that the bulls make to prove a strong economy. However, the official BLS jobs numbers are “baked” to exclude those who have given up on seeking employment, as well as counting 2nd or 3rd jobs. Not to mention that the BLS numbers were exposed by the Fed as overstating 1 million jobs during 2022. Even if one accepts the “baked” numbers, layoffs have a lagging effect on unemployment, including by industry (eg. tech layoffs before service sector). Now new jobless claims have grown at the fastest pace since Lehman'. It is also noteworthy that just about every recession has been preceded by low unemployment numbers. The increase in layoffs will put further pressure on the Fed to pivot, which on top of increased unemployment benefits, will cause inflation to surge again. This creates another doom loop, as inflation leads to more unemployment, as consumers are forced to cut back on spending.

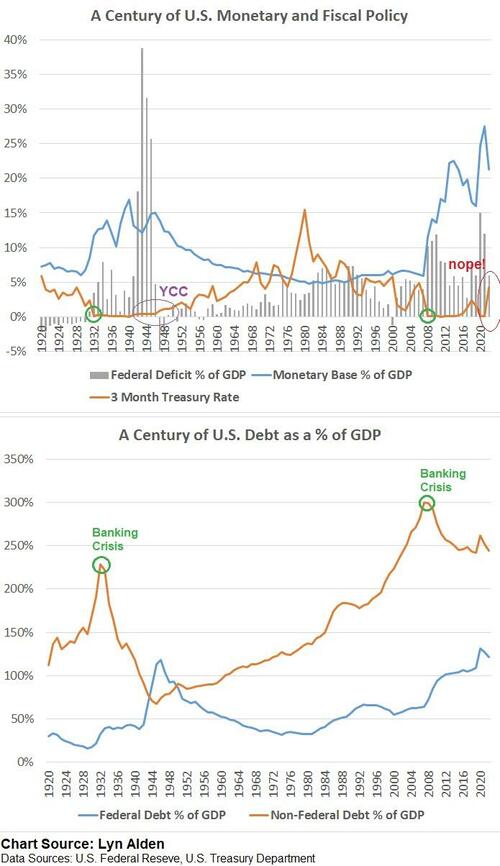

Source: ZeroHedge

While bulls can say that this time is different from past crashes, all of the signs are pointing to this crisis being much worse than previous crashes. For instance, the economic recovery, after Volcker was done raising rates to fight inflation, was possible because of lower levels of debt, but the US has never entered a recession with debt/GDP at 125% and deficit/GDP at 7% in at least 85 years. Also the fallout of the 2008 crash was mitigated by a strong dollar, which also minimized the effects of inflation last year, but inflation will surge if the dollar is weakened. Despite signs of a pivot, the Fed has been moving much faster to fight inflation, then in the past, even with Volker. This crisis is also unique in that rates are being raised while entering a severe recession, and inflation could coincide mass layoffs. While the general assumption is that severe economic downturns are deflationary, financial commentator, Peter Schiff, makes a compelling case as for why an Inflationary Depression is a likelihood. Under this nightmare scenario, which would be much worse than even the Great Depression, inflation will negate any of the remedies that ended past crises, such as the New Deal, quantitative easing in 08, and the covid stimulus. Other signs of economic peril include, the steepest yield curve inversion since the early 80s recession, which is a barometer that has predicted just about every single recession, a major decline in ISM manufacturing sales, a big decline in savings rates, and Americans’ credit card debt approaching a record $1 Trillion.

source

This is the perfect storm with inflation, stagflation, recession, a potential debt crisis, as well as energy and supply chain issues. With this bubble to end all bubbles or too big to fail on steroids, the Fed has two choices, cause a liquidity crisis by shrinking the money supply, or letting inflation rip. While raising rates appears to be the least bad of these two options, further rate hikes are futile with the return of QE. A combo of QE plus interest rates having to remain high, is what could lead to that scenario of inflationary financial collapse, that Peter Schiff warned about. Though most likely it will either be long term stagflation or a deflationary Depression. This is not a hyperbole, nor clickbait, but a Depression is a very real possibility, especially if policy makers continue to kick the can down the road, to prop up the bubble.

* * *

Subscribe to Robert Stark's Newsletter

Economic Death Spiral | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Economic Death Spiral

BY TYLER DURDENTUESDAY, MAR 21, 2023 - 04:25 PM

Authored by Robert Stark via Substack,

Fed Trap: Financial Collapse or Hyper Inflation?

With this banking crisis, which has serious Lehman vibes, it is a good time to revisit my article, Is This The End of The End of History, from March of last year. The article dealt with the theme of collapse vs stagnation, and historical cycles, in light of the Ukraine war, the post-pandemic climate, the onset of inflation, and speculation about economic collapse. A point of mine, that has especially been vindicated, is that “a delay in the Fed raising interest rates, could cause a short term rally in stocks, further expanding the bubble. The bigger the bubble, the worse inflation gets, and the longer the Fed keeps delaying raising rates, the worse the crash will be down the road.” For the most part, most of my geopolitical and economic forecasts have come true, though I actually predicted an economic collapse to occur sooner, which actually vindicates that point, that kicking the can down the road will just create a much worse crisis.Despite countless signs of economic volatility, the recent bank failures, with shockwaves to the entire financial system, are a turning point, where it is clear that there is going to be a severe economic downturn. For instance, Elon Musk recently said, lot of current year similarities to 1929, and Moody’s cut the outlook on the entire U.S. banking system to negative from stable, citing a "rapidly deteriorating operating environment." Even the perma bulls, mainstream media, and financial “experts,” can no longer deny the obvious signs of economic peril. However, the bullish propaganda was still strong as recently as January, which was really the bulls’ last gasp, with the monkey rally, in response to the Fed only raising interest rates by .25 points, plus economic data showing record low unemployment plus a dip in inflation.

It is important to emphasize that the same figures in media, banking, and government, who were recently shilling a soft landing or mild recession, were previously saying that inflation is transitory. It is especially laughable to think that there are people who take someone like CNBC’s, Jim Cramer, seriously, who in 2008 told his audience don’t be silly on Bear Stearns, right before it crashed, and more recently shilled for Silicon Valley Bank, and is still predicting a soft landing. A lot of the recent propaganda is practically identical to right before the 08 crash, as well as during stagflation in the 70s, and even before the Great Depression, as the media has vested economic and political interests in propping up the markets. The financial YouTuber, Maverick of Wall Street, brilliantly uses this “self-love” gif of Jack Nicholson, from the film, One Flew Over the Cuckoo’s Nest, as a metaphor for whenever perma-bulls see any data that may signify a Fed pivot, causing stocks to rally. As the desperation really kicks in, expect further talk of a soft landing, as well as more rallies in stocks, as we saw in response to the bailouts, as well as desperate investors switching back and forth between the NASDAQ and S&P500, which happened in 08. So any return to bullish sentiment is actually a sign of greater economic catastrophe. The stock market rallying over bad economy news, as a sign of a potential pivot, just further shows that the markets are not a good metric for the health of the economy. Not to mention that the top 1% own over half of all stocks.

It has always been the case with bubbles, that the greater the size of the bubble, the more copes to deny reality, and the more vested interests there are in preventing the inevitable crash. Certainly many corporations and banks have made economic decisions based upon an assumption of a soft landing or Fed pivot. This also explains the gaslighting to justify that the 2010s economic boom, especially in tech, was based upon productivity and innovation, when it was primary due to Fed monetary policy, plus data mining in the case of Big Tech. While it is silly for conservatives to blame wokeness as the primary culprit of bank failures, wokeness and bullshit DEI jobs, are a symptom of the corruption that Fed policy enabled.

Fed Balance Sheet: Return to QE

Source

The current banking crisis is triggering more stock buybacks, and a return to Quantitative Easing with the bank bailouts, including plans to inject another $2 Trillion into the banking system, on top of the $300 billion increase in the Fed’s Balance Sheet, in just the last week. This seems counter intuitive, as QE caused inflation, but the economy is so addicted to the “Cocaine,” that is cheap money. So basically quantitative tightening is being implemented and interest rates raised to stop inflation, but as soon as the first major economic disruption of raising rates is felt, then a return to financial policies to further prop up the bubble, causing more inflation. Now the Fed is trapped with two bad options, raise rates or pivot, both of which will lead to inevitable economic doom.

Populists can talk about nationalizing the banks into public debt free banking, and Austrian School libertarians can call for ending the Fed, and returning to a gold standard. While it is true that the Federal Reserve is a corrupt system, that is quasi private in how private banks own shares, the reality is that we are stuck with this system of relying upon the Fed’s interest rates, for the incoming economic crisis. If the Fed continues raising rates, there will be a liquidity crisis, with more bank failures. While interest rates were close to zero, banks used uninsured deposits to both invest in securities and purchase bonds, and thanks to fractional reserve banking, banks are only required to hold a fraction of deposits. So when rates rose, bonds fell in value and unrealized losses surged, so the banks were not able to pay off their depositors.

source

Regional banks make up about half of all US banking, so any contagion in the banking system, as people and businesses move their deposits to mega banks, deemed “too big to fail,” could trigger a Depression. One of the main reasons that the economy has not crashed sooner is because more people have been tapping into their savings and maxing out their credit cards. However, high interest rates will cause many people to default on their credit card debt, which will exacerbate the banking crisis. Not to mention Auto loans defaults wiping out credit unions, and the potential for another mortgage crisis, due to rising mortgage rates. There is a ripple effect, as far as rising interest rates being felt by debt holders, and now is just the tip of the iceberg. This could end up being a multifaceted debt crisis, in banking, corporate debt, personal debt, and government debt.

Besides the Fed likely pivoting soon due to the banking crisis, higher rates will make interest payments on the National Debt too expensive to pay off, risking a default on government debt. Overall levels of debt, both public and private, are much worse than when Fed Chair, Volcker, raised rates very high to successfully quell inflation. Any freeze in Federal spending or a default on the national debt, in response to the debt ceiling, will crash the economy, and any major extension in the debt ceiling will accelerate inflation. There is a good chance that inflation will be tolerated, with the dollar greatly devalued, to make government debt cheaper so that creditors eat the costs.

Source: Peter G. Peterson Foundation

A tight labor market is the main case that the bulls make to prove a strong economy. However, the official BLS jobs numbers are “baked” to exclude those who have given up on seeking employment, as well as counting 2nd or 3rd jobs. Not to mention that the BLS numbers were exposed by the Fed as overstating 1 million jobs during 2022. Even if one accepts the “baked” numbers, layoffs have a lagging effect on unemployment, including by industry (eg. tech layoffs before service sector). Now new jobless claims have grown at the fastest pace since Lehman'. It is also noteworthy that just about every recession has been preceded by low unemployment numbers. The increase in layoffs will put further pressure on the Fed to pivot, which on top of increased unemployment benefits, will cause inflation to surge again. This creates another doom loop, as inflation leads to more unemployment, as consumers are forced to cut back on spending.

Source: ZeroHedge

While bulls can say that this time is different from past crashes, all of the signs are pointing to this crisis being much worse than previous crashes. For instance, the economic recovery, after Volcker was done raising rates to fight inflation, was possible because of lower levels of debt, but the US has never entered a recession with debt/GDP at 125% and deficit/GDP at 7% in at least 85 years. Also the fallout of the 2008 crash was mitigated by a strong dollar, which also minimized the effects of inflation last year, but inflation will surge if the dollar is weakened. Despite signs of a pivot, the Fed has been moving much faster to fight inflation, then in the past, even with Volker. This crisis is also unique in that rates are being raised while entering a severe recession, and inflation could coincide mass layoffs. While the general assumption is that severe economic downturns are deflationary, financial commentator, Peter Schiff, makes a compelling case as for why an Inflationary Depression is a likelihood. Under this nightmare scenario, which would be much worse than even the Great Depression, inflation will negate any of the remedies that ended past crises, such as the New Deal, quantitative easing in 08, and the covid stimulus. Other signs of economic peril include, the steepest yield curve inversion since the early 80s recession, which is a barometer that has predicted just about every single recession, a major decline in ISM manufacturing sales, a big decline in savings rates, and Americans’ credit card debt approaching a record $1 Trillion.

source

This is the perfect storm with inflation, stagflation, recession, a potential debt crisis, as well as energy and supply chain issues. With this bubble to end all bubbles or too big to fail on steroids, the Fed has two choices, cause a liquidity crisis by shrinking the money supply, or letting inflation rip. While raising rates appears to be the least bad of these two options, further rate hikes are futile with the return of QE. A combo of QE plus interest rates having to remain high, is what could lead to that scenario of inflationary financial collapse, that Peter Schiff warned about. Though most likely it will either be long term stagflation or a deflationary Depression. This is not a hyperbole, nor clickbait, but a Depression is a very real possibility, especially if policy makers continue to kick the can down the road, to prop up the bubble.

* * *

Subscribe to Robert Stark's Newsletter

Hfcomms

EN66iq

RT 20 minutes

Very timely. BOA warns of systemic credit event referenced in post 230.

- Status

- Not open for further replies.