20Gauge

TB Fanatic

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Wall Street won't rest until it become the biggest - and perhaps only - landlord in the US.

At least that's the impression one gets by observing the behavior of the two Wall Street "black" giants, Blackrock and Blackstone. As a reminder, the WSJ sparked widespread outrage recently when it exposed what most industry insiders had known for a long time, namely that Blackrock (and other institutional investors) have been ravenously gobbling up US real estate. Now it's Blackstone's turn.

On Tuesday, the WSJ reported that Blackstone - which already is not only America's largest landlord but also the world's largest real estate company with a $325 billion portfolio - has agreed to buy single-family rental company Home Partners of America for $6 billion, betting the demand for suburban housing will stay hot even as the pandemic eases. Home Partners owns more than 17,000 houses in the United States; the company buys, rents out and eventually offers its tenants a chance to buy them. Now all those functions will be done by the largest US private equity firm.

Single-family rentals have been a favorite institutional bet over the past year, as real estate investors have sought new places to invest during a pandemic that kept Americans away from offices, hotels and malls. The result, as the WSJ reported, has been a frenzy among 200 companies and investment firms who have entered the house hunt: computer-assisted flipper Opendoor Technologies, money managers including J.P. Morgan and BlackRock, platforms such as Fundrise and Roofstock that buy and arrange for the management of rentals on behalf of individuals and builder LGI Homes Inc., which now reports wholesale home sales to bulk buyers in its quarterly results.

At the same time, remote work and school created strong demand for suburban homes by buyers and renters alike, pushing prices up and inventory down.

“Clearly the tenant demand is still robust, and that’s driving significant cash flow increases at the property level,” said Jeff Langbaum, an analyst at Bloomberg Intelligence. “Smart people with smart money want to get a piece of that.”

Not so smart people with dumb money also want a piece of that.

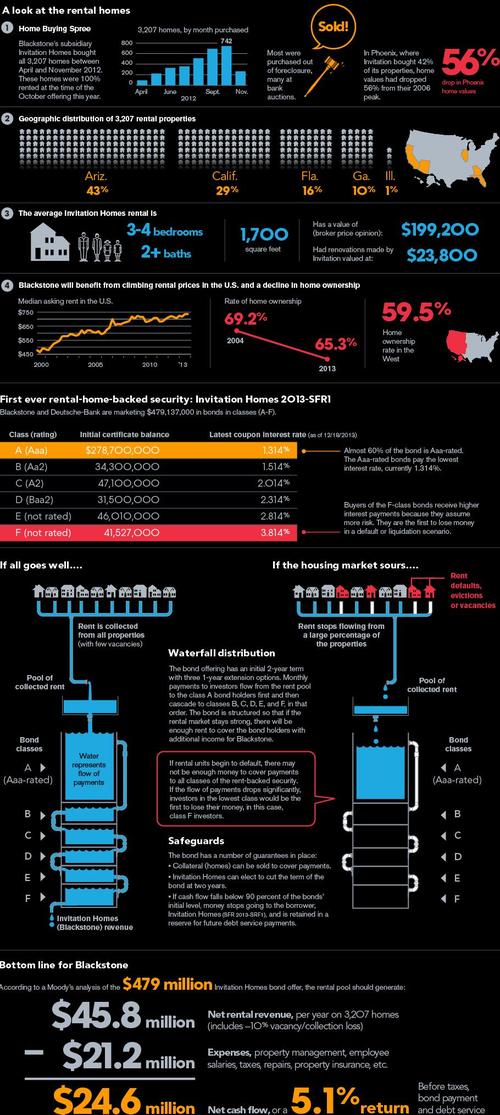

Unlike BlackRock which is a relatively recent entrant into the US housing market, Blackstone - which built Invitation Homes - into the largest single-family landlord following the U.S. foreclosure crisis, has rekindled its interest. Last August, it led a group of investors that acquired a minority stake in Toronto-based Tricon Residential Inc., which owns and operates more than 31,000 homes and apartments.

As Bloomberg notes, there may also be a case of sellers regret. The company exited its stake in Invitation Homes in 2019, selling the last of its position at $30.10 per share. Blackstone made about $7 billion on its stake in Invitation, more than doubling its money, Bloomberg reported at the time. But shares in the company have increased by 25% since then.

So now it's time for Blackstone to easily double its money again, once again courtesy of the Fed's ultra easy money which grants the likes of Blackstone virtually unlimited funds, even as most Americans struggle to pay off their 20% APR credit cards.

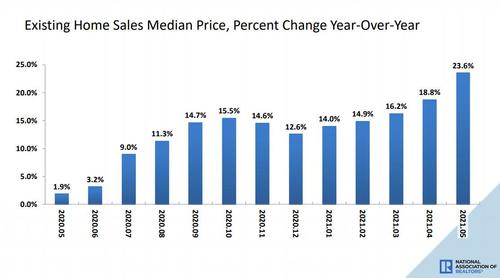

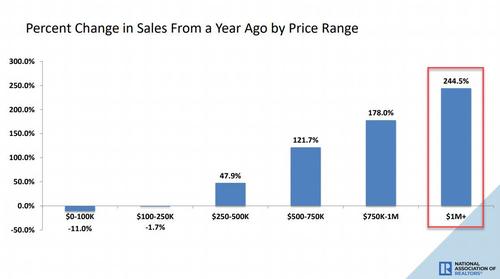

The flood of investor capital comes as low inventory pushes prices higher at the fastest pace ever, and tenants opt for rental houses over apartments. Moments ago, the NAR reported that the median existing home sale price hit a record $350,000, up 24% in the past year.

.... while sales of houses in the $1 million price range are up 245%.

Invitation Homes posted an occupancy rate of more than 98% in the first quarter, allowing the industry giant to increase rents on new leases at a record rate.

Rising rents and low inventory have also made single-family landlords a target across the political spectrum.

Recently, book author J.D. Vance started a firestorm on Twitter by arguing that Wall Street investors were making it hard for regular Americans to buy homes... and spoiler alert: he's right - although it's hardly new, and is something we have been saying since 2013 when we first profiled Wall Street as America's New Landlord:

In 2019, Democratic Senator Elizabeth Warren blasted Blackstone for “shamelessly” profiting from the U.S. foreclosure crisis, arguing that Wall Street’s investment in single-family homes was a “huge loss for America’s renters.”