marsh

On TB every waking moment

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The Loss Of US Refining Capacity Is Helping Drive Record Diesel Prices, And It Won’t Improve Anytime Soon

WEDNESDAY, JUN 15, 2022 - 06:25 AM

By John Kingston of FreightWaves

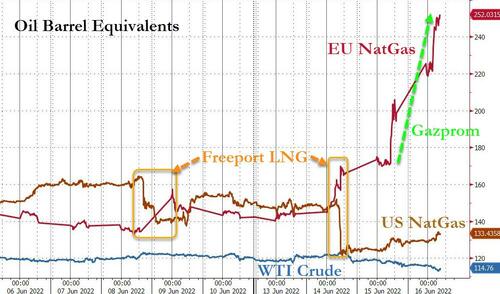

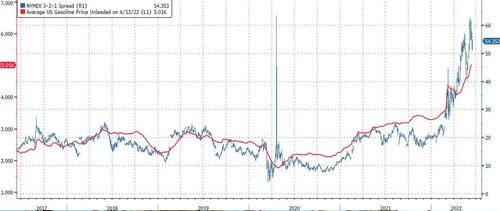

Analysts and casual observers of oil markets rely on a very simple number to determine the strength of refined petroleum products relative to a barrel of crude: the 3:2:1.

There are far more complex models out there, but the beauty of the 3:2:1 is that anybody can calculate it. Take the futures price of Brent or West Texas Intermediate (WTI) and multiply it by three. Then take the price of reformulated blendstock for oxygenate blending (RBOB) gasoline, an intermediate product used to produce finished gasoline, multiply the cents-per-gallon price by 42 to get dollars per barrel, and then do the same with one barrel of ultra-low-sulfur diesel.

Add the RBOB and diesel prices together, subtract the crude price, and you have your 3:2:1 number.

In 2019, the last full pre-pandemic year, the 3:2:1 for WTI averaged $18.63 a barrel, based on data from the daily settlements of the CME Group Inc. commodity exchange. It regularly dipped below $10 a barrel during the pandemic-gripped market of 2020. At the start of this year, it stood at around $20 a barrel.

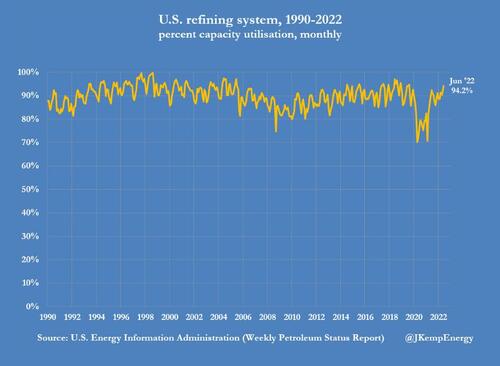

The 3:2:1 for WTI in recent days has hovered just under $60 a barrel, and traders are shaking their heads because they readily admit they have never seen anything like it. Crude is up, but products such as diesel are up a lot further.

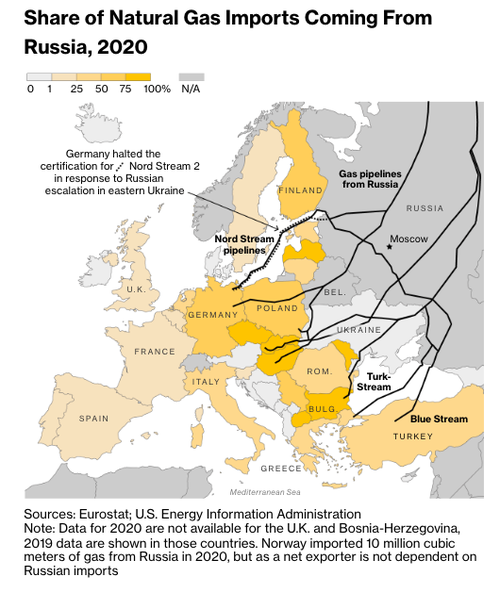

Oil markets are starting to accept that while the cutoff of an unknown quantity of Russian crude from the markets is clearly a factor in the surge in petroleum prices, markets also are getting hit with upward pressure from several years of refinery closures, particularly in the U.S. Combine that with pandemic-induced slowdowns in new refineries being built in other parts of the world and you have a squeeze on refining products that is clearly visible in that eye-popping 3:2:1 margin. More complex models of refining yields also are at levels not seen for years, if ever.

And it’s coming as high prices do not yet appear to be having a significant impact on demand.

Product supplied, a proxy for U.S. demand in data supplied by the Energy Information Administration, was about 900,000 barrels per day less than the first week of June in 2019, but it’s also the second-highest level ever. And GasBuddy, a service that provides gasoline retail price information and demand, tweeted Sunday that weekend gasoline demand continued to show no signs of a downturn.

And that’s part of the issue: a loss of refining capacity during the pandemic, both old and new, combined with refined products demand that has ratcheted up higher and faster than almost anybody thought possible.

Energy economist Philip Verleger, in his most recent weekly report, summed up the issue through this headline: “It’s Refining, Stupid!”

Because oil products can be put on ships and moved thousands of miles, all consumers are impacted by the global refining market. A U.S. consumer does benefit from a barrel of new refining capacity built in Southeast Asia. And as the most recent BP Statistical Review shows, the world has been adding refining capacity at a steady clip, rising to 101.9 million barrels per day in 2020 from 93.8 million barrels per day in 2010.

It was notable that the increase from 2019 to 2020 was small, just 200,000 barrels per day.

There were other years during that span in which the annual jump was more than 1 million barrels a day. (The data goes through 2020.)

‘We lost some refining capacity’

But as Charles Kemp, a vice president at the refinery consulting firm of Baker & O’Brien, said, not all refinery additions are equal.

Looking over the loss of refining capacity in the U.S. in recent years, Kemp told FreightWaves in a phone interview that “a factor that has not been accounted for is that yes, we lost some refining capacity. We could have lost some simple refining capacity without a significant fuel shortage. But we also lost complex conversion capacity.”

Not all refineries are alike. There are refineries that simply cook crude in a crude distillation unit — the most basic building block in a refinery — with a yield of products that are mostly considered intermediate products which require further processing is necessary to make a product such as gasoline. These refineries are often known in the industry as “teapots.”

And then there are giant refining complexes with a tremendous amount of what is known as conversion units. They have units such as cat crackers and cokers that can squeeze a high percentage of desired products such as gasoline or diesel out of those units. As one refining executive said years ago of his company’s refinery, “We could throw old shoes into that thing and get gasoline out of it.”

With the recent loss of refineries in the world and a rapid recovery in petroleum demand post-pandemic, Kemp said, “we are short conversion capacity in this hemisphere.”

And though the market for refined products is global, that means that while new greenfield refineries or capacity expansions in other parts of the world can provide the U.S. with products directly or at least displace other supplies than can then head to the U.S., the cost of freight and other logistics costs come into play.

Andrew Lipow, an independent refining and markets consultant, noted a long list of non-U.S. refining projects that have been thrown off track, adding to the squeeze in refining capacity that has its roots in the loss of plants in the U.S.

Lipow ticked them off: an almost 700,000-barrel-per-day refinery in Kuwait that is likely to begin coming online this summer, long after its initial start date; a refinery of at least 200,000 barrels per day in Oman; and a new 300,000-barrel-per-day refinery in Malaysia that opened a few years ago but has experienced explosions that have kept it offline for months.

Meanwhile, the U.S. was going through a capacity contraction that came after years of expansions. That growth in capacity came not through building new full refineries — that hasn’t happened since the 1970s — but through several other actions outlined by Lipow.

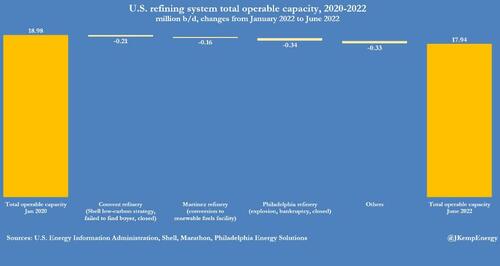

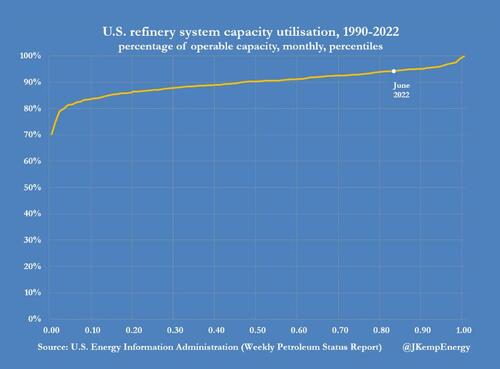

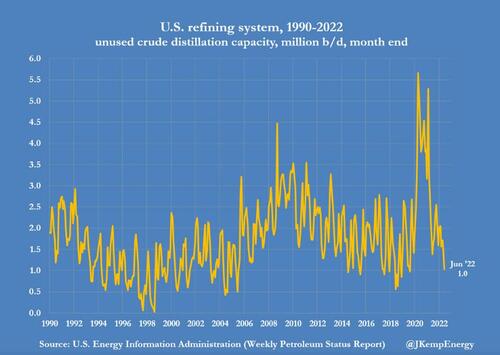

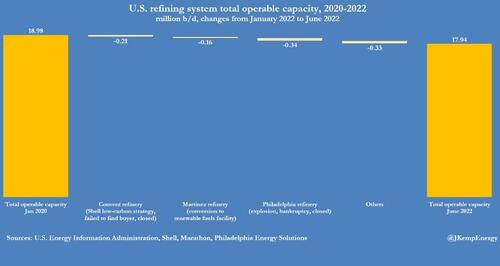

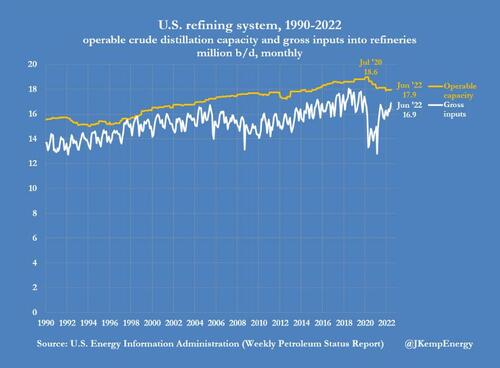

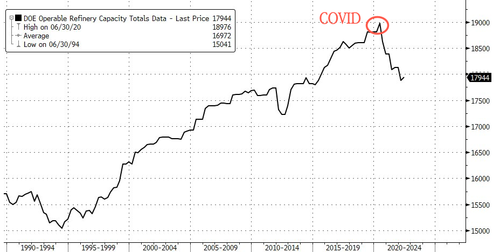

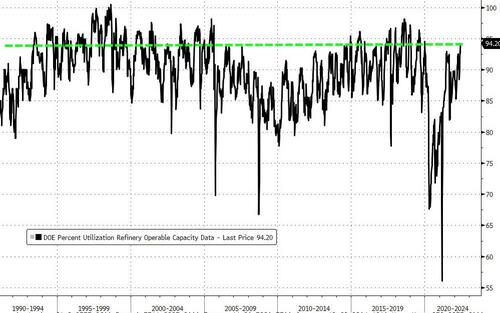

The key numbers to know: According to the Department of Energy (DOE), U.S. refining capacity at the start of 2010 was about 17.7 million barrels per day. Ten years later, it had moved to just under 20 million barrels per day. But in the most recent weekly report, the DOE’s Energy Information Administration (EIA) listed U.S. capacity at 17.9 million barrels per day, almost down to the level it was at the beginning of 2010. U.S. consumption during that period rose to about 20.5 million barrels per day from about 18.6 million.

The movement upward without the construction of new refineries is what Lipow referred to as “capacity creep.” And despite those declining numbers out of the EIA, he said “it still exists.”

“You have small amounts, 5,000 barrels per day here, 10,000 there,” Lipow said, as refinery engineers find new ways to squeeze products out of their inputs.

But broader trends have been offsetting that. For example, Lipow noted that as the U.S. began producing increasing amounts of light oil from shale formations, the problem was that the U.S. refining sector was not set up to process that quality of oil. Lipow said the solution to that was the construction of a type of processing facility called a “splitter,” which is not a full refinery but can take extremely light oil and make various refined products out of it.

“But come December 2015 and the U.S. crude export ban was lifted,” Lipow said. “So there was no more need to build capacity. The excess crude could hit the world market.”

There were less subtle disruptions to U.S. refining capacity, such as the explosion of the Philadelphia Energy Solutions (PES) refinery and the subsequent decision not to rebuild that plant, the East Coast’s biggest.

But Lipow said he sees the decision by PES not to rebuild as being driven in part by corporate decisions that concluded the future for refining is not bright. (Or as he noted, this is the golden age of refining. And if it lasts two years, that’s two out of 40.)

“As a refinery, are you willing to invest hundreds of millions of dollars in capital expenditures to extend the life of the refinery by 30 to 40 years in an environment where fossil fuel demand has plateaued and government and state policies have been enacted to reduce demand?” Lipow said, laying out the conundrum refinery managers face as they look to the future.

He added that that sort of consideration was a major factor in several of the refinery closures in the U.S.: a Shell refinery in Martinez, California; a Phillips 66 refinery also near the San Francisco Bay area; and a smaller refinery in Cheyenne, Wyoming, shut by Holly Frontier. In all three cases, the sites were converted into renewable diesel facilities. But the total output is far less than the size of the crude units that are being shuttered.

And it isn’t over. LyondellBasell Industries said in April it was going to close its Houston refinery by the end of 2023 after unsuccessful attempts to sell it. Refinery sales tend to be frequent and if the market for them is weak, the price generally drops to a level where a buyer pops up. A company saying it is taking the closure option because it simply cannot find a buyer aligns with much of what Lipow said.

John Mayes, vice president of industry analysis and special studies at the refinery consulting firm of Turner Mason & Co., was somewhat less pessimistic about the future of global refining expansions, though he was unambiguous that a permit for a new U.S. refinery would likely be impossible to obtain.

“The ones that were started will get built,” Mayes said. But the deferral of new projects during the pandemic means that many of them won’t get built in the next five years.

The line of new capacity that went straight down when the pandemic began, Mayes said, “will start going back up again.” And then at a certain point, he said, the industry will revert to its “consistent pattern of overbuilding and then underbuilding. With COVID, we were definitely moving into an environment where we were underbuilding.”

Mayes also said the strong refining margins the market sees now will last for a few years, “and that will stimulate overbuilding.”

![CNBC's Jim Cramer says President Joe Biden's letter to oil companies is worrisome [Screenshot CNBC] CNBC's Jim Cramer says President Joe Biden's letter to oil companies is worrisome [Screenshot CNBC]](https://images.dailycaller.com/image/width=960,height=411,fit=cover,f=auto/https://cdn01.dailycaller.com/wp-content/uploads/2022/06/Screen-Shot-2022-06-15-at-12.46.04-PM-e1655311699484.png)