There are better discussions out there, but this one is short at least.

================

Ever since the U.S. left the gold standard for good in 1971, some politicians and investors have called for its return.

usfunds.com

An Illustrated Timeline of the Gold Standard in the U.S.

December 8, 2015

Ever since the U.S. left the gold standard for good in 1971, some politicians and investors have called for its return. At one of the Republican presidential debates in October, Texas Senator Ted Cruz became the latest, touting the stability and booming prosperity the U.S. economy enjoyed in the years when the dollar was pegged to the yellow metal.

In previous Frank Talks, I’ve highlighted some of the consequences of having a free-floating fiat currency, one of them being

soaring national debt. When money is limited, as it is in a true gold standard system, so too is reckless government spending.

You can see how dramatically all debt in the U.S., both public and private, began to soar past economic growth once the gold standard was ended.

But my goal today isn’t to argue for or against a gold standard. The system worked well in the second half of the 19th century, but economies have grown so large that there’s no longer any way they could be sustained by such a limited commodity.

Even former Federal Reserve Chairman Alan Greenspan, who has consistently supported the idea that gold is money, agrees, telling the

Gold Report in 2013: “A return to the gold standard in any form is nowhere on anybody’s horizon.”

So instead, I want to lay out the facts of America’s past relationship with gold as a currency and dispel some of the misconceptions people might have.

1789

For the first 40 years of its existence, the U.S. operates on a bimetallic system of gold and silver—officially, at least. Practically, silver coins are the favored currency, and domestic purchases made with gold are rare.

1834

Congress adjusts the silver-to-gold ratio, from 15-1 to 16-1. This makes gold cheaper relative to the world market price ratio. Silver begins to be exported, and by 1850, silver coins all but disappear in the U.S. The yellow metal becomes the principal form of currency.

1862

The U.S. abandons the gold standard briefly during the Civil War. For the first time, it issues fiat money with no convertibility into silver, gold or any other metal. In 1879, Congress freezes the amount of paper money in circulation at $347 million, where it remains for about a century.

1879

The U.S. finally adopts a “classic” gold standard, one that proponents such as Senator Cruz wish to revive. In such a system, a standard mass of the yellow metal defines the value of a currency unit. Paper money, then, is not a separate good from gold and is fully convertible.

This system lasts until World War I. Although this period isn’t free of financial crises, it’s still widely considered to be one of the most economically stable in American history.

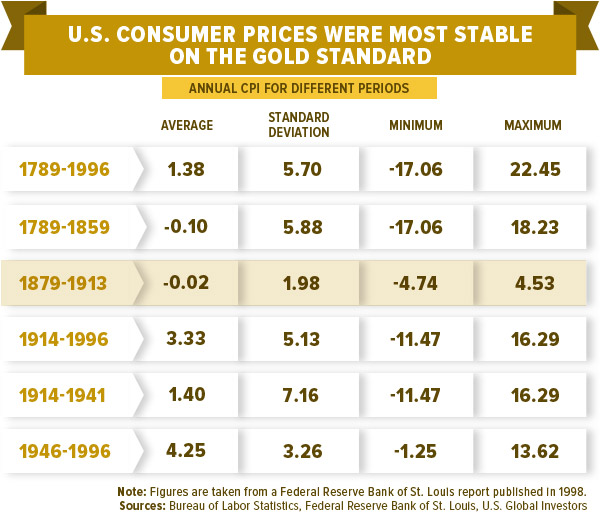

But let’s not overstate this stability. The table below shows us that between 1879 and 1913, when the classic gold standard is in effect, the U.S. actually experiences an average deflationary rate of -0.02 percent. At the same time, consumer prices have a standard deviation of only 1.98. Inflation never falls below -4.74 percent or rises above 4.53 percent. The other periods, by contrast, have huge swings in consumer prices.

1900

Concerned that the U.S. might be returning to a bimetallic system, Congress passes the Gold Standard Act, making the gold dollar the official unit of currency. Greenbacks remain as legal tender but for the first time can be redeemed in gold.

1913

In response to periodic banking panics when gold reserves fell short, the Federal Reserve is established as a lender of last resort. The Fed is not only charged with maintaining the gold standard but also starts issuing Federal Reserve notes that are 40 percent backed by the yellow metal.

1933

Four years after the Wall Street Crash of 1929, the Fed removes the U.S. from the gold standard to expand monetary policy. Convertibility, therefore, is ended.

“The free circulation of gold coins is unnecessary,”

President Franklin Roosevelt tells Congress, insisting that the transfer of gold “is essential only for the payment of international trade balances.”

Roosevelt nationalizes gold by issuing an executive order requiring all gold coins, bullion and certificates to be turned over to the Fed at $20.67 per ounce. Hoarding gold in coin or bullion is punishable by a fine of up to $10,000 and/or jail time. These policies are reinforced in the Gold Reserve Act of 1934.

1944

Representatives from the U.S. and 43 other countries meet in Bretton Woods, New Hampshire, to normalize commercial and financial relations. The agreement is a quasi-gold standard whereby each currency other than the U.S. dollar has a fixed parity to the dollar, which itself is pegged to and can be exchanged for gold at $35 per ounce. (This does not apply to Americans, however, who still can’t hold gold.) The dollar becomes the world’s reserve currency.

1971

President Richard Nixon “closes the gold window” after announcing the U.S. would no longer convert dollars into gold. This move is initially supposed to be temporary, but in 1976 the U.S. monetary system officially becomes one purely of fiat money. Gold rises 2,330 percent during the decade, from $35 per ounce to $850.

1974

On December 31, President Gerald Ford permits private gold ownership again in the U.S.

.

.