For links see article source.....

Posted for fair use.....

https://www.economist.com/news/chin...-limits-what-debt-crisis-provinces-says-about

Centre-local tussles

What a debt crisis in the provinces says about governing China

Xi Jinping’s enormous power still has limits

Print edition | China

Nov 16th 2017 | BEIJING

IT IS a truth universally acknowledged, said China’s central-bank chief, Zhou Xiaochuan, recently, that huge debts are “the root of weakness in China’s macro financial system”. A truth less universally acknowledged is the role of politics. A big part of the debt problem stems from a dysfunctional relationship between central and local governments. Tensions between them pushed up debt to dangerous levels in 2015. Changing the rules seemed to have solved the problem for a while. But as in the film “Pride and Prejudice and Zombies”, the horror is back from the dead.

China is so vast that relations between the centre and periphery have always been problematic. As one epigram puts it: “The empire, long divided, must unite; long united, must divide.” During the past few years the centre has been stressing the need for unity. Convinced that local governments have been enjoying too much autonomy, it has been trying to exert greater control over them. Localities, however, keep pushing back.

Under China’s peculiar fiscal system, local governments—those at provincial, city and county levels—have strictly limited revenue-raising powers. Until 2014 they could not borrow or issue bonds without the centre’s permission. Localities depend on fixed shares of certain taxes: 50% of value-added tax, for example, and 40% of personal income tax.

https://cdn.static-economist.com/si...th/images/print-edition/20171118_CNC208_0.png

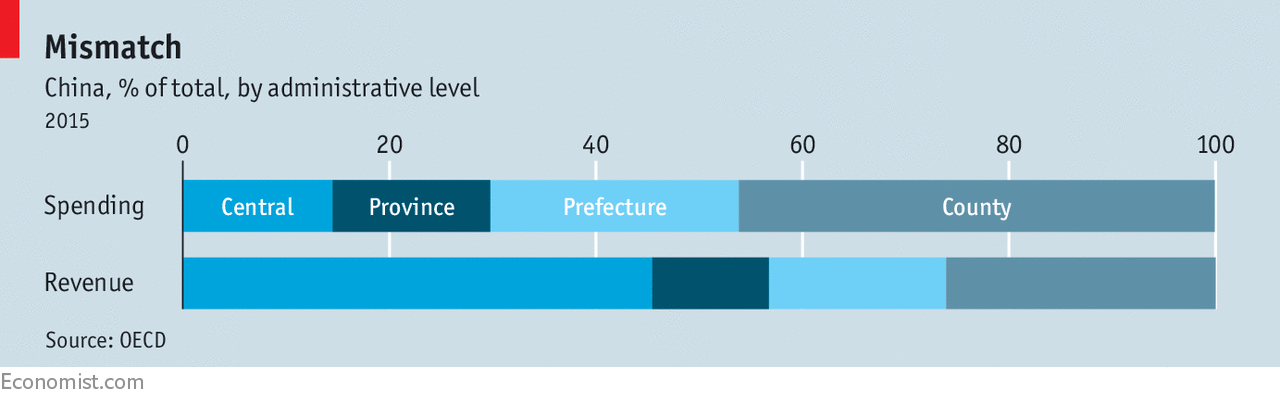

The share is never enough. Local governments receive roughly half of total tax revenues but are responsible for two-thirds of government spending. In counties the discrepancy is especially large (see chart). The result is that local authorities are permanently dependent on transfers from the centre to keep afloat. These transfers account for, on average, half of local spending. Such huge flows give the centre a lot of influence over lower tiers.

Equally naturally, local governments look for ways to escape control from above. One that began to emerge in the 1990s is a shadowy kind of investment company, under local-authority control, known as a “local government financing vehicle”, or LGFV. Such firms used state-owned land and shares in local state firms as collateral to raise money from banks, the bond market and consumers.

The purpose of this borrowing was usually to build houses, roads and other infrastructure. But it was largely unregulated. LGFVs were not banks, so they were not subject to the same financial rules. Neither were they local-government departments, which are subject to central controls. They were set up as state-owned enterprises, which allowed them to ignore budget constraints and often to keep their balance-sheets hidden from public view.

Kicking the tyres

Alarmed by the growth of LGFVs, the central government set out to investigate. In 2013 it counted over 10,000 of them and calculated their total borrowing at 7trn yuan ($1.1trn, or 13% of GDP). Mainland China has 31 provinces, 330 prefectures and 2,800 county-level administrations, so this works out at more than three per jurisdiction. At the end of 2015 total local-government debt, mostly involving LGFVs, amounted to 15trn yuan, or 24% of GDP. Compared with China’s total outstanding credit, amounting to 250% of GDP at that time, this was not such a big share. But most borrowing by LGFVs was “off budget”, that is, unreported. It had exploded during the previous decade.

In 2014 the central government began trying to sort out the mess by banning local authorities from raising money through financing vehicles. Instead, it said, they could issue bonds and use the money to refinance LGFV debt. By 2018 all such debt is supposed to be converted into bonds. This implies issuing about 15trn yuan, a huge amount. By putting local borrowing onto the books, the government hopes to bring some transparency to the debt problem. By imposing ceilings on the amount of locally issued bonds, it also aims to limit the issue of new debt. Turning LGFV debt into bonds, it reckons, should also help the local authorities because bond yields are cheaper than bank loans.

There followed an avalanche of other reforms. The national government began to include assessments of local officials’ borrowing decisions in their annual performance reviews. They would be held responsible even after moving to another area. The centre also banned some dodgy incentives that local governments had used to attract private investors. Most ambitiously, the five-year plan for economic development that took effect in 2016 promised that there would be a new revenue- and tax-sharing deal between the central and local levels.

It all made excellent sense. Yet in July 2017 Mr Xi made clear that the fixes were not working. He told a conference on the financial system that local-government debt was still one of the two biggest threats to China’s financial stability (the other was debt built up by state-owned firms). The problem was that local governments were still using every trick in the book to disguise their shenanigans.

Houze Song of the Paulson Institute, an American think-tank, says local officials have been reclassifying loans so they no longer appear in official statistics. As the finance ministry reported in August, complicated public-private partnerships are being used to disguise debt as private capital. This month a manager at one LGFV told Caixin, a Beijing-based magazine, that even if an institution announces that it is separating from the local government, it will quickly turn to the local government again when it gets in financial trouble. Huo Zhihu of China Securities Credit Rating, a domestic ratings agency, was quoted by the magazine as saying that such separations were “just a formality”.

The persistence of the debt problem reveals much about the difficulties of governing China and the limits even of Xi Jinping’s immense authority. In principle, it ought to be possible to make a clearer division of tax-raising powers between the centre and periphery, a prospect raised in the five-year plan and reiterated by Mr Xi at a party congress in October. Such a deal would lessen the mismatch between spending and revenues. In particular a property tax, promised in 2013, would give local governments a new tax base.

The trouble is that central and local governments do not trust each other enough to negotiate such a deal. To make matters worse, they have drawn different lessons from the LGFV debt saga. The centre thinks local authorities need to be reined in, not given their own tax base. The periphery seems to have decided that increasingly elaborate schemes are needed to defend what little financial autonomy they have. Localities also worry that a property tax might lower house prices—and no one wants to be blamed for that.

Mr Xi has long complained that local officials are obstructing his policies and says he needs more powers to force changes through. The party congress has given him those. The local-debt crisis will be a test of whether he plans to reform the system of government in China, or whether he will be content merely to have its top layer stacked with his allies.

This article appeared in the China section of the print edition under the headline "The walking debt"

Posted for fair use.....

https://www.economist.com/news/chin...-limits-what-debt-crisis-provinces-says-about

Centre-local tussles

What a debt crisis in the provinces says about governing China

Xi Jinping’s enormous power still has limits

Print edition | China

Nov 16th 2017 | BEIJING

IT IS a truth universally acknowledged, said China’s central-bank chief, Zhou Xiaochuan, recently, that huge debts are “the root of weakness in China’s macro financial system”. A truth less universally acknowledged is the role of politics. A big part of the debt problem stems from a dysfunctional relationship between central and local governments. Tensions between them pushed up debt to dangerous levels in 2015. Changing the rules seemed to have solved the problem for a while. But as in the film “Pride and Prejudice and Zombies”, the horror is back from the dead.

China is so vast that relations between the centre and periphery have always been problematic. As one epigram puts it: “The empire, long divided, must unite; long united, must divide.” During the past few years the centre has been stressing the need for unity. Convinced that local governments have been enjoying too much autonomy, it has been trying to exert greater control over them. Localities, however, keep pushing back.

Under China’s peculiar fiscal system, local governments—those at provincial, city and county levels—have strictly limited revenue-raising powers. Until 2014 they could not borrow or issue bonds without the centre’s permission. Localities depend on fixed shares of certain taxes: 50% of value-added tax, for example, and 40% of personal income tax.

https://cdn.static-economist.com/si...th/images/print-edition/20171118_CNC208_0.png

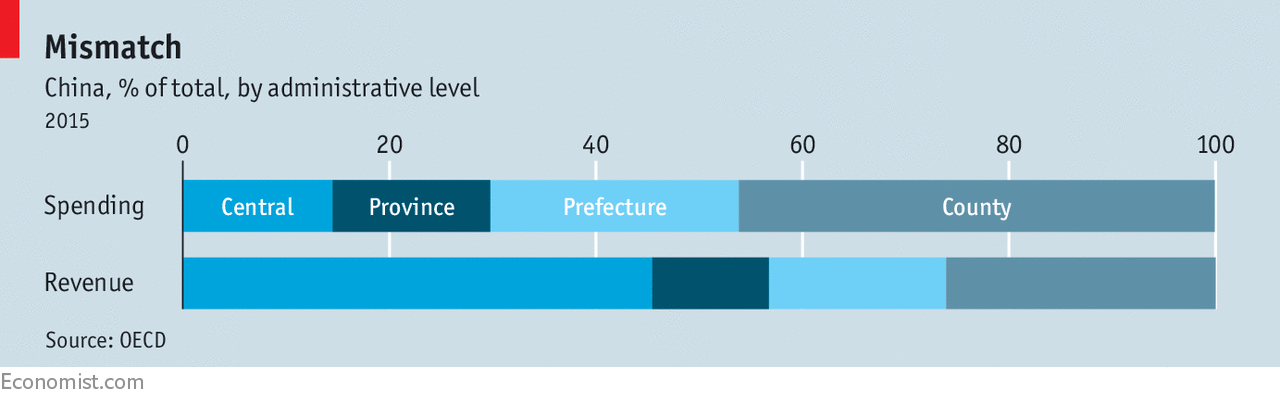

The share is never enough. Local governments receive roughly half of total tax revenues but are responsible for two-thirds of government spending. In counties the discrepancy is especially large (see chart). The result is that local authorities are permanently dependent on transfers from the centre to keep afloat. These transfers account for, on average, half of local spending. Such huge flows give the centre a lot of influence over lower tiers.

Equally naturally, local governments look for ways to escape control from above. One that began to emerge in the 1990s is a shadowy kind of investment company, under local-authority control, known as a “local government financing vehicle”, or LGFV. Such firms used state-owned land and shares in local state firms as collateral to raise money from banks, the bond market and consumers.

The purpose of this borrowing was usually to build houses, roads and other infrastructure. But it was largely unregulated. LGFVs were not banks, so they were not subject to the same financial rules. Neither were they local-government departments, which are subject to central controls. They were set up as state-owned enterprises, which allowed them to ignore budget constraints and often to keep their balance-sheets hidden from public view.

Kicking the tyres

Alarmed by the growth of LGFVs, the central government set out to investigate. In 2013 it counted over 10,000 of them and calculated their total borrowing at 7trn yuan ($1.1trn, or 13% of GDP). Mainland China has 31 provinces, 330 prefectures and 2,800 county-level administrations, so this works out at more than three per jurisdiction. At the end of 2015 total local-government debt, mostly involving LGFVs, amounted to 15trn yuan, or 24% of GDP. Compared with China’s total outstanding credit, amounting to 250% of GDP at that time, this was not such a big share. But most borrowing by LGFVs was “off budget”, that is, unreported. It had exploded during the previous decade.

In 2014 the central government began trying to sort out the mess by banning local authorities from raising money through financing vehicles. Instead, it said, they could issue bonds and use the money to refinance LGFV debt. By 2018 all such debt is supposed to be converted into bonds. This implies issuing about 15trn yuan, a huge amount. By putting local borrowing onto the books, the government hopes to bring some transparency to the debt problem. By imposing ceilings on the amount of locally issued bonds, it also aims to limit the issue of new debt. Turning LGFV debt into bonds, it reckons, should also help the local authorities because bond yields are cheaper than bank loans.

There followed an avalanche of other reforms. The national government began to include assessments of local officials’ borrowing decisions in their annual performance reviews. They would be held responsible even after moving to another area. The centre also banned some dodgy incentives that local governments had used to attract private investors. Most ambitiously, the five-year plan for economic development that took effect in 2016 promised that there would be a new revenue- and tax-sharing deal between the central and local levels.

It all made excellent sense. Yet in July 2017 Mr Xi made clear that the fixes were not working. He told a conference on the financial system that local-government debt was still one of the two biggest threats to China’s financial stability (the other was debt built up by state-owned firms). The problem was that local governments were still using every trick in the book to disguise their shenanigans.

Houze Song of the Paulson Institute, an American think-tank, says local officials have been reclassifying loans so they no longer appear in official statistics. As the finance ministry reported in August, complicated public-private partnerships are being used to disguise debt as private capital. This month a manager at one LGFV told Caixin, a Beijing-based magazine, that even if an institution announces that it is separating from the local government, it will quickly turn to the local government again when it gets in financial trouble. Huo Zhihu of China Securities Credit Rating, a domestic ratings agency, was quoted by the magazine as saying that such separations were “just a formality”.

The persistence of the debt problem reveals much about the difficulties of governing China and the limits even of Xi Jinping’s immense authority. In principle, it ought to be possible to make a clearer division of tax-raising powers between the centre and periphery, a prospect raised in the five-year plan and reiterated by Mr Xi at a party congress in October. Such a deal would lessen the mismatch between spending and revenues. In particular a property tax, promised in 2013, would give local governments a new tax base.

The trouble is that central and local governments do not trust each other enough to negotiate such a deal. To make matters worse, they have drawn different lessons from the LGFV debt saga. The centre thinks local authorities need to be reined in, not given their own tax base. The periphery seems to have decided that increasingly elaborate schemes are needed to defend what little financial autonomy they have. Localities also worry that a property tax might lower house prices—and no one wants to be blamed for that.

Mr Xi has long complained that local officials are obstructing his policies and says he needs more powers to force changes through. The party congress has given him those. The local-debt crisis will be a test of whether he plans to reform the system of government in China, or whether he will be content merely to have its top layer stacked with his allies.

This article appeared in the China section of the print edition under the headline "The walking debt"