Southside

Has No Life - Lives on TB

I know this comes as no surprise to anyone here

jensendavid.substack.com

jensendavid.substack.com

David Jensen

Mar 27, 2024

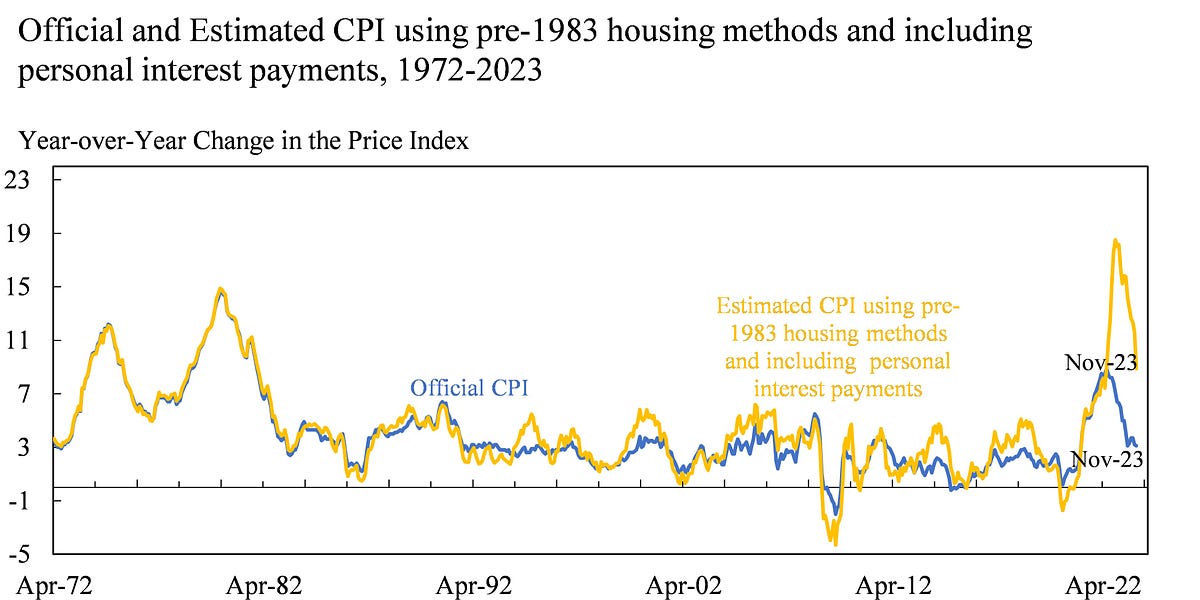

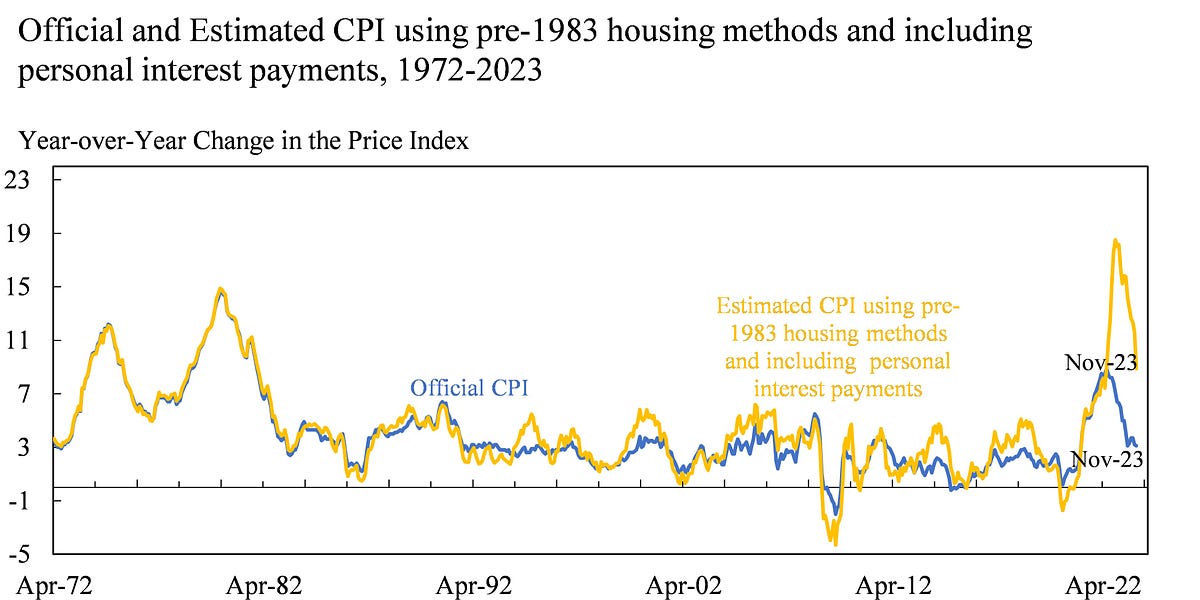

Former Treasury Secretary Larry Summers put out a tweet thread on February 27, 2024 highlighting his participation in a new paper estimating a more accurate Consumer Price Index (CPI) cost of living estimate for the US.

What is sure to jolt many is that Summers paper estimates the real cost of living increase peaked in 2022 by 18% when mortgage, auto loan, and interest expenses generally are considered and was running at 9% at the end of 2023. Compare that to the 3.2% offical CPI published for February 2024.

This graph illustrates the disparity between Summers’ new CPI estimate including mortgage and debt costs and published official CPI numbers:

Summers’ tweet thread about his new paper can be found here:

View: https://twitter.com/LHSummers/status/1762607534676853015

Note that Summers states their new CPI index accounts for 70% of the disparity between consumer (i.e. citizen) sentiment and the rosy economic conditions portrayed by official statistics. Even accounting for the mortgage and loan costs, there remains a 30% sentiment gap between what people are feeling and what the government is publishing.

Since the 1980s and especially since the Boskin/Greenspan revision of the CPI index, the CPI / CPI-U index cost of living estimates have been repeatedly remodeled to reduce acknowledged price inflation using tools such as:

Taking these factors as well as Summers’ interest expense estimates into account, what individuals really saw was a peak 25+% true cost of living increase in 2022 and a 12% year-over-year cost of living increase in 2023 on top of that.

Net: The middle and lower-income individuals and families in our society are being absolutely wrecked by the policies of our governments and monetary central planners.

As the next leg of price inflation acceleration takes hold, we are going to see further debilitation of our citizens and society as a direct consequence of money-printing.

There has not been a better time to hold gold and silver than now.

Best regards,

David Jensen

Former US Treasury Secretary Says US CPI Cost of Living Inflation Peaked in 2022 Actually Above 18% And Above 9% in 2023

Former Treasury Secretary Larry Summers put out a tweet thread on February 27, 2024 highlighting his participation in a new paper estimating a more accurate Consumer Price Index (CPI) cost of living estimate for the US. What is sure to jolt many is that Summers paper estimates the real cost of...

Former US Treasury Secretary Says US CPI Cost of Living Inflation Peaked in 2022 Actually Above 18% And Above 9% in 2023

David Jensen

Mar 27, 2024

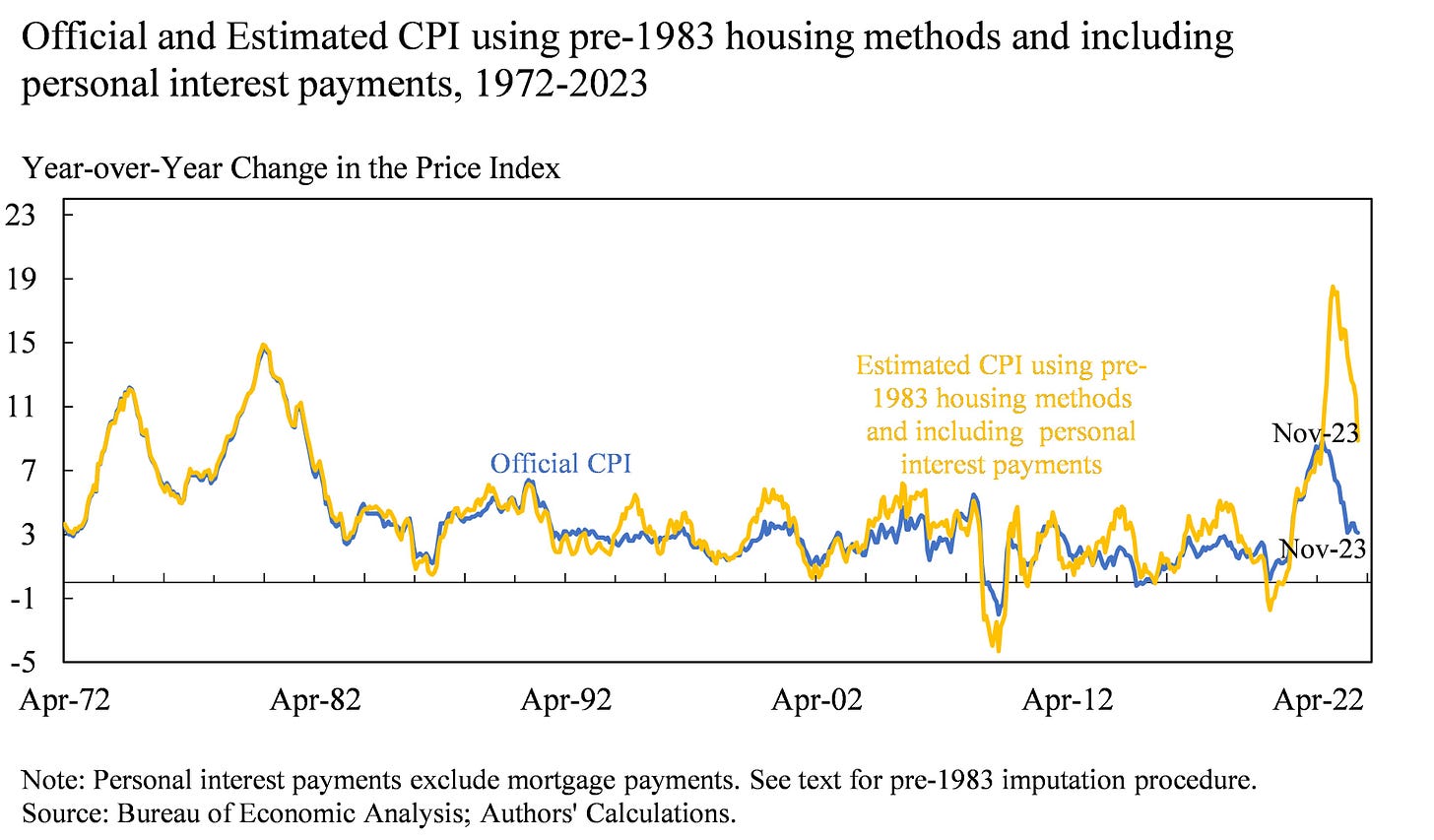

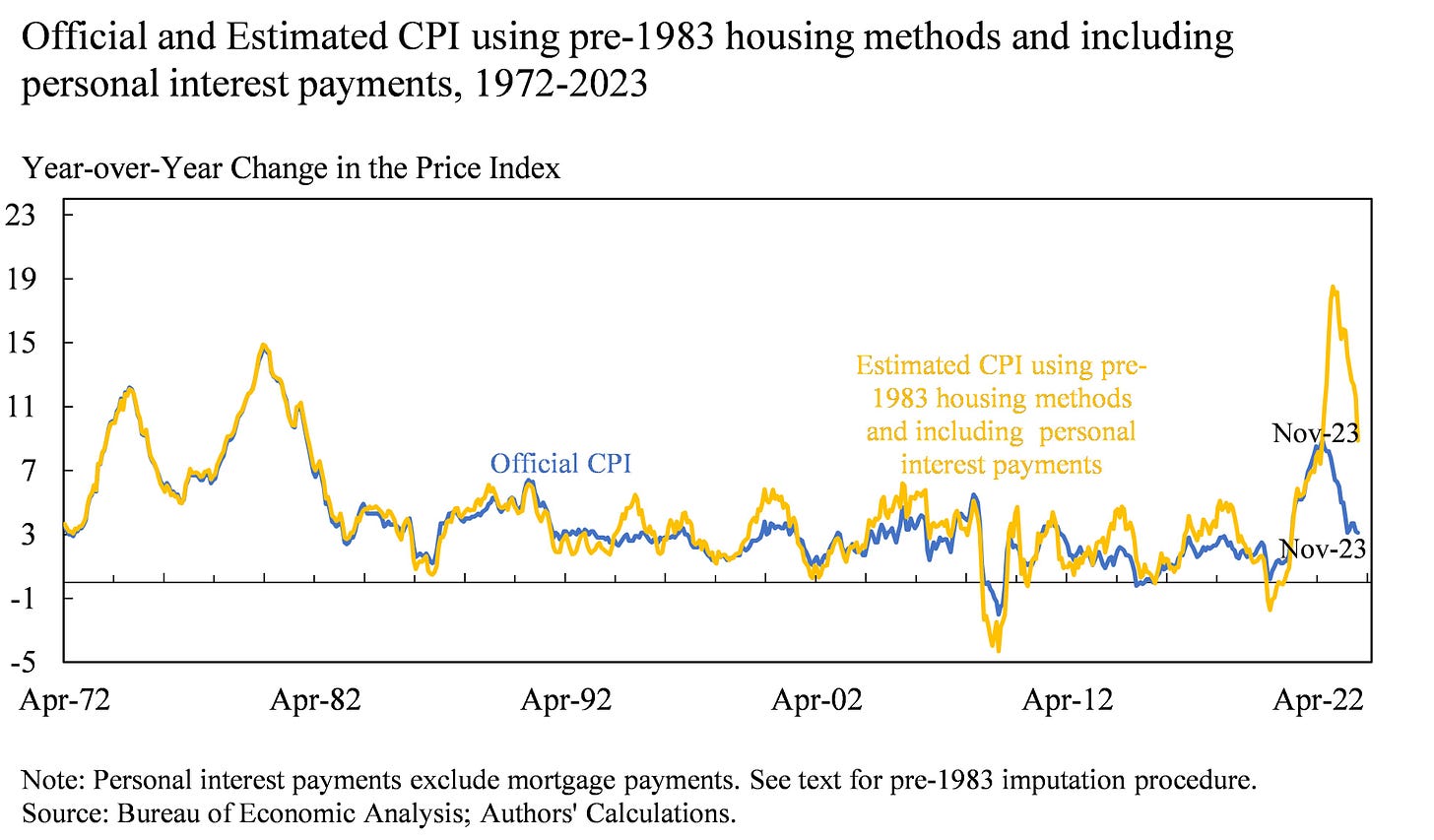

Former Treasury Secretary Larry Summers put out a tweet thread on February 27, 2024 highlighting his participation in a new paper estimating a more accurate Consumer Price Index (CPI) cost of living estimate for the US.

What is sure to jolt many is that Summers paper estimates the real cost of living increase peaked in 2022 by 18% when mortgage, auto loan, and interest expenses generally are considered and was running at 9% at the end of 2023. Compare that to the 3.2% offical CPI published for February 2024.

This graph illustrates the disparity between Summers’ new CPI estimate including mortgage and debt costs and published official CPI numbers:

Summers’ tweet thread about his new paper can be found here:

View: https://twitter.com/LHSummers/status/1762607534676853015

Note that Summers states their new CPI index accounts for 70% of the disparity between consumer (i.e. citizen) sentiment and the rosy economic conditions portrayed by official statistics. Even accounting for the mortgage and loan costs, there remains a 30% sentiment gap between what people are feeling and what the government is publishing.

Since the 1980s and especially since the Boskin/Greenspan revision of the CPI index, the CPI / CPI-U index cost of living estimates have been repeatedly remodeled to reduce acknowledged price inflation using tools such as:

- Substitution Effect - eg. if a consumer substitutes ground beef for steak as prices rise, the impact on cost of living prices is assumed to be negligible as the the consumer gets their protein for less.

- Hedonics - prices are assumed to be reduced if, for instance, a product provides more performance over time (eg. faster computers, more features in automobiles, etc.). Old fashioned progress is redefined as a reduction in product costs.

- Geometric vs. arithmetic weighting of CPI index components - this automatically gives a lower weighting to CPI components that are rising in price, and a higher weighting to those items dropping in price. etc. …

Taking these factors as well as Summers’ interest expense estimates into account, what individuals really saw was a peak 25+% true cost of living increase in 2022 and a 12% year-over-year cost of living increase in 2023 on top of that.

Net: The middle and lower-income individuals and families in our society are being absolutely wrecked by the policies of our governments and monetary central planners.

As the next leg of price inflation acceleration takes hold, we are going to see further debilitation of our citizens and society as a direct consequence of money-printing.

There has not been a better time to hold gold and silver than now.

Best regards,

David Jensen