hiwall

Has No Life - Lives on TB

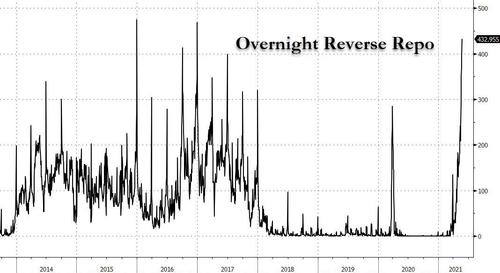

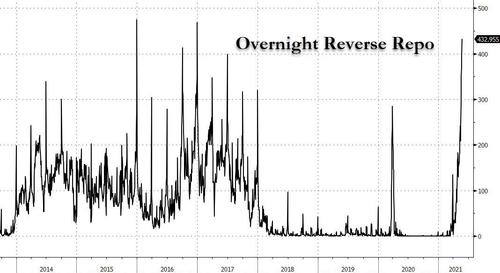

The Federal Reserve borrows money to banks every day. The amount has been growing daily. It is up to $450 billion per day now.

Note: amounts in Billions

May 11 - $181

May 12 - $209

May 13 - $235

May 14 - $241

May 17 - $208

May 18 - $243

May 19 - $293

May 20 - $351

May 21 - $369

May 24 - $394

May 25 - $432

May 26 - $450

Ahead of today's 1:15pm overnight Reverse Repo deadline we asked (for the second day in a row) if today was the day the repo market finally cracks, pushing the amount of reserves parked at the Fed to a new record above $500 billion.

Why does this matter? Three reasons, all of which we explained in extensive detail in "Fed Alert: Overnight Reverse Repo Usage Soars Above Covid Crisis Highs", Repo Crisis Looms: Fed's Reverse Repo Usage Soars To $351BN, Fifth Highest Ever, and Zoltan On The Coming QE Endgame: "Banks Have No More Space For Reserves",

It's not just us concerned about how clogged up the market plumbing has become: in his daily Repo Market Commentary note from Monday, Curvature's repo market guru Scott Skyrm wrote the following:

... and balking at even a penny of additional liquidity. How the Fed will continue to monetize debt then, when the repo system is now out of collateral, is anyone's guess.

www.zerohedge.com

www.zerohedge.com

Note: amounts in Billions

May 11 - $181

May 12 - $209

May 13 - $235

May 14 - $241

May 17 - $208

May 18 - $243

May 19 - $293

May 20 - $351

May 21 - $369

May 24 - $394

May 25 - $432

May 26 - $450

Ahead of today's 1:15pm overnight Reverse Repo deadline we asked (for the second day in a row) if today was the day the repo market finally cracks, pushing the amount of reserves parked at the Fed to a new record above $500 billion.

And for the second day in a row, we were off, but we are getting warmed by the day: on Tuesday, the Fed revealed that the amount of overnight reserves parked at the Fed rose by another $38BN to $433BN (with 48 counteparties, down from 54 yesterday) from $394.9BN on Monday, which was the 3rd highest in history, up a whopping $190 billion in one week and the highest non-quarter end reverse repo usage ever!$500BN in reverse repo today?

— zerohedge (@zerohedge) May 25, 2021

Why does this matter? Three reasons, all of which we explained in extensive detail in "Fed Alert: Overnight Reverse Repo Usage Soars Above Covid Crisis Highs", Repo Crisis Looms: Fed's Reverse Repo Usage Soars To $351BN, Fifth Highest Ever, and Zoltan On The Coming QE Endgame: "Banks Have No More Space For Reserves",

- The Fed is taking Treasurys out of the market through QE purchases and putting them right back in via the RRP

- The heavy use of the o/n RRP facility tells us that foreign banks too are now chock-full of reserves.

- Banks don't have the balance sheet to warehouse any more reserves at current spread levels.

It's not just us concerned about how clogged up the market plumbing has become: in his daily Repo Market Commentary note from Monday, Curvature's repo market guru Scott Skyrm wrote the following:

And while Powell & Co pretend that they can continue business as usual for years to come, the repo market is not only cracking but banks, full to the gills with inert reserves and which increase by $30 billion every week, are on the verge of pulling a Mr Creosote...RRP Explosion

On March 17, a little over two months ago, there was no volume at the Fed's RRP window. Nothing. Today, it was almost $400 billion! How do you go from zero to $400 billion in two months? Not only was today's activity at the RRP one of the largest ever, it was also THE largest non-quarter-end, non-year-end print. There's an incredible amount of cash in the Repo market right now! Clearly, the Fed took too much collateral out of the market - or - added too much cash.

The market is distorted from too much QE and hopefully QE tapering will be announced in June.

... and balking at even a penny of additional liquidity. How the Fed will continue to monetize debt then, when the repo system is now out of collateral, is anyone's guess.

"RRP Explosion": Fed Reverse Repo Soars To Third Highest With "Incredible Amount Of Cash" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

/investing18-5bfc2b8fc9e77c005143f183.jpg)

Only $479 billion.

Only $479 billion.