You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON Eviction Crisis On Schedule

- Thread starter Doomer Doug

- Start date

This won't matter, loss of rental payments, so much to the big rental companies like Equity, Mid-America, etc as any income from loss of payments will just be written off of their taxes and carried forward for years. And any cash flow shortages will just be covered up by going to the bond market to sell debt.

Who this hurts is the small mom&pop's with just a couple of rentals who have mortgages on the properties and cannot afford to cover the payments due to the loss of rental income. Their only option is to cover the shortfall themselves or refinance the mortgage.

Back many moons ago before moving to Ga I had 2 rentals I owned. Due to 1 bad tenant they barely covered cashflow. The only thing that really saved me and made it worthwhile was the capital gains I made from selling the places. Even with that though I got turned off from ever owning rentals again.

In the current political and economic environment a small time rental owner has to work much harder to keep his head above water. And having tenants you have to evict makes the process even harder.

tbd

That's not how rental income is accounted for. You don't "write it off" you just don't earn it. You only claim actual income, you can't write off expected income minus actual income.

Now if you get an eviction and then get a judgment, you can write the judgment off but it is a different kettle of fish. First off, the judgment doesn't become income until or unless it is paid. Which 99.999999% of the time it is not. However, hubby and I are looking into a potential solution of "writing off" the judgment as a loss (it would have been an account payable on our books) and then submitting a 1099 or 1098 or similar to the IRS. This may not be possible but we have a call out to our account about this. It isn't something that is normally done from our understanding but if we aren't going to get paid might as well see about making them feel the pain in some way.

Rental income is like any other kind of investment income. Never bet more than you can afford to lose. We had been giving real consideration to getting out of the business but the truth is after 25 years and an extremely low debt to income ratio with our business, we'd be crazy to sell for at least another decade (given our age) because we can't replace the 50% plus return on investment. There's nothing out there that will cashflow consistently like that. Not even the stock market.

I owned a rental once. It was a horror show. The “family” we rented to past the background check and were very presentable. They paid the first and last months rent, plus deposit and checks cleared.

Things got screwy when I called before going to get the second months check. The number was disconnected. I showed up the next day and knock and I hear someone yell “don’t answer the door”. I was going to let myself in and noticed the locks were changed.

I’m gonna skip all the craziness that went on trying to get them out with the courts. I posted an ad on Craigslist saying tenants were evicted and anything there is free for the taking. Dozens of people showed up looking for the free stuff.

I was at the neighbors watching and called to report the disturbance. The cops showed and I came over and gave them permission to search the house. I planned ahead and had a copy of the lease to show anything found was theirs not mine.

Things got screwy when I called before going to get the second months check. The number was disconnected. I showed up the next day and knock and I hear someone yell “don’t answer the door”. I was going to let myself in and noticed the locks were changed.

I’m gonna skip all the craziness that went on trying to get them out with the courts. I posted an ad on Craigslist saying tenants were evicted and anything there is free for the taking. Dozens of people showed up looking for the free stuff.

I was at the neighbors watching and called to report the disturbance. The cops showed and I came over and gave them permission to search the house. I planned ahead and had a copy of the lease to show anything found was theirs not mine.

homecanner1

Veteran Member

I think it was Catherine Austin Fitts recently said the unpaid rent/mortgage since June 1 has accumulated to $17 billion

with a B

it left me jawdropped to grasp the dimensions of this catastrophe

its not just renters who will be evicted, I anticipate a run on storage lockers till folks can relocate.

with a B

it left me jawdropped to grasp the dimensions of this catastrophe

its not just renters who will be evicted, I anticipate a run on storage lockers till folks can relocate.

marsh

On TB every waking moment

12 Million Renters Owe More Than $5K in Rent

About 12 million renters owe over $5,000 in past-due rent, according to a recent survey, while about one-in-five families with children have fallen behind on paying their rent...

12 Million Renters Owe More Than $5K in Rent

(Getty Images)

By Theodore Bunker | Monday, 07 December 2020 05:21 PM

About 12 million renters owe over $5,000 in past-due rent, according to a recent survey, while about one-in-five families with children have fallen behind on paying their rent, The Washington Post reports.

The Census Bureau found that 21% of families are falling behind on rent, including 29% of Black families and 17% of Hispanic families. The Federal Reserve Bank of Philadelphia found that 1.3 million households with people who had a job before the coronavirus pandemic and lost it after are, on average, $5,400 in debt when it comes to rent and utilities.

“The tidal wave is coming. It’s going to be really horrible for people,” Charlie Harak, a senior attorney at the National Consumer Law Center, told the Post. “The number of people who are now 90 days behind and the dollars they are behind are growing quite significantly.”

Mark Wolfe, executive director of the National Energy Assistance Directors’ Association, compared many people’s living situation to “a Charles Dickens novel.”

He added, “It’s an evolving story of how people at the bottom are suffering.”

“It’s much better for Congress to err on the side of helping too much than too little,” Mark Zandi, Moody’s Analytics’ chief economist, noted. “There’s nothing scarier than losing your home, especially in January with a pandemic out of control. That would be overwhelming.”

He added that the amount of unpaid debt for rent and utilities will likely reach $70 billion by January, and even more damage could be caused by widespread evictions in 2021, which he predicts will cause people to “lose faith” in the government.

“The economic damage created by this pandemic will be many times more severe if we lose faith that the government has our back,” Zandi said.

Doomer Doug

TB Fanatic

Oregon diverted $68 million in covid relief funds only to black people, a little down payment. Didn't do them much good since they wasted a LOT of it. Oregon kicked it all to January 1st 2021 and now wants the feds to bail out the renters.

The tidal wave of ebictions will hit about the same time all the other crap hits.

The tidal wave of ebictions will hit about the same time all the other crap hits.

marsh

On TB every waking moment

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Tenants, Landlords Face Imminent Crisis As Pandemic Lifelines Expire

Tue, 12/08/2020 - 23:05

January is going to be a mess. America's small-time landlords, along with their tenants, are in trouble as safety nets are set to expire. Tenants haven't paid rent in months, with a looming eviction moratorium expiring at the end of December. According to Reuters, the lack of rental income for landlords has also been troublesome, with many skipping mortgage payments, potentially resulting in a firesale of properties in the year ahead.

For 12 million Americans and their families - this Christmas will be their worst - as the extended unemployment benefits that have kept many of them afloat are set to expire later this month. Then on New Year's Day, the Centers for Disease Control and Prevention's eviction moratorium expires, which could result in a massive wave of evictions in the first half of 2021.

At the moment, $70 billion in unpaid back rent and utilities are set to come due, according to a new report via Moody's Analytics Chief Economist Mark Zandi.

Last month, Maryland utility companies began to terminate customers with overdue bills, many of which were unable to pay because of job loss due to the coronavirus downturn.

New research from the Aspen Institute warns 40 million people could be threatened with eviction over the coming months as the real economic crisis is only beginning.

According to Stacey Johnson-Cosby, president of the Kansas City Regional Housing Alliance, landlords are also in deep turmoil. She said more than 40% of the landlords surveyed in her coalition said they will have to sell their units because of the lack of rental income.

She said small landlords are frightened to speak out about non-paying tenants because social justice warriors and their "Cancel Rent" groups have attacked landlords."They are sheltering our citizens free of charge, and there's nothing we can do about it," said Johnson-Cosby. "This is their retirement income."

Reuters interviewed Clarence Hamer, who may have to sell his house in the coming months because his "downstairs tenant owes him nearly $50,000." He owns a duplex in Brownsville, Brooklyn - and without those rental payments, Hamer has been unable to pay his mortgage."What they don't realize is that if they run us out and we fail, it will be private equity and Wall Street firms that buy up all our properties, just like they did with houses after the last foreclosure crash."

Hamer is not alone - millions of Americans are headed for a "dark winter" as they could be evicted or lose their homes in the coming months as government safety nets are set to expire."I don't have any corporate backing or any other type of insurance," said Hamer, a 46-year-old landlord who works for the city of New York. "All I have is my home, and it seems apparent that I'm going to lose it."

Meanwhile, on Tuesday, stimulus talks quickly faded after it was reported that Senate Majority Leader Mitch McConnell touted his own plan rather than a bipartisan compromise for a deal.

John Pollock, a Public Justice Center attorney and coordinator of the National Coalition for a Civil Right to Counsel, recently said January could bring a surge of eviction and homelessness," unlike anything we have ever seen" before.

Something to not overlook are college towns, where there are thousands if not tens of thousands of units sitting empty right now. I know here the occupancy rate is very low right now, semester ended last week and students won't be back until mid January if then even.

In Tampa, many of those condos, houses, etc once occupied by college students are either on the market or have already sold for big bucks. Student housing is already at least partially owned by the university they are attached to so the reap what they sow. USF had on-campus classes as well as distance learning varieties. After Thanksgiving, as was planned, classes all converted to distance learning.

Melodi

Disaster Cat

And those evictions if they come in January, in much of the United States, could and will be a death sentence for some small children, the elderly, and just about anyone who might freeze to death, it all depends on the weather.

I have close friends who are private landlords too and they can't continue on like this either - I haven't checked but it wouldn't surprise me if they just sold the urban properties and moved into their retirement home now that both of them are actually retired.

If they can't get a sale, well I suspect they will just walk away from the rental properties and jingle mail the keys to the bank (they own both their homes free and clear as far as I know) and I suspect banks are going to get huge amounts of "jingle mail" from private landlords if this situation isn't sorted.

As I've said before, I saw the original "experiment" on this in the late 1980s when the Denver Oil market crashed at the same time "balloon mortgages" came due; the results were lots of people leaving their keys in the mailbox and leaving town.

At one point the US Federal Government (HUD) was the largest land owner in the city and county of Denver - banks don't really like being landlords either, especially when there are thousands of empty properties (lawns must be mowed, windows replaced, insurance paid etc).

I have close friends who are private landlords too and they can't continue on like this either - I haven't checked but it wouldn't surprise me if they just sold the urban properties and moved into their retirement home now that both of them are actually retired.

If they can't get a sale, well I suspect they will just walk away from the rental properties and jingle mail the keys to the bank (they own both their homes free and clear as far as I know) and I suspect banks are going to get huge amounts of "jingle mail" from private landlords if this situation isn't sorted.

As I've said before, I saw the original "experiment" on this in the late 1980s when the Denver Oil market crashed at the same time "balloon mortgages" came due; the results were lots of people leaving their keys in the mailbox and leaving town.

At one point the US Federal Government (HUD) was the largest land owner in the city and county of Denver - banks don't really like being landlords either, especially when there are thousands of empty properties (lawns must be mowed, windows replaced, insurance paid etc).

Oregon diverted $68 million in covid relief funds only to black people, a little down payment. Didn't do them much good since they wasted a LOT of it. Oregon kicked it all to January 1st 2021 and now wants the feds to bail out the renters.

The tidal wave of ebictions will hit about the same time all the other crap hits.

Again, it is going to depend on the state. We have a wait list a mile long for all of our rental units. We have 153 units, mostly single family and duplex (no "complexes"). We could literally fill twice that many without even blinking an eye. A lot of people are moving to Florida ... many of them leaving the Northeast.

Saw this morning CA wants to extend the ban on evictions for another year.

All they are creating is a ticking timebomb where people get used to spending their rent money every month instead of paying it. I'm not even sure it would stand up to a constitutional challenge. That's, in part, why all of the eviction moratoriums have as part of their language that all rents are due when the moratorium comes to an end.

In Florida some of us were about to challenge the state-level moratorium because it didn't offer equal protection under the law. De Santis saw the writing on the wall and got out of the moratorium business. All that has done has increased property values which is a good thing all around even if it does mean higher property taxes.

And the CDC moratorium isn't protecting people either because there are several limitations to its application in any eviction case. These goes for foreclosures as well, especially those that started preceding the covid lockdowns.

Moving to FL will at least buy people some time, even if they end up living out of their vehicles. From everything I've been studying the Mid-West is becoming too cold and snowy. I would prefer to move back there, or the North East, but I don't think either of the two areas will be functional in ten or more years - winters are going to get so much more severe (DYODD).

More .gov isn't going to fix solar induced climate change. People will have to look out for and provide for their own kids, or not. Whole lot of population "reduction" coming down the pike, both natural and planned.

More .gov isn't going to fix solar induced climate change. People will have to look out for and provide for their own kids, or not. Whole lot of population "reduction" coming down the pike, both natural and planned.

Meemur

Voice on the Prairie / FJB!

From everything I've been studying the Mid-West is becoming too cold and snowy.

Nope! Don't move here. Never mind that today is sunny and in the the 60s. Hahahahah.

Winters are becoming milder overall. When I was little, there was snow on the ground from Oct - April. Today, I'll be mowing the last of the leaves. No snow anywhere.

If any place is going to be spared, I would like it to be "fly-over country." Has the best people.Nope! Don't move here. Never mind that today is sunny and in the the 60s. Hahahahah.

Winters are becoming milder overall. When I was little, there was snow on the ground from Oct - April. Today, I'll be mowing the last of the leaves. No snow anywhere.

Melodi

Disaster Cat

And what will happen when all the private landlords (my friends are in California) up and turn the properties over to the bank either by design or by default?Saw this morning CA wants to extend the ban on evictions for another year.

Who will keep the plumbing fixed and all the other maintenance a rental apartment or home requires, the banks in Denver had a terrible record on that.

When I left Denver I made a choice, I could have stayed and bought a perfectly good house for nothing down and 500 dollars a month like many of my friends did.

But the kicker was, most of the homes had broken windows, the kitchen's torn out, and sometimes vagrants living in them you had to deal with first.

The main exceptions were the Victorians near Capital Hill (the people I babysat got one for the same mortgage) but they were harder to get and higher standards for mortgages (aka my job didn't pay enough).

20Gauge

TB Fanatic

The lock thing is why we key the doors differently and don't give them a key to the back door.I owned a rental once. It was a horror show. The “family” we rented to past the background check and were very presentable. They paid the first and last months rent, plus deposit and checks cleared.

Things got screwy when I called before going to get the second months check. The number was disconnected. I showed up the next day and knock and I hear someone yell “don’t answer the door”. I was going to let myself in and noticed the locks were changed.

I’m gonna skip all the craziness that went on trying to get them out with the courts. I posted an ad on Craigslist saying tenants were evicted and anything there is free for the taking. Dozens of people showed up looking for the free stuff.

I was at the neighbors watching and called to report the disturbance. The cops showed and I came over and gave them permission to search the house. I planned ahead and had a copy of the lease to show anything found was theirs not mine.

20Gauge

TB Fanatic

That's not how rental income is accounted for. You don't "write it off" you just don't earn it. You only claim actual income, you can't write off expected income minus actual income.

Now if you get an eviction and then get a judgment, you can write the judgment off but it is a different kettle of fish. First off, the judgment doesn't become income until or unless it is paid. Which 99.999999% of the time it is not. However, hubby and I are looking into a potential solution of "writing off" the judgment as a loss (it would have been an account payable on our books) and then submitting a 1099 or 1098 or similar to the IRS. This may not be possible but we have a call out to our account about this. It isn't something that is normally done from our understanding but if we aren't going to get paid might as well see about making them feel the pain in some way.

Rental income is like any other kind of investment income. Never bet more than you can afford to lose. We had been giving real consideration to getting out of the business but the truth is after 25 years and an extremely low debt to income ratio with our business, we'd be crazy to sell for at least another decade (given our age) because we can't replace the 50% plus return on investment. There's nothing out there that will cashflow consistently like that. Not even the stock market.

The 1099 thing is legit.

It has to be a 1099C for the cancellation of debt.

Of course, if they change ALL the locks, that won't matter.The lock thing is why we key the doors differently and don't give them a key to the back door.

20Gauge

TB Fanatic

So a large number of these people got Unemployment that was better than their wages before, plus got a cash infusion but still couldn't pay the rent. So we will just give them money for lacking responsibility.........Good idea!!!!

12 Million Renters Owe More Than $5K in Rent

About 12 million renters owe over $5,000 in past-due rent, according to a recent survey, while about one-in-five families with children have fallen behind on paying their rent...www.newsmax.com

12 Million Renters Owe More Than $5K in Rent

(Getty Images)

By Theodore Bunker | Monday, 07 December 2020 05:21 PM

About 12 million renters owe over $5,000 in past-due rent, according to a recent survey, while about one-in-five families with children have fallen behind on paying their rent, The Washington Post reports.

The Census Bureau found that 21% of families are falling behind on rent, including 29% of Black families and 17% of Hispanic families. The Federal Reserve Bank of Philadelphia found that 1.3 million households with people who had a job before the coronavirus pandemic and lost it after are, on average, $5,400 in debt when it comes to rent and utilities.

“The tidal wave is coming. It’s going to be really horrible for people,” Charlie Harak, a senior attorney at the National Consumer Law Center, told the Post. “The number of people who are now 90 days behind and the dollars they are behind are growing quite significantly.”

Mark Wolfe, executive director of the National Energy Assistance Directors’ Association, compared many people’s living situation to “a Charles Dickens novel.”

He added, “It’s an evolving story of how people at the bottom are suffering.”

“It’s much better for Congress to err on the side of helping too much than too little,” Mark Zandi, Moody’s Analytics’ chief economist, noted. “There’s nothing scarier than losing your home, especially in January with a pandemic out of control. That would be overwhelming.”

He added that the amount of unpaid debt for rent and utilities will likely reach $70 billion by January, and even more damage could be caused by widespread evictions in 2021, which he predicts will cause people to “lose faith” in the government.

“The economic damage created by this pandemic will be many times more severe if we lose faith that the government has our back,” Zandi said.

I do realize that their a number of people are hurting, but I have seen too many who did just fine and yelled "poverty and I need help!"

20Gauge

TB Fanatic

Actually we have found they don't know how to change the locks if we don't give them a key. Not sure why, but true!Of course, if they change ALL the locks, that won't matter.

20Gauge

TB Fanatic

We had over a dozen applicants for a single place. We never advertised or put a sign out. They saw me working on the place and kept coming back again and again trying to rent the place.Again, it is going to depend on the state. We have a wait list a mile long for all of our rental units. We have 153 units, mostly single family and duplex (no "complexes"). We could literally fill twice that many without even blinking an eye. A lot of people are moving to Florida ... many of them leaving the Northeast.

The 1099 thing is legit.

It has to be a 1099C for the cancellation of debt.

That's what we heard but our accountant says there are some caveats to it. In Florida there is a Count I and a Count II in the eviction process. We are trying to determine if we can 1099 them with Count I or will we have to continue on to Count II which is a little trickier because the original eviction has to be personally served. I'm hoping it only has to go to Count I. Count II is what you have to have if you want to take it all the way to a "sheriff's sale" which is really pretty useless for most eviction debt collection.

Meemur

Voice on the Prairie / FJB!

Good luck with all that! They're sure not making it easy for small businesses, and I include landlords in that group.

One suggestion to landlords and others who want to expand in 2021: you might be able to do some property management for the smaller, local banks if they end up with a lot of foreclosed homes. I had neighbors who had construction and lawn maintenance experience and did quite well with their own property management business. Later, they started buying some of the better properties and flipping them. Try to work with local banks: they are more likely to hire and pay you. Again, your millage may vary depending on state laws but it was quite doable in Ohio.

One suggestion to landlords and others who want to expand in 2021: you might be able to do some property management for the smaller, local banks if they end up with a lot of foreclosed homes. I had neighbors who had construction and lawn maintenance experience and did quite well with their own property management business. Later, they started buying some of the better properties and flipping them. Try to work with local banks: they are more likely to hire and pay you. Again, your millage may vary depending on state laws but it was quite doable in Ohio.

We had over a dozen applicants for a single place. We never advertised or put a sign out. They saw me working on the place and kept coming back again and again trying to rent the place.

They like to see management working on vacant properties. We always have to keep blank applications on hand. We used to do free application for years but nowadays we charge $50+ depending on the unit because I have to go so deep now to check nationwide databases and follow up on anything that looks hinky.

People pay it. Most places around Tampa are now charging average $125 just for the application fee but they use professional service companies to run applicants. I do it myself and after 25 years in the business I've got a few standouts that I absolutely will not approve. And I catch you lying on the application and you just wasted your money. I warn them ahead of time and idiots still try and pull that stuff.

Nor do I check credit reports. There are too many errors out there not to mention most people have something on their credit that is adverse. I stick to the civil/criminal side of things and so far so good.

Scammers will always be with us.So a large number of these people got Unemployment that was better than their wages before, plus got a cash infusion but still couldn't pay the rent. So we will just give them money for lacking responsibility.........Good idea!!!!

I do realize that their a number of people are hurting, but I have seen too many who did just fine and yelled "poverty and I need help!"

I would rather see us print up some more monopoly money to keep 9 million from living in tents, even if some scammers get some.

When I think of how the Elites, big business, Wall Street, et al, continue to scam all of us, I don't worry about the small fry.

Good luck with all that! They're sure not making it easy for small businesses, and I include landlords in that group.

One suggestion to landlords and others who want to expand in 2021: you might be able to do some property management for the smaller, local banks if they end up with a lot of foreclosed homes. I had neighbors who had construction and lawn maintenance experience and did quite well with their own property management business. Later, they started buying some of the better properties and flipping them. Try to work with local banks: they are more likely to hire and pay you. Again, your millage may vary depending on state laws but it was quite doable in Ohio.

REOs turn so fast here in Florida that the banks usually have a buyer or two lined up before the foreclosure is even final. Between 2009 and 2015 we doubled our portfolio twice using REOs that our local bank came to us to bail them out with.

I wouldn't be getting into the investment property game right now for love or money. Prices are way freaking too high here in Florida. All it would take is for the rental market to slow down and your break even property will turn into a money pit. All of our properties are cash cows, debt to income ratio is so low it is starting to affect our taxes (not enough expenses), and we took selling some units off the table because we couldn't replace the income, even in the stock market.

That said it is about time for some of the units to be renovated so that will bump our expenses back up, for tax purposes.

The bookkeeping is never done when you are a landlord.

Meemur

Voice on the Prairie / FJB!

When I think of how the Elites, big business, Wall Street, et al, continue to scam all of us, I don't worry about the small fry.

I agree. That's why I don't have a problem with another $1,200. If it buys us a little more time before the monkeys burn down the cities, that's a Good Thing.

Ultimately, we're headed for WW III. The US will never pay off its debt, in my opinion.

20Gauge

TB Fanatic

That's what we heard but our accountant says there are some caveats to it. In Florida there is a Count I and a Count II in the eviction process. We are trying to determine if we can 1099 them with Count I or will we have to continue on to Count II which is a little trickier because the original eviction has to be personally served. I'm hoping it only has to go to Count I. Count II is what you have to have if you want to take it all the way to a "sheriff's sale" which is really pretty useless for most eviction debt collection.

Not sure about Florida and how that would effect the situation, but under IRS rules if the debt is "forgiven" or "defaulted upon" you can issue the 1099C.

So the question would be at what point does Florida say it is defaulted? Or you can just forgive it and then 1099C

20Gauge

TB Fanatic

Since we are a small town, we check the local courthouse. That dumps about 90% of the peopleThey like to see management working on vacant properties. We always have to keep blank applications on hand. We used to do free application for years but nowadays we charge $50+ depending on the unit because I have to go so deep now to check nationwide databases and follow up on anything that looks hinky.

People pay it. Most places around Tampa are now charging average $125 just for the application fee but they use professional service companies to run applicants. I do it myself and after 25 years in the business I've got a few standouts that I absolutely will not approve. And I catch you lying on the application and you just wasted your money. I warn them ahead of time and idiots still try and pull that stuff.

Nor do I check credit reports. There are too many errors out there not to mention most people have something on their credit that is adverse. I stick to the civil/criminal side of things and so far so good.

I actually had a meth dealer try and apply once using her daughter as the applicant.

Since we are a small town, we check the local courthouse. That dumps about 90% of the people

I actually had a meth dealer try and apply once using her daughter as the applicant.

That's why we make them put everyone on the application that is going to be living in the unit. We also list those individuals on the lease, minors of all ages included. IF we catch anyone that isn't on the lease living there, even if it is just a weekend arrangement, we give them a 7-day notice to comply and then we say they've broken their lease. The reason beyond the obvious of trouble makers and law avoiders bringing unwelcome traffic into the unit is that we pay for water for most of our units. Every extra person living in the unit more than 3 days a month will cause a $25 charge for excess utility usage. In houses the charge is for extra wear and tear.

People do not realize that rents are set based on expenses and local market. Also, code enforcement does ticket for too many people living in a unit and then WE have to pay fines. You can be nickle and dimed into bankruptcy if you don't keep on top of things.

I agree. That's why I don't have a problem with another $1,200. If it buys us a little more time before the monkeys burn down the cities, that's a Good Thing.

Ultimately, we're headed for WW III. The US will never pay off its debt, in my opinion.

I do have a problem with another stimulus. Most people I know ... like 90%+ ... did not use that money to pay bills. They used it on stay-cations, big ticket electronic purchases, booze, more guns, etc. My parents used theirs to pay for moving expenses without us knowing that's what they were doing as we had planned on paying it.

Lots of stories like that and none of them include bills. My brother is the only one I can honestly say paid bills with it ... because the IRS needed to be paid and took it after he deposited it.

So no, not thrilled with the idea of another so-called stimulus unless there are strings attached. I'm tired of my taxes paying other people's "bills" and playtime..

Hint: a lot of us paying for the stimulus didn't qualify to get our freebies, not even the small business loans.

marsh

On TB every waking moment

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Expect The Most Evictions In History As Ban Expires

MONDAY, DEC 14, 2020 - 11:40

Authored by Mike Shedlock via MishTalk,

The federal ban on evictions expires in January. For millions that's when huge problems start.

Wave of Evictions Coming

Prepare for a Wave of Evictions in January as Federal Ban Expires.

Millions of U.S. renters face the prospect of eviction in January unless federal officials extend protections put in place during the Covid-19 pandemic.

That month is when the Centers for Disease Control and Prevention’s ban on evictions is set to expire. The moratorium protects tenants who have missed monthly rent payments from being thrown out of their homes if they declare financial hardship. The CDC ordered the halt on evictions under the Public Health Service Act, which allows the federal government to enact regulations that help stop the spread of infectious diseases.

Between 2.4 million and 5 million American households are at risk of eviction in January alone, and millions more will be vulnerable in the months after, according to estimates from the investment bank and financial-advisory firm Stout Risius Ross.

Most Evictions In HistoryLandlords have already filed more than 150,000 eviction petitions during the pandemic in the 27 cities tracked by Princeton University’s Eviction Lab. Many of those tenants have lost their cases, and are now on the hook for all their back rent.

Questions Abound‘I don’t see how it’s possible that we’re not going to see more evictions on Jan. 1 than we’ve ever seen in a month,’ said John Pollock, staff attorney at the Public Justice Center

- It's easy to sympathize with tenants but what about landlords who cannot pay mortgages?

- Are we to postpone evictions forever while landlords lose their property?

So unless there is specific aid sufficient aid in the bill to allow tenants to catch up, millions of evictions are on the way.

Betty_Rose

Veteran Member

If any place is going to be spared, I would like it to be "fly-over country." Has the best people.

This is so true. As a widow on a tight budget rebuilding an old house, I have met so many wonderful people in this process.

They’ve gone above and beyond to show me great kindness.

The Midwest has the best people.

marsh

On TB every waking moment

Mapped: The Risk Of Eviction And Foreclosure In U.S. States | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Mapped: The Risk Of Eviction And Foreclosure In U.S. States

TUESDAY, DEC 15, 2020 - 19:45

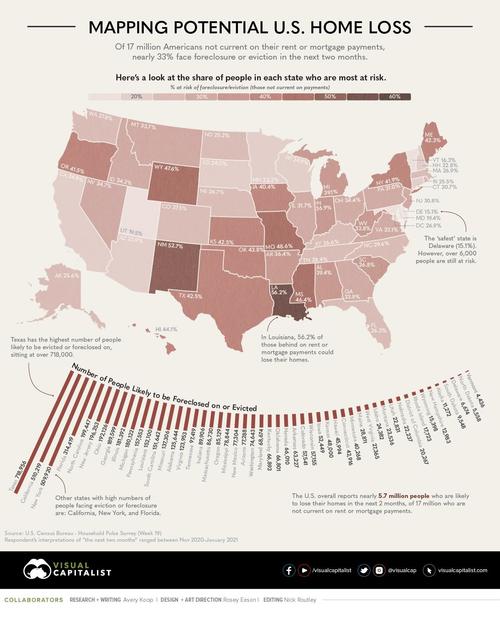

Alongside potential obstacles such as job loss, financial insecurity, and a subsequent inability to cover many upcoming bills, Visual Capitalist's Avery Koop notes that many Americans are now facing potential home loss as well.

According to a recent survey by the U.S. Census Bureau, of the estimated 17 million adults who are not current on their rent or mortgage payments, a whopping 33% of them could be facing eviction or foreclosure in the “next two months”.

Note: While this survey was conducted Nov 11-23, 2020, respondents’ interpretations of “the next two months” ranged between Nov 2020–Jan 2021.

Millions Facing Home Loss

Although people across the country face similar risks, Texas stands out with an estimated 718,000 people facing foreclosures or eviction. In fact, more than 7.1 million people in the state may be expecting a loss of employment income in the coming four weeks.

Other states looking at high percentages of potential home loss include Louisiana, New Mexico, Mississippi, Wyoming, and Missouri.

To get a closer look, here are the top 10 metro areas with the highest percentages of people who will potentially be facing eviction or foreclosure:

Home for the Holidays?

On the other end of the spectrum, there are states that appear to have less need for concern, as the percentage of people likely to experience foreclosure or eviction in these places stands between 15% and 20%. However, this level of relative home security is the case for only Delaware, Vermont, Maryland, and Utah.

Everyone else is floating in a proverbial gray area, between a majority who may still be in their same home after Christmas, and those who may need to find a new place in the months following the holidays.

Even in the states with extremely low percentages like Delaware (15%), there are still thousands people who are highly likely to face the possibility of losing their home.

Going Forward

It goes without saying that with nearly 17 million Americans behind on mortgage and rent payments, there could be significant consequences down the road.

In an order issued by the CDC under the Public Health Service Act, it was stated that an eviction moratorium could help with the effectiveness of COVID-19 prevention measures like quarantining, social distancing, and self-isolation.

However, while evictions were temporarily halted under this order on September 4th, the extent of this protection runs out on the last day of 2020.

President-elect Joe Biden expressed his desire for measures such as rent forgiveness back in March 2020, but it remains unclear what actions will be taken under the new administration when inauguration occurs on January 20th, 2021.

jward

passin' thru

Reuters

@Reuters

2m

On the economic front, President Biden asked the CDC to extend a moratorium on evictions until the end of March, and the Department of Education to suspend student loan payments until the end of September https://reut.rs/396PWQN

@Reuters

2m

On the economic front, President Biden asked the CDC to extend a moratorium on evictions until the end of March, and the Department of Education to suspend student loan payments until the end of September https://reut.rs/396PWQN

Doomer Doug

TB Fanatic

Hm, I thought he was extending the eviction ban till September 30th like the student loan payment suspension.

The plain truth is all this money owed for back rent, back mortgage payments, unpaid utility bills of all types, will never be repaid. Once the $15 minimum wage takes effect, the federales tell us 4 million jobs will vaporize. I see no reason for the ongoing chaos and anarchy to stop now that Trump is gone. It is a Marxist Tyranny they seek to impose after all, and bideypoop isn't a part of that.

The country is still bitterly divided, 52 to 48 percent when Trump left yesterday.

Biden will trigger an economic collapse as fast as he can so they can still blame it all on Trump. Just wait another 3 months when the fiat money printing press can't keep the mob happy.

The plain truth is all this money owed for back rent, back mortgage payments, unpaid utility bills of all types, will never be repaid. Once the $15 minimum wage takes effect, the federales tell us 4 million jobs will vaporize. I see no reason for the ongoing chaos and anarchy to stop now that Trump is gone. It is a Marxist Tyranny they seek to impose after all, and bideypoop isn't a part of that.

The country is still bitterly divided, 52 to 48 percent when Trump left yesterday.

Biden will trigger an economic collapse as fast as he can so they can still blame it all on Trump. Just wait another 3 months when the fiat money printing press can't keep the mob happy.

Redleg

Veteran Member

I thought the same thing. Beat me to it.Of course, if they change ALL the locks, that won't matter.