20Gauge

TB Fanatic

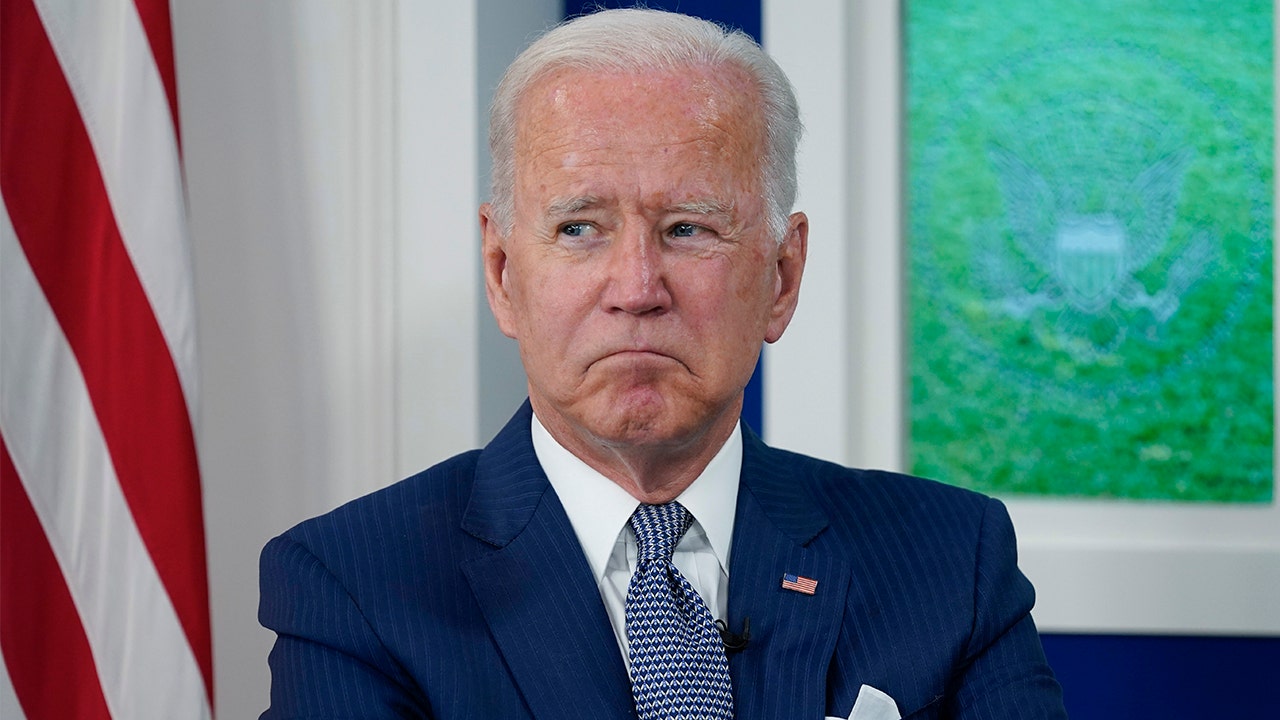

Biden may owe up to $500K in back taxes

President Biden may have improperly avoided paying Medicare taxes before he took office

President Biden may have improperly avoided paying Medicare taxes before he took office and could owe the IRS up to $500,000, according to a Congressional Research Service report.

"Joe Biden wants to raise taxes by $2.1 trillion while claiming the rich need to pay their ‘fair share.’ But in 2017, multi-millionaire Joe Biden skirted his payroll taxes — the very taxes that fund Medicare and Obamacare," said Rep. Jim Banks, who chairs the conservative Republican Study Committee.

Banks said the report indicated that Biden improperly used "S corporations" while he and first lady Jill Biden raked in over $13 million on speaking fees and book sales in 2017 and 2018, but counted less than $800,000 of it as a salary that could be taxed for Medicare.

Biden is leading the charge to pass a $3.5 trillion bill that would help fund child care, education and health care. In order to help pay for the cost of the massive legislation, Biden's plan calls for targeting tax avoidance while raising taxes on people in high-income brackets who Biden claims don't "pay their fair share."

A draft of the bill includes a provision that would close loopholes similar to the one Biden used, though the report indicates that Biden would still owe taxes under the current rules, as well.

The report does not name the president, but it analyzes cases where the IRS won a judgment against taxpayers who improperly exploited the S corporations to avoid the Medicare tax.

But when the Bidens released their tax returns during his presidential campaign, they showed that the couple saved up to $500,000 by avoiding the 3.8% self-employment tax with the S corporations.

"As demonstrated by their effective federal tax rate in 2017 and 2018—which exceeded 33%—the Bidens are committed to ensuring that all Americans pay their fair share," the Biden campaign said in a statement at the time.

Some experts believe that the IRS does not have the resources to investigate all the taxpayers who may abuse S corporations to avoid taxes.

"There are millions — literally millions — of S corporations. So there might be a half a million S corporations that are playing this game," said John Bogdanski, who served as a member of the IRS Commissioner’s Advisory Group. "And the IRS doesn’t have anywhere near enough of a budget to bring a half a million cases every year."