BREAKING: Fifth largest life insurance company in the US paid out 163% more for deaths of working people ages 18-64 in 2021 - Total claims/benefits up $6 BILLION (substack.com)

BREAKING: Fifth largest life insurance company in the US paid out 163% more for deaths of working people ages 18-64 in 2021 - Total claims/benefits up $6 BILLION

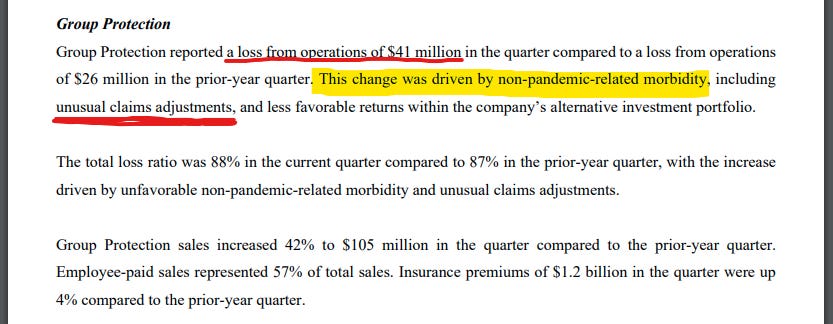

Company cites "non-pandemic-related morbidity" and "unusual claims adjustments" in explanation of losses from group life insurance business: Stock falling, replaces CEO

Margaret Menge

Jun 15

Five months after breaking the story of the CEO of One America insurance company saying deaths among working people ages 18-64 were up 40% in the third quarter of 2021, I can report that a much larger life insurance company, Lincoln National, reported a 163% increase in death benefits paid out under its group life insurance policies in 2021.

This is according to the annual statements filed with state insurance departments — statements that were provided exclusively to Crossroads Report in response to public records requests.

The reports show a more extreme situation than the 40% increase in deaths in the third quarter of 2021 that was cited in late December by One America CEO Scott Davison — an increase that he said was industry-wide and that he described at the time as “unheard of” and “huge, huge numbers” and the highest death rates that have ever been seen in the history of the life insurance business.

The annual statements for Lincoln National Life Insurance Company show that the company paid out in death benefits under group life insurance polices a little over $500 million in 2019, about $548 million in 2020, and a stunning $1.4 billion in 2021.

From 2019, the last normal year before the pandemic, to 2020, the year of the Covid-19 virus, there was an increase in group death benefits paid out of only 9 percent. But group death benefits in 2021, the year the vaccine was introduced, increased almost 164 percent over 2020.

Here are the precise numbers for Group Death Benefits taken from Lincoln National’s annual statements for the three years:

2019: $500,888,808

2020: $547,940,260

2021: $1,445,350,949

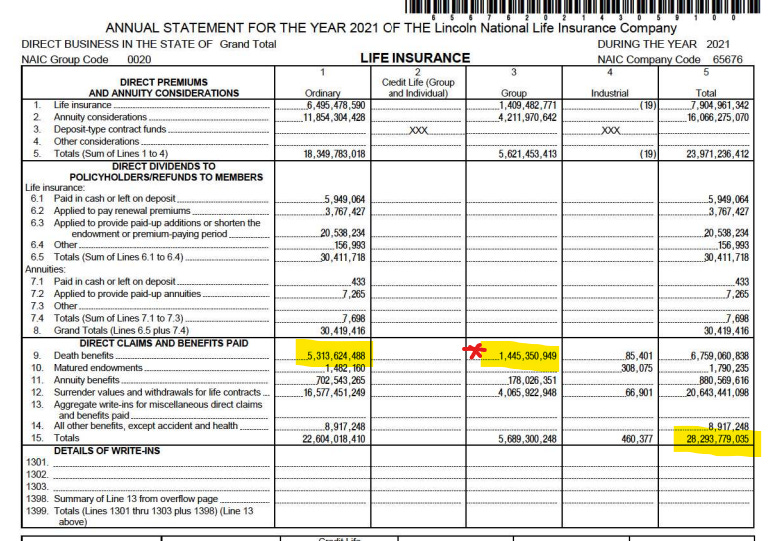

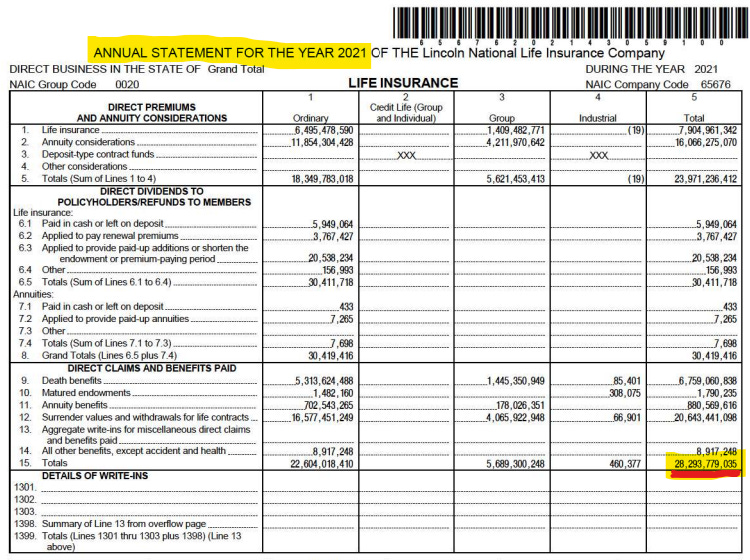

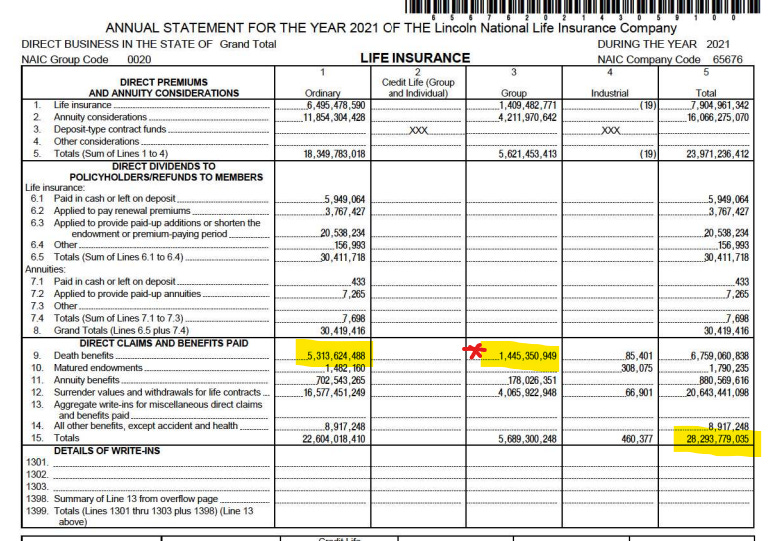

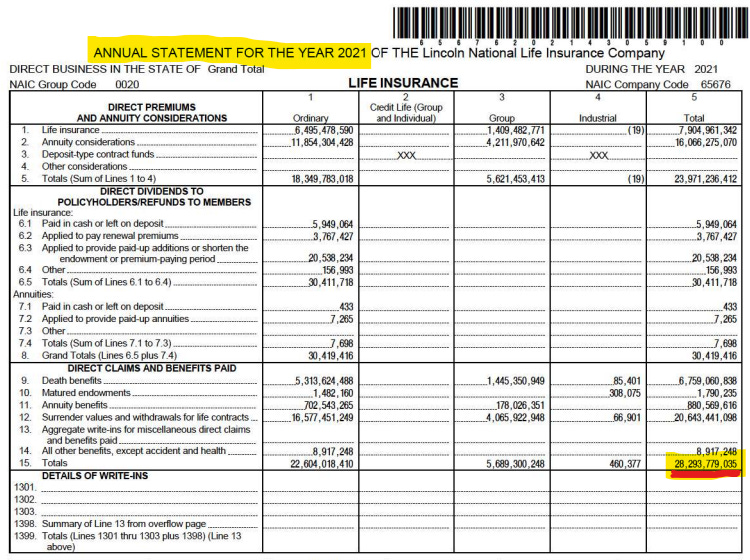

Here are the key numbers for 2021, below, shown on the company’s annual statement that was filed with the Michigan Department of Insurance and Financial Services. These are national numbers, not state-specific:

Lincoln National is the fifth-largest life insurance company in the United States, according to BankRate, after New York Life, Northwestern Mutual, MetLife and Prudential.

The company was founded in Fort Wayne, Indiana in 1905, getting the OK from Abraham Lincoln’s son, Robert Todd Lincoln, to use his father’s name and likeness in its advertising.

It’s now based in Radnor, Pennsylvania.

The annual statements filed with the states do not show the number of claims — only the total dollar amount of claims paid.

Group life insurance policies, in most cases, cover working-age adults ages 18-64 whose employer includes life insurance as an employee benefit.

How many deaths are represented by the 163% increase? It is not possible to determine by the dollar figures on the statements.

But the average death benefit for employer-provided group life insurance, according to the Society for Human Resource Management, is one year’s salary.

If the average annual salary of people covered by group life insurance policies in the United States is $70,000, this may represent 20,647 deaths of working adults, covered by just this one insurance company. This would represent at least 10,000 more deaths than in a normal year for just this one company.

The statements for the three years also show a sizable increase in ordinary death benefits — those not paid out under group policies, but under individual life insurance policies.

In 2019, the baseline year, that number was $3.7 billion. In 2020, the year of the Covid-19 pandemic, it went up to $4 billion, but in 2021, the year in which the vaccine was administered to almost 260 million Americans, it went up to $5.3 billion.

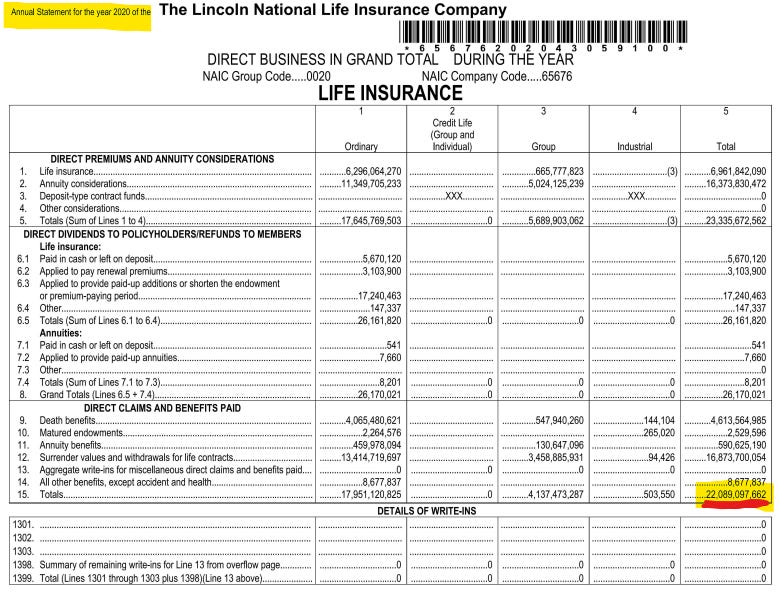

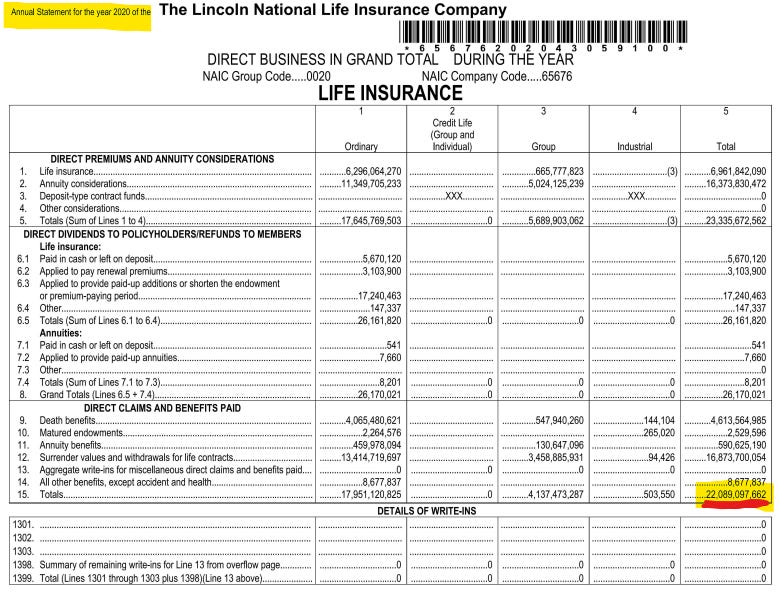

The statements show that the total amount that Lincoln National paid out for all direct claims and benefits in 2021 was more than $28 billion, $6 billion more than in 2020, when it paid out a total of $22 billion, which was less than the $23 billion it paid out in 2019, the baseline year.

A $6 billion increase in expenses is something few companies could absorb, but Lincoln National has been working to do just that — by increasing sales of new insurance polices.

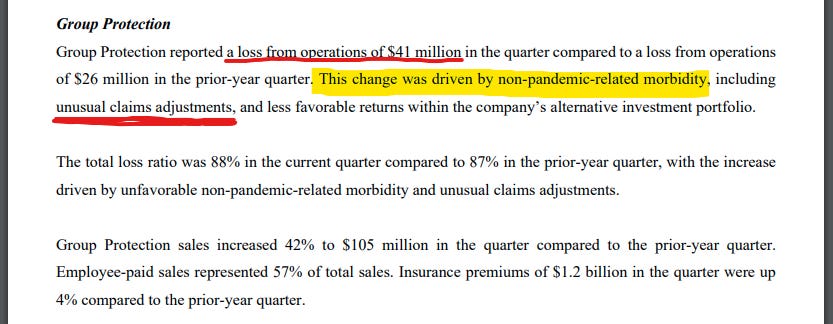

In the press release accompanying its annual report, and in its press release announcing the first quarter 2022 results — in which the company announces a $41 million loss in its Group Protection business — it trumpets an increase in sales. For first quarter 2022 that increase was 42 percent. The company also mentions that premiums have gone up 4 percent.

Interestingly, in the press release accompanying the first-quarter 2022 results, Lincoln National attributes the $41 operating million loss to “non-pandemic-related morbidity” and “unusual claims adjustments.”

“This change was driven by non-pandemic-related morbidity [emphasis added], including unusual claims adjustments [emphasis added], and less favorable returns within the company’s alternative investment portfolio.”

Morbidity, of course, means disease. A lot of people are sick.

This matches what I was told by OneAmerica in January in emails following the publication of my story in The Center Square — that it was not only deaths of working-age people that shot up to unheard-of levels in 2021, but also short- and long-term disability claims.

Annual statements for other insurance companies are still being compiled and reviewed. So far, Lincoln National shows the sharpest increases in death benefits paid out in 2021, though Prudential and Northwestern Mutual also show significant increases — increases much larger in 2021 than in 2020, indicating that the cure was worse than the disease — much worse.

Lincoln National’s stock price fell from about $70 a share on January 3 to $50 a share this week, and last month, a new CEO was installed. It doesn’t appear to be a sudden change, but could have been timed to assuage major shareholders who have no idea what’s really happening and may think that a fresh face and fresh ideas can turn this around. Could I suggest instead an honest and thorough assessment of what’s really driving these stunning numbers?

Crossroads Report is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Subscribe

NOTE: If your name is Charlie Kirk or if you work for Turning Point USA, this is NOT YOUR STORY. YOU DID NOT REPORT THIS STORY. YOU CANNOT TAKE CREDIT FOR THIS STORY because THAT WOULD BE THEFT. DO NOT mention this story anywhere without crediting the author and publication above and do not say or insinuate that you “found” this story or “discovered” this information on your own. You did not. Also, please remit payment to me for theft of the One America story, which was published by The Center Square on Jan. 1, 2022. I’m charging you $5,000 for your theft of the story, which ‘earned’ you an appearance on ‘Tucker Carlson Tonight’ and allowed you to pass yourself off as a journalist, though you are not a journalist.

BREAKING: Fifth largest life insurance company in the US paid out 163% more for deaths of working people ages 18-64 in 2021 - Total claims/benefits up $6 BILLION

Company cites "non-pandemic-related morbidity" and "unusual claims adjustments" in explanation of losses from group life insurance business: Stock falling, replaces CEO

Margaret Menge

Jun 15

Five months after breaking the story of the CEO of One America insurance company saying deaths among working people ages 18-64 were up 40% in the third quarter of 2021, I can report that a much larger life insurance company, Lincoln National, reported a 163% increase in death benefits paid out under its group life insurance policies in 2021.

This is according to the annual statements filed with state insurance departments — statements that were provided exclusively to Crossroads Report in response to public records requests.

The reports show a more extreme situation than the 40% increase in deaths in the third quarter of 2021 that was cited in late December by One America CEO Scott Davison — an increase that he said was industry-wide and that he described at the time as “unheard of” and “huge, huge numbers” and the highest death rates that have ever been seen in the history of the life insurance business.

The annual statements for Lincoln National Life Insurance Company show that the company paid out in death benefits under group life insurance polices a little over $500 million in 2019, about $548 million in 2020, and a stunning $1.4 billion in 2021.

From 2019, the last normal year before the pandemic, to 2020, the year of the Covid-19 virus, there was an increase in group death benefits paid out of only 9 percent. But group death benefits in 2021, the year the vaccine was introduced, increased almost 164 percent over 2020.

Here are the precise numbers for Group Death Benefits taken from Lincoln National’s annual statements for the three years:

2019: $500,888,808

2020: $547,940,260

2021: $1,445,350,949

Here are the key numbers for 2021, below, shown on the company’s annual statement that was filed with the Michigan Department of Insurance and Financial Services. These are national numbers, not state-specific:

Lincoln National is the fifth-largest life insurance company in the United States, according to BankRate, after New York Life, Northwestern Mutual, MetLife and Prudential.

The company was founded in Fort Wayne, Indiana in 1905, getting the OK from Abraham Lincoln’s son, Robert Todd Lincoln, to use his father’s name and likeness in its advertising.

It’s now based in Radnor, Pennsylvania.

The annual statements filed with the states do not show the number of claims — only the total dollar amount of claims paid.

Group life insurance policies, in most cases, cover working-age adults ages 18-64 whose employer includes life insurance as an employee benefit.

How many deaths are represented by the 163% increase? It is not possible to determine by the dollar figures on the statements.

But the average death benefit for employer-provided group life insurance, according to the Society for Human Resource Management, is one year’s salary.

If the average annual salary of people covered by group life insurance policies in the United States is $70,000, this may represent 20,647 deaths of working adults, covered by just this one insurance company. This would represent at least 10,000 more deaths than in a normal year for just this one company.

The statements for the three years also show a sizable increase in ordinary death benefits — those not paid out under group policies, but under individual life insurance policies.

In 2019, the baseline year, that number was $3.7 billion. In 2020, the year of the Covid-19 pandemic, it went up to $4 billion, but in 2021, the year in which the vaccine was administered to almost 260 million Americans, it went up to $5.3 billion.

The statements show that the total amount that Lincoln National paid out for all direct claims and benefits in 2021 was more than $28 billion, $6 billion more than in 2020, when it paid out a total of $22 billion, which was less than the $23 billion it paid out in 2019, the baseline year.

A $6 billion increase in expenses is something few companies could absorb, but Lincoln National has been working to do just that — by increasing sales of new insurance polices.

In the press release accompanying its annual report, and in its press release announcing the first quarter 2022 results — in which the company announces a $41 million loss in its Group Protection business — it trumpets an increase in sales. For first quarter 2022 that increase was 42 percent. The company also mentions that premiums have gone up 4 percent.

Interestingly, in the press release accompanying the first-quarter 2022 results, Lincoln National attributes the $41 operating million loss to “non-pandemic-related morbidity” and “unusual claims adjustments.”

“This change was driven by non-pandemic-related morbidity [emphasis added], including unusual claims adjustments [emphasis added], and less favorable returns within the company’s alternative investment portfolio.”

Morbidity, of course, means disease. A lot of people are sick.

This matches what I was told by OneAmerica in January in emails following the publication of my story in The Center Square — that it was not only deaths of working-age people that shot up to unheard-of levels in 2021, but also short- and long-term disability claims.

Annual statements for other insurance companies are still being compiled and reviewed. So far, Lincoln National shows the sharpest increases in death benefits paid out in 2021, though Prudential and Northwestern Mutual also show significant increases — increases much larger in 2021 than in 2020, indicating that the cure was worse than the disease — much worse.

Lincoln National’s stock price fell from about $70 a share on January 3 to $50 a share this week, and last month, a new CEO was installed. It doesn’t appear to be a sudden change, but could have been timed to assuage major shareholders who have no idea what’s really happening and may think that a fresh face and fresh ideas can turn this around. Could I suggest instead an honest and thorough assessment of what’s really driving these stunning numbers?

Crossroads Report is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Subscribe

NOTE: If your name is Charlie Kirk or if you work for Turning Point USA, this is NOT YOUR STORY. YOU DID NOT REPORT THIS STORY. YOU CANNOT TAKE CREDIT FOR THIS STORY because THAT WOULD BE THEFT. DO NOT mention this story anywhere without crediting the author and publication above and do not say or insinuate that you “found” this story or “discovered” this information on your own. You did not. Also, please remit payment to me for theft of the One America story, which was published by The Center Square on Jan. 1, 2022. I’m charging you $5,000 for your theft of the story, which ‘earned’ you an appearance on ‘Tucker Carlson Tonight’ and allowed you to pass yourself off as a journalist, though you are not a journalist.