ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com

Macleod: Inflation Is Turning Hyper...

THURSDAY, SEP 15, 2022 - 07:20 PM

Authored by Alasdair Macleod via GoldMoney.com,

Money supply took off during covid lockdowns. It is now about to take off again to pay everyone’s energy bills.[/B] But that is not all.

Demands for currency and credit to be conjured out of thin air to pay for everything will be coming thick and fast. Expectations that energy prices, including European electricity, have peaked are naïve. Putin has yet to put the winter and spring screws on Europe and the world fully. It will be surprising if global oil and natural gas prices in Europe are not significantly higher on a twelve-month view. And Europe has messed up its electricity supplies — that is where the energy costs will rise most.

Bankers are trying to reduce their loan exposure to rising interest rates, undermining GDP. Besides paying for everyone’s energy bills, rescuing troubled banks, collapsing tax revenues, and difficulties in selling government debt on rising yields, governments are expected to apply economic stimulus to support both their economies and financial markets.

Furthermore, this article points to evidence as to why the expansion of central bank credit has a far greater impact on prices than contracting bank credit. The replacement of commercial bank credit by central bank credit will have a far greater inflationary impact than the deflation from bank credit alone.

Attempts to rescue the American, European, and Japanese economies by replacing commercial bank credit with central bank credit will probably be the coup de grace for fiat.

We can begin to anticipate the path to the destruction of purchasing power for all fiat currencies, not just those of Zimbabwe, Turkey, and Venezuela et al. A global hyperinflation is proving impossible to avoid.

First it was covid, now it is energy…

For the magic money tree, its exfoliation is just one thing after another…

Having recognised the impracticality of putting price controls on Russian gas and oil, the EU is turning to protecting all households and businesses from the energy crisis. Even Switzerland, and now the UK are bowing to the inevitable consequences of combining inflationary monetary policies of recent years, environmental wokism, and frankly irresponsible energy policies with the decision to sanction the world’s largest energy exporter.

There can be little doubt that a common approach to resolving energy problems has been decided upon following informal discussions at a supranational level. After all, forums such as the G7 and G20 are all about agreeing to act together, a united front to prevent markets taking control of events out of government hands. Lines of communication continue between formal meetings. That way, establishment statists believe there is less chance of a currency crisis created by one government pursuing a rogue course.

The consequence, of course, is that even with successful management, misguided policies get implemented. A group-thinking form of myopia takes over. And while the immediate problem is addressed, the consequences are rarely foreseen. These subsequent effects are almost certainly going to undermine statist attempts to alleviate the hardship their earlier policies have inflicted on their electors.

In Britain’s case, it is proposed that electricity and presumably gas bills will be fully funded above £2,500 per household, with support arrangements to be put in place for businesses. But much of France’s nuclear power is shut down — 32 of Électricité de France’s 56 nuclear reactors are out of action, with four showing stress corrosion and small cracks in the cement works and a further 12 reactors suspected of being similarly affected. The other sixteen are shut for routine maintenance. It seems that France expects to import electricity through October to February from European neighbours, including the UK, while the UK expects to import French electricity.

How support for businesses will be implemented is unclear; it is an extremely complex issue. But there is little doubt that without this support, the economy will collapse this winter as businesses shut down, unemployment rockets, and the lowest rungs in society, emotively the elderly and struggling single mothers, find it impossible to keep body and soul together. From the government’s point of view, if nothing is done now revenue will collapse, welfare costs escalate, civil disobedience could worsen, and law and order break down. The same problems would arise in the European Union, with some nations facing a greater propensity to riot.

There is no doubt that in the practical world of modern politics, where everyone’s business is the business of government, there is no alternative to ramping up support for the people and their employers in the times ahead. Either the problem has to be faced now, or the consequences for government finances will have to be faced later.

The problem of financing energy subsidies is not yet a public issue. As experience with covid showed, governments were able to ramp up their funding to cover emergencies without much difficulty. This leads to an assumption that governments can simply issue more debt — perhaps £150 billion in the UK’s case but likely to be more, taking the government debt to GDP ratio to over 110%. The impact on indebted EU member states with already far higher debt to GDP ratios is not good either, but what else is to be done?

Undoubtedly, selling bonds to pay for everyone’s excess energy bills will be problematic. Government funding through covid and its aftermath was against a background of declining interest rates, when banks, insurance companies and pension funds were prepared to buy government bonds. We now face the prospect of rising interest rates, with price inflation suggesting that interest rates have much, much further to rise. Appetite for fixed interest bonds is bound to be substantially diminished. Furthermore, central banks are no longer quantitatively easing, but beginning to tighten.

Therefore, the market certainty that comes with central banks underwriting their government bond prices is no longer there. Investors, mostly in the form of pension funds and insurance companies, are bound to take a more cautious view and have little alternative to ducking auctions of government debt.

Without genuine investment being diverted from the private sector into government bonds, any issue of government debt exceeding redemptions of existing stock becomes inflationary. Central banks are surely aware that to accommodate this new wave of government borrowing, quantitative tightening will have to be abandoned, funding through short-term commercial bank credit will be increasingly relied upon, and bond yields must rise to the point where debt can be got away. As to whether quantitative easing will be reintroduced, that would represent a policy U-turn of great difficulty at a time of rising interest rates and rising consumer prices.

Market participants have not yet taken this problem fully inboard, confirmed by complacency over valuations in financial markets. Despite the wake-up call this week when US consumer prices rose ever so slightly more than expected and the Dow fell 1,276 points, investors still hope that inflation is transitory, and that the threat of a deepening recession is a far greater problem, limiting the rise in bond yields. Current macroeconomic theories only allow for one or the other outcome. A contraction of credit, higher prices, and higher interest rates is deemed contradictory to the solution for a recessionary outlook.

But rising bond yields in any real magnitude simply destroys value and therefore credit. A shortage of credit ensues, and the scramble for more credit to replace it drives interest rates even higher. It always happens at the onset of a financial crisis, as clearly illustrated by the UK’s secondary banking crisis in 1973. The Bank of England’s rates reluctantly began to rise that April from 9.75% against a deteriorating economic background, reflecting a tightening of credit. Banks exposed to commercial property began to collapse after the BoE’s rate was raised to 12% in October.

The root of the confusion is essentially ignorance of the relation between the quantity of credit in circulation and the consequences of its contraction. It is this relationship which rules prices, not the supply and demand curves favoured by the neo-Keynesian consensus.

Economists and the investing establishment prefer to view the expansion of currency and credit in connection with the covid crisis as a one-off event, with economies and government finances reverting to more sustainable paths in due course. Examples of this thinking are shown in both the Congressional Budget Office’s ten-year forecasts, and in those of the UK’s Office for Budget Responsibility. Every time their forecasts are proved incorrect, they simply extend the timeline back to the official inflation target.

Putting aside the legacy of damages done to businesses and personal finances, it can be claimed that covid is behind us. But to believe that government finances are free to recover over time is ill-founded.

Yet more “one-off” inflation waves are to follow

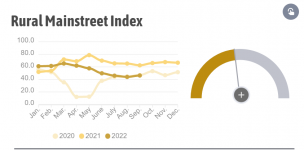

Though the particulars always differ, once the path of inflationary finance is embarked upon, requirements for more inflationary finance always arise. From covid, we segway to energy and food for the masses. The consequences for the western world’s fiat currencies and financial systems are dire, but that is not the end of demand for yet more inflationary finance. The following competing issues are increasingly certain to arise in the coming months, some of them running concurrently and some yet to materialise:

Energy supplies. Having shut down Nord-stream 1, Russia is already tightening energy supplies for Europe and the NATO alliance generally, which will strictly limit their ability to accumulate further fossil energy reserves for the winter. While Europe has made good headway storing gas from other sources recently, depleted reserves will still have to be addressed in the spring. Separately, with a large chunk of France’s nuclear generation currently offline electricity prices are set to soar, irrespective of gas and oil prices. The best that Europe can do is pray for a very mild winter. And while EU nations will be ready to impose windfall taxes on energy suppliers, there will still be enhanced budget deficits to be financed if businesses and consumers are to be compensated.

Future energy prices. The decline in oil prices since June will almost certainly be reversed. European governments have already or are about to promise to bail out all their consumers and businesses irrespective of cost. The cost can only be met by limitless currency dilution, difficult to achieve when the entire euro system of the ECB and national central banks itself is in negative equity due to falling bond values. The commitment to subsidise energy costs gives Putin an added weapon: yet higher oil and gas prices will undermine EU governments’ finances even further, bringing extra pressure to bear on politicians leading to a likely breakdown of the NATO alliance. This is Putin’s real objective, and he won’t let up until this is achieved. Until then, for Putin the higher European oil and gas prices go, the better.

The war in Ukraine. Military setbacks for Russia in East Ukraine are likely to intensify retaliatory restrictions on European energy supplies. Grain and fertiliser shortages are not going to be resolved in the foreseeable future, and shipments from Odessa are likely to be stopped. While western press reports suggest that Ukraine is winning back territory, it seems to be making progress in thinly defended areas along a 1000-mile border. In any event, the campaign season on the ground cannot last long before late autumnal rains and snow turn battlefields into muddy quagmires. The war will then turn into a stalemate and armies become entrenched like those of the Somme. There is unlikely to be any economic relief for Russia’s “unfriendlies” from current military successes against Russian troops.

Geopolitics. Russia’s geopolitical focus is to create with China a new Asian powerhouse. Oil and gas are being heavily discounted for fellow travellers, giving them an economic advantage over Russia’s “unfriendlies”. Even the Saudis recognise that their future is not with fossil-fuel hating Europeans, but with fellow Asians, Africans, and South Americans such as Brazil. The western powers face a relative economic decline, which is bound to encourage governments in the Asian camp to liquidate their US, UK and EU government bond and currency holdings. With substantial Asian-owned debt and currency balances tending to be liquidated, the negative consequences for western financial markets and their currencies are yet to materialise.

Eurozone’s financial fragility. Unless NATO compromises sufficiently (i.e., the Americans withdraw from European affairs and remove their missiles), Europe can expect no help from Russia. Germany’s economy is already verging on collapse. It is the EU’s powerhouse: with Germany in steep decline, all sorts of issues are raised — the future of the banks, the future of the TARGET2 euro settlement system, the future of the euro itself. The ECB and the entire euro system can only respond by supplying unlimited quantities of inflationary finance to preserve the euro system: that is more important to the ECB than preserving value for the euro on the foreign exchanges.

Rising interest rates. Interest rates are now rising, driven not by central banks, which are determined to resist the trend, but by contracting credit. Falling purchasing powers for the dollar and the other major western currencies are just beginning to accelerate, ensuring a buyers’ strike in bond markets and significantly higher yields. Initially, bank lending margins may benefit, but non-performing loans will increase rapidly. The €9 trillion Eurozone repo market will begin to unwind, creating a liquidity crisis for banks which depend upon it to maintain their balance sheet integrity. Central banks will be called upon to ensure there are no bank failures in this challenging operational environment.

Bank credit downturn. We face a cyclical downturn in commercial bank credit. The evidence that it has started is mounting. When bank lending in an economy shrinks, it always leads to a financial and economic crisis, proportional to the expansion that preceded it. It will be a miracle if this downturn does not lead to a collapse of one or more of the major banks, with a domino effect almost certain to follow. The most leveraged banks are in the Eurozone, which faces the added problems of a belligerent Russia on its eastern front, and in Japan. These banks may have to be bailed leading to a further expansion of central bank currency and the introduction of bank lending guarantees to keep zombie corporations out of bankruptcy, this time under the combined direction of both central banks and their governments.

Falling financial asset values. Rising interest rates and bond yields will undermine all financial asset values. Not only will this damage economic confidence, but banks will be forced to liquidate financial assets held as collateral against loans. This will magnify pressure on banks to reduce their balance sheet totals while they can, and financial market values will fall more heavily in consequence, undermining economic confidence. Undoubtedly, vested interests will fight for renewed inflationary policies and interest rate suppression in a desire to maintain asset values, particularly in the US which has become over-dependent on investor confidence in financial markets.

The slump in GDP. Because the transactions that make up GDP are entirely financed by bank credit, bank credit contraction will lead to a slump in nominal GDP. Driven by interventionist economic policies, in their desperation governments are sure to try to stimulate recovery by increasing their spending at a time of declining tax revenues. The cost of the extra debt incurred will soar, not just due to the quantities involved, but because higher interest rates and auction failures will be the backdrop to what amounts to a global debt trap from which it is impossible to escape.

To summarise so far; from covid being a one-off economic crisis requiring enhanced deficit spending by governments, we now see a second one-off crisis centred on subsidising energy and food. This will be followed by further and increasing demands for inflationary funding, as briefly enumerated in the bullet points above. Attempts to prevent western economies contracting, buyers strikes in bond markets, along with collapsing bank credit will probably be the coup de grace for fiat currencies.

How currency debasement as opposed to contracting bank credit leads to a final collapse of fiat currency purchasing power must be our next topic.

The relative consequences of currency and credit inflation

There has been little or no theoretical analysis done of the different effects on prices from an increased quantity of bank credit, and that of currency. The former is essentially cyclical, while in fiat currency regimes, the increase in the quantity of currency is continual with a strong tendency to accelerate.

Observation of the current situation, informed by the consequences of a rising interest rate outlook, together with statistical evidence from the history of bank credit cycles, point to a periodic and severe contraction in bank credit which is only now becoming evident. Other things being equal, contracting bank credit is likely to apply downward pressure on prices. We can expect contracting bank credit to be replaced by central bank credit expansion. Because they will work in opposition, we need to assess how important the deflationary pressure is likely to be from the bank credit cycle relative to inflationary pressures from increasing quantities of central bank derived credit, issued to finance rising government deficits.

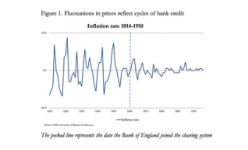

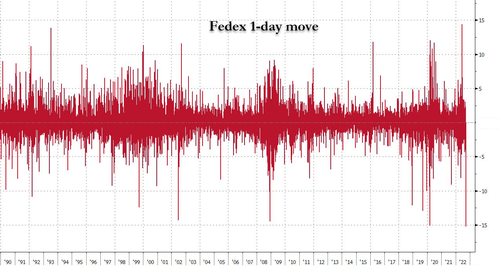

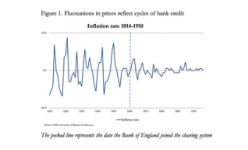

First, we must isolate the effect on prices from variations of commercial bank credit. Under Britain’s gold coin standard which ran from 1817 to 1914, the cycle of bank credit expansion and contraction is evidenced in the effect on the inflation rate of wholesale prices, as shown in Figure 1.

The cycle’s periodicity was remarkably constant, averaging a ten-year span, a constancy which remains evident to this day. The pecked line marks the date the Bank of England joined the commercial bank clearing system, the relevance of which is discussed below. Wholesale prices are a more direct reflection of cycles of bank credit than consumer prices which during those times of very little consumer credit were less affected by cycles of bank lending. Furthermore, statistics representing the general level of consumer prices were not widely available before the 1930s, and consumer price statistics before the First World War are just guesswork.

Part 1 of 2