Henry Bowman

Veteran Member

It's almost like being Groucho.Is transitory hyperinflation kinda like peaceful protests?

You will most assuredly get paid Next Tuesday ....See Transitory

It's almost like being Groucho.Is transitory hyperinflation kinda like peaceful protests?

Groucho's payments are nothing if not transitory...It's almost like being Groucho.

You will most assuredly get paid Next Tuesday ....See Transitory

Groucho's payments are nothing if not transitory...

It's almost like being Groucho.

You will most assuredly get paid Next Tuesday ....See Transitory

Instead of " Orange man bad " the new phrase will be " senile man bad "Very dark days are ahead, and those that are trusting Joe Biden to save America are going to be bitterly, bitterly disappointed.

TWO bitterlys. I'm not into that.

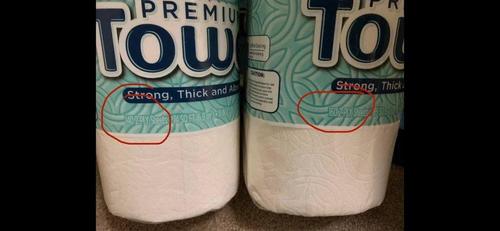

... the obvious next step will be to no longer bother with such attempts at masking double digit inflation, and to hike prices outright until there is an actual decline in supply, or as TBT predicts, "this is the precursor to real inflation next." And sure enough, names from consumer giants from Kimberly-Clark to Clorox, Procter & Gamble, as well as food makers such as Hormel, JM Smucker, General Mills, Skippy and Hershey are already doing just that.I tried telling the clerk at Costco about this, and they said “who cares, it’s just 20 sheets.”

Will be the typical response.

Wife is going crazy over cost of bedding plants

can’t find seed potatoes

This is gonna be another sucky year

I have always been taught it is 3 digit inflation, but that was never a hard target.Hyper inflation? Here's an article on that. What Causes Hyperinflation

The main takeaway is that hyper inflation is a rate of 50% of inflation per month!

Here's an example as shown in this article; "Imagine the cost of food shopping going from $500 per week to $750 per week the next month, to $1,125 per week the next month and so on. If wages aren't keeping pace with inflation in an economy, the standard of living for the people goes down because they can't afford to pay for their basic needs and cost of living expenses."

Not that I'm necessarily doing it, but I would suggest laying in a really good stock of food that stores well. A year's supply isn't out of the question. Think ammo. Some of you really wish you had bought early and often. It's the same with food. Don't get left standing at the station when the train pulls out.

I remember past computer chip shortages from decades past when I worked in the industry, they never lasted less than 18 months.

Get Ready For The Most Painful Inflation Since The Jimmy Carter Years Of The 1970s

If you are too young to have been alive during the 1970s, you might want to read up on that decade, because current economic conditions are starting to become eerily similar to what we experiencedthemostimportantnews.com

Get Ready For The Most Painful Inflation Since The Jimmy Carter Years Of The 1970s

May 2, 2021

FacebookTwitterSubscribe

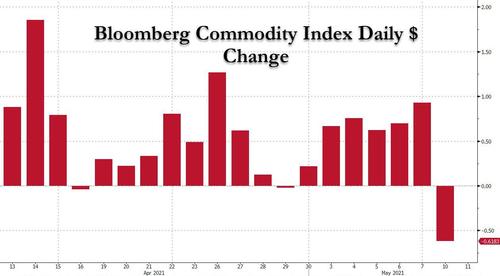

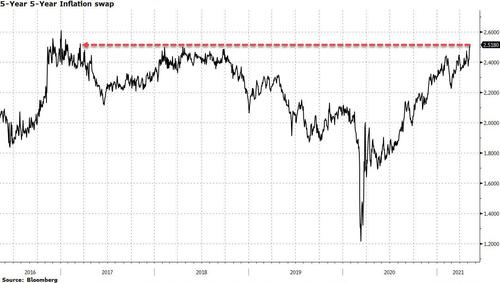

If you are too young to have been alive during the 1970s, you might want to read up on that decade, because current economic conditions are starting to become eerily similar to what we experienced back then. In the 1970s, an energy crisis caused tremendously long lines at gas stations all over the country. In 2021, we don’t have a shortage of gasoline, but shortages of other key products are starting to cause very serious problems. In fact, as you will see below, even the Biden administration is publicly admitting that there will be “supply chain disruptions” in the months ahead. The 1970s also featured extremely painful inflation, and I certainly don’t need to tell you that prices have been rising very aggressively lately. In fact, Bloomberg is using the term “skyrocketing” to describe the “upward trajectory” of commodity prices…

Over the past year, the Federal Reserve has pumped more money into the financial system than ever before, and the U.S. government has been on a wild spending spree that makes Zimbabwe look fiscally conservative.

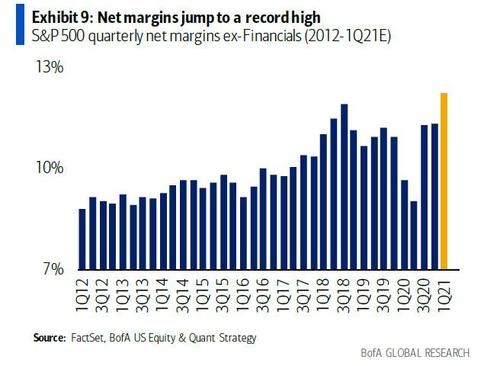

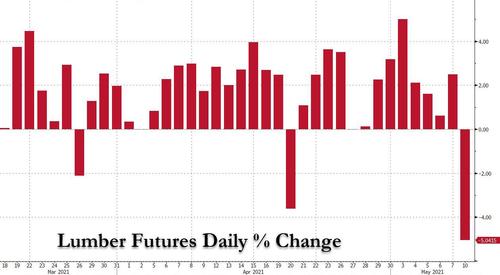

It was inevitable that this was going to cause rampant inflation, but the numbers that we are starting to see are so crazy they are difficult to believe. A couple weeks ago, Charlie Bilello posted a summary of how commodity prices have changed over the past year…

Lumber: +265%

WTI Crude: +210%

Gasoline: +182%

Brent Crude +163%

Heating Oil: +107%

Corn: +84%

Copper: +83%

Soybeans: +72%

Silver: +65%

Sugar: +59%

Cotton: +54%

Platinum: +52%

Natural Gas: +43%

Palladium: +32%

Wheat: +19%

Coffee: +13%

At this point, nobody can deny what is happening, and even the Biden administration is admitting that there will be “supply chain disruptions” and “transitory increases in prices”…

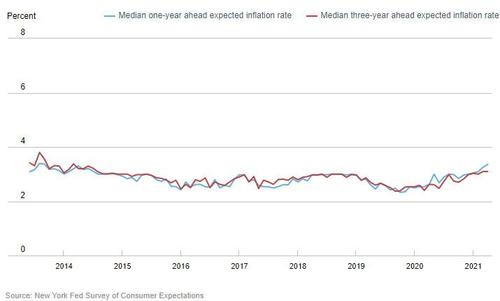

Biden administration officials would like for us to believe that this inflationary period will just be “temporary”, but exactly how do they plan to achieve that?

Do they have a plan to somehow pull trillions of dollars out of the system?

No, they are planning to borrow and spend trillions more.

In the 1970s, double-digit inflation made headlines for years on end. Many people believe that we are well on the way to a return to such levels, but according to John Williams of shadowstats.com, we are already there. In fact, if inflation was still calculated the way that it was back in 1980, we would already be in double-digit territory.

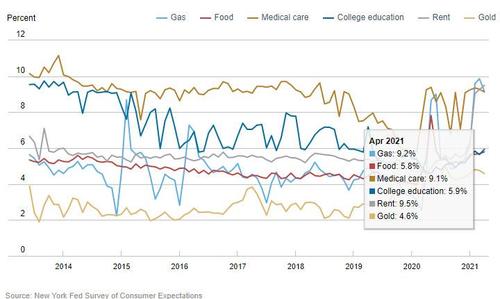

And for certain items, we are already seeing inflation that is off the charts.

For example, the price of corn is up more than 30 percent so far in 2021…

Corn is used in hundreds of different products at the grocery store, and so this is going to dramatically affect the food budgets of millions upon millions of American families.

Meanwhile, we continue to see more shortages start to emerge. Last week, the mainstream media was freaking out over our new nationwide chicken shortage…

That shortage is supposed to be “temporary”, but analysts are warning that the current computer chip shortage could last until 2022.

But despite all of the problems that I just detailed, Americans are increasingly optimistic about the future.

In fact, one recent poll found that a whopping 64 percent of all Americans “are optimistic about the direction of the country”…

And Americans are also extremely optimistic about the stock market. If you can believe it, Americans now have more of their assets invested in the stock market than ever before…

Most Americans seem to believe that happy days are here again, and the stage is set for an immense nationwide emotional meltdown once this “bubble of hope” inevitably bursts.

Anyone that believes that things are going to get better has a fundamental misunderstanding of the times in which we live.

We have just been through the most painful year for the U.S. economy since the Great Depression of the 1930s, and I know that most people would like to see things turn around, but that simply is not going to happen.

Very dark days are ahead, and those that are trusting Joe Biden to save America are going to be bitterly, bitterly disappointed.

Don't forget the cannibals......Got a couple of issues here. The "Transitory" quote was for " HYPERINFLATION" and not simple INFLATION.

HYPERINFLATION is almost ALWAYS "transitory" since it ends. Quite suddenly. USUALLY with elaborate thunder and light-shows.

Oh and flying body parts.

In the article I put there, they give the example of 50% per month. At that rate, money isn't. I always used the thought that the money issued by the .gov simply had no value. I had read that many moons ago. Matters not since our ship of state is hurtling toward the rocky shoals at flank speed.I have always been taught it is 3 digit inflation, but that was never a hard target.

My answer was on an annual basis, so you are saying the same, but 600% annually where I was saying 100% annually.

Either way is horrible.

Edited.....

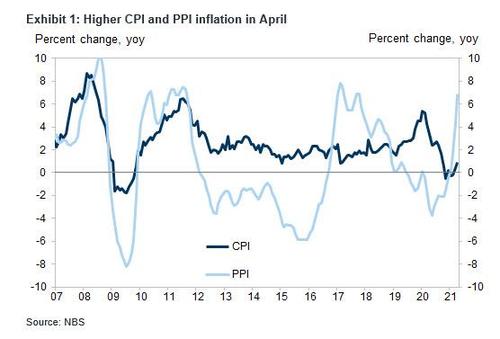

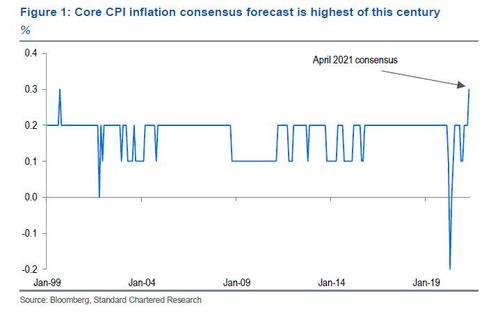

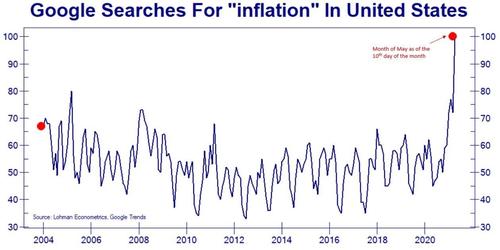

Source: Lehman econometrics

Source: Lehman econometrics

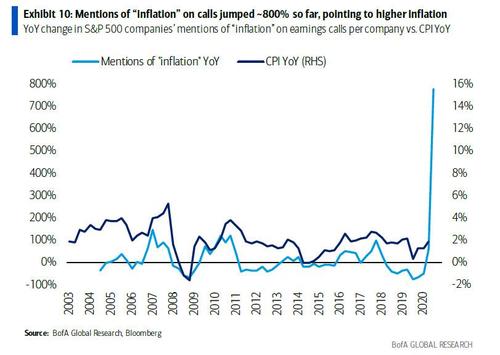

Therein lies the rub. Pinpointing inflation is no easy task. Grant noted that it’s easy for the Fed and government officials to downplay inflationary pressures because it is extremely difficult to measure. As Peter Schiff put it, CPI is a lie.I think the Fed is under the misconception that it controls events. Sometimes, events control the Fed, and I wouldn’t be surprised if this was one of those times. The Fed thinks that not only can it control events, but it can measure them. It believes it can pinpoint the rate of inflation.”

“These are strange and oppressive markers of financial markets that have lost moorings of valuation,” Grant said.

Meanwhile, the Fed continues to create money. M1 annual growth is 350%; M2 is growing at approximately 28%.I think the astounding complacency toward, or indifference of, the evident excesses in our monetary and fiscal affairs … I think the lack of concern about those things is perhaps the most striking inflationary augur I know of.”

Grant said central bankers like Powell are guilty of hubris. They suffer from the delusion that they can actually control everything. Grant called the Fed “un-self-aware.”“Never before have we had monetary peacetime growth this fast,” Grant said.

“Tell me who cares.”

Despite Jay Powell’s credentials, he knows nothing about the past and believes he knows everything about the future.”