jward

passin' thru

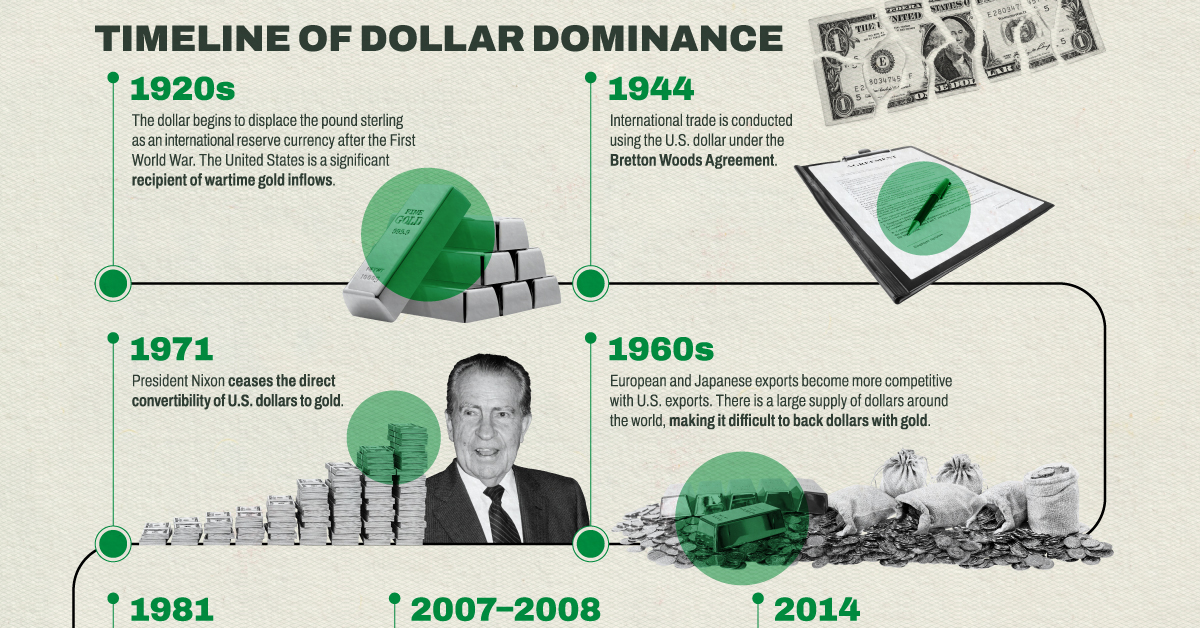

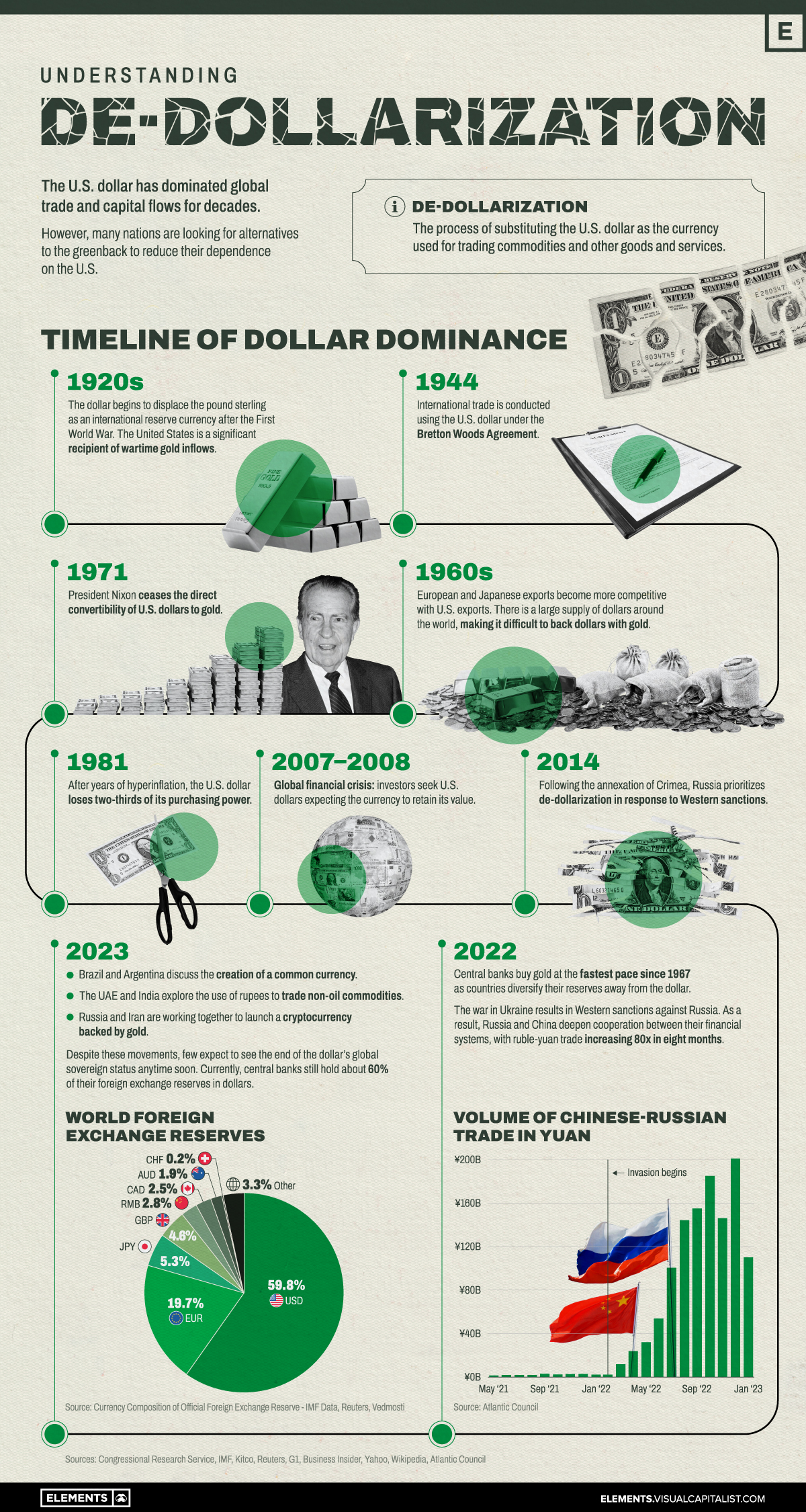

Today we've seen India and Malaysia join the growing group of countries that are moving beyond the dollar, a few days ago it was China and Brazil. Various posters have noted that this topic is likely to expand in the days ahead, both in # of countries who follow such courses of action, and in the impact we will experience domestically. Twas suggested that we might want to be sure these events did not get lost in all the other big events occurring daily, so though I'll use today's move beyond the dollar by India and Malaysia as the OP, please feel free to document other such changes in the global financial order.

Kallol Bhattacherjee

India and Malaysia have agreed to settle trade in the Indian rupees, the Ministry of External Affairs announced on on April 1, 2023.

The announcement came in the backdrop of ongoing official efforts to Safeguard Indian trade from the impact of Ukraine crisis. The shift away from The U.S. dollar which has been the dominant reserve currency for international trade so far has added significance as it indicates India is willing to take concrete steps towards de-dollarisation of its international trade.

The Union Bank of India in a statement said that it has become the first bank in India to operationalise this option by opening a Special Rupee Vostro Account through its “corresponding bank” in Malaysia — India International Bank of Malaysia.

“Trade between India and Malaysia can now be settled in Indian Rupee (INR) in addition to the current modes of settlement in other currencies. This follows the decision by the Reserve Bank of India in July 2022 to allow the settlement of international trade in the Indian Rupee (INR). This initiative by RBI is aimed at facilitating the growth of global trade and to support the interests of the global trading community in Indian rupees, “ the Ministry of External Affairs announced.

Trading in the U.S. dollar has faced growing difficulties especially after the Russian economy was sanctioned by the western powers following President Vladimir Putin’s launch of a so-called “special military operation” against Ukraine on February 24, 2022. As a fallout of the sanctions and war, making payments to Russia in U.S. dollars became increasingly difficult which in turn triggered a search for solutions in national currencies and de-dollarisation worldwide.

“India International Bank of Malaysia (IIBM), based in Kuala Lumpur, has operationalised this mechanism by opening a Special Rupee Vostro Account through its Corresponding Bank in India i.e. Union Bank of India,” the official announcement stated.

“This mechanism will allow the Indian and Malaysian traders to invoice the trade in Indian rupee and therefore achieve better pricing for goods and services traded. This mechanism is expected to also benefit the traders on both sides as they can directly trade in Indian Rupee and therefore save on currency conversion spreads,” a press note from the Union Bank of India informed on Saturday.

India-Malaysia bilateral trade touched $19.4 billion during 2021-22 and Saturday’s announcement is expected to help bilateral trade to overcome currency-related obstacles. Malaysia is the third largest trading partner of India in the ASEAN region, after Singapore and Indonesia that account for $30.1 billion and $26.1 billion bilateral trade with India respectively.

posted for fair use

www.thehindu.com

www.thehindu.com

India, Malaysia move beyond dollar to settle trade in INR

Kallol Bhattacherjee

India and Malaysia have agreed to settle trade in the Indian rupees, the Ministry of External Affairs announced on on April 1, 2023.

The announcement came in the backdrop of ongoing official efforts to Safeguard Indian trade from the impact of Ukraine crisis. The shift away from The U.S. dollar which has been the dominant reserve currency for international trade so far has added significance as it indicates India is willing to take concrete steps towards de-dollarisation of its international trade.

The Union Bank of India in a statement said that it has become the first bank in India to operationalise this option by opening a Special Rupee Vostro Account through its “corresponding bank” in Malaysia — India International Bank of Malaysia.

“Trade between India and Malaysia can now be settled in Indian Rupee (INR) in addition to the current modes of settlement in other currencies. This follows the decision by the Reserve Bank of India in July 2022 to allow the settlement of international trade in the Indian Rupee (INR). This initiative by RBI is aimed at facilitating the growth of global trade and to support the interests of the global trading community in Indian rupees, “ the Ministry of External Affairs announced.

Trading in the U.S. dollar has faced growing difficulties especially after the Russian economy was sanctioned by the western powers following President Vladimir Putin’s launch of a so-called “special military operation” against Ukraine on February 24, 2022. As a fallout of the sanctions and war, making payments to Russia in U.S. dollars became increasingly difficult which in turn triggered a search for solutions in national currencies and de-dollarisation worldwide.

For better trade

On March 14, the government had informed the Rajya Sabha that, banks from eighteen countries were allowed by the Reserve Bank of India (RBI) to open Special Rupee Vostro Accounts (SRVAs) to settle payments in Indian rupees. Malaysia was one of the eighteen countries that figured in the statement laid out before the Rajya Sabha, by Minister of State for Finance Dr. Bhagwat Kishanrao Karad.“India International Bank of Malaysia (IIBM), based in Kuala Lumpur, has operationalised this mechanism by opening a Special Rupee Vostro Account through its Corresponding Bank in India i.e. Union Bank of India,” the official announcement stated.

“This mechanism will allow the Indian and Malaysian traders to invoice the trade in Indian rupee and therefore achieve better pricing for goods and services traded. This mechanism is expected to also benefit the traders on both sides as they can directly trade in Indian Rupee and therefore save on currency conversion spreads,” a press note from the Union Bank of India informed on Saturday.

India-Malaysia bilateral trade touched $19.4 billion during 2021-22 and Saturday’s announcement is expected to help bilateral trade to overcome currency-related obstacles. Malaysia is the third largest trading partner of India in the ASEAN region, after Singapore and Indonesia that account for $30.1 billion and $26.1 billion bilateral trade with India respectively.

posted for fair use

India, Malaysia move beyond dollar to settle trade in INR

The announcement came against the backdrop of ongoing official efforts to Safeguard Indian trade from the impact of Ukraine crisis