View: https://twitter.com/zerohedge/status/1637568408060297222

Fed Panics; Announces "Coordinated" Daily US Dollar Swap Lines To Ease Banking Crisis

BY TYLER DURDEN

SUNDAY, MAR 19, 2023 - 04:34 PM

"The market stops panicking when central banks start panicking"

In January 2022, just around the time the Fed was about to launch its most aggressive tightening campaign since Volcker, we warned "

remember, every Fed tightening cycle ends in disaster and then, much more Fed easing"

Fast forward to just over a week ago, when the Fed tightening cycle indeed ended

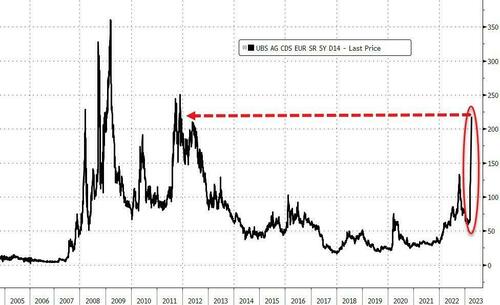

in disaster when SIVB became the first (of many) banks to fail, a chain of dominoes that culminated with today's collapse of Credit Suisse - a systematically important bank with $600BN in assets.

And then, at 5pm, the easing officially began, because while a bunch of laughable macrotourists were arguing on FinTwit whether last week's record surge in the Fed's discount window was QE or wasn't QE (answer: it didn't matter, because as we said, it assured what comes next),

the Fed finally capitulated, just as we warned over and over and over that it would...

... and at exactly 5pm the Fed announced "

coordinated central bank action to enhance the provision of U.S. dollar liquidity" by opening

daily Dollar Swap lines with all major central banks, in a carbon copy repeat of the Fed's panicked post-covid crisis policy response playbook.

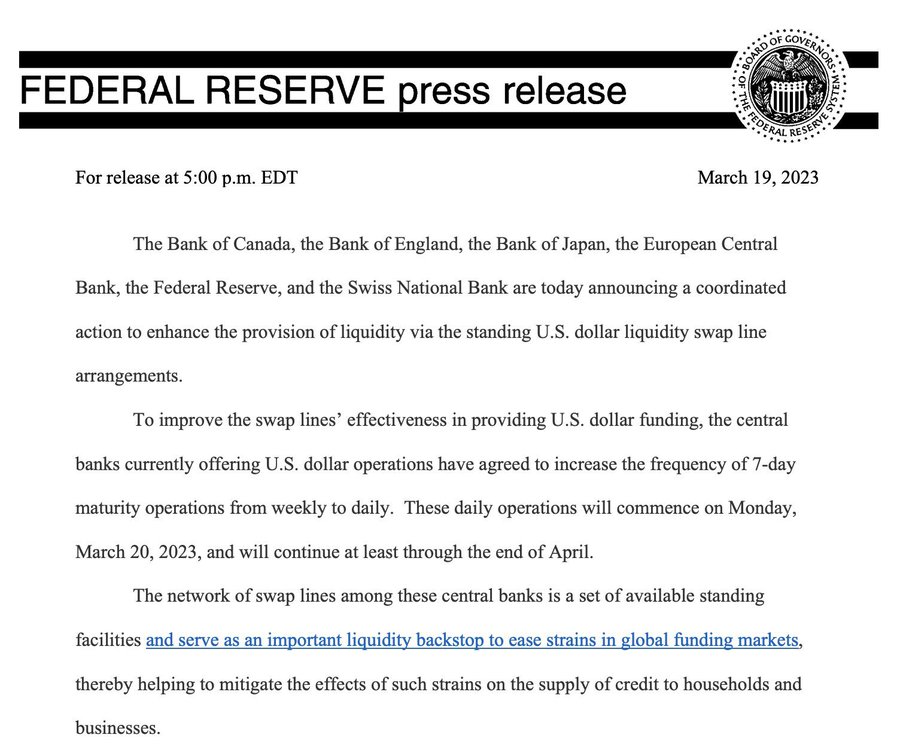

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing U.S. dollar liquidity swap line arrangements.

To improve the swap lines' effectiveness in providing U.S. dollar funding, the central banks currently offering U.S. dollar operations have agreed to increase the frequency of 7-day maturity operations from weekly to daily. These daily operations will commence on Monday, March 20, 2023, and will continue at least through the end of April.

The network of swap lines among these central banks is a set of available standing facilities and

serve as an important liquidity backstop to ease strains in global funding markets, thereby helping to mitigate the effects of such strains on the supply of credit to households and businesses.

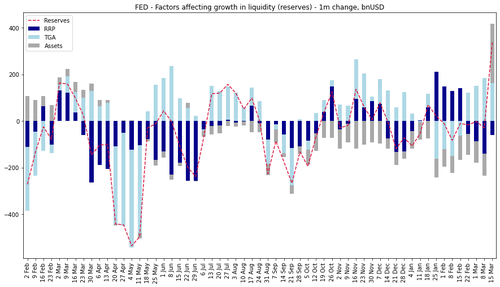

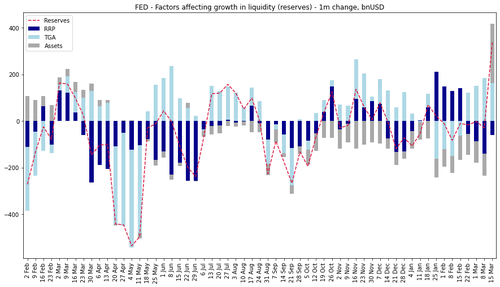

And once the USD swap lines are reopened, the rest of the cavalry follows: rate cuts, QE (the real stuff, not that Discount Window nonsense), etc, etc. In fact, we have already seen a near record surge in reserve injections:

The Fed may as well formalize it now and at least preserve some confidence in the banking sector, even if it means destroying all confidence left in the "inflation fighting" Fed, with all those whose were in charge handing in their resignation for their catastrophic handling of this bank crisis.

Then again, maybe they should just wait until he Fed hikes its inflation target to 3% or more - something else we predicted...

... because now that we are back in liquidity injection mode, well, say goodbye to hopes of seeing affordable eggs ever again.