Blacknarwhal

Let's Go Brandon!

Here's a lovely dot for everyone who follows gold.

Zero Hedge has minimal if any connection to actual gold sales.

Fair use cited so on and so forth.

www.zerohedge.com

www.zerohedge.com

ABN Amro Abandons 106 Year Physical Gold Business, Clients Forced To Sell

by Tyler Durden

Wed, 03/25/2020 - 08:22

Seven years ago - to the day - Dutch megabank ABN Amro changed its precious metals custodian rules to "no longer allow physical delivery."

Have no fear, they reassuringly added, your account will be settled at the bid or offer price in the 'market' and "you need to do nothing" as "we have your investments in precious metals."

At the time it was unclear who the "other custodian" was but we now know ABN Amro transferred the precious metal trade to the Swiss bank UBS.

Crucually, however, at UBS, it was not possible for customers to actually request the gold or silver.

Which brings us to today's news from Trouw.nl, that ABN Amro customers will no longer be able to put their money into physical gold, silver or platinum.

The bank will discontinue these three investment products next Friday.

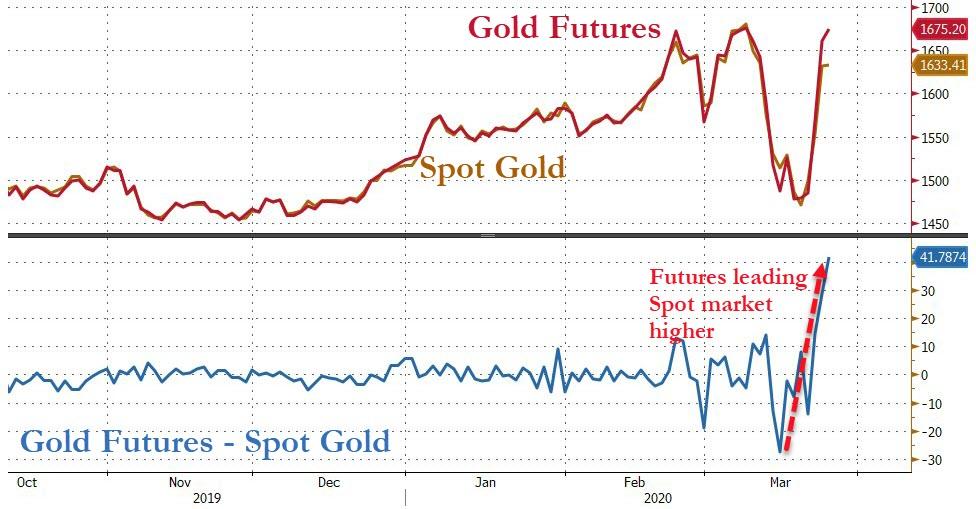

Interestingly, as this news breaks, spot gold prices are lagging futures as they both are bid...

With the gold market "breaking down," as we detailed earlier, amid a record surge in demand for physical gold but also a near shut down in supply as the most productive gold refiners, those located in the southern Swiss town of Ticina, namely Valcambi, Pamp and Argor-Heraeus, now appear to be offline indefinitely; we wonder if the timeliness of ABN's decision is more about avoiding the potential blowback from their ultimate fiduciary duty over clients' precious metals investments.

Let's just hope, for the 200o or so private-banking accounts at ABN (and custodied at UBS) that the Swiss bank can get its hands on some of that 'deliverable' before time runs out...

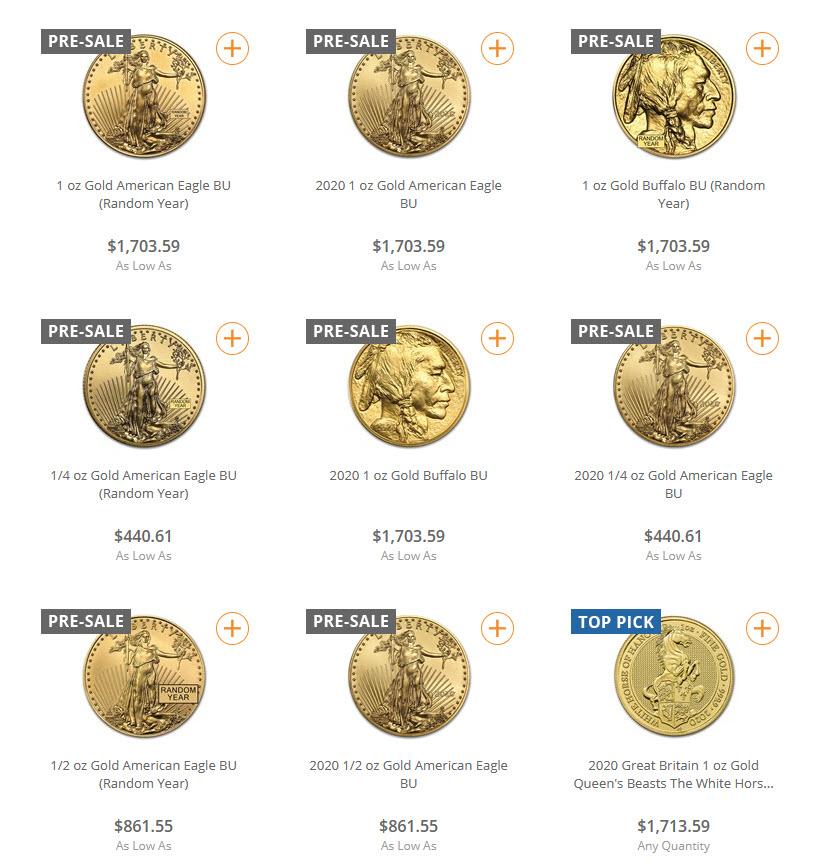

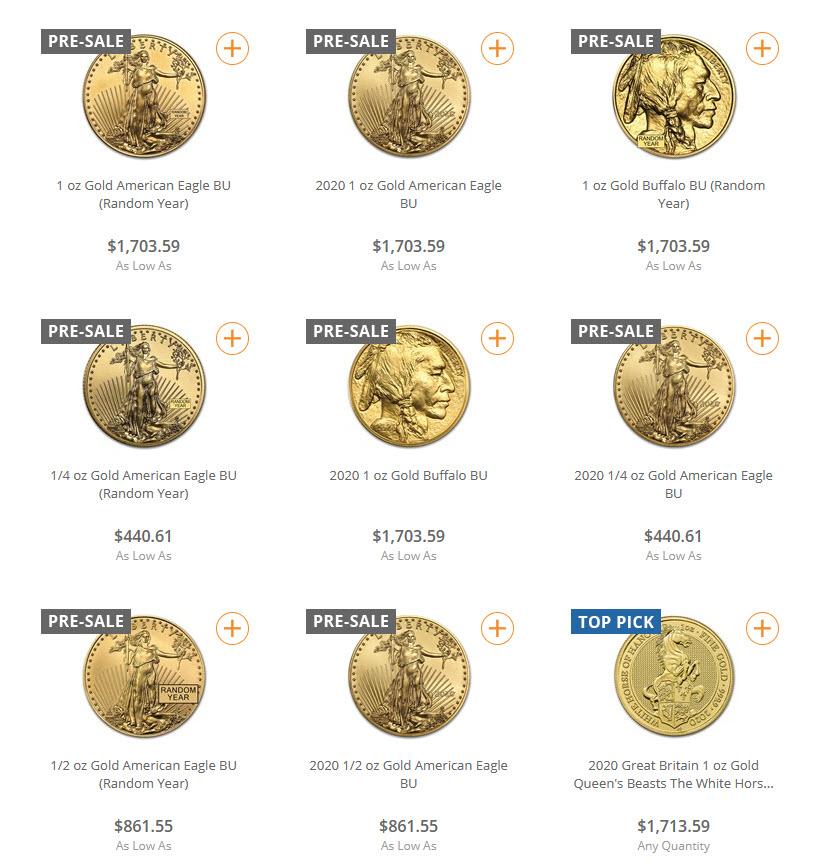

Which anyone who has been to APMEX or any other gold seller in the past few days, has discovered - may not be as easy to source as they hope:

https://www.zerohedge.com/users/tyler-durden

Zero Hedge has minimal if any connection to actual gold sales.

Fair use cited so on and so forth.

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

ABN Amro Abandons 106 Year Physical Gold Business, Clients Forced To Sell

by Tyler Durden

Wed, 03/25/2020 - 08:22

Seven years ago - to the day - Dutch megabank ABN Amro changed its precious metals custodian rules to "no longer allow physical delivery."

Have no fear, they reassuringly added, your account will be settled at the bid or offer price in the 'market' and "you need to do nothing" as "we have your investments in precious metals."

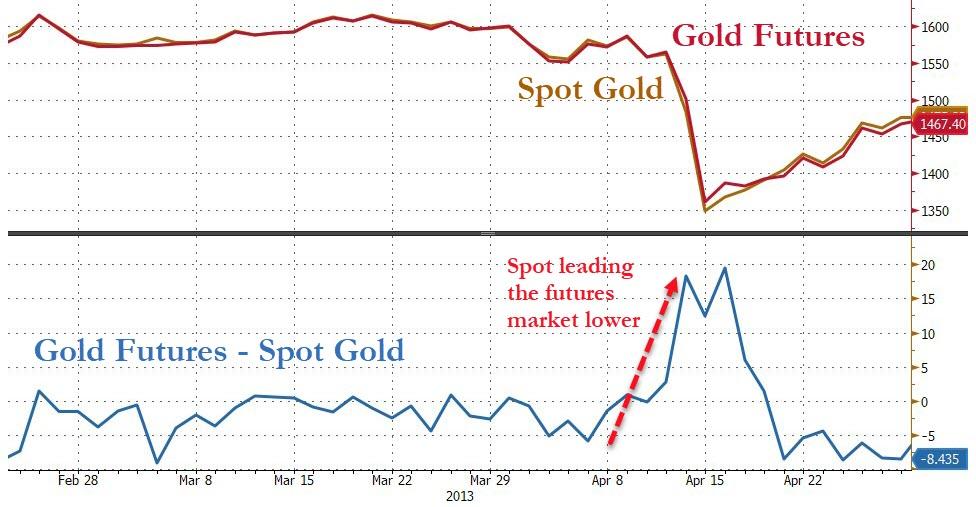

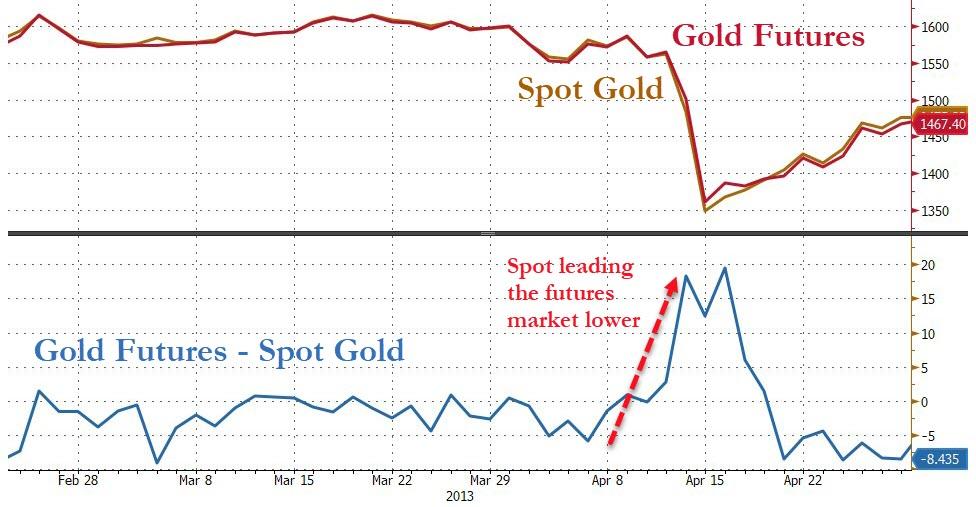

At the time, we wondered if this was the canary in the coalmine of potential physical shortages in the precious metals markets. Soon after we saw notable selling pressure in the gold markets with Spot (physical) selling leading futures lower...Changes in the handling of orders in bullion

On 1 April 2013,. ABN AMRO to another custodian for the precious metals gold, silver, platinum and palladium...

...

You need do nothing. We ensure that we have your investments in precious metals now the new way to handle and administer.

At the time it was unclear who the "other custodian" was but we now know ABN Amro transferred the precious metal trade to the Swiss bank UBS.

Crucually, however, at UBS, it was not possible for customers to actually request the gold or silver.

Which brings us to today's news from Trouw.nl, that ABN Amro customers will no longer be able to put their money into physical gold, silver or platinum.

The bank will discontinue these three investment products next Friday.

The driver for this decision appears to new EU regulations as Trouw explains:Customers will have to sell their positions before April 1. If that does not happen, ABN Amro will do this for them at the prevailing price.

The cancellation of these accounts by ABN Amro brings to an end a history that goes back to the establishment of the Hollandsche Bank Unie (HBU) in 1914, writes gold trading company Aunexum in retrospect.Because the physical delivery of precious metals is not possible, a precious metal purchased through ABN Amro is not a “direct investment”.

Because it is a complex product, ABN Amro must comply with additional regulations.

Those rules for European financial markets have been tightened.

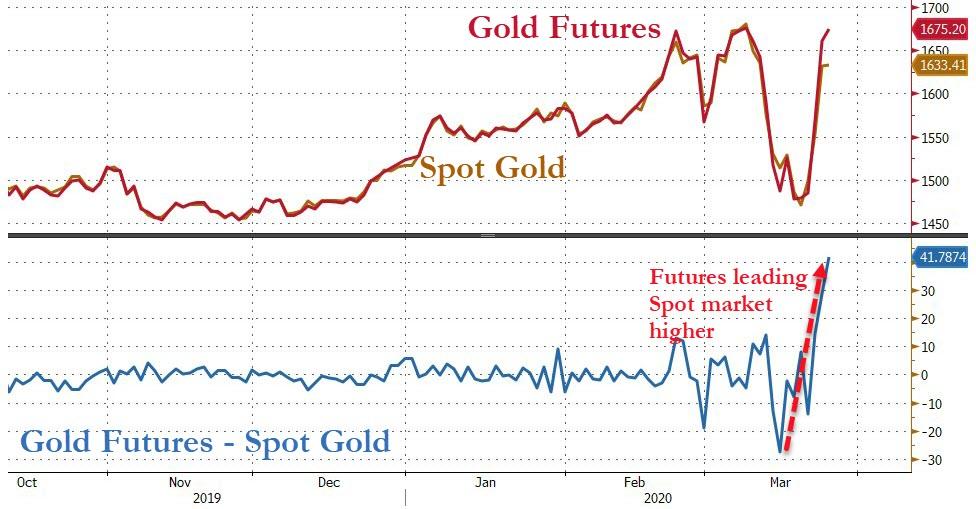

Interestingly, as this news breaks, spot gold prices are lagging futures as they both are bid...

With the gold market "breaking down," as we detailed earlier, amid a record surge in demand for physical gold but also a near shut down in supply as the most productive gold refiners, those located in the southern Swiss town of Ticina, namely Valcambi, Pamp and Argor-Heraeus, now appear to be offline indefinitely; we wonder if the timeliness of ABN's decision is more about avoiding the potential blowback from their ultimate fiduciary duty over clients' precious metals investments.

Let's just hope, for the 200o or so private-banking accounts at ABN (and custodied at UBS) that the Swiss bank can get its hands on some of that 'deliverable' before time runs out...

Which anyone who has been to APMEX or any other gold seller in the past few days, has discovered - may not be as easy to source as they hope:

https://www.zerohedge.com/users/tyler-durden