From a couple of days ago, It would appear that they still have a work to do.

Last week, South Dakota Governor Kristi Noem broadcast a warning on the Tucker Carlson show about a bill that passed her State House and Senate that she was forced to veto because it changed the definition of money and banned non-govt-issued cryptocurrency like Bitcoin. {Broadcast Warning Here}...

theconservativetreehouse.com

March 14, 2023 |

Sundance |

371 Comments

Last week, South Dakota Governor Kristi Noem broadcast a warning on the Tucker Carlson show about a bill that passed her State House and Senate that she was forced to veto because it changed the definition of money and banned non-govt-issued cryptocurrency like Bitcoin. {

Broadcast Warning Here}

The bill stems from the generally innocuous Uniform Commercial Code (UCC), which

Daniel Horowitz describes as, “

a set of standards to facilitate interstate sales and commercial transactions such that all definitions pertaining to such commerce are uniform and clearly understood.” It looks like Horowitz was the first to transmit the public warning, as identified by two members of the South Dakota House Freedom Caucus, and then Kristi Noem became aware – thus the veto.

Governor Noem warned that the bill was already passing through several states, and if you look at the UCC Amendment tracking page [

DATA HERE],

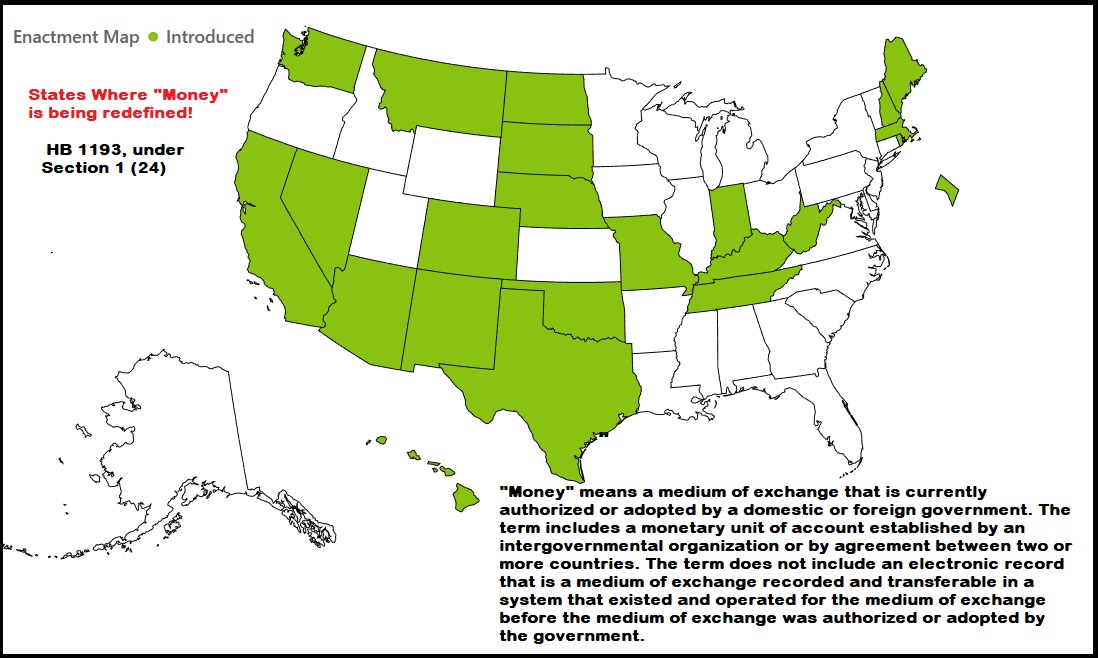

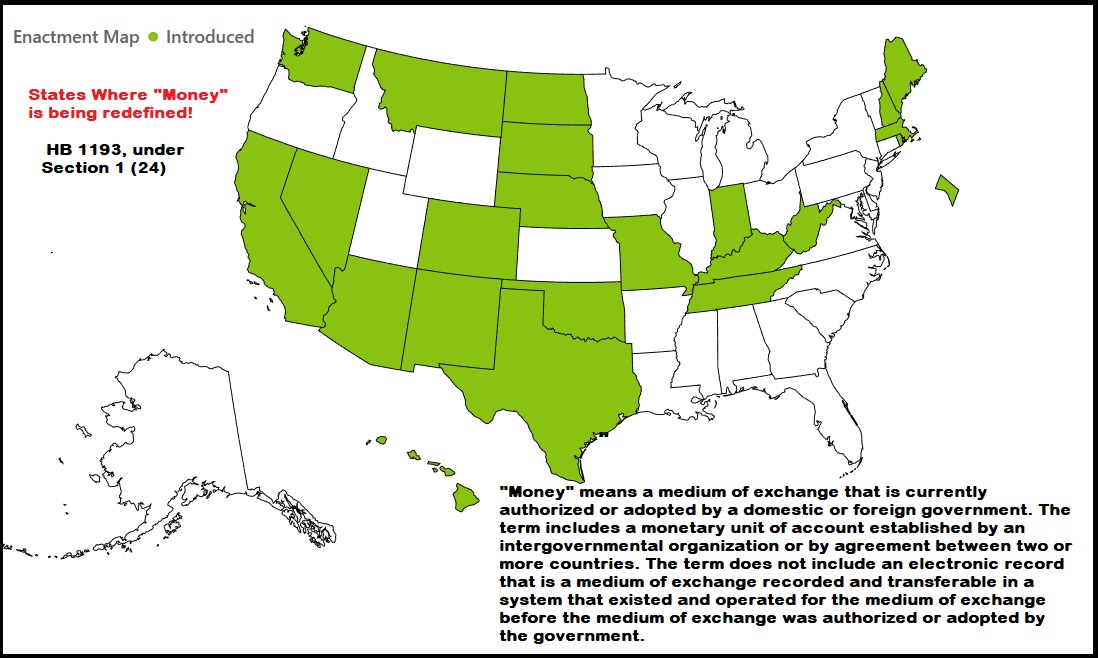

she is correct. The states in green on the map below are states where the UCC revision bill has already been introduced.

As Daniel Horowitz notes in his initial warning

dated March 2, 2023:

“The revisions to Article I are very clear now that Bitcoin will not be money, because even though the definition provides for electronic money … it says that an asset that is adopted by a government as its medium of exchange will not qualify as money … if the electronic asset, such as Bitcoin, existed before it was adopted by the government. So Bitcoin, of course, exists today; it existed before El Salvador adopted it as its currency … so it will never be money for UCC purposes. The same for other kinds of crypto currencies.” So there you have it. Officials clearly mean to pave the way for CBDC while explicitly barring all competition. (more)

This is obviously alarming.

Additionally, with the timing of this national revision taking place very quietly; and with the failure of SVB and Signature Bank following a few weeks later; and with specific impacts to the cyptocurrency market; one is left wondering if the current bank “failure” and Biden team intervention was not an intentional crisis with a motive to push government controlled central bank digital currencies into the mainstream.

In essence, was the SVB banking collapse, a designed crisis? And as a result, was the federal government response predetermined and just waiting to be triggered?

When asked last week why her legislature would do this, Noem responded the state politicians likely did not read the bill as it was constructed by lobbyists. Noem is exactly correct and hits on a subject we have discussed here frequently {

GO DEEP}. However, one of the more alarming aspects to Noem’s discussion of the issue is that around 20 other states are considering similar legislation.

WATCH:

View: https://youtu.be/WVfRzWlmiXg

.