You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON Hey Gang! Silver is Over $21!

- Thread starter Sub-Zero

- Start date

SquonkHunter

Geezer (ret.)

Re: silver price. I'm doing just as the Moody Blues song says, Watching and Waiting. I might sell off some culls if it gets high enough. Just Watching and Waiting.

Quiet Man

Nothing unreal exists

Amen. '85 for me. I'm not sure if I should be elated or scared for the future; likely both.It has been a long time coming.

Hfcomms

EN66iq

It's a melt up.

Haven't seen this since 2010? 2011?

I started in 1998, 1999. It has been a long time coming.

Southside

Not yet. Silver hasn’t even taken out it’s old high and people are just starting to wake up about the metals. When silver starts to make $5 daily moves and spot gold $150 daily moves with everyone scrambling to get metal at that point one could call it a melt up. I expect paper gold to go down shortly to around $1700 and then explode higher taking out $2500 in a rapid move.

Paper gold is doing a classic cup and handle charting formation. Had the old high in 2011 and then a decline and bottoming out and then a gradual increase over the last few years, that is the cup formation. The ‘handle’ should bring it down to around $1700 and then way up. Of course that is paper gold but too many really don’t understand the difference between paper and physical.

West

Senior

Not yet. Silver hasn’t even taken out it’s old high and people are just starting to wake up about the metals. When silver starts to make $5 daily moves and spot gold $150 daily moves with everyone scrambling to get metal at that point one could call it a melt up. I expect paper gold to go down shortly to around $1700 and then explode higher taking out $2500 in a rapid move.

Paper gold is doing a classic cup and handle charting formation. Had the old high in 2011 and then a decline and bottoming out and then a gradual increase over the last few years, that is the cup formation. The ‘handle’ should bring it down to around $1700 and then way up. Of course that is paper gold but too many really don’t understand the difference between paper and physical.

I would muse that your correction to $1700 down is a guarantee if Trump wins hands down.

If the election is screwed up or Biden takes it...thinking we go to $4k quickly.

Yes, actually, it could be different this time. We've never racked up trillions of dollars of debt in such a short period of time.PMs are going up, way up but look back at charts of PM prices. They have gone up before. And come down again. Is it different this time? Nothing except death is for sure in this world.

View attachment 212879

Powell has it all under control at the Fed, no worries.

(snark)

MARKET INSIDER

Powell is expected to say the Fed will keep doing whatever it can while it considers its next move

PUBLISHED WED, JUL 29 20207:10 AM EDTUPDATED WED, JUL 29 20208:47 AM EDT

www.cnbc.com

www.cnbc.com

(snark)

MARKET INSIDER

Powell is expected to say the Fed will keep doing whatever it can while it considers its next move

PUBLISHED WED, JUL 29 20207:10 AM EDTUPDATED WED, JUL 29 20208:47 AM EDT

Powell is expected to say the Fed will keep doing whatever it can while it considers its next move

Markets are watching the Fed but may focus more on what Congress is doing with its trillion dollar plus stimulus package.

Doomer Doug

TB Fanatic

Silver is closing on

$28.75 and Gold on $2060.

No plans to sell, but moving out of downtown portland is more feasible every day. The fed reserve FOOLS have now called the entire global fiat reserve status into question with their print $100 Trillion if we have to. Sheesh, it is all on the table now: $5000 gold, 15000 gold, why not? $50 silver, $100, again why not?

$28.75 and Gold on $2060.

No plans to sell, but moving out of downtown portland is more feasible every day. The fed reserve FOOLS have now called the entire global fiat reserve status into question with their print $100 Trillion if we have to. Sheesh, it is all on the table now: $5000 gold, 15000 gold, why not? $50 silver, $100, again why not?

Last edited:

TxGal

Day by day

$29.04 silver and $2065.99 gold respectively, as of this second. Watching closely here, looking for a buy jump...going back to a little here and a little there, rather than waiting too long.

ETA: And it jumped again before I could post that! Texas Precious Metals is running out of stock again.....

ETA: And it jumped again before I could post that! Texas Precious Metals is running out of stock again.....

EMICT

Veteran Member

The paper market appears to be breaking down, no one wants to short SLV, and those who want to settle their contracts for physical silver are finding that it is not deliverable for three to six months. Not real sure we'll see backwardation until production ramps up and surpasses demand. We may see a late March attempt to drive down prices again with resulting premiums going through the roof for physical, but look where that 'attempt' got them. Trying to settle contracts with physical when they have little to none in stock.I wonder if we will see Futures prices go into Backwardation (i.e. below Spot) soon (?).

I think those who say when silver gets above $30, and stays there for

a few days, that $50 silver will be hit amazingly fast next, are spot on.

Always felt silver was the better buy for anybody wanting some PM's.

That silver would always be doubling quicker & more often than gold.

Panic Early, Beat the Rush!

- Shane

a few days, that $50 silver will be hit amazingly fast next, are spot on.

Always felt silver was the better buy for anybody wanting some PM's.

That silver would always be doubling quicker & more often than gold.

Panic Early, Beat the Rush!

- Shane

TxGal

Day by day

I will, thanks!TxGal: If you need a little encouragement, and can spare the time, see the video in post #314 on this thread.

Quiet Man

Nothing unreal exists

Thank you for taking the time to broaden my understanding of the new dynamics. I suppose this is a way of saying that backwardation doesn't matter -- The people who know are already doing their best to get what they can now.paper market appears to be breaking down

In the video with Chris and Andrew Maguire (Post #315) Andrew said they were told that they had to wait till 1Q21 for delivery. I wonder if they will get it at all.

I doubt any source has accurate information about how much physical silver actually exists on the planet. No matter what else, markets - even manipulated markets- are price discovery mechanisms. Listen to what the market tells you.

As to mines, most new silver as I understand it is refined as a byproduct of other metals. There are few actual silver mines which produce only silver.

As to mines, most new silver as I understand it is refined as a byproduct of other metals. There are few actual silver mines which produce only silver.

Quiet Man

Nothing unreal exists

Right. Gold has just passed its ATH, and Silver is still just a little over half of its own. That, plus lots of technical analysis, and historical understanding, is 'speaking' pretty loudly right now. I have the same understanding re Silver mining, and a large number have been closed.

Quiet Man

Nothing unreal exists

Sean/SGT Report interviews Bill Holter

MELTUP: GOLD & SILVER SUPERCYCLE BEGINS!! -- BILL HOLTER

35 minutes

View: https://www.youtube.com/watch?v=DLmwCWexf8k

MELTUP: GOLD & SILVER SUPERCYCLE BEGINS!! -- BILL HOLTER

35 minutes

Yes, it will be suppressed, but not for long.Futures pop again:

View attachment 212933

So, will $30 silver be defended, or was $26-27 pretty-much it for a bit?

Yeah, spot was in the $12 range back in March.When the last stimulus came around I bought some... It is, currently, almost doubled in price...

We Are All Speculators Now

Precious metals are entering the second half of their secular bull market that began in 2001. Yet, they are still cheap. But in the near term remaining cautious is recommended.

We Are All Speculators Now

By Peter Krauth

Friday, July 31, 2020 4:28 PM EDT

Like it or not, you’re now a speculator.

Whether you own gold, stocks, or bonds. Even if you leave all your savings in cash or a certificate of deposit paying you a microscopic interest rate.

The fact is, you’re taking risks, and it’s not even your fault. You may think that’s not the case with a 1-year CD with an explicit federal government guarantee. But calculate the real rate of return by subtracting inflation from your yield, and you’re losing money.

If you’ve been on the fence about buying gold, silver or their mining stocks, let me erase those doubts right here and now, with a small qualifier, as you read on.

It’s Not Even Your Fault

Central banks forcing interest rates down to 5,000-year lows means a negative return when you subtract inflation from your yield. Holding bonds to maturity will lose you money.

Bonds at historically low rates are pushing lower. In all likeliness the Fed will implement negative rates. But once the market loses faith in longer maturity bonds, that game is over.

Stocks probably still have a good run left in them. The massive global stimulus is going to get bigger, and stocks will benefit. Eventually, that game will be up too. So stocks are a speculation as well.

And that leaves precious metals.

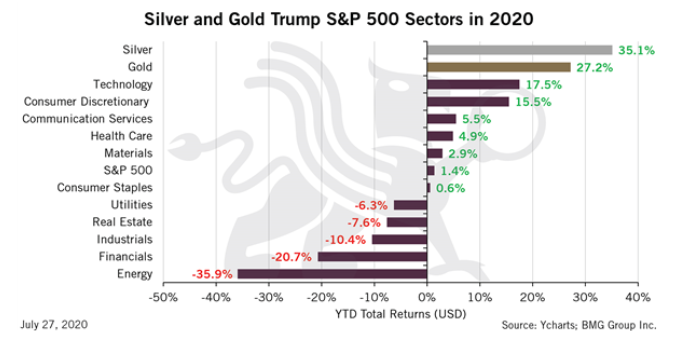

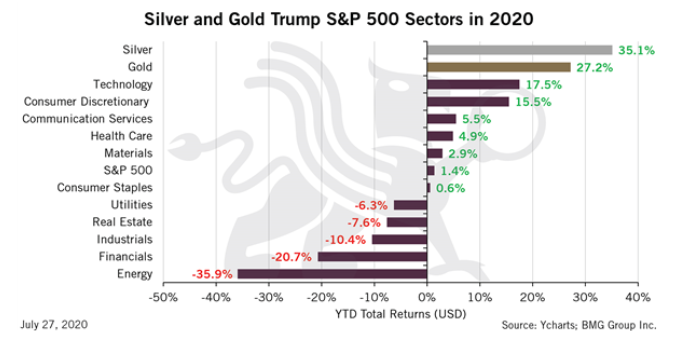

Sure, gold feels like a speculation. It’s already up 35% this year. And at all-time USD record highs, it’s only ever been cheaper, in nominal terms.

But that doesn’t mean it’s too late. In fact, I’d argue quite the opposite.

(Click on image to enlarge)

The truth is, gold’s price adjusted for inflation is still 48% below its 1980 high at $875.Today, that price would equal $2,900.

(Click on image to enlarge)

In the grand scheme, it still looks cheap. With the tens of trillions of dollars unleashed globally in the Covid-19 pandemic’s wake, gold’s just getting started.

Although you might be a speculator without wanting or intending to, that doesn’t mean you have to take huge risks and can’t be intelligent about your allocations.

Cash and short-term deposits offer some degree of certainty, security, and flexibility. Stocks should continue higher for some time, especially with ongoing stimulus. They’re even a reasonable way to hedge inflation to some extent. But the bull market in stocks is only alive thanks to the Fed. And this historically long bull market is very long in the tooth.

Gold is Still Cheap

Precious metals are, in my view, entering the second half of their secular bull market that began in 2001.

Yet, they are still cheap. But in the near term, I recommend remaining cautious.

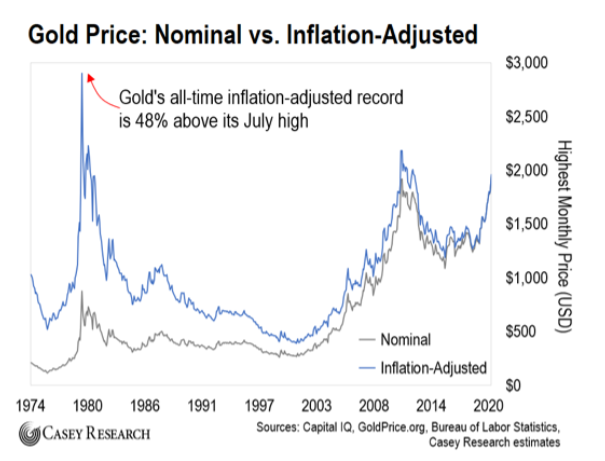

The sector has run up in large part thanks to the recent selloff in the US dollar.

(Click on image to enlarge)

Since peaking at 103 in mid-March, the US Dollar Index has become dramatically oversold. The RSI and MACD momentum indicators are confirming this.

Odds are good we’ll get a rally in the US Dollar Index to at least the 95 or 96 level, both previous support levels. That would likely weigh on the precious metals sector somewhat. But it’s going to be temporary.

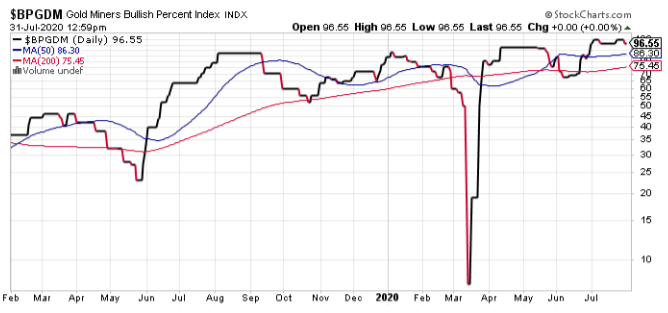

Consider too that the Gold Miners Bullish Percent Index is also suggesting the miners are very overbought.

(Click on image to enlarge)

With the index recently at an impressive 100 (meaning 100% of the stocks were in bullish technical patterns) being rare, and the current reading still at 96, there appears to be some froth in the sector.

However, despite this runup in gold and the miners, precious metals remain massively undervalued in the bigger picture versus practically every other investment sector.

Still, in the near term, odds are good you can buy in within a few weeks at better levels.

So don’t buy gold right now unless you don’t own any at all. As for the miners, I’d suggest holding off for a better entry point soon.

Stay tuned, and I’ll keep a close watch to let you know when time appears right.

mbabulldog

Inactive

so for gits and shiggles, I reached out to Apmex last night to see what I would get for my junk silver I bought from them a few years back. When I sent the email, here's what Apmex was selling the junk silver for:

Here's the email I got back from them telling me what they would buy it from me for:

I get that everyone needs to make a few bucks to keep the doors open, and yes, there's a risk being the middleman in precious metals, but HOLY SHIT, a $5,000 spread between the bid and ask is greedy...

Here's the email I got back from them telling me what they would buy it from me for:

I get that everyone needs to make a few bucks to keep the doors open, and yes, there's a risk being the middleman in precious metals, but HOLY SHIT, a $5,000 spread between the bid and ask is greedy...

I get that everyone needs to make a few bucks to keep the doors open, and yes, there's a risk being the middleman in precious metals, but HOLY SHIT, a $5,000 spread between the bid and ask is greedy...

$4.49 over spot.

Roughly, a 25% profit margin.

mbabulldog

Inactive

$4.49 over spot.

Roughly, a 25% profit margin.

not a bad business model for them, for sure!

Sicario

The Executor

Damn! Selling for $4.50 OVER spot and buying for $10.30 UNDER spot? I'll take a little of that action!so for gits and shiggles, I reached out to Apmex last night to see what I would get for my junk silver I bought from them a few years back. When I sent the email, here's what Apmex was selling the junk silver for:

View attachment 213031

Here's the email I got back from them telling me what they would buy it from me for:

View attachment 213032

I get that everyone needs to make a few bucks to keep the doors open, and yes, there's a risk being the middleman in precious metals, but HOLY SHIT, a $5,000 spread between the bid and ask is greedy...

Then you have to pay for EXPEDITED shipping TO THEM! Not gonna happen. I guess that's why I'm seeing so many PMs changing hands on Craigslist (which is dangerous as hell).

EMICT

Veteran Member

$10.31 below spot is a little rich for the buy price.$4.49 over spot.

Roughly, a 25% profit margin.

$10.31 below spot is a little rich for the buy price.

Indeed

You can do that when everyone in town is playing the same game. That's what "spot" is for. In London they call it 'the fix."

Deal with people who are not playing 'the fix' game.

ETA - when I was buying 90% early on, it was often available for sale below spot - maybe only $.10 to .25 below spot, but it seemed like a deal to me.

Deal with people who are not playing 'the fix' game.

ETA - when I was buying 90% early on, it was often available for sale below spot - maybe only $.10 to .25 below spot, but it seemed like a deal to me.

The Snack Artist

Membership Revoked

They are just protecting themselves. The volatility of pms is very high right now. Hence the reason for the spread. If silver is moving 6% a day the dealers really have no clue as to where they will be able to unload it. Could be a 20% lower price in a day. Then they're cooked. Watch silver bid/ask become like gold. (I hope)