continued.........

Many people ask why buy PMs..........

My thoughts regarding this is changing as time progresses......

Years ago I considered it an investment. Yeah I did. I could make some money at it. In reality, I did, but it was a lot of work. But I felt our money and the way we handled it was sound enough to last my lifetime if not longer.

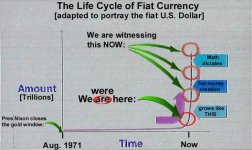

Then as I got older, I came to think it was a bridge from one currency to another.... That the collapse would come and it may in my life time, but all I needed was enough to last from one currency to the new currency.... I never had a lot of cash in the bank, but enough to pay the bills and buy some things just in case.....

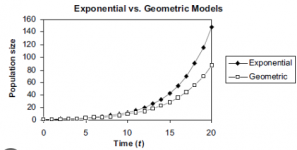

Now that I am in the 2nd half of my lifetime, ( I do expect to reach 100+ with today's tech ) I see things changing faster and faster..... example we are in stagflation similar to the 70s, but its impact is far worse. Then it meant getting some cheese from the government or maybe some food stamps.

Now it means you can not even afford the rent / buy a used car under 20 years old / the basics in life. None of these things were under threat in the 70s stagflation. Today? They are and far worse. We are starting to see the poor who have given up ( in my opinion ) are living and eating better than the average family.

We see debt rising so fast that it hard to comprehend. Can you really imagine what a trillion dollars really is? I can't. I have trouble with billions and that is a 1,000 billions.

Years ago we passed the ability to pay off the debt. We are now passing the ability to inflate ourselves out of debt ( yeah that is possible, but we screwed that up ). Our only option now is killing the dollar and hoping we stay together enough to create a new dollar ( digital or not ). I really believe we can not do that...yeah we passed that option also.

I now believe we need enough in PMs to last for several years of chaos. Times where you will use all of the BBBs. Our individual survival will be slim, less so if you don't have skills that are few and far between these days.

Example, what percentage of the population can change their oil, change a faucet, an outlet, cook a meal, harvest an animal, and grow some food???????

What do we need to do? Who knows, but I scoffed at the idea of 2 years of food was needed, After these last few days thinking, ( Yeah I do that some times ), even that may not be enough..........

I am at a crossroads for sure.....