sad commentary if it is not in your hand, it ain’t yours finance versionWhat about a savings account?

Same thing??

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ECON [FINANCE] First Deathburger Thread of the 2023 Banking Crisis. ALL welcome (hall passes at the door). Have At It.

- Thread starter night driver

- Start date

- Status

- Not open for further replies.

hiwall

Has No Life - Lives on TB

Isn't that going to be the case when we get the Central Bank crypto currency in July?For that matter, why not maximize the charade and just stop offering checking and savings to consumers at all. That way there is never a concern about needing liquidity.

Is this a recession or not?

Is this an economic disaster or is the economy booming?

Is this a financial disaster or is this "money for nothing, chicks free"?

Is risk increasing or decreasing?

Seems pretty straight forward to me.

The news media, government, and Federal Reserve are not likely to tell you the truth.

Is this an economic disaster or is the economy booming?

Is this a financial disaster or is this "money for nothing, chicks free"?

Is risk increasing or decreasing?

Seems pretty straight forward to me.

The news media, government, and Federal Reserve are not likely to tell you the truth.

BUBBAHOTEPT

Veteran Member

I believe that is exactly what the Fed Coin will do. Whether in actuality or de facto, your new Digital Fed Dollar will be in your Fed checking and savings account right on your precious smart phone…For that matter, why not maximize the charade and just stop offering checking and savings to consumers at all.

You got dollars? No problem, spend ‘em while you got ‘em, cause the Fed will smoke ‘em when they get ‘em… No confiscation, no pressure, no bank runs anymore…

bw

Fringe Ranger

Several years I think.During the Great Depression, there were ups and downs too... people believed it was all over and then it would slam back down before the final crash came. It took weeks, if not months, to crash completely.

The Hammer

Has No Life - Lives on TB

Seeing mention now of big banks coming to rescue First Republic Bank.

Dow +315...

Dow +315...

CaryC

Has No Life - Lives on TB

I think that is true. I think the worst year 1931, maybe 32. FDR got elected with the "New Deal" big federal works projects.Several years I think.

First Republic Bank Shares Jump On 'Big Bank' Deposit Bailout Plan

BY TYLER DURDENTHURSDAY, MAR 16, 2023 - 11:27 AM

Update (1300ET): CNBC's David Faber is reporting that the large banks are planning - as a group - to deposit around $20 billion of their own cash with First Republic.

JPMorgan, Citigroup, BofA, and Wells Fargo are among the banks in talsk over the despoit of their cash into First Republic. Morgan Stanley and Goldman Sachs are also reportedly involved along with US Bancorp and PNC Financial Services.

This makes some sense as the 'big banks' have lots of reserves relative to assets...

As a reminder, JPM and the "Big 4" got even bigger recently thanks to small bank deposit run from past week, which they are now returning as deposits back into those troubled banks.

The Wall Street Journal reports, according to sources, that not all banks will contribute the same amount to the pool, but each one that is participating so far will likely put in at least $1 billion.

FRC shares are jumping (and halted) on the headlines...

* * *

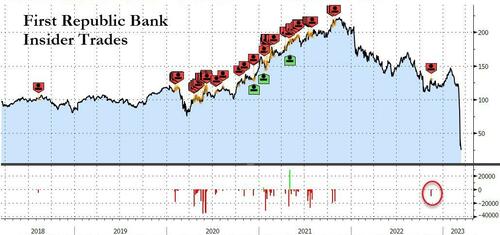

Update (1230ET): What did they know and when?

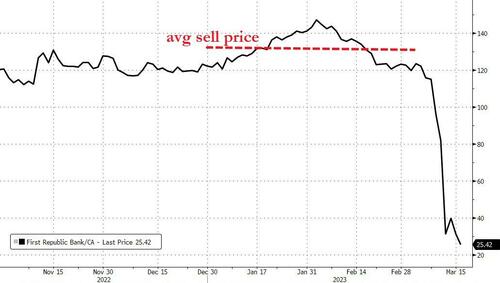

As chatter continues to build of some bailout for First Republic Bank this week, after the company's share price has collapsed, The Wall Street Journal reports that top execs at the bank sold millions of dollars of company stock in the last two months... but did not report the sales to SEC.

A gander at the SEC filings show only one small 'insider sale' recently (in November)...

However, executive have been selling for months, as unlike insider sales at most companies, those at First Republic aren’t required to be reported to the Securities and Exchange Commission.

Instead, the trades were reported to the Federal Deposit Insurance Corporation.

A handful of banks currently file these forms to the FDIC, which posts them on a website where the documents can be accessed one at a time.

As of Wednesday, First Republic is the only company listed on the S&P 500 index that doesn’t file its insider trades with the SEC, a Wall Street Journal analysis shows.

In all, insiders have sold $11.8 million worth of stock so far this year at prices averaging just below $130 a share.

Finally, we would expect a knock at the door if we were them as the DoJ is already looking at insider sales made by Silicon Valley Bank executives a week before that bank’s failure,

* * *

Update (1100ET): The Wall Street Journal reports that JPMorgan and Morgan Stanley are among a group in talks to bolster First Republic Bank.

According to people familiar with the matter, several large banks are discussing a potential deal with First Republic Bank that could include a sizable capital infusion to shore up the beleaguered lender.

Any deal would need the blessing of regulators and will be driven at least in part by the bank’s highly volatile stock.

FRC shares are bouncing hard off the earlier lows (halted numerous times)...

That headline sent the US Majors soaring...

* * *

As we detailed earlier, First Republic Bank shares have plunged this morning, extending a week-long rout, as executives consider courting a buyer to prop up the bank in the wake of the collapse of several regional peers.

Bloomberg reports that, according to people familiar with the matter, the San Francisco-based bank is said to be exploring strategic options that include a sale. The firm is also weighing options for shoring up liquidity, some of the people said.

FRC shares are down over 30% this morning, back at post-SVB lows...“Normally, a headline of a potential sale would support the stock,” Christopher McGratty, an analyst at Keefe, Bruyette and Woods, wrote in a report.

“However, the potentially significant deposit outflows post-SIVB failure likely leave FRC in a tough spot.”

“Any potential sale would likely be a tough outcome for existing shareholders, given mark-to-market accounting on loans,” McGratty wrote.

First Republic saw its credit rating was cut to junk by S&P Global Ratings and Fitch Ratings.

But, but, but President Biden said:“First Republic’s options have narrowed following deposit outflow, a sharp share-price decline and recent downgrades from ratings agencies, while a potential sale of the bank could center on the attractive wealth-management business,” Herman Chan, an analyst at Bloomberg Intelligence, wrote in a note.

It's not over."Americans can rest assured that our banking system is safe. Your deposits are safe."

First Republic Bank Shares Jump On 'Big Bank' Deposit Bailout Plan | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The Hammer

Has No Life - Lives on TB

Everything Biden says seems to age incredibly poorly.

If he says it's safe, run for the hills...

If he says it's safe, run for the hills...

bw

Fringe Ranger

The Jim Cramer of politics.Everything Biden says seems to age incredibly poorly.

If he says it's safe, run for the hills...

I think it helps bring in the CBDC. If banks are very restrictive as to who they give accounts to the easy solution is for the Fed to set up an account for everyone.Isn't that going to be the case when we get the Central Bank crypto currency in July?

SmithJ

Veteran Member

Don't they mean they are about to deposit $20 billion of THEIR DEPOSITORS cash? I mean, it's not really their money, right? No matter what the depositor agreement says.....First Republic Bank Shares Jump On 'Big Bank' Deposit Bailout Plan

BY TYLER DURDEN

THURSDAY, MAR 16, 2023 - 11:27 AM

Update (1300ET): CNBC's David Faber is reporting that the large banks are planning - as a group - to deposit around $20 billion of their own cash with First Republic.

stormie

Veteran Member

We did too. Took my 401K out about 2 months before the crash and bought metals. Metals went up and off set the penalties and taxes.We pulled everything out of an old 401k the week before it crashed. Took the hit on penalties and taxes, and haven't regretted it. We'd been watching the markets and saw it coming.

Sacajawea

Has No Life - Lives on TB

I thought so.

But I had to ask

When I explained that to my D, her head exploded.

Southside

Has No Life - Lives on TB

I was a few years behind that. But the "Robert Rubin" years at the .Gov changed me. He was appointed by Clinton in 1993.I ultimately lost faith in 1996, when I bought my first gold.

The Hammer

Has No Life - Lives on TB

Might see an afternoon rollover. Dow still up 250, but the rally seems to be stalling.

Ides of March - Vehicle

View: https://youtu.be/TXvegzWNIps

Ides of March - Vehicle

Rebel_Yell

Senior Member

As a reminder, JPM and the "Big 4" got even bigger recently thanks to small bank deposit run from past week, which they are now returning as deposits back into those troubled banks.

I saw last Friday that Jamie Dimon had pulled deposits from SVP. I couldn't help wondering if they were shorting the stock at the same time.

Southside

Has No Life - Lives on TB

Jim Peterik lives in the Chicago area. Have seen his act many times over the years. He just "shows up". Everywhere, it seems.Might see an afternoon rollover. Dow still up 250, but the rally seems to be stalling.

Ides of March - Vehicle

View: https://youtu.be/TXvegzWNIps

jward

passin' thru

Peter St Onge, Ph.D.

@profstonge

1h

Yellen hinting bailouts will only be for "systemic risks." Meaning big banks and, presumably, banks with enough friends in Washington to get a seat on the lifeboat.

View: https://twitter.com/profstonge/status/1636427897928835074?s=20

@profstonge

1h

Yellen hinting bailouts will only be for "systemic risks." Meaning big banks and, presumably, banks with enough friends in Washington to get a seat on the lifeboat.

View: https://twitter.com/profstonge/status/1636427897928835074?s=20

The Hammer

Has No Life - Lives on TB

Still +331, so might close with some green shoots for Thursday...

jward

passin' thru

Reuters

@Reuters

2m

Credit Suisse sued by US shareholders over finances, controls Credit Suisse sued by US shareholders over finances, controls

@Reuters

2m

Credit Suisse sued by US shareholders over finances, controls Credit Suisse sued by US shareholders over finances, controls

jward

passin' thru

zerohedge

@zerohedge

1m

*BAC, C, JPM, WFC EACH MAKING A $5B UNINSURED DEPOSIT INTO FRC

*GOLDMAN SACHS AND MORGAN STANLEY EACH DEPOSITING $2.5B

*BNY-MELLON, PNC BANK, STATE STREET, U.S. BANK EACH DEPOSIT $1B

*TOTAL OF 11 BANKS TO DEPOSIT $30B INTO FIRST REPUBLIC BANK

View: https://twitter.com/zerohedge/status/1636448215934402560?s=20

@zerohedge

1m

*BAC, C, JPM, WFC EACH MAKING A $5B UNINSURED DEPOSIT INTO FRC

*GOLDMAN SACHS AND MORGAN STANLEY EACH DEPOSITING $2.5B

*BNY-MELLON, PNC BANK, STATE STREET, U.S. BANK EACH DEPOSIT $1B

*TOTAL OF 11 BANKS TO DEPOSIT $30B INTO FIRST REPUBLIC BANK

View: https://twitter.com/zerohedge/status/1636448215934402560?s=20

Dollar Short

Veteran Member

In light of this week's events, I think it is time to resurrect this classic Aussic comic explanation of quantitive easing...

View: https://www.youtube.com/watch?v=j2AvU2cfXRk

Marthanoir

TB Fanatic

Tommy Tiernan - Who Do We Owe Money To? And Why Don't We ... ( humour )

vector7

Dot Collector

JANET YELLEN: "I consider high inflation the number one economic problem that all of us need to face and address...I was very supportive of the American Rescue Plan."

REMINDER: The Democrats' $1.9 TRILLION "American Rescue Plan" fueled inflation!

RT 30secs

View: https://twitter.com/SteveGuest/status/1636380363240112133?s=20

Reminds me of this...

RT 21secs

View: https://youtu.be/G7RgN9ijwE4

REMINDER: The Democrats' $1.9 TRILLION "American Rescue Plan" fueled inflation!

RT 30secs

View: https://twitter.com/SteveGuest/status/1636380363240112133?s=20

Reminds me of this...

RT 21secs

The Hammer

Has No Life - Lives on TB

I remember Greenspan used to be indecipherable. But Yellen just spouts the undiluted stupidity.JANET YELLEN: "I consider high inflation the number one economic problem that all of us need to face and address...I was very supportive of the American Rescue Plan."

REMINDER: The Democrats' $1.9 TRILLION "American Rescue Plan" fueled inflation!

RT 30secs

View: https://twitter.com/SteveGuest/status/1636380363240112133?s=20

Reminds me of this...

RT 21secs

View: https://youtu.be/G7RgN9ijwE4

Blacknarwhal

Let's Go Brandon!

Not quite as good as the immortal meme question:

Has Anyone Really Been Far Even as Decided to Use Even Go Want to do Look More Like?

but still pretty sound.

Thanks big banks.11 banks give FRC 30 billion.

Stock plummets 27% after hours.

EPIC FAIL.

In one door.

Out the other.

The Hammer

Has No Life - Lives on TB

Yeah, that's not good...11 banks give FRC 30 billion.

Stock plummets 27% after hours.

EPIC FAIL.

The Hammer

Has No Life - Lives on TB

Is that a Biden quote?Not quite as good as the immortal meme question:

Has Anyone Really Been Far Even as Decided to Use Even Go Want to do Look More Like?

but still pretty sound.

Warm Wisconsin

Easy as 3.141592653589..

That’s because they cancelled the dividend at the same moment. Many dividend retirement funds that had FRB we’re forced to sell the stock.11 banks give FRC 30 billion.

Stock plummets 27% after hours.

EPIC FAIL.

20 More Banks on Shaky Foundation While JP Morgan Profited $1B on Metals

RT 28:22

The money gun comes out ...

5,336 views Mar 16, 2023

Are you looking for ways to protect your wealth during these uncertain times? Our expert Gold & Silver analysts have 27+ years of experience and can help you develop customized strategies to safeguard your assets. You can schedule a FREE strategy call through this link: - ITM Trading, Inc.... or by calling 877-410-1414.

Get a FREE guide on how to buy gold and silver: https://learn.itmtrading.com/buyers-g....

They want you to think that it's over, that the new facility that the Fed magically created. They want you to think that that has fixed everything. But all they ever do is change the way they account for things. And what really happens is the system gets more vulnerable because this whole thing hinges on whether or not you believe their lies. And you come here. I'm telling you the truth. And not only am I telling you the truth, but I'm giving you the tools to do your own due diligence. Don't take my word for anything, but don't take theirs. Because when you do that, you leave everything vulnerable and exposed. And I'm going to expose the truth. And I'm going to help you not be vulnerable.

Chapters:

0:00 Introduction

1:52 SVB Balance-Sheet

6:55 CEO Stock Selloff

10:00 20 Banks Potential Securities Losses

18:00 FDIC Banking Profile 2019-2022

22:08 Gold Premiums

night driver

ESFP adrift in INTJ sea

I will make sure I have plenty of hardwoods, AND MESQUITE!!! CAN NOT forget the mesquite this time.

There will be plenty of ground beef, and a pile of brisket over on the prep sideboard Sunday afternoon for DEATHBURGER 2023.2 this weekend. It APPEARS we're going to need it all.

And while I am doing the prep-work in Cyber-life, I am calling on EACH and EVERY ONE OF YOU in Meatspace to spend some time Friday looking through your pantry cupboard, or cold room, or carrot and root crop sandbox, and freezer to make SURE you will have AT LEAST enough for a decent Easter Feast, and a good, strong Planting Finish celebration, with enough food to get you through the spring harvest and into the summer harvesting and canning time.

PLEASE look AHEAD and PREPARE, people. I don't want to wander all alone through these Forum Halls, with only the echoes of the heels of my Justins on the Parquette floor, echoing down the long, dim, empty halls.

DO NOT SCREW THIS UP, PEOPLE!!! Starvation is a TERRIBLE WAY TO GO!!! DON'T GO THAT WAY!!

There will be plenty of ground beef, and a pile of brisket over on the prep sideboard Sunday afternoon for DEATHBURGER 2023.2 this weekend. It APPEARS we're going to need it all.

And while I am doing the prep-work in Cyber-life, I am calling on EACH and EVERY ONE OF YOU in Meatspace to spend some time Friday looking through your pantry cupboard, or cold room, or carrot and root crop sandbox, and freezer to make SURE you will have AT LEAST enough for a decent Easter Feast, and a good, strong Planting Finish celebration, with enough food to get you through the spring harvest and into the summer harvesting and canning time.

PLEASE look AHEAD and PREPARE, people. I don't want to wander all alone through these Forum Halls, with only the echoes of the heels of my Justins on the Parquette floor, echoing down the long, dim, empty halls.

DO NOT SCREW THIS UP, PEOPLE!!! Starvation is a TERRIBLE WAY TO GO!!! DON'T GO THAT WAY!!

- Status

- Not open for further replies.