You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ALERT JUST IN: Republic First Bank officially collapses and seized by regulators.

- Thread starter jward

- Start date

LoupGarou

Ancient Fuzzball

Or, the plan may be that everything fails, bails in, and sucks everything tangible in with it (that is their plan after all), and then thanks to the FDIC, MMT, and CBDCs, we all get a 250K of CrazyBernie'sDemocraticCash in our "new" FedMow accounts that will self destruct in a month if not spent on whatever few things exist and we are allowed to buy with them...On the positive side, those with deposits in that bank, if they hurry up, can get their money from the FDIC. As the slippery slide begins and they all fall like dominoes, the later and later and more claims come, the less likely you are to be covered.

After all, that is how Equity works in their world.

Add that with the insane exponential inflation that will happen and the 25% tax on "Unrealized profits" on everything that you own, and you can bet that their "You will own nothing" will happen in a short time period...

Assuming they aren't reimbursed with digital dollars and starts the next level of phase in.

Plain Jane

Just Plain Jane

Bank Failures Begin Again: Philly's Republic First Seized By FDIC | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Bank Failures Begin Again: Philly's Republic First Seized By FDIC

BY TYLER DURDEN

FRIDAY, APR 26, 2024 - 06:45 PM

Who could have seen that coming? (here, here, here, and most detailed here)

Admittedly, we were a couple of weeks off, but trouble has been brewing in the banking sector and tonight - after the close - we get the first bank failure of the year.

The FDIC just seized the troubled Philadelphia bank, Republic First Bancorp and and struck an agreement for the lender’s deposits and the majority of its assets to be bought by Fulton Bank.

Republic Bank had about $6 billion of assets and $4 billion of deposits at the end of January, according to the FDIC (considerably smaller than the $100-200BN assets with SVB and Signature).

The FDIC estimated the failure will cost the deposit insurance fund $667 million.

As The Wall Street Journal reports, Republic First had for months struggled to stay afloat.

Around half of its deposits were uninsured at the end of 2023, according to FDIC data.

Its total equity, or assets minus liabilities, was $96 million at the end of 2023, according to FDIC filings.

That excluded $262 million of unrealized losses on bonds that it labeled “held to maturity,” which means the losses hadn’t counted on its balance sheet.

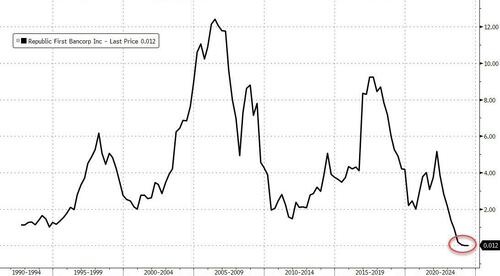

Its stock, which was delisted from Nasdaq in August, had been near zero.

Republic Bank’s 32 branches across New Jersey, Pennsylvania and New York will reopen as branches of Fulton Bank on Saturday, according to a statement from the FDIC.

Depositors of Republic Bank will become depositors of Williamsport, Pennsylvania-based Fulton Bank, the regulator said.

You should not be surprised given that rates are higher now than they were at the start of the SVB crisis - which means, unless banks have hedged hard or dumped their bonds at a loss, they are even more underwater...

View: https://twitter.com/Barchart/status/1783321578291200246?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1783321578291200246%7Ctwgr%5E289854d317af49ba443aaa51fd865363c6b74cf6%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.zerohedge.com%2Fmarkets%2Fbank-failures-begin-again-phillys-republic-first-seized-fdic

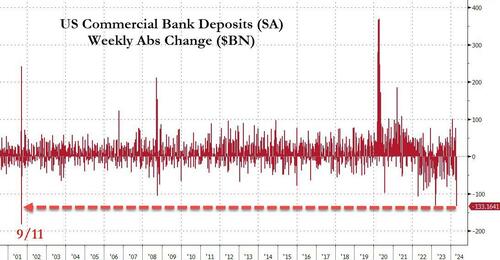

Add to this the fact that last week - seasonally-adjusted for tax-season - US banks saw the largest deposit outflows since 9/11 (yes, that 9/11)...

...and, as we showed earlier, absent the $126BN outstanding in The Fed's BTFP bailout fund (which is now terminated and slowly running down as the term loans mature)...

...the banking crisis is back and now the question is "who's next?"

naegling62

Veteran Member

Don’t panic, as we have learned you only have to be the tallest midget in the room.

energy_wave

Has No Life - Lives on TB

You can't have multiple banks under communism. They have to collapse them all to create one central bank under strict government control.

Bubble Head

Has No Life - Lives on TB

I think we had a call for a death burger earlier in the week. Friday night after all is closed they make their announcement. Of course everyone on the proper committees in DC made it out without a scratch.

energy_wave

Has No Life - Lives on TB

Maybe we should have a bank failure thread to track them world wide. We might see a pattern.

night driver

ESFP adrift in INTJ sea

It's a WHOLE LOT WORSE if they announce on a Wednesday afternoon....

hiwall

Has No Life - Lives on TB

This can go on for a long time yet.

Smaller banks will go bust then be "absorbed" by a larger bank. Gradually more and more banks will be "absorbed". We could end up with just a small handful of mega banks. The end will come shortly after that. Could be a few years from now.

Smaller banks will go bust then be "absorbed" by a larger bank. Gradually more and more banks will be "absorbed". We could end up with just a small handful of mega banks. The end will come shortly after that. Could be a few years from now.

Henry Bowman

Veteran Member

Yes but this could now pick up at a faster pace. From the article:This can go on for a long time yet.

Smaller banks will go bust then be "absorbed" by a larger bank. Gradually more and more banks will be "absorbed". We could end up with just a small handful of mega banks. The end will come shortly after that. Could be a few years from now.

Add to this the fact that last week - seasonally-adjusted for tax-season - US banks saw the largest deposit outflows since 9/11 (yes, that 9/11)...

...and, as we showed earlier, absent the $126BN outstanding in The Fed's BTFP bailout fund (which is now terminated and slowly running down as the term loans mature)...:

This is about to take on a life of it's own. It will affect larger banks soon as Credit card and loans defaults are at all time highs and climbing.

Hfcomms

EN66iq

This can go on for a long time yet.

Smaller banks will go bust then be "absorbed" by a larger bank. Gradually more and more banks will be "absorbed". We could end up with just a small handful of mega banks. The end will come shortly after that. Could be a few years from now.

It could....as it has gone on far long than I ever thought possible. But one thing we do know is that we are a lot closer to the collapse than we used to be. I wouldn't dare assume we have a few years left or even a few months. We might but then again we might not. A system this complex has many points of failure along the line. Nobody knows when the Jenga piece is pulled that brings everything down.

Dobbin

Faithful Steed

CBDCsAssuming they aren't reimbursed with digital dollars and starts the next level of phase in.

Created out of bytes and will go back to bytes at the push of a button.

Not your button.

Meanwhile, they see how much you spend on plastic straws, fattening Mondo-Burgers, cigarettes, booze, and gasoline.

You WILL comply.

Social credit scores at the ready.

Dobbin

Dobbin

Faithful Steed

I suspect we've seen the pattern.Maybe we should have a bank failure thread to track them world wide. We might see a pattern.

Bad economic news from the Biden Regime - worse observations from Birch Gold and others - and another bank throws in their towel.

And rinse and repeat with a new towel, a week, a month, a year hence.

And - then a concentration of "bad investments" eventually taking down even the possibility of injecting enough capital to cover it.

You're now at 1 trillion per 100 days. You're at the point where "the curve accelerates."

Dobbin

momma_soapmaker

Disgusted

Get out of debt and prepare your household as much as possible.

This will be nasty.

This will be nasty.

Wyominglarry

Veteran Member

The Great Taking will happen before the election.

night driver

ESFP adrift in INTJ sea

Yeah, it's one of them "Hockey-stick" curves, too.

20Gauge

TB Fanatic

That is intended to prevent panicInteresting how these bank failures are almost always announced on Fridays after the markets close isn’t it?

20Gauge

TB Fanatic

This is due to ( no matter what they say ) people being broke and horribly broke at that..... it is going to get worse...Yes but this could now pick up at a faster pace. From the article:

Add to this the fact that last week - seasonally-adjusted for tax-season - US banks saw the largest deposit outflows since 9/11 (yes, that 9/11)...

...and, as we showed earlier, absent the $126BN outstanding in The Fed's BTFP bailout fund (which is now terminated and slowly running down as the term loans mature)...:

This is about to take on a life of it's own. It will affect larger banks soon as Credit card and loans defaults are at all time highs and climbing.

20Gauge

TB Fanatic

Very true. We have been this way since the 70s in my opinion. It has only gotten worse since then. At this point all that is needed ( in my mind ) is that one person starting to scream zombies. Whether it be on TV or on youtube. We are near collapsing the camel's back......It could....as it has gone on far long than I ever thought possible. But one thing we do know is that we are a lot closer to the collapse than we used to be. I wouldn't dare assume we have a few years left or even a few months. We might but then again we might not. A system this complex has many points of failure along the line. Nobody knows when the Jenga piece is pulled that brings everything down.

Just one more person and it is gone.....

20Gauge

TB Fanatic

That has been our plan for the last decade. We are down to just the house...... it still will take a few years more.....Get out of debt and prepare your household as much as possible.

This will be nasty.

20Gauge

TB Fanatic

My parents have the local bank calling them.... wanting to talk.....why?????

This was the bank that got rude to my father and then my wife and I. So the family ( and as many friends as we can convince ) have been moving money from the bank a bit at a time......

My parents are very well off. They have earned it by living under their wages for 5 decades.....and investing in many different things and doing it themselves.....

So when 400k moves from a small bank...... they will take notice......They still have more there, but it is too much of a pain to move just yet....

So the bank is calling 1st the teller, then the manager, and now the President of the bank.......Mom has been ignoring them. She already said her piece about the whole thing.... nothing to fix at this point. Just move our money....

I am not sure about the longer term viability of the bank......

This was the bank that got rude to my father and then my wife and I. So the family ( and as many friends as we can convince ) have been moving money from the bank a bit at a time......

My parents are very well off. They have earned it by living under their wages for 5 decades.....and investing in many different things and doing it themselves.....

So when 400k moves from a small bank...... they will take notice......They still have more there, but it is too much of a pain to move just yet....

So the bank is calling 1st the teller, then the manager, and now the President of the bank.......Mom has been ignoring them. She already said her piece about the whole thing.... nothing to fix at this point. Just move our money....

I am not sure about the longer term viability of the bank......

Dobbin

Faithful Steed

Not to worry - the "Biden 'F'-Curve" will solve it.Yeah, it's one of them "Hockey-stick" curves, too.

For your elite.

Dobbin

jward

passin' thru

but I'm always the smallest person in the room- of adults, at least, and sometimes even of children.Don’t panic, as we have learned you only have to be the tallest midget in the room.

- now, may I

Yes. A pattern of people complaining about big threads ; )Maybe we should have a bank failure thread to track them world wide. We might see a pattern.

So y'all don't expect the usual papering over of the issue until after the (s)election?

This is a bit of topic or is it..???

Things are changing... had two credit unions...a few days into April got a letter... they would be closed this weekend..to convert to this new system.... the next time you came in the branch they would need to scan your driver's license into their computer.... the data base would be run by a second company...in addition they wanted you to put your signature in their computer...and you would need to show your driver's license to do transactions in their bank..and your account number would be changed to a new one... (conforming to something...I bet....)

Called to see if we could opt out of the computer garbage.... NO.....but the data bases were super secure...nothing to worry about...and they had to up date my driver's license because it was expired..blah..bhal..and so forth

Could see the donkey flying around that credit union....told the branch manager to order what was in the account and call when she had it...we picked it up and closed the account ...now we have only one credit union...hum.. wonder if they will get weird also....

Be very aware...things are changing rapidly

Protect yourself and get out of debt.

If they bail in...you will still owe your debts .. they take your money but you still have to pay...so just how does that work out for you.....

Things are changing... had two credit unions...a few days into April got a letter... they would be closed this weekend..to convert to this new system.... the next time you came in the branch they would need to scan your driver's license into their computer.... the data base would be run by a second company...in addition they wanted you to put your signature in their computer...and you would need to show your driver's license to do transactions in their bank..and your account number would be changed to a new one... (conforming to something...I bet....)

Called to see if we could opt out of the computer garbage.... NO.....but the data bases were super secure...nothing to worry about...and they had to up date my driver's license because it was expired..blah..bhal..and so forth

Could see the donkey flying around that credit union....told the branch manager to order what was in the account and call when she had it...we picked it up and closed the account ...now we have only one credit union...hum.. wonder if they will get weird also....

Be very aware...things are changing rapidly

Protect yourself and get out of debt.

If they bail in...you will still owe your debts .. they take your money but you still have to pay...so just how does that work out for you.....

Monster insider trading alert: Ted Cruz sells up to $500k of Goldman Sachs stock

Ana Zirojevic

Apr 25, 2024

Despite criticism of individuals with insider knowledge of the inner workings of companies investing in the same organizations’ stocks, they seem to continue trading these shares unbothered, with the most recent example involving United States Senator Ted Cruz.

As it happens, Cruz has recently sold nearly $500,000 worth of Goldman Sachs (NYSE: GS) stock while, at the same time, critics pointed out that his wife, Heidi Cruz, was a managing director at the said investment banking and securities behemoth, and therefore privy to insider information.

Specifically, the politician disclosed a sale of between $250,001 and $500,000 worth of GS shares from April 15, 2024, in the most recent US Senate financial disclosures period transaction report, according to the information shared by politician stock trades monitoring platform congresstrading.com on April 24.

Goldman Sachs stock price analysis

Meanwhile, Goldman Sachs shares were at press time trading at the price of $422.91, recording a slight decline of 0.23% on the day but nonetheless climbing 4.02% across the past week and advancing an accumulated 3.91% on its monthly chart, as per the most recent data on April 25.

All things considered, there is a possibility that the Cruz couple could hold important information about Goldman Sachs that could negatively impact the GS share price in the future, and they are trying to make as much profit as possible before this happens.

One example could be Goldman Sachs getting out of the robo-advisory business with the sale of its Marcus Invest digital investing accounts to digital investment adviser Betterment while focusing on the GS’s core strengths – investment banking, asset management, and trading.

However, the Goldman Sachs stock is currently demonstrating a strong technical rating, trading near its 52-week high and outperforming 79% of the other 210 stocks in the capital markets industry. That said, time will tell if GS shares retain their bullish momentum triggered around four months ago.

Monster insider trading alert: Ted Cruz sells up to $500m of Goldman Sachs stock

United States Senator Ted Cruz, whose wife is a managing director at Goldman Sachs, has sold nearly half a million worth of GS stock.

jward

passin' thru

this isn't bank news per se, but does seem to be part o' the bad economic scene we seem to be on the cusp of entering more fully...?

S p r i n t e r F a c t o r y

@Sprinterfactory

Egypt, South Africa, Nigeria, Ghana, Cameroon, Senegal, Algeria and Saudi Arabia have begun withdrawing their national gold reserves from the United States

S p r i n t e r F a c t o r y

@Sprinterfactory

Egypt, South Africa, Nigeria, Ghana, Cameroon, Senegal, Algeria and Saudi Arabia have begun withdrawing their national gold reserves from the United States

pauldingbabe

The Great Cat

Very true. We have been this way since the 70s in my opinion. It has only gotten worse since then. At this point all that is needed ( in my mind ) is that one person starting to scream zombies. Whether it be on TV or on youtube. We are near collapsing the camel's back......

Just one more person and it is gone.....

Aliens on my front 5 acres.

Still a waiting..

Dobbin

Faithful Steed

This is a world response to the discussions in Congress to "using" frozen Russian assets to repay/rebuild Ukraine.this isn't bank news per se, but does seem to be part o' the bad economic scene we seem to be on the cusp of entering more fully...?

S p r i n t e r F a c t o r y

@Sprinterfactory

Egypt, South Africa, Nigeria, Ghana, Cameroon, Senegal, Algeria and Saudi Arabia have begun withdrawing their national gold reserves from the United States

The Congressional action has a logical rationale: the Russians have dominated and destroyed the Ukraine - let the Russian value rebuild it.

The problem with that rationale is that the frozen assets are likely not Russian Government assets. Russia has a business and a marketplace, and they have deposited monies in US banks and holdings in a search for "security" for their assets - a business advantage in a nation-state adjacent to a war zone.

If the US "seizes" these assets, it's like reneging on an agreement to hold those assets and keep them bearer on demand - probably the surest way to prove to the world that the US is NOT the security advantage that everyone thinks it is.

The US and the dollar became the world standard for trade by doing trading honestly and securely. A Russian asset seizure flies in the face of this - and is an action that was never before done, even in WWII with both Germany and Japan.

And here the US is, wringing its hands over the possibility of the Dollar Hegemony being taken over in world trade by the BRICS "Basket of Currencies" as the standard value trade mechanism, and they then go and prove to the world that their fears about the security of the US as a depository are founded?

This horse should run for Congress and explain to those charlatans the true meaning of what their Bonnie & Clyde actions mean.

Dobbin