You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

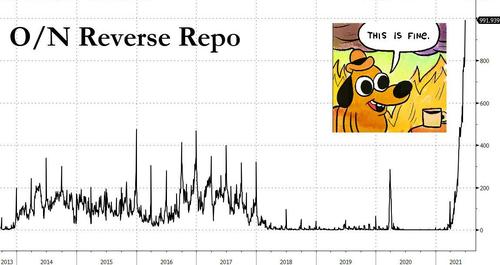

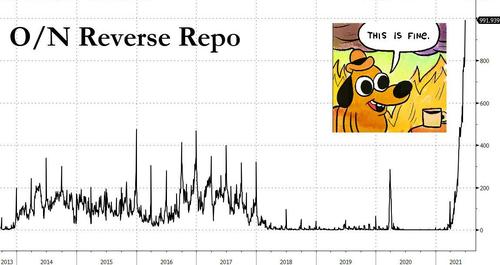

USA "RRP Explosion": Fed Reverse Repo Soars To Third Highest With "Incredible Amount Of Cash" Up to $450 billion per day

- Thread starter hiwall

- Start date

hiwall

Has No Life - Lives on TB

Just carry some extra cash with you.Maybe, and I hope you are correct, but another “Colonial Pipeline” hack job shutdown anywhere along the route I am planning on going would do the trick.

bw

Fringe Ranger

Now we have to shoot for 1 trillion.

It's good to set goals.

Hfcomms

EN66iq

intothatgoodnight

. . .

The "Federal Reserve" is a PRIVATELY owned entity. Nothing "Federal" nor "Reserve" about them.I got the impression the Fed was 'lending' money to the banks whether they wanted it or not. That was how they were covering the spending. But there is a limit that the banks can handle and we are close to that.

So what does the Fed do now? Thinking about that does not lead me to a tranquil mind.

BTW, all the bitching and moaning about the Fed?

If Congress balanced the budget, would that not ease the b&m about the Fed?

In other words, the Fed is where it is because of the profligacy of the Congress.

Start there.

intothegoodnight

intothatgoodnight

. . .

How about the U.S. Constitution? Is that enough of a "lawful leg to stand" upon?Let’s hope the Cosmic Referee can find some error in their construct, that “we” might have a lawful leg to stand on when trial by combat ensues.

Yup.

intothegoodnight

Alaskan_Leatherhead

Contributing Member

And When the federal reserve hands out currency there doing so from an account with a balance of zero. Pretty much legalized crime.

Samuel Adams

Has No Life - Lives on TB

How about the U.S. Constitution? Is that enough of a "lawful leg to stand" upon?

Yup.

intothegoodnight

Save for the fact that the people accepted the fraud....to this day.

That is referred to as a quiet revolution—same as when the people and the states let the constitution stand even though it called for unanimous state ratification yet received only 9 of 13 votes.....

Now if the people had refused to let go their gold and silver, and refused to use privately issued fiat scrip, with all those damning strings attached......well.....

alchemike

Veteran Member

Save for the fact that the people accepted the fraud....to this day.

That is referred to as a quiet revolution—same as when the people and the states let the constitution stand even though it called for unanimous state ratification yet received only 9 of 13 votes.....

Now if the people had refused to let go their gold and silver, and refused to use privately issued fiat scrip, with all those damning strings attached......well.....

Gold and silver are equally manipulated. Anyone in the game for any reasonable length of time knows this. Including most on this forum.

Samuel Adams

Has No Life - Lives on TB

But they are still lawful money with which just about anyone but a US citizen (what ?) can actually PAY....(extinguish) and not merely discharge a debt.

How many know that, and it’s ramifications regarding property rights— including most on this forum ?

How many know that, and it’s ramifications regarding property rights— including most on this forum ?

Thank you. I had an extensive Google lesson on Allodial titles. Time to contact the real estate attorneyAllodial

jed turtle

a brother in the Lord

after my investigation of alloidal rights I concluded that only non-profits come close to that status. Churches, land conservation organizations, etc. I speculate that possibly a “church“ could be expanded in definition to cover a group of farmers that worked the land of the “church” and live on its land, and thus not be taxed, but they would essentially not be owners, but merely employees (or maybe congregants) of the church. And I doubt that their ”sovereign ownership” of that land would beyond the ability of the “government” to commandeer for the “greater good”...

btw, I decided to not take the long trip. Planted the garden, Instead, ( praying for rain ) and this thread -and the recent talk by very suspicious dudes in high and mighty positions talking about possible hacking of the grid - have not eased my expectations of life-changing black swans appearing over the horizon in the very near future. When the “trust” in the USDollar blows up and blows away, I pray that we all have other plans to make ends meet that don’t require dollars on hand.

btw, I decided to not take the long trip. Planted the garden, Instead, ( praying for rain ) and this thread -and the recent talk by very suspicious dudes in high and mighty positions talking about possible hacking of the grid - have not eased my expectations of life-changing black swans appearing over the horizon in the very near future. When the “trust” in the USDollar blows up and blows away, I pray that we all have other plans to make ends meet that don’t require dollars on hand.

Samuel Adams

Has No Life - Lives on TB

Thank you. I had an extensive Google lesson on Allodial titles. Time to contact the real estate attorney

Never refer to your holding as “real estate”.

Refer to it as land.

Are you familiar with the US Land Patent ?

Prepare yourself for a fairly deep rabbit hole......and don’t make any claims or legal moves until you understand the concept, thoroughly.

Jed Turtle is right if you only hold a deed to land.

Jed Turtle is right.....if you are a US citizen or exercise any 14 Amendment benefits, privileges or immunities.

Jed Turtle is right if you “purchased” your land with federal reserve notes or commercial credit.....and have never settled with the Federal Reserve in the matter of completing a bona fide purchase for value.

Remedy can be found in “Clark’s Summary of American Law”, under that heading.

I would love to sit in that meeting with the attorney and yourself......

Truth - What Is A Land Patent - Allodial Titles

Truth - What Is A Land Patent - Allodial Titles

www.freedomforallseasons.org

Last edited:

Never refer to your holding as “real estate”.

Refer to it as land.

Are you familiar with the US Land Patent ?

Prepare yourself for a fairly deep rabbit hole......and don’t make any claims or legal moves until you understand the concept, thoroughly.

Jed Turtle is right if you only hold a deed to land.

Jed Turtle is right.....if you are a US citizen or exercise any 14 Amendment benefits, privileges or immunities.

Jed Turtle is right if you “purchased” your land with federal reserve notes or commercial credit.....and have never settled with the Federal Reserve in the matter of completing a bona fide purchase for value.

Remedy can be found in “Clark’s Summary of American Law”, under that heading.

I would love to sit in that meeting with the attorney and yourself......

Truth - What Is A Land Patent - Allodial Titles

Truth - What Is A Land Patent - Allodial Titleswww.freedomforallseasons.org

Ill post in here as it unfolds.

Cyclonemom

Veteran Member

That does not sound healthy.Wow, today's amount was 755 billion dollars. Over 3/4 of a billion dollars.

Masterchief117

I'm all about the doom

I think you mean "3/4 of a trillion dollars."Wow, today's amount was 755 billion dollars. Over 3/4 of a billion dollars.

hiwall

Has No Life - Lives on TB

Changed it. ThanksI think you mean "3/4 of a trillion dollars."

intothatgoodnight

. . .

"What difference does it make?"

<ahem>

intothegoodnight

<ahem>

intothegoodnight

Hfcomms

EN66iq

It's just numbers ...

That is more flow in one flipping day than was spent in 2008 in rescuing the system from imploding. We are well down the path to ruin.

Ractivist

Pride comes before the fall.....Pride month ended.

Exponential growth in action......never ends well. It’s one thing to double a dollar over thirty days, imagine where this is headed.........agree with those who see all the other fronts doing about the same darned thing.....leads to ugly things.

At this point my morbid curiosity needs to be satiated

At this point my morbid curiosity needs to be satiated

Oh, it will be.

EMICT

Veteran Member

Do We Hear A Trillion: Fed's Reverse Repo Hits Record $992 Billion, Up $150 Billion In One Day

WEDNESDAY, JUN 30, 2021 - 01:42 PM

There's not much we can add here: after all we have beaten to death the topic of the Fed's soaring reverse repo facility (see "With Fed's Reverse Repo Hitting Half A Trillion, Wall Street Scrambles To Figure Out What Comes Next" and especially "Powell Just Launched $2 Trillion In "Heat-Seeking Missiles": Zoltan Explains How The Fed Started The Next Repo Crisis"), but while many were expecting fireworks for month and quarter end, nobody expected that a record 90 counterparties (up from 74 on Tuesday) would park an additional $150 billion in loose liquidity (for context, all of QE2 was $600 billion) at the Fed's reverse repo facility where it is now earning 0.05% compared to the 0.00% rate prior to the June FOMC, bringing the total reverse repo usage to a mindblowing $991.9 billion, after printing a record $841.2 billion on Tuesday (across 74 counterparties).

In an amusing twist, whereas once upon a time banks would flood into the Fed's repo facility at quarter end to window dress their balance sheet, now it is an all out scramble to just get rid of excess liquidity which the Fed continues to inject at a pace of $120 billion.

But while today's print is likely an outlier due to quarter end, we expect the new normal reverse repo usage to rise above $1 trillion shortly for the very reason Zoltan Pozsar explained last week: with the banks repurchasing well over $100 billion in stock, their CET1 balance sheet capacity is about to collapse by over $2 trillion due to the 20x leverage. As a reminder this is what we said:

WEDNESDAY, JUN 30, 2021 - 01:42 PM

There's not much we can add here: after all we have beaten to death the topic of the Fed's soaring reverse repo facility (see "With Fed's Reverse Repo Hitting Half A Trillion, Wall Street Scrambles To Figure Out What Comes Next" and especially "Powell Just Launched $2 Trillion In "Heat-Seeking Missiles": Zoltan Explains How The Fed Started The Next Repo Crisis"), but while many were expecting fireworks for month and quarter end, nobody expected that a record 90 counterparties (up from 74 on Tuesday) would park an additional $150 billion in loose liquidity (for context, all of QE2 was $600 billion) at the Fed's reverse repo facility where it is now earning 0.05% compared to the 0.00% rate prior to the June FOMC, bringing the total reverse repo usage to a mindblowing $991.9 billion, after printing a record $841.2 billion on Tuesday (across 74 counterparties).

In an amusing twist, whereas once upon a time banks would flood into the Fed's repo facility at quarter end to window dress their balance sheet, now it is an all out scramble to just get rid of excess liquidity which the Fed continues to inject at a pace of $120 billion.

But while today's print is likely an outlier due to quarter end, we expect the new normal reverse repo usage to rise above $1 trillion shortly for the very reason Zoltan Pozsar explained last week: with the banks repurchasing well over $100 billion in stock, their CET1 balance sheet capacity is about to collapse by over $2 trillion due to the 20x leverage. As a reminder this is what we said:

Today is the first day that we see this prediction in action, and it will only get much worse: expect total repo usage to soar in the coming days, with the total inert cash parked at the Fed hitting north of $2 trillion in a few weeks.... imagine what will happen to the RRP facility if banks indeed proceed to repurchase $142BN in stock; applying Pozsar's 20x leverage multiple, this means that bank balance sheets will shrink by just under $3 trillion, including trillions in reserves which will have to be parked at the Fed, which also means that in the coming weeks usage on the Fed's reserve facility is set to explode to unprecedented levels.

1-12020

Senior Member

So this all means that inflation is speeding up and a box of cereal will be 10 bucks and smaller, instead of 2.50?

I don't see how you can even prepare for this?

Even if you have gold / silver who will buy it and why would you want dollars? I guess trade is the only option?

So one should buy stuff now?

I don't know how to really prepare for this. I've seen the pictures of Germany after world war 1 and wheel barrel loads of cash.

This seems as bad as the russian/ china situations or even worse.

I don't see how you can even prepare for this?

Even if you have gold / silver who will buy it and why would you want dollars? I guess trade is the only option?

So one should buy stuff now?

I don't know how to really prepare for this. I've seen the pictures of Germany after world war 1 and wheel barrel loads of cash.

This seems as bad as the russian/ china situations or even worse.

BUBBAHOTEPT

Veteran Member

And the band played on…

We've all had this discussion before, how can this continue, yet it does. And now we have Mr. F***ing Magoo and his merry band of Marxists and Deep State cronies at the helm of this ship called America. I am at a loss for words or where we are headed. All I can say for sure, is this will not end well…..

We've all had this discussion before, how can this continue, yet it does. And now we have Mr. F***ing Magoo and his merry band of Marxists and Deep State cronies at the helm of this ship called America. I am at a loss for words or where we are headed. All I can say for sure, is this will not end well…..

Nothing is going to happen tomorrow.

We have plenty of time to get ready.

For sure. TPTB will let the American Plebs get drunk, blow their fireworks, and have their BBQs for the fourth. Bread and circuses and whatnot. I expect a doomsday news dump friday to ensure it gets lost in the holiday weekend, and then come Tuesday, we shall see what we shall see

The Snack Artist

Membership Revoked

“Essentially, the Fed is keen to reduce cash balances in the banking system to avoid any overnight rate from going negative,” wrote Gary Kirk, a portfolio manager at TwentyFour Asset Management, in emailed commentary this week.

Let 'er rip!

Let 'er rip!