"We Sold Over $100 Million Of Gold During The Quarter": Costco CFO

by Tyler Durden

Monday, Dec 18, 2023 - 10:20 AM

Authored by Naveen Athrappully via The Epoch Times,

Wholesale retailer Costco sold more than $100 million worth of gold in the most recent quarter, with gold bars seeing high demand from customers.

“You've probably read about the fact that we're selling one-ounce gold bars. We sold over $100 million of gold during the quarter” ended Sept. 30, Richard Galanti, the chief financial officer of Costco, said during an earnings call on Dec. 14. This was the first quarter of fiscal 2024 at Costco. The wholesale retailer started selling gold online beginning September. In an earnings call late that month, Mr. Galanti had alluded to massive demand for the product.

“When we load them [gold bars] on the site, they're typically gone within a few hours.”

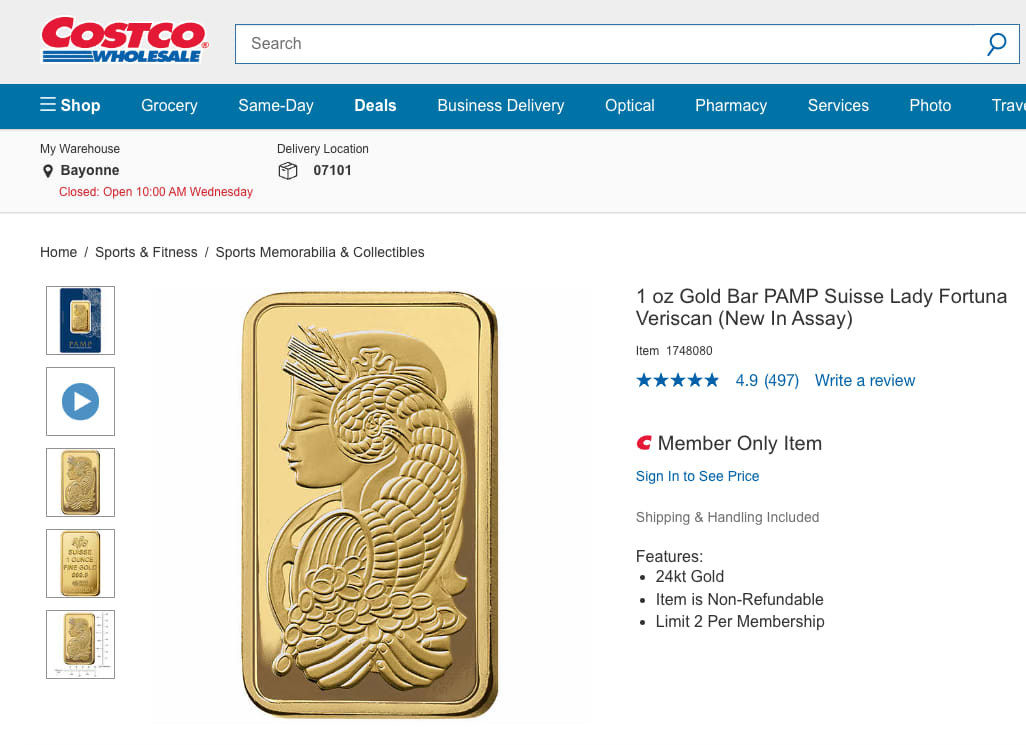

At present, Costco has listed two, 1-ounce gold bars for sale—one from PAMP Suisse Lady Fortuna Veriscan and the other from Gold Bar Rand Refinery. Both items are listed as 24-karat gold available for members only and limited to two bars per member. Costco offers three types of memberships: gold star and business membership costing $60 yearly each, and an executive membership costing $120.

The gold bars were listed for sale at $2,069.99 on Friday, according to CNBC. At the time, this was nearly $50 higher than the spot gold price of $2,020.58. Both items are shipped via UPS and delivered within around two to five days to customers across the United States. Once sold, the gold bars cannot be returned or refunded.

Costco’s $100 million gold sales come as the retailer continues to report strong profits and the company’s shares have surged this year. Meanwhile, gold prices have also risen.

Year to date, Costco shares have risen by more than 45 percent as of Dec. 18, 06:30 a.m. EDT. Gold prices have jumped from around $1,797 per ounce to $1,984 during this time, an increase of over 10 percent.

Elevated Gold Price

Earlier this month, spot gold prices hit an all-time intraday record high of $2,152. Spot gold was trading at roughly $1,200 back in 2019. Analysts expect gold prices to remain elevated next year due to geopolitical uncertainty, potential rate cuts by the Federal Reserve, and a weaker U.S. dollar.

Ever since the Israel-Hamas conflict was triggered in October, gold prices have been rising as its safe haven status boosted inflows into the metal.

“The anticipated retreat in both the USD and interest rates across 2024 are key positive drivers for gold,” Heng Koon How, head of markets strategy, global economics, and markets research at UOB, told CNBC.

He expects gold prices to hit up to $2,200 per ounce by the end of next year.

Nicky Shiels, head of metals strategy at MKS PAMP, believes “

there is simply less leverage this time around vs. 2011 in gold ... taking prices through $2,100 and putting $2,200/oz. in view.”

Bart Melek, head of commodity strategies at TD Securities, is expecting gold to average $2,100 in the second quarter of next year. He sees central bank gold buying demand to be a major driver of gold prices.

According to an Oct. 31 update by the World Gold Council (WGC), global central banks collectively bought “an astonishing” 800 tons of gold in the first three quarters of 2023. This is a 14 percent increase in gold buying compared to the same period last year.

“The People’s Bank of China (PBoC) regained the title of the largest buyer globally, increasing its gold reserves by 78 [tons] during the quarter (Q3). Since the start of the year, the PBoC has increased its gold holdings by 181t, to 2,192t (equivalent to 4 percent of total reserves),” WGC stated.

A May 30 survey published by the organization found that a majority of central banks expect the proportion of their total reserves denominated in gold to increase over the next five years, thus contributing to upside pressure on gold prices. Developing economies were found to be mainly holding such views.

Fed Rates, Market Positions

According to a Dec. 4 report by ING, “safe-haven demand and the U.S. interest rate outlook” will keep gold prices elevated next year.

“We believe Fed policy will remain key to the outlook for gold prices in the months ahead. US dollar strength and central bank tightening have weighed on the gold market for most of 2023. Higher rates are typically negative for gold, which doesn’t offer any interest,” it said.

“Our U.S. economist expects the starting point for Fed rate cuts to be in May and is forecasting 150 basis points of rate cuts next year in total, with a further 100bp in early 2025. This should support gold’s move higher.”

Gold demand in exchanges shows a mixed picture. For instance, total holdings in bullion-backed ETFs declined this year even though gold prices rose.

However, global gold ETF outflows in October were at a slower pace compared to September. ING expects a “resurgence of investor interest” in gold next year and a return to net inflows into gold ETFs.

At the COMEX exchange, net long positioning on gold rose 137 percent month over month in late October. Compared to 2019 and 2020, positioning this year has looked neutral, ING stated.

“This suggests that there is still plenty of room for speculators to add to their net long in 2024 and push gold prices even higher.”