You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON Price of Gold

- Thread starter Terrwyn

- Start date

THIS STORY IS FROM 2008

Gold prices post biggest 1-day dollar gain ever - ABC News

Gold prices post biggest 1-day dollar gain ever

By Stevenson Jacobs, AP Business Writer

September 17, 2008, 8:54 PM

• 3 min read

NEW YORK -- Gold prices exploded Wednesday — posting the biggest one-day gain ever in dollar terms — as fears of more credit market turmoil unnerved investors and triggered a flood of safe-haven buying.

Gold for December delivery rose as much as $90.40, or 11.6%, to $870.90 an ounce in after-hours trading on the New York Mercantile Exchange after jumping $70 to settle at $850.50 in the regular session. That was the biggest one-day price jump ever; gold's previous single-day record was a $64 gain on Jan. 29, 1980. In percentage terms, it was gold's largest one-day advance since 1999.

The huge rally came after the government moved overnight to rescue troubled insurer American International Group with an $85 million bailout loan. The Federal Reserve stepped in after AIG, teetering on collapse from losses tied to the subprime crisis and the credit crisis, failed to find adequate capital in the private sector.

The emergency measure came a day after Lehman Brothers Holdings, a 158-year-old investment bank, filed for bankruptcy after failing to find a buyer.

Fearing more tightening of credit markets, investors reacted swiftly and began dumping stocks and socking money into gold, silver and other safe-haven commodities. Gold is especially attractive during times of crisis because the metal is known for holding its value.

Jon Nadler, analyst with Kitco Bullion Dealers Montreal, said buying accelerated as rumors spread across trading floors that another financial firm may be in trouble.

"The psychology right now has everyone asking, 'Who's next?," Nadler said. "If another big bank falls, we could see an implosion and that has people very worried."

A weaker dollar also boosted gold prices. A falling greenback encourages investors to shift funds into hard assets like gold and other commodities that are bought as hedges against inflation and weakness in the U.S. currency.

Gold rocketed above $1,000 an ounce for the first tme in March, boosted by record oil prices, a weak dollar and worries that the U.S. economy was sliding into a recession. It has since pulled back sharply as a global commodities boom loses momentum.

"The same market participants who got out of gold are coming back in now. This is the start of an upward move," said Carlos Sanchez, analyst with CPM Group in New York, who predicted prices could climb back to $1,000 by year's end.

Silver prices also jumped. The December contract soared $1.158 to settle at $11.675 an ounce. December copper, however, fell 4.65 cents to settle at $3.0425 a pound.

Wednesday's gold rally lifted virtually every other commodity, with crude oil, corn, wheat and soybeans all trading higher.

Gold prices post biggest 1-day dollar gain ever - ABC News

Gold prices post biggest 1-day dollar gain ever

By Stevenson Jacobs, AP Business Writer

September 17, 2008, 8:54 PM

• 3 min read

NEW YORK -- Gold prices exploded Wednesday — posting the biggest one-day gain ever in dollar terms — as fears of more credit market turmoil unnerved investors and triggered a flood of safe-haven buying.

Gold for December delivery rose as much as $90.40, or 11.6%, to $870.90 an ounce in after-hours trading on the New York Mercantile Exchange after jumping $70 to settle at $850.50 in the regular session. That was the biggest one-day price jump ever; gold's previous single-day record was a $64 gain on Jan. 29, 1980. In percentage terms, it was gold's largest one-day advance since 1999.

The huge rally came after the government moved overnight to rescue troubled insurer American International Group with an $85 million bailout loan. The Federal Reserve stepped in after AIG, teetering on collapse from losses tied to the subprime crisis and the credit crisis, failed to find adequate capital in the private sector.

The emergency measure came a day after Lehman Brothers Holdings, a 158-year-old investment bank, filed for bankruptcy after failing to find a buyer.

Fearing more tightening of credit markets, investors reacted swiftly and began dumping stocks and socking money into gold, silver and other safe-haven commodities. Gold is especially attractive during times of crisis because the metal is known for holding its value.

Jon Nadler, analyst with Kitco Bullion Dealers Montreal, said buying accelerated as rumors spread across trading floors that another financial firm may be in trouble.

"The psychology right now has everyone asking, 'Who's next?," Nadler said. "If another big bank falls, we could see an implosion and that has people very worried."

A weaker dollar also boosted gold prices. A falling greenback encourages investors to shift funds into hard assets like gold and other commodities that are bought as hedges against inflation and weakness in the U.S. currency.

Gold rocketed above $1,000 an ounce for the first tme in March, boosted by record oil prices, a weak dollar and worries that the U.S. economy was sliding into a recession. It has since pulled back sharply as a global commodities boom loses momentum.

"The same market participants who got out of gold are coming back in now. This is the start of an upward move," said Carlos Sanchez, analyst with CPM Group in New York, who predicted prices could climb back to $1,000 by year's end.

Silver prices also jumped. The December contract soared $1.158 to settle at $11.675 an ounce. December copper, however, fell 4.65 cents to settle at $3.0425 a pound.

Wednesday's gold rally lifted virtually every other commodity, with crude oil, corn, wheat and soybeans all trading higher.

Last edited by a moderator:

CaryC

Has No Life - Lives on TB

Yeah boy If we could get Canada to close some more banks (5 major banks Wed. PM into Thursday), and keep the Canadians from getting to their money, we may hit gold at 2,000.00 an Oz.

Scared the webby geebies out of a lot. (Don't forget when your money is in the bank it's not your money anymore, it's theirs)

BTW for clarity: Gold today is above 1900.00

Hi-D's article is from 2008.

Scared the webby geebies out of a lot. (Don't forget when your money is in the bank it's not your money anymore, it's theirs)

BTW for clarity: Gold today is above 1900.00

Hi-D's article is from 2008.

CaryC

Has No Life - Lives on TB

Bank Run? Canada's Top Banks Mysteriously Go Offline

Days after Canadian Prime Minister Justin Trudeau said he would invoke emergency orders to crack down on demonstrators by freezing their bank accounts, five major Canadian banks went offline on Wednesday night, as customers reported their funds were unavailable, according to technology website Bleeping Computer.

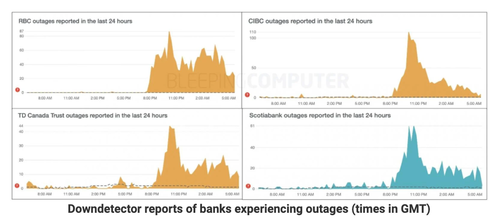

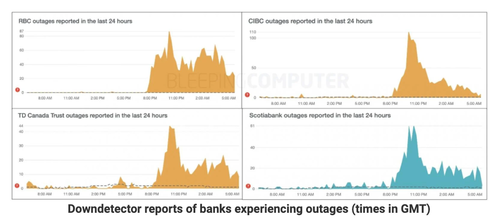

Royal Bank of Canada (RBC), BMO (Bank of Montreal), Scotiabank, TD Bank Canada, and the Canadian Imperial Bank of Commerce (CIBC) were all hit with unexplainable outages on Wednesday evening. Users began reporting issues with banks around 1600-1700 ET, Downdector data showed.

Canadian Twitter users reported they couldn't access their funds at the ATMs. One user took a photo of an error message at one of RBC's ATMs that read, "Tap transactions aren't available for this card."

There were countless stories of banking customers who experienced trouble accessing their funds yesterday evening. No bank explained the source of the outrage, but essential to note the outage comes, as we said above, days after Trudeau invoked the Emergencies Act.

The power gives the federal government direct access to banks to force any business conducted with Freedom Convoy protesters and affiliates to freeze their bank accounts. Trust in the banking system among depositors is crucial to prevent bank runs. Freezing accounts of people linked to the protests can incite fear.

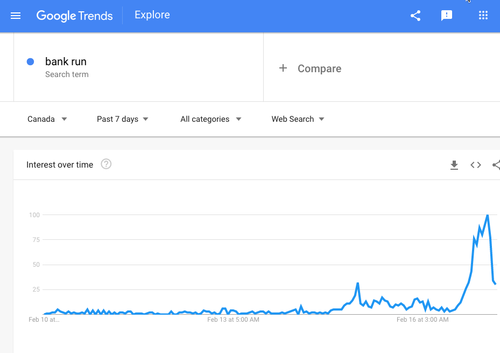

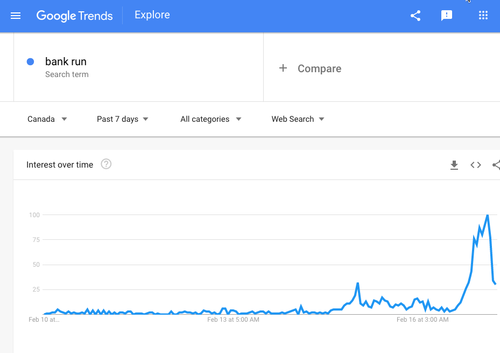

Google Trends shows Canadians have panic searched "bank run," first jumped on Tuesday then went parabolic on Wednesday, right around the time the bank outages were reported.

Canadians have panic searched "bank outages Canada," "bank run Canada," "bank run definition," and Canadian bank run" yesterday.

There's been a lot of speculation about the outages. Some Twitter users have said "banks are faking outages" to minimize bank runs as people lose faith in the banking sector, following Trudeau's comments earlier in the week.

Still, nothing conclusive points to what caused the banking outages last night though it just so happens it comes days after Trudeau invoked emergency orders to freeze bank accounts, forcing many folks to panic. The one thing a government cannot do is have citizens lose trust in the banking sector -- otherwise, all hell breaks out.

Bank Run? Canada's Top Banks Mysteriously Go Offline | ZeroHedge

Days after Canadian Prime Minister Justin Trudeau said he would invoke emergency orders to crack down on demonstrators by freezing their bank accounts, five major Canadian banks went offline on Wednesday night, as customers reported their funds were unavailable, according to technology website Bleeping Computer.

Royal Bank of Canada (RBC), BMO (Bank of Montreal), Scotiabank, TD Bank Canada, and the Canadian Imperial Bank of Commerce (CIBC) were all hit with unexplainable outages on Wednesday evening. Users began reporting issues with banks around 1600-1700 ET, Downdector data showed.

Canadian Twitter users reported they couldn't access their funds at the ATMs. One user took a photo of an error message at one of RBC's ATMs that read, "Tap transactions aren't available for this card."

In response, RBC tweeted, "We are currently experiencing technical issues with our online and mobile banking, as well as our phone systems."

BMO customers also reported issues. One customer said, "I'm having trouble and money transfer just auto gets rejected for no reason. Not going over my limit, all info is verified correct and receiving bank says no issues on their end.""Our experts are investigating and working to get this fixed as quickly as possible, but we have no ETA to provide at this time. We appreciate your patience."

There were countless stories of banking customers who experienced trouble accessing their funds yesterday evening. No bank explained the source of the outrage, but essential to note the outage comes, as we said above, days after Trudeau invoked the Emergencies Act.

The power gives the federal government direct access to banks to force any business conducted with Freedom Convoy protesters and affiliates to freeze their bank accounts. Trust in the banking system among depositors is crucial to prevent bank runs. Freezing accounts of people linked to the protests can incite fear.

Google Trends shows Canadians have panic searched "bank run," first jumped on Tuesday then went parabolic on Wednesday, right around the time the bank outages were reported.

Canadians have panic searched "bank outages Canada," "bank run Canada," "bank run definition," and Canadian bank run" yesterday.

There's been a lot of speculation about the outages. Some Twitter users have said "banks are faking outages" to minimize bank runs as people lose faith in the banking sector, following Trudeau's comments earlier in the week.

Others posted memes about how Bitcoin prevents Trudeau from freezing your money."Do you think people will keep their money in institutions that now can easily freeze it from them?" one Twitter user said.

One Twitter user wasn't surprised about what has unfolded: "Government threatens to freeze their money in your bank >> people panic to take their money out of the bank so they can survive >> bank outages >> surprised Pikachu face."

Some on the fringe said, "Take all your money out of banks. Buy gold silver crypto and ammo."

Still, nothing conclusive points to what caused the banking outages last night though it just so happens it comes days after Trudeau invoked emergency orders to freeze bank accounts, forcing many folks to panic. The one thing a government cannot do is have citizens lose trust in the banking sector -- otherwise, all hell breaks out.

Bank Run? Canada's Top Banks Mysteriously Go Offline | ZeroHedge

CaryC

Has No Life - Lives on TB

Gold Tops $1900, Stocks Slump As Bullard And Blinken 'Double Whammy' Fuels Fear

BY TYLER DURDEN

THURSDAY, FEB 17, 2022 - 11:25 AM

Things have escalated a little this morning as Nasdaq is now testing the lows of the day, as investors de-risk on the heels of Blinken's 'Russia threat' rhetoric and Bullard's 'rate-hikes and asset sales' ranting.

Russia is establishing a pretext to invade Ukraine, according to comments by US Secretary of State Antony Blinken to the UN Security Council.

Bullard said that Core PCE - The Fed's favorite inflation measure - "does not have the reputation of coming down naturally."

And at the same time, safe-havens are bid with yields falling on longer-dated bonds and gold pushing back above $1900 for the first time since June 2021...

At the same time, bitcoin has been hit hard very recently as gold jumped - but both are higher as geopolitical pressure rises...

The Ruble is down but steady. Does The Fed really want to crash the markets after all?

Gold Tops $1900, Stocks Slump As Bullard And Blinken 'Double Whammy' Fuels Fear | ZeroHedge

BY TYLER DURDEN

THURSDAY, FEB 17, 2022 - 11:25 AM

Things have escalated a little this morning as Nasdaq is now testing the lows of the day, as investors de-risk on the heels of Blinken's 'Russia threat' rhetoric and Bullard's 'rate-hikes and asset sales' ranting.

Russia is establishing a pretext to invade Ukraine, according to comments by US Secretary of State Antony Blinken to the UN Security Council.

"This could be a violent event that Russia will bring on Ukraine, or an outrageous accusation that Russia will level against the Ukrainian government.

"Russia may describe this event as ethnic cleansing or a genocide making a mockery of a concept that we in this chamber did not take lightly," he added.

"We believe these targets include Russia's capital (or) Ukraine's capital Kiev, a city of 2.8 million people," he said.

Bullard said that Core PCE - The Fed's favorite inflation measure - "does not have the reputation of coming down naturally."

This move has taken the Dow into the red for the week and the S&P to unchanged..."So we're way on one side of the ship and I think we have to re-center. I want to re-center faster than some of my colleagues," Bullard said.

"I think there is actually widespread agreement across financial markets" that the Fed should "get going," Bullard said.

Bullard said he wants the Fed to start to shrink its $9 trillion balance sheet in the second quarter, adding that the Fed should have a "plan B" to sell some of the longer-term bonds from its portfolio to push longer-term interest rates higher.

And at the same time, safe-havens are bid with yields falling on longer-dated bonds and gold pushing back above $1900 for the first time since June 2021...

At the same time, bitcoin has been hit hard very recently as gold jumped - but both are higher as geopolitical pressure rises...

The Ruble is down but steady. Does The Fed really want to crash the markets after all?

Gold Tops $1900, Stocks Slump As Bullard And Blinken 'Double Whammy' Fuels Fear | ZeroHedge

Gold Tops $1900, Stocks Slump As Bullard And Blinken 'Double Whammy' Fuels Fear

BY TYLER DURDEN

THURSDAY, FEB 17, 2022 - 11:25 AM

Things have escalated a little this morning as Nasdaq is now testing the lows of the day, as investors de-risk on the heels of Blinken's 'Russia threat' rhetoric and Bullard's 'rate-hikes and asset sales' ranting.

Russia is establishing a pretext to invade Ukraine, according to comments by US Secretary of State Antony Blinken to the UN Security Council.

Bullard said that Core PCE - The Fed's favorite inflation measure - "does not have the reputation of coming down naturally."

This move has taken the Dow into the red for the week and the S&P to unchanged...

And at the same time, safe-havens are bid with yields falling on longer-dated bonds and gold pushing back above $1900 for the first time since June 2021...

At the same time, bitcoin has been hit hard very recently as gold jumped - but both are higher as geopolitical pressure rises...

The Ruble is down but steady. Does The Fed really want to crash the markets after all?

Gold Tops $1900, Stocks Slump As Bullard And Blinken 'Double Whammy' Fuels Fear | ZeroHedge

I see your problem.

CaryC

Has No Life - Lives on TB

Does that mean you are charging me for being my physicist? That's kind of like be Fauci, forcing something on me I don't want.I see your problem.

CaryC

Has No Life - Lives on TB

Yeah my bad. Misspelled it. psychiatrist. Ya know the people who probe into your mind. I think you need a break and go watch Bloomberg.You want me to be your physicist? You people are used to getting it for free.

Yeah my bad. Misspelled it. psychiatrist. Ya know the people who probe into your mind. I think you need a break and go watch Bloomberg.

I have it running all the time. When I leave I can run it back to see if I missed anything important. Now let's get back to that mind you need probed. Do you feel the need to own gold at any price or just going to hang around until everyone is dead and then trade it to someone?

West

Senior

Found another silver dime in the change machine in Walmart today. Can't beat that!

Still no regular crackers on the shelves. And I went to 4 stores in total.

Regarding gold, so if most people are dead, there's still going to be some man that needs a gold ring to put around his brides finger. And will do most anything to get it, even make fresh crackers, .

.

Still no regular crackers on the shelves. And I went to 4 stores in total.

Regarding gold, so if most people are dead, there's still going to be some man that needs a gold ring to put around his brides finger. And will do most anything to get it, even make fresh crackers,

.

.

Last edited:

Found another silver dime in the change machine in Walmart today. Can't beat that!

Still no regular crackers on the shelves. And a went to 4 stores in total.

Regarding gold, so if most people are dead, there's still going to be some man that needs a gold ring to put around his brides finger. And will do most anything to get it, even make fresh crackers,.

I am pretty sure if that happens, we will be back to dragging them around by the hair.

Wont he just get it off the dead?Found another silver dime in the change machine in Walmart today. Can't beat that!

Still no regular crackers on the shelves. And a went to 4 stores in total.

Regarding gold, so if most people are dead, there's still going to be some man that needs a gold ring to put around his brides finger. And will do most anything to get it, even make fresh crackers,.

Or maybe us Amazon's will be leading you around with a leash. We already have you by the you know what.I am pretty sure if that happens, we will be back to dragging them around by the hair.

Or maybe us Amazon's will be leading you around with a leash. We already have you by the you know what.

LOL, You already do no doubt about that.

A very nice Mormon lady told me a joke a long time ago when we were a lot younger. Cavemen drug women around like that so they did not fill up with dirt.

Last edited:

West

Senior

Wont he just get it off the dead?

Yeah, but those went quick to impress the bride with a loaf of bread, eggs and wine he needed to wine and dine her, to ask for her hand.

And the father of the bride melted down a ton to get the 20k acres that his daughter and fiance wanted for there new ranch?

IDK

bracketquant

Veteran Member

When will people understand that fiat currency is not your money. You have special drawing rights to get their money. It's issued at interest, with the supply only being the principal. Therefore, the interest can never be paid off. But then, when it goes under because of a lack of confidence in it, it's not going to matter.Yeah boy If we could get Canada to close some more banks (5 major banks Wed. PM into Thursday), and keep the Canadians from getting to their money, we may hit gold at 2,000.00 an Oz.

Scared the webby geebies out of a lot. (Don't forget when your money is in the bank it's not your money anymore, it's theirs)

BTW for clarity: Gold today is above 1900.00

Hi-D's article is from 2008.

Hfcomms

EN66iq

Just keep in mind that an ounce of gold ten or twenty years ago is an ounce of gold today. Gold isn’t changing, its the currency that is imploding not the gold getting more valuable. Gold will shoot above fundamental value eventually as everyone is going to want some.

Only about .5% of all investible money is in physical gold. During a real scare what happens to the price in any currency if it goes to 10% (which is the percentage that used to be recommended by financial experts 40 years ago) of investible assets try to move into gold or more? Gold will become unobtainium to coin a new word. At some point in a frenzy gold is likely to go above fair value.

If a piece of computer code or non-fungible tokens can go to 64K what could the traditional safe haven asset do? But, that isn’t the reason to buy it. The reason to buy it is that it is your savings account and financial insurance that can’t be inflated away.

Only about .5% of all investible money is in physical gold. During a real scare what happens to the price in any currency if it goes to 10% (which is the percentage that used to be recommended by financial experts 40 years ago) of investible assets try to move into gold or more? Gold will become unobtainium to coin a new word. At some point in a frenzy gold is likely to go above fair value.

If a piece of computer code or non-fungible tokens can go to 64K what could the traditional safe haven asset do? But, that isn’t the reason to buy it. The reason to buy it is that it is your savings account and financial insurance that can’t be inflated away.

stop tyranny

Veteran Member

While gold may be seen as a hedge against inflation it is NOT rising in value near as fast as our fiat currency has been losing value over the past 12 months. I fully expect our currency to continue to devalue at the same rate if not more every year for at least the next three years. If we do not suffer a complete economic and societal break down before they manage to collapse the dollar.

Donghe Surfer

Veteran Member

LBMA a deer in headlights as Western Sanctions show up Russian Gold Refiners

As new financial sanctions target Russia's financial system, one area that has escaped scrutiny are the LBMA approved Russian gold refineries

Some extremely interesting points made here. With so many western organizations denouncing Russia and leaving that market, why hasn't the LBMA come out and said that the gold held for ETFs are NO longer valid? Is it because it would screw the gold ponzi scheme in ETF-land?

---

Maybe it’s because there are nearly 1000 Russian 400 oz gold bars currently being held in the famous SPDR Gold Trust (GLD) in a vault in London (either in the HSBC custodian vault or the Bank of England sub-custodian vault).

If you open the pdf and scroll to page1629, and then scroll down through to page 1646, see will see that the SPDR Gold Trust holds a huge number of gold bars from LBMA Russian refiners Novosibir, Prioksky, Krastsvetmet, Uralelectromed, I wonder how many GLD hedge fund and institutional investors know this? While gold bars from suspended Russian gold refineries may still be good delivery in the eyes of the LBMA, this is not the case in the eyes of traders.

Looking back to May 2018 at the time of Ekaterinburg’s suspension, Reuters said the following:

“Suspension from the list makes it harder for buyers and sellers to trade bars in the mainstream precious metals market, traders said.

‘"Our company would not touch any bars that are not LBMA-accredited,’ one trader at a major precious metals house said. ‘Most probably they are going to be in a secondary market.’

TKO

Veteran Member

No worries. They'll have it down to 1800s by tomorrow. No way will they let silver go over 25 for long.1902 oz at the moment. Up 30 bucks an oz.

EMICT

Veteran Member

If oil, wheat, soy et. al. rises, then the pressure to decrease the price starts to diminish.No worries. They'll have it down to 1800s by tomorrow. No way will they let silver go over 25 for long.

That's the biggest move I've seen in silver in quite a while.No worries. They'll have it down to 1800s by tomorrow. No way will they let silver go over 25 for long.

TKO

Veteran Member

It is. Let's check in on it tomorrow.That's the biggest move I've seen in silver in quite a while.

jed turtle

a brother in the Lord

Naw. At the point where you’re the only guy left with food, they’ll be following you around like puppies...I am pretty sure if that happens, we will be back to dragging them around by the hair.

Naw. At the point where you’re the only guy left with food, they’ll be following you around like puppies...

A world full of skinny women. Is that good or bad? You could become a victim of a feeding frenzy.

Limit price on silver is10% above previous close. It should have been limiting every day since the start of this war. Just too much stuff to buy nowadays.

I should also add that the 10-year yield is back down to 1.716. That is either fear in the market or the fed adding liquidity.

Last edited:

EMICT

Veteran Member

The end of the month is always 'reset' time for the 'paper precious metals'.It is. Let's check in on it tomorrow.

TKO

Veteran Member

I'm a happy camper on metals. I want it over $2K on gold. I've been buying gold since I was in college and maybe by the time I give it to my grandchildren they can buy a few books with it in kolidge.The end of the month is always 'reset' time for the 'paper precious metals'.

EMICT

Veteran Member

Better than FRN's... maybe. To bad it's not a Ruble equivalent.I'm a happy camper on metals. I want it over $2K on gold. I've been buying gold since I was in college and maybe by the time I give it to my grandchildren they can buy a few books with it in kolidge.

Of Two Minds - Why So Few See the Last Chance to Exit

Why So Few See the Last Chance to Exit

February 28, 2022

When the crash can no longer be denied, the drop is widely recognized as having been obvious and inevitable..

The last chance to exit is well-known in stock trading circles, but the concept can be applied much more broadly. The basic dynamic at work is a mismatch between the fundamentals (i.e. the real world) which are deteriorating due to structural changes and the psychology of participants which continues to be confident and upbeat.

A wide spectrum of emotions and human traits are in play, but the core dynamic is our desire to discount signs of trouble rather than deal with a long-term change in the tides. The long uptrend supports confidence that the uptrend will continue moving higher more or less permanently, and the desire to keep minting money by staying fully invested in the uptrend encourages cherry-picking data to support the idea that the fundamentals are still solid.

Selection bias, denial, complacency and greed all play parts in this continuation of the psychology of an uptrend even as the S-Curve has shifted from growth to stagnation as the fundamentals have deteriorated beneath the surface.

This asymmetry between the fundamentals of valuation and the psychology of valuation cloaks the change in trend so few recognize it as the last chance to exit. Participants, so well trained by years of profits to "buy the dip" and anticipate future gains, see the initial dip as an opportunity to buy rather than as a warning sign.

This complacency is reinforced by the prompt reversal of any dip and a new high in valuations. Again, this dynamic is not limited to stocks; the ascent of housing valuations feeds the same complacency and selection bias: housing can't go down because...the litany of supportive narratives is always long and illustrious.

The last chance to exit is also present in states, cities, industries, jobs, institutions, groups and neighborhoods. The decay is ignored as everything seems to remain glued together and the rot is papered over by various pronouncements and policies.

There is typically a period of consolidation that further supports a complacent confidence that the present is immutable: the uptrend is permanent. But this consolidation is misleading: it's not a continuation of the uptrend, it's the result of first-movers selling to True Believers in the immutability of the present and getting out of Dodge.

When the S-Curve rolls over, the rapidity of the descent surprises True Believers, who assure themselves that the rebound will start any day. They find reasons to ignore the acceleration down as those who had hesitated to sell suddenly hit the sell button, list the house for sale, etc.

When the crash can no longer be denied, the drop is widely recognized as having been obvious and inevitable. Hindsight is 20/20, but the damage done to those who didn't sell at the the last chance to exit cannot be repaired; the losses are too deep.

Why So Few See the Last Chance to Exit

February 28, 2022

When the crash can no longer be denied, the drop is widely recognized as having been obvious and inevitable..

The last chance to exit is well-known in stock trading circles, but the concept can be applied much more broadly. The basic dynamic at work is a mismatch between the fundamentals (i.e. the real world) which are deteriorating due to structural changes and the psychology of participants which continues to be confident and upbeat.

A wide spectrum of emotions and human traits are in play, but the core dynamic is our desire to discount signs of trouble rather than deal with a long-term change in the tides. The long uptrend supports confidence that the uptrend will continue moving higher more or less permanently, and the desire to keep minting money by staying fully invested in the uptrend encourages cherry-picking data to support the idea that the fundamentals are still solid.

Selection bias, denial, complacency and greed all play parts in this continuation of the psychology of an uptrend even as the S-Curve has shifted from growth to stagnation as the fundamentals have deteriorated beneath the surface.

This asymmetry between the fundamentals of valuation and the psychology of valuation cloaks the change in trend so few recognize it as the last chance to exit. Participants, so well trained by years of profits to "buy the dip" and anticipate future gains, see the initial dip as an opportunity to buy rather than as a warning sign.

This complacency is reinforced by the prompt reversal of any dip and a new high in valuations. Again, this dynamic is not limited to stocks; the ascent of housing valuations feeds the same complacency and selection bias: housing can't go down because...the litany of supportive narratives is always long and illustrious.

The last chance to exit is also present in states, cities, industries, jobs, institutions, groups and neighborhoods. The decay is ignored as everything seems to remain glued together and the rot is papered over by various pronouncements and policies.

There is typically a period of consolidation that further supports a complacent confidence that the present is immutable: the uptrend is permanent. But this consolidation is misleading: it's not a continuation of the uptrend, it's the result of first-movers selling to True Believers in the immutability of the present and getting out of Dodge.

When the S-Curve rolls over, the rapidity of the descent surprises True Believers, who assure themselves that the rebound will start any day. They find reasons to ignore the acceleration down as those who had hesitated to sell suddenly hit the sell button, list the house for sale, etc.

When the crash can no longer be denied, the drop is widely recognized as having been obvious and inevitable. Hindsight is 20/20, but the damage done to those who didn't sell at the the last chance to exit cannot be repaired; the losses are too deep.

A world full of skinny women. Is that good or bad? You could become a victim of a feeding frenzy.

If that happens - maybe they will stop telling us how pretty fat women are.

$10,000 in Au, approx 5 Troy Oz, $10,000 in Ag, approx 400 Troy Oz. Seems easier to store, secure & transport Au than Ag. Don't get me wrong, I like both. Wish I had some.Gold is a paradoxical thing. Everyone wants it, but too much of it is a problem to store and secure. Who has your gold is an issue, too- are they trustworthy?

I sold most of mine in 2011.

As far as who has one's Pm's. If you don't hold it, you don;t own it'

$10,000 in Au, approx 5 Troy Oz

People who REALLY own gold, have 400 ounce bars