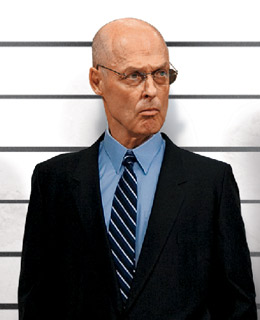

Treasury Secretary Janet Yellen and Fed Chair Jerome Powell are seeking to reassure investors to halt a slide in financial stocks.

www.wsj.com

First Republic Bank Looms Large for U.S. Regulators After Credit Suisse Sale

Yellen and Powell try to reassure investors to halt slide in financial stocks

By

David Benoit

Follow

and

Andrew Ackerman

Follow

Updated March 19, 2023 6:59 pm ET

Late Sunday, the Fed and five major central banks announced a coordinated effort to improve liquidity by moving U.S. dollars among themselves each day, starting Monday, instead of once a week. The central banks then lend those dollars out to financial institutions, in an effort to backstop other countries’ funding needs should strains emerge in global markets.

As

jittery markets prepare to open Monday, U.S. officials’ main concern is

First Republic Bank FRC -32.80%, which

required rescue funding last week from a group of

the nation’s biggest banks. Whether First Republic and other regional lenders stabilize in coming days will dictate whether additional private or government assistance is needed for banks.

In Switzerland, crumbling confidence prompted the sale of Credit Suisse for

more than $3 billion. Regulators globally worried that a

collapse of Credit Suisse, a systemically important financial institution, could reverberate among large banks in a number of countries. In the U.S., the President’s Working Group on Financial Markets, which includes officials from the Federal Reserve and Treasury Department, met to monitor the situation.

After the Credit Suisse takeover was announced Sunday, Treasury Secretary Janet Yellen and Fed Chair Jerome Powell welcomed the deal while also trying to reassure U.S. investors. “The capital and liquidity positions of the U.S. banking system are strong, and the U.S. financial system is resilient,” the two said in a joint statement.

Newsletter Sign-up

What’s News

Catch up on the headlines, understand the news and make better decisions, free in your inbox every day.

In the U.S., First Republic has become the latest pressure point. Its stock has fallen more than 80% in March. Customers have pulled some $70 billion in deposits, almost 40% of its total, according to people familiar with the matter. But the withdrawals stabilized Friday, after the country’s biggest banks came to its aid, the people said.

That slowdown and the $30 billion in new deposits from 11 of the biggest banks gave First Republic a chance to consider its future options.

“First Republic Bank is well-positioned to manage short-term deposit activity,” a bank spokesman said Sunday.

Regulators, too, were relatively quiet over the weekend, worried that after two weeks of

intervention in the banking sector, too much more activity, too soon, would signal to skittish markets that the regulatory work done so far was insufficient. Further action, at the current juncture, might also discourage potential suitors for the struggling bank.

First Republic had discussed with advisers other potential solutions, such as an equity sale, before the bank rescue. Such options remain on the table, the people said. While bankers this weekend continued to debate potential next steps, no deal seemed imminent. First Republic’s leaders are hoping to prove the rescue deal stabilized the lender and avoid fire-sale prices, the people said.

Janet Yellen at a Senate Finance Committee hearing last week. The U.S. Treasury secretary welcomed the UBS takeover of Credit Suisse on Sunday.Photo: Al Drago/Bloomberg News

Still, with the stock down sharply Friday and analysts warning the rescue plan didn’t patch a hole in the bank’s balance sheet, investors and analysts are questioning how stable First Republic is and for how long it can hold out.

Analysts said First Republic still needs to raise funds or sell itself because it is sitting on losses similar to the ones that helped

sink Silicon Valley Bank earlier this month. For instance, Wedbush analysts said any acquirer would have to fill a $13.5 billion capital hole at First Republic.

On Sunday, S&P Global Ratings cut the credit rating on First Republic for the second time in the past week.

Advertisement - Scroll to Continue

How First Republic fares in the markets could determine whether the biggest banks, including

JPMorgan Chase & Co.,

Bank of America Corp.,

Citigroup Inc. and

Wells Fargo & Co., have managed to stem the panic that has gripped the banking system this month. And it will play a role in how the market tumult ultimately affects broader economic activity.

The market’s reaction to developments at First Republic and Credit Suisse could influence how the Federal Reserve approaches its rate-setting meeting this week, where officials face a finely balanced decision over whether to raise interest rates by a quarter-percentage point or to forgo an increase altogether.

Fed officials have raised rates rapidly to slow the economy and fight inflation by tightening financial conditions, such as by lifting borrowing rates and pushing down asset prices. A significant question at their two-day meeting, which ends Wednesday, is how much additional tightening they expect to get from the markets turmoil and the banking sector.

Central-bank officials who say financial conditions are at greater risk of tightening abruptly because of the banking shock could favor holding steady their benchmark rate, currently in a range between 4.5% and 4.75%. Those who see the effects as more likely to be temporary, contained or modest could argue for pressing ahead with the next increase, aimed at cooling the economy, amid still-high inflation.

Illustration: Jacob Reynolds

Meanwhile, the Fed, Federal Deposit Insurance Corp. and

the Biden administration continue to study the question of whether and when they might have to seek to provide further assistance to the banking industry, in particular smaller lenders.

For the moment, regulators were inclined to wait and see how First Republic and its peers fare in markets early this week. The calculus was that while First Republic is weak, it is still viable. So action by the Fed or government could be seen as overreacting and hinder private-sector solutions, which would be the preferred outcome.

Last week, for example, senior Biden administration officials talked with billionaire investor Warren Buffett as

the banking crisis intensified. It wasn’t immediately clear what was discussed; Mr. Buffett didn’t respond to requests for comment and the Treasury declined to comment.

On Sunday, House Financial Services Committee Chairman Patrick McHenry(R., N.C.) told CBS News that major U.S. banks buying up smaller troubled lenders is a possible solution to ensure that Americans continue to have confidence in the financial system.

“I think all options should be on the table. That’s what I’m considering legislatively, that’s what I would encourage the administration to consider as well,” Mr. McHenry said.

Although policy makers prefer private action, there continue to be calls for bolder, broader steps, especially regarding bank deposits. On Friday, the Mid-Size Bank Coalition of America urged regulators to immediately guarantee all deposits in the U.S. for two years. In a letter, the group said deposits are leaving banks of all sizes and flooding into the four biggest banks, putting everyone at risk of a wider panic.

“Should another bank fail it is very possible that customer panic will set off a string of failures due to depositor bank runs regardless of the financial condition of the underlying banks,” the group wrote.