DoubleLine Warns Events Are In Motion To Remove Dollar As Reserve Currency

BY TYLER DURDEN

ZERO HEDGE

SATURDAY, FEB 06, 2021 - 10:10

Authored by Bill Campbell via DoubleLine Capital,

For every action, there is an equal and opposite reaction. In the case of international trade and global payments, the U.S. made aggressive use of sanctions and tariffs. With some merit, Washington has argued that these actions level the playing field for global trade or punish bad global actors.

But a series of equal and opposite reactions are occurring as nations move to remove the role of the U.S. dollar at the center of global trade and finance.

This will have a long-lasting structural impact in ending the dominance of the dollar as the world’s reserve currency.

This will have a long-lasting structural impact in ending the dominance of the dollar as the world’s reserve currency.

Over the past years, the U.S. set out to address inequities in the global trade environment by imposing tariffs and sanctions on various countries from China to Mexico and Canada with the rewriting of the North American Free Trade Agreement into the United States-Mexico-Canada Agreement. Even the countries in the European Union were affected. In addition, Washington implemented sanctions against Russia in 2014 in response to Moscow’s annexation of Crimea, and more recently against Iran and Venezuela, effectively using the dollar’s role at the center of global trade and finance to force compliance of other nations. These actions impacted nations beyond those directly targeted by the U.S. action, and today many governments around the world are taking countervailing steps to remove their reliance on the dollar-based global trade and finance system that has reigned since 1944.

In November, 15 Asian countries, comprising 30% of global GDP, signed the Regional Comprehensive Economic Partnership (RCEP), creating a free-trade zone among the signatories. This agreement attempts to provide gains to trading within the regional partnership through reduction of trade and investment barriers, and increased incentives for economic integration. It is noteworthy that RCEP came about without participation of either the U.S. or Europe, and has effectively created the world’s largest trading bloc, according to the Rand Corp. Beyond the obvious benefits for economic growth in the region, a more-subtle byproduct of this agreement is to focus on bilateral settlement of trade, effectively removing the dollar as the standard unit of transaction for regional trade, according to economist and geopolitical analyst Peter Koenig, a veteran of more than 30 years with the World Bank. Liu Xiaochun, deputy dean of the Shanghai New Finance Research Institute, recently furthered this idea, stating, “Under RCEP, currency choices for regional settlement in trade, investment and financing will increase significantly for the yuan, yen, Singapore dollar and Hong Kong dollar.” Liu’s comments were posted to the China Finance 40 Forum, a think tank comprising senior Chinese regulatory officials and financial experts.

Asia is not the only region taking steps to disentangle itself from the U.S. dollar standard in global trade and payments. The European Commission, the executive branch of the 27-country European Union (EU), released a communication explicitly stating the goal to strengthen the “international role of the euro.” This goal would “help achieve globally shared goals such as the resilience of the international monetary system, a more stable and diversified global currency system, and a broader choice for market operators.”5 The communication also highlights the use of sanctions by other countries, which hurt domestic EU interests, as an additional reason for taking action to make the EU more autonomous in the global trade-and-payments infrastructure. This document outlines specific action items to help move the EU in this direction of more autonomy from the current dollar-centric system. The implementation of a digital finance strategy will be a key component of this new EU strategy, including work on a retail central bank digital currency available to the general public.

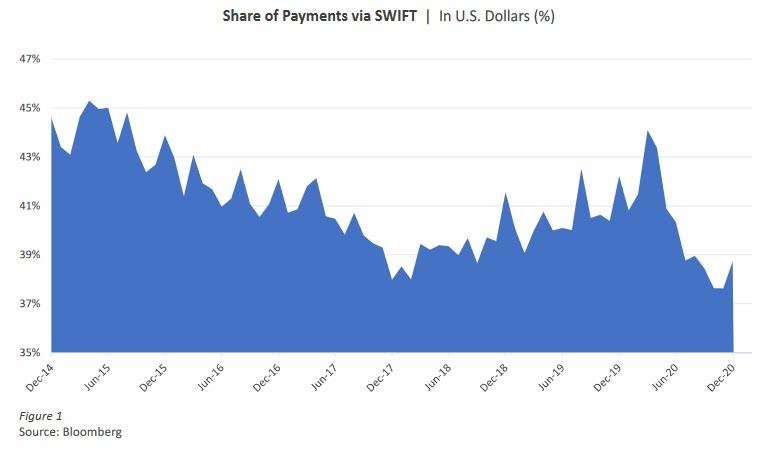

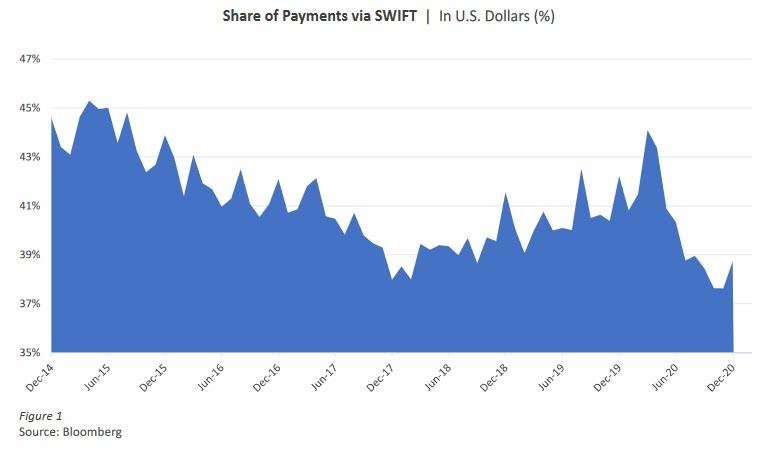

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), the largest global payment settlement network, has already experienced drop-off in dollar transactions in its most-recent readings. It is interesting that this occurred after the implementation of RCEP, although the timing also comes in the wake of the COVID-19 pandemic and resulting economic disruptions. (Figure 1)

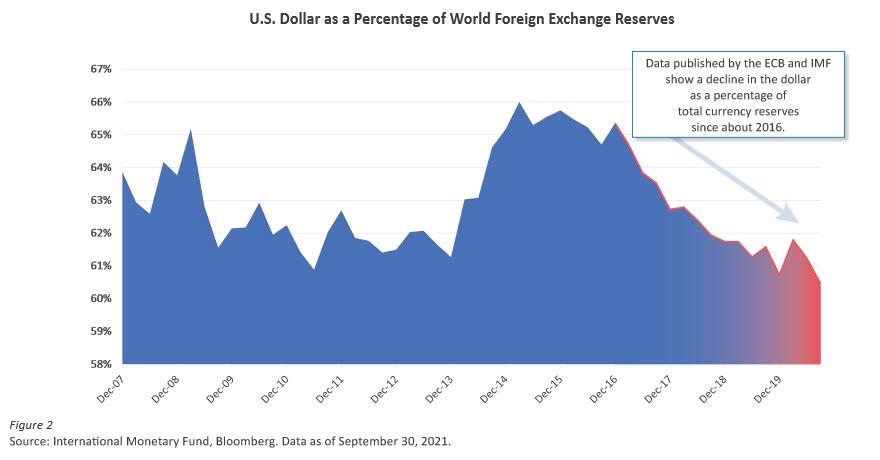

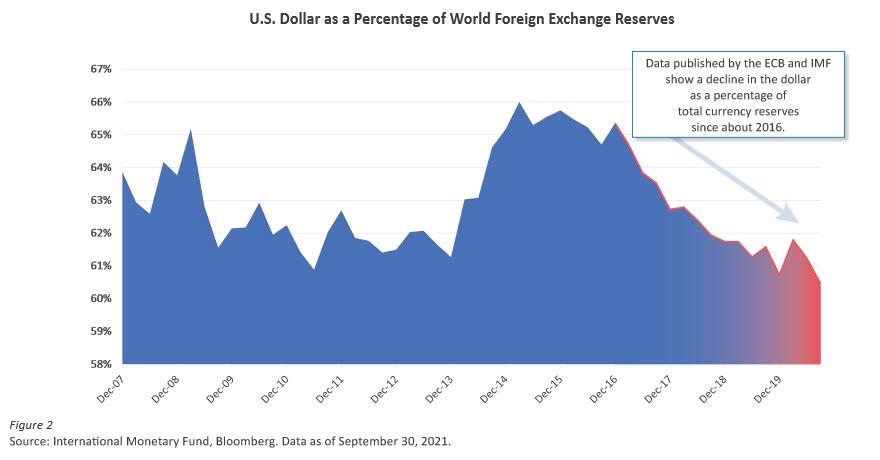

An additional element to watch will be the allocation of global central banks’ foreign currency reserves to the dollar. Non-dollar currencies recently have strengthened as the dollar has sold off. This has given many nations the opportunity to start to intervene to help stop the appreciation of their currencies and to rebuild their reserves buffers. Historically, the bulk of international reserves has been in the dollar. Today, a close eye should be kept on these allocations. If holdings in the U.S. currency decrease as a percentage of the total currency reserves while non-U.S. countries are building those reserves, that could mark a significant change in their behavior. In fact, perhaps such a deliberate policy change might have already begun. Data published by the European Central Bank (ECB) and the International Monetary Fund (IMF) show a decline in the dollar as a percentage of total currency reserves since about 2016. (Figure 2)

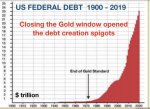

The dollar was already contending with structural headwinds. One is the large stock of international savings on deposit and invested in the U.S. A decline in the value of the dollar risks creating a negative feedback loop where hedging and capital outflows can exacerbate the dollar’s decline. Another is the weakening fundamental picture for the dollar due to America’s widening of the current account deficit and a growing budget deficit. These headwinds are likely to persist for the foreseeable future – not to mention being exacerbated by the aforementioned regional trade agreements and international policy actions.

For the postwar period, the United States wielded the dollar’s central role in global trade and finance to its advantage, trying to even the playing field for trading relationships and as a sanctioning facility. The end of this powerful, unipolar advantage might be at hand.

The pendulum is swinging in the direction of a new, multipolar world. Countries are reclaiming autonomy in global trade, payments and finance. With the implementation of more regional trade agreements with local currency settlements, the dollar’s once-dominant role in global finance likely will continue to erode.

As the global trade-and-payments systems move away from a single-currency standard, the U.S. dollar, to a bilateral exchange framework, countries that are the most productive, most innovative or offer the most competitive goods and services will see their currencies in greater demand.

This change is coming, and we should be ready for the change as it comes.

DoubleLine Warns Events Are In Motion To Remove Dollar As Reserve Currency | ZeroHedge

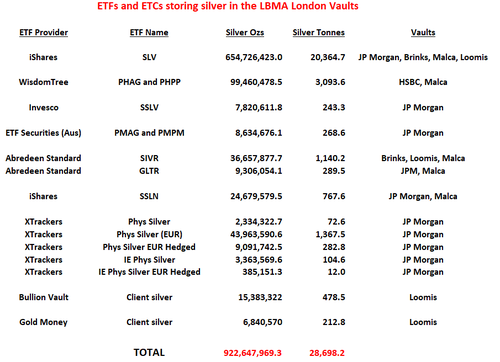

ETFs / ETCs / Transparent holdings store 28,698 tonnes of Silver in LBMA London vaults, over 85% of all the silver in LBMA London. Sources – Provider websites

ETFs / ETCs / Transparent holdings store 28,698 tonnes of Silver in LBMA London vaults, over 85% of all the silver in LBMA London. Sources – Provider websites