Hfcomms

EN66iq

It is obviously time to go back to basics. I say this based on the emails we’ve received this week which ranged from tears to tirades regarding gold and silver price action. While speaking with a friend a few months back (during a period of price weakness), I said tongue in cheek that I should write an article titled “We are not your psychoanalysts”! The amount of fear was and is astonishing to me. We have tried to demonstrate with math, logic and history what the ending is. The problem for most is, even if the ending is understood they “want it and they want it now”!

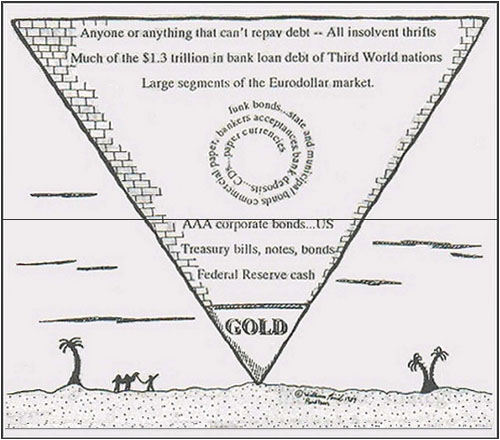

So, in an effort to help the panicked or despondent, let’s go back to the very basics. Below is an image of John Exter’s pyramid;

You will notice the pyramid is inverted. 100 years ago, this pyramid was inverted but obviously much smaller altogether. What has happened over the last 100+ years is that more and more “derivatives” of all sorts have been created. Also, “promises” of all sorts have been made. When I say promises, we are talking about pension plans, health aid, welfare etc. that promise current and future benefits. Basically, via the use of credit (and derivatives since the 1970’s), asset values have been continually inflated and re inflated. Without credit and without derivatives, valuations of most ALL assets would be only tiny fractions of what they are today.

The size and scope of the pyramid has gotten larger and larger in relation to the base (gold and silver). Notice that as you go higher and higher up the pyramid, the assets carry more and more risk. It is the high risk assets that now make up a larger and larger majority of all assets. Thus, “systemic” risk has continually grown over the years as the highest risk assets are now the vast majority of what society considers “assets”. As a side note, everything above gold on the pyramid is “derived” from money (gold), the further away from money …the lesser connection to (think money) value.

Looking at the pyramid, the vast majority of assets are “promises” to pay or perform something in the future. Gold and silver are different, they don’t promise anything at all in the future. Rather, theirs is simply a past promise. Gold and silver only promise that capital, labor and equipment WAS USED in the past to create it. This in a nutshell is what gold is all about. It already is pure money and the capital was already expended to create it. It does not need to promise anything in the future (ie. pay interest) to have value today. For example, what value would any debt security have if it promised to never pay any interest? (Yes I know, we almost live in that world now with some debt trading at negative yields but that only proves the point of insanity in our society today!).

Look around you, everyone and everything is in debt or has value created by debt. Sovereign treasuries all over the world now have debt to GDP levels that 30 years ago were signposts to being banana republics (and they are the ones who issue what the public considers money?). Pensions are woefully underfunded even with asset values at all time (and unsustainable) highs. Credit is now regularly offered with little to no proof of ability to pay back. Loans have had maturities extended so borrowers could “fit” into the amounts borrowed. …And on the other side, we have seen lenders/investors accept ridiculously low rates from deadbeats because “they needed yield”. Don’t ever forget, the vast majority of what the world now considers “assets”, require the performance of a promise(s) to perform. When the dust settles, this statement will be wholly obvious to all!

Folks, we live in a world of promises that cannot be kept. Where exactly do you believe the capital will flow to when promises cascade into broken promises? It will be THE largest transfer of wealth in all of history …INTO gold and silver because they don’t promise anything at all. Gold and silver are already “kept promises” that labor, capital and equipment were expended to create them. They are “proof” of kept promises!

These are trying times for those logically holding gold and silver. A financial collapse should have occurred sometime over the last three years but has not. Because it has not happened yet is not in any way proof that it will not. In fact, “math” is never refuted, only delayed. I will leave you with an example; is there any possible way London has the ability to deliver 3-4 years worth of global gold and silver production to their EFP’s? It’s OK, you know the answer … yet still worry over current price?

Standing watch,

Bill Holter

Holter-Sinclair collaboration

https://www.milesfranklin.com/back-to-basics-with-exters-pyramid/

So, in an effort to help the panicked or despondent, let’s go back to the very basics. Below is an image of John Exter’s pyramid;

You will notice the pyramid is inverted. 100 years ago, this pyramid was inverted but obviously much smaller altogether. What has happened over the last 100+ years is that more and more “derivatives” of all sorts have been created. Also, “promises” of all sorts have been made. When I say promises, we are talking about pension plans, health aid, welfare etc. that promise current and future benefits. Basically, via the use of credit (and derivatives since the 1970’s), asset values have been continually inflated and re inflated. Without credit and without derivatives, valuations of most ALL assets would be only tiny fractions of what they are today.

The size and scope of the pyramid has gotten larger and larger in relation to the base (gold and silver). Notice that as you go higher and higher up the pyramid, the assets carry more and more risk. It is the high risk assets that now make up a larger and larger majority of all assets. Thus, “systemic” risk has continually grown over the years as the highest risk assets are now the vast majority of what society considers “assets”. As a side note, everything above gold on the pyramid is “derived” from money (gold), the further away from money …the lesser connection to (think money) value.

Looking at the pyramid, the vast majority of assets are “promises” to pay or perform something in the future. Gold and silver are different, they don’t promise anything at all in the future. Rather, theirs is simply a past promise. Gold and silver only promise that capital, labor and equipment WAS USED in the past to create it. This in a nutshell is what gold is all about. It already is pure money and the capital was already expended to create it. It does not need to promise anything in the future (ie. pay interest) to have value today. For example, what value would any debt security have if it promised to never pay any interest? (Yes I know, we almost live in that world now with some debt trading at negative yields but that only proves the point of insanity in our society today!).

Look around you, everyone and everything is in debt or has value created by debt. Sovereign treasuries all over the world now have debt to GDP levels that 30 years ago were signposts to being banana republics (and they are the ones who issue what the public considers money?). Pensions are woefully underfunded even with asset values at all time (and unsustainable) highs. Credit is now regularly offered with little to no proof of ability to pay back. Loans have had maturities extended so borrowers could “fit” into the amounts borrowed. …And on the other side, we have seen lenders/investors accept ridiculously low rates from deadbeats because “they needed yield”. Don’t ever forget, the vast majority of what the world now considers “assets”, require the performance of a promise(s) to perform. When the dust settles, this statement will be wholly obvious to all!

Folks, we live in a world of promises that cannot be kept. Where exactly do you believe the capital will flow to when promises cascade into broken promises? It will be THE largest transfer of wealth in all of history …INTO gold and silver because they don’t promise anything at all. Gold and silver are already “kept promises” that labor, capital and equipment were expended to create them. They are “proof” of kept promises!

These are trying times for those logically holding gold and silver. A financial collapse should have occurred sometime over the last three years but has not. Because it has not happened yet is not in any way proof that it will not. In fact, “math” is never refuted, only delayed. I will leave you with an example; is there any possible way London has the ability to deliver 3-4 years worth of global gold and silver production to their EFP’s? It’s OK, you know the answer … yet still worry over current price?

Standing watch,

Bill Holter

Holter-Sinclair collaboration

https://www.milesfranklin.com/back-to-basics-with-exters-pyramid/